- Last week was positive for most stock markets around the world

- Bullish sentiment increased 2.8 points to 30.6%

- Friday's U.S. employment figures pose a big short-term risk

- British Ftse +0.75%

- Japanese Nikkei -2.14%

- Spanish Ibex -6.26%

- French Cac -9.52%

- Dow Jones -9.73%

- S&P 500 -13.03%

- Eurostoxx -13.33%

- German Dax -14.55%

- Chinese CSI -15.86%

- Italian Mib -17.41%

- Italian Mib -17.41%

- NASDAQ -19.10%

Led by a +2.15% rebound on the NASDAQ Composite, the S&P 500 rose +0.36%, the Nikkei 225 +1.35%, the FTSE 100 +0.22%, the Euro Stoxx 50 +0.47%, the CAC 40 +0.37%, the FTSE MIB +0.81%, the DAX +0.67%, and the IBEX 35 gained +0.14%. The laggards were the Dow Jones Industrial Average and the CSI 1000, which lost -0.13% and -032%, respectively.

With the above figures, the global stock market ranking in 2022 is as follows:

Investor Sentiment (AAII)

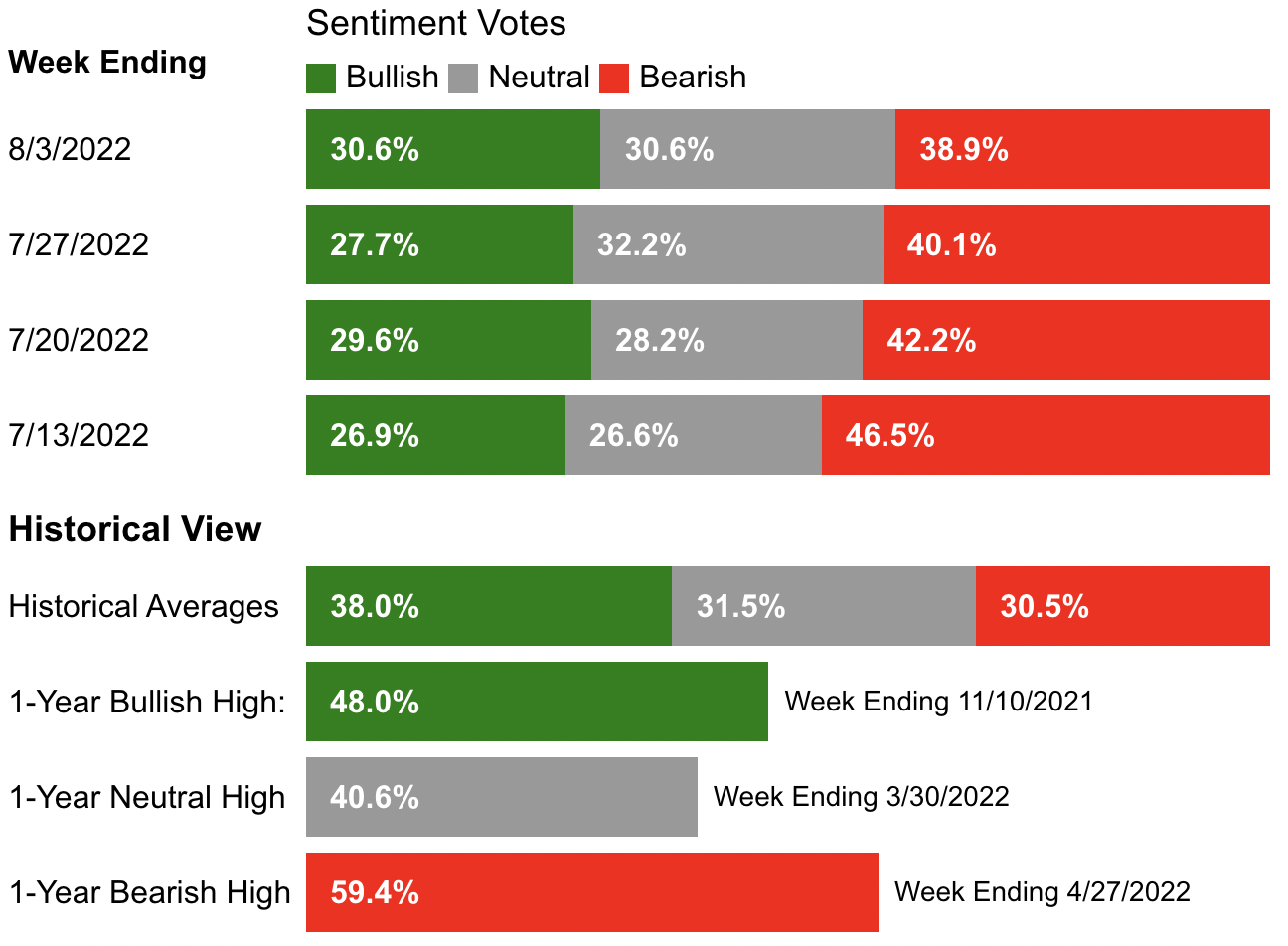

* Bullish sentiment (expectations that stocks will rise over the next six months) increased 2.9 points to 30.6%—implying the highest level of optimism since June 2. Still, it remains below its historical average of 38%.

* Bearish sentiment (expectations that stocks will fall over the next six months) is down 1.2 points to 38.9, remaining well above its historical average of 30.5%.

Money Is Returning To U.S. Funds.

Over the long term, we all know that the U.S. stock market has performed very well, accumulating over +10% per year on average for nearly a century. We also know that along the way, investors have had to endure steep declines—such as the -20% drop in the first half of this year. For the time being, however, we are enjoying some respite.

Proof of this is, for example, the Nasdaq 100, which posted its third consecutive week of gains, its longest weekly streak since last April. Moreover, over the last 25 trading days, we have seen intraday gains of more than +1% 13 times, a rare occurrence.

This context encourages investors to return to U.S. equity mutual funds, which are already accumulating over 3 billion subscriptions in 2022.

Money is also flowing into the dollar, as shown by Bank of America's survey of mutual fund managers. Buying positions in the dollar are at levels not seen in 7.5 years. Here I am talking about the strength of the dollar against other currencies.

Friday's Numbers Do Not Help

