Phoenix Spree Deutschland (LON:PSDL) has completed the strategic sale of a 16-building portfolio of rental properties. Under its amended financing terms, PSD can now significantly accelerate condominium (condo) sales, exploiting the wide sales premium over investment property valuations.

This is central to an orderly realisation strategy aimed at maximising shareholder value, which we believe is materially ahead of that implied by the share price. Disposal proceeds will first be used to repay existing debt ahead of the 2026 maturity, although refinancing options to accelerate shareholder distributions are possible.

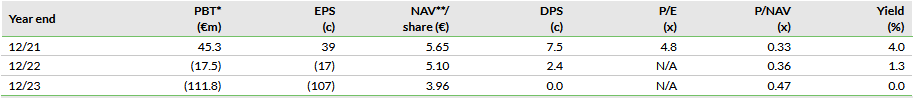

Note: *As reported on an IFRS basis including realised and unrealised gains. **Measured as EPRA net tangible assets per share.

Following the 16-building sale, the remaining portfolio comprises 75 buildings. Of these, 61 (c 1,700 units) are primarily (80% of the units) legally split as condos. The other 14 buildings (c 500 units) are not split and will be operated as private rental properties. Under the new debt arrangements, the number of buildings that PSD is able to market as condos at any point in time has increased from six to 40, representing c 950 units.

An initial phase of 16 buildings, including those already available for sale, will be marketed by end-2024, a further 24 by mid-2025, and further buildings will be added, subject to future financing arrangements. PSD is targeting an increase in condo sales to €50m pa by end-2025, increasing thereafter, and has already strengthened its sales capability by engaging two of the leading sales platforms.

The portfolio was sold to funds managed by Partners Group for €76m, most of which will be used to repay borrowings, with the balance available for capex and general corporate purposes. The net loan to value ratio (LTV) is expected to reduce to 42.7% (H124: 46.5%). The cost of debt will increase slightly (to 2.9% from 2.6%).

While this strategic portfolio sale will reduce EPRA NTA by c 8%, from €3.68 per share at H124 to a pro-forma €3.39, it is the key to unlocking material value within the wider portfolio. Condo sales in FY24 have been at an average €4,122 per sqm, a 19% premium to the external portfolio valuation, which is mostly on a ‘rental valuation basis’, with just 5% on the higher ‘condo’ basis. PSD expects half of the portfolio buildings to be valued on a condo basis at end-FY24 and says that current market evidence supports achievable condo sales values of c €5,000 per sqm for vacant units and €3,500 for those occupied.

The board believes that the enhanced, managed realisation strategy will maximise shareholder returns and has brought forward (to 17 February) the continuation vote that was due by June 2025. Should this not pass, it will be required to consider alternatives, including voluntary liquidation. We will update our asset sale analysis conducted in June which highlighted the potential to at least maintain NAV, representing a very material uplift to the current share price.