Friday July 20: Five things the markets are talking about

Euro equities start the day on the back foot despite most Asian bourses finding a little traction to close out their week. Nevertheless, a weaker Chinese yuan and trade uncertainty continues to weigh on global markets.

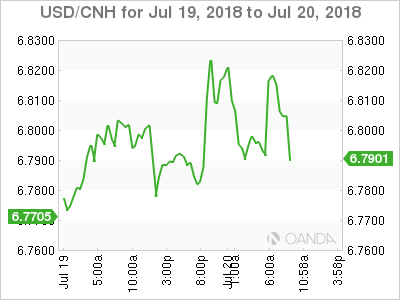

The manipulation of the yuan’s value, considered by many, is being used as a direct response to President Trump’s actions on global trade and protectionism.

With uncertainty continuing to dominate markets, it’s becoming a lot more difficult to ignore the Chinese yuan moves in the face of a potential currency war.

The yuan hit a 12-month low outright early Friday after authorities guided its official exchange rate down by -0.9% to ¥6.7671, the largest retreat in two-years. The currency has fallen -2.3% against the dollar this month alone.

Chinese actions have prompted Trump to publically express his own dissatisfaction with the Fed’s monetary policy.

The U.S. Presidents comments yesterday, on the dollar and monetary policy, depart from a convention in which sitting Presidents have refrained from expressing views specifically on their own currency and interest rates.

Strap in, be prepared, some of these currency moves may not make sense from an economic and monetary policy perspective – some prices will be guided by covert actions and Twitter rants!

Further falls in the yuan will only heighten worries about capital flights from China like the one investors witnessed three-years ago.

1. Stocks mixed results

In Japan, equities slipped overnight in choppy trading as Chinese yuan moves knocked investor sentiment. The Nikkei share average fell -0.29%, while the broader Topix shed -0.26%. However, both indexes posted their second consecutive weeks of gains.

Down-under, Aussie shares ended the week higher thanks to gains in financials. The S&P/ASX 200 index closed up +0.37%, and tacked on +0.3% for the week. In S. Korea, the KOSPI stock index erased early falls to close higher as Chinese shares rebounded. The index closed +0.3% higher.

In China, stocks rebounded overnight, erasing this week’s losses as investors piled into financial shares on rumoured reports that suggested looser-than-expected asset management rules. The blue-chip CSI300 index rose +1.9%, while the Shanghai Composite Index gained +2%.

In Hong Kong, shares also closed higher, but lower for the week. The Hang Seng index ended +0.8% higher, while the China Enterprises Index closed up +1.5%. For the week, Hang Seng still lost over -1%.

In Europe, regional bourses have opened slightly lower and are trading largely sideways. Expect risk sentiment to remain muted going into the weekend.

U.S stocks are set to open little changed.

Indices: Stoxx 50 flat at 3,470, FTSE 100 +0.1% at 7,693, DAX -0.1% at 12,676, CAC 40 -0.3% at 5,404; IBEX 35 -0.2% at 9,703, FTSE MIB -0.7% at 21,728, (SMI) +0.3% at 8,962, S&P 500 Futures -0.05%

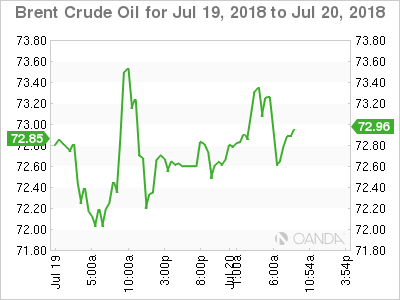

2. Oil prices rally, but set for weekly drop on oversupply, trade worries

Crude prices are a tad better bid, but remains set for a weekly drop on concerns about oversupply and the ongoing Sino-U.S trade conflict, the world’s two biggest oil users.

Brent oil had has climbed +27c, or +0.4% to +$72.85 a barrel, while U.S West Texas Intermediate (WTI) crude is up +29c, or +0.4%, at +$69.79 a barrel.

However, both benchmarks are on track for their third consecutive weekly loss, with Brent set to decline -3.3% and WTI to fall by -1.8%.

Prices have fallen on emerging evidence of higher production from Saudi Arabia and other members of the OPEC as well as Russia and the U.S.

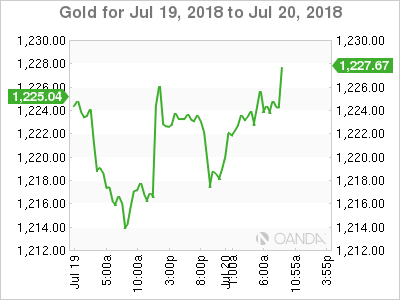

Ahead of the U.S open, Gold prices have advanced in volatile trade overnight, after hitting a one-year low Thursday, as the U.S dollar eased from its 12-month highs. Spot gold is trading at +$1,224.55 an ounce. Yesterday, it fell to its weakest since July last year at +$1,211.08 an ounce.

3. Sovereign yields little changed

This week has seen U.S three-month T-bill yields back up above the +2% mark for the first time since June 2008, just before the global financial crisis erupted in earnest.

Higher yields reflect anticipated further Fed hikes. Currently, there is a +90% probability of another +25 bps increase, to +2%-2.25%, at the Sept. 25-26 meeting of the FOMC. A further hike, to +2.25%-2.50%, has about a +65% chance.

Elsewhere, the yield on 10-year Treasuries has increased +1 bps to +2.84%. In Germany, the 10-year Bund yield has decreased -1 bps to +0.32%, the lowest in more than a week, while in the U.K, the 10-year Gilt yield has declined less than -1 bps to +1.185%, the lowest in almost seven months.

Market confidence in the Fed’s monetary policy will not be shaken by Trump’s criticism of the central bank raising interest rates.

4. Dollar drifts from 12-month highs

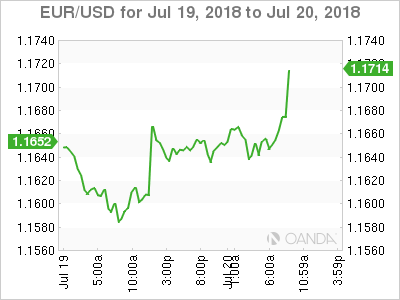

In the last session for the week, the ‘mighty’ USD is a tad softer for the first time in five sessions after Trump commented that the greenback’s strength put the U.S at a disadvantage.

EUR/USD (€1.1645) has moved off its best levels on renewed political concerns in Italy. Commentary from Italy League party official Borghi (budget committee) again expressed his usual EUR sceptic views.

CNY (¥6.8154) trades atop of new lows despite market speculation that officials were seeking to stem the drop. Earlier the PBoC set the Yuan reference rate at €6.7671 for its seventh straight weaker yuan fix and the weakest since July 14, 2017.

5. ECB watch

With little or no significant data in the coming few sessions, the market will focus on whether the European Central Bank (ECB) will give details on its reinvestment policy under its asset purchasing program when they meet next Thursday (July 26).

Officials revealed last month that they would likely halve asset purchases in Q4, before ending them at year-end.

Market speculation has grown that the ECB may look to reinvest more into longer-dated bonds to maintain the QE portfolio’s maturity profile.

Dealers will also be looking for more detail to last months statement that interest rates would stay at current levels “at least through the summer of 2019.”