Friday's U.S. employment data was good and well above expectations. In fact, all the jobs lost during the pandemic have already been recovered.

But contrary to what one might think, those figures are negative for equity markets, as it implies that the Federal Reserve has no reason to slow down its interest rate hike. Had the data been negative, they could have considered not continuing with such an aggressive rate hike cycle (which Chairman Powell even hinted at).

With the current employment figures, there is a greater probability that we will see another 75 basis point rate hike at the Fed's next meeting in September.

European Banks Outperform

European banks had one of their best quarters of the last decade, as the rise in interest rates propels the net interest margins—i.e., the difference between the interest paid by the bank to the borrower and the interest charged to the lender.

15 of the top 20 banks in the continent exceeded profit estimates thanks to higher interest income and debt trading. The ten largest listed banks in the European Union posted a combined profit of EUR 13.9 billion, the third best in the last ten years.

In addition, provisions for non-performing loans declined in the quarter, as banks had built up reserves earlier in the year.

The chart below shows the Stoxx 600 Banks, and we can see how 2020 was a turning point when the index fell to 2009 levels and touched strong support.

August In The Stock Market

If we take the S&P 500 from 1950 to 2020, we have that on 39 occasions, August has been a positive month, and in 32, it has been negative. The average movement is +0.5%.

The best August in history was in 1982, with the S&P 500 rising +11.6%. Conversely, the worst was in 1998, when the broad U.S. index dropped by -14.58%.

Earnings Season: Better Than Expected

More than 350 S&P 500 companies have already reported their second-quarter results, and the overall balance is quite positive.

Earnings growth is over 6%. Yes, it is the lowest earnings growth since 4% in the last quarter of 2020, but really, considering the scenario and the context in which we find ourselves, it is not bad at all.

To highlight two companies that posted the most significant upside surprise in earnings per share in the second quarter: T-Mobile (NASDAQ:TMUS) with 424% and American Tower (NYSE:AMT) with 103%.

Disclosure: The author currently does not own any of the securities mentioned in this article.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »