By Andrew Galbraith

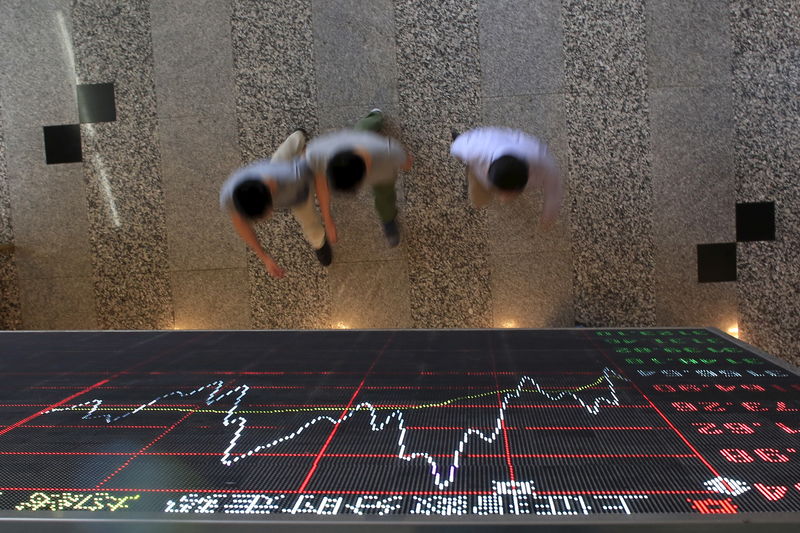

SHANGHAI (Reuters) - Asian shares fell on Tuesday after U.S. President Donald Trump stunned markets by imposing tariffs on imports from Brazil and Argentina, rekindling fears over global trade tensions, while weak U.S. factory data added to the investor gloom.

But European shares, which had also slumped following Trump's tariff announcement, were expected to rise on Tuesday.

Pan-region Euro Stoxx 50 futures (STXEc1) were up 0.41% in early trades, while German DAX futures (FDXc1) added 0.45% and FTSE futures (FFIc1) gained 0.26%.

U.S. S&P 500 e-mini stock futures (ESc1) also pointed higher, rising 0.2% to 3,120.5.

MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.43% as Australian shares (AXJO) recorded their worst day in two months with a 2.2% drop.

Japan's Nikkei (N225) shed 0.64%.

But some Asian indexes rebounded in afternoon trade from session lows.

China's blue-chip CSI300 index (CSI300) fell as much as 0.62% before clawing back to register small gains. The Shanghai Composite Index (SSEC) was down 0.08% after earlier hitting its lowest point since Aug. 26.

Hong Kong's Hang Seng Index (HSI) was 0.24% lower after earlier falling as much as 1.44%.

In tweets on Monday, Trump said he would impose tariffs on steel and aluminium imports from Brazil and Argentina, attacking what he saw as both countries' "massive devaluation of their currencies."

Contrary to his remarks, both Brazil and Argentina have been trying to strengthen their respective currencies against the dollar.

Steven Daghlian, market analyst at CommSec in Sydney, said while the South American tariffs dominated market worries on Tuesday, China's response to U.S. support for anti-government protesters in Hong Kong has also chilled sentiment.

"Markets are extremely sensitive to any good or bad news on the U.S.-China dispute front, but also the U.S. relationship with other nations as well," he said.

China said on Monday U.S. military ships and aircraft won't be allowed to visit Hong Kong, and also announced sanctions against several U.S. non-government organisations for encouraging protesters to "engage in extremist, violent and criminal acts."

Worsening the mood, data from the Institute for Supply Management (ISM) showed the U.S. manufacturing sector contracted for a fourth straight month in November as new orders slid.

That erased cheer markets had drawn from upbeat Chinese factory surveys released over the past few days.

While trade war headlines have been a key driver of markets in recent weeks, sentiment has broadly held up. The U.S. S&P 500 index (SPX), the Dow Jones Industrial Average (DJI), the Nasdaq Composite (IXIC) and Australia's S&P/ASX 200 index all touched record highs last week.

On Monday, the Dow Jones index fell 0.68% to 27,861.52, the S&P 500 lost 0.59% to 3,122.45 and the Nasdaq dropped 0.94% to 8,584.20.

"I think some kind of breathing or consolidation probably is needed," said Joanne Goh, Asia equity strategist at DBS in Singapore, noting that some data releases, such as China's factory surveys, are suggesting a bottoming out.

"I think investors should pick quality stocks not really affected by the trade war," she said.

BOND TURNAROUND

Bearish sentiment on Tuesday initially pushed U.S. Treasury prices higher, but yields later rose slightly across the curve, reflecting the more positive mood in Europe.

Benchmark 10-year Treasury notes (US10YT=RR) yielded 1.8414% on Tuesday afternoon in Asia, up from a U.S. close of 1.836% on Monday. The policy-sensitive two-year yield (US2YT=RR), ticked up to 1.6162% from its U.S. close of 1.614%.

In currency markets, the dollar rose 0.17% against the yen to 109.16 and the euro was off 0.05%, buying $1.1072.

The dollar index (DXY), which tracks the greenback against a basket of six major rivals, was up 0.06% at 97.917.

The Australian dollar rose to $0.68440 after the Reserve Bank of Australia kept its cash rate on hold at 0.75% and stuck with an optimistic outlook for the economy.

Oil prices continued to rise on expectations that the Organisation of the Petroleum Exporting Countries (OPEC) and its allies may agree to deepen output cuts at a meeting this week.

Global benchmark Brent crude added 0.26% to $61.08 per barrel, and U.S. West Texas Intermediate crude was up 0.38% to $56.17 a barrel.

Gold was lower on the spot market , shedding 0.1% to trade at $1,460.87 per ounce.