Following a strategic review earlier this year, the manager of the Bankers Investment Trust (LON:BNKR), Alex Crooke, has concentrated the portfolio, reducing the number of holdings from around 170 to 100 by focusing on the best ideas available across global markets.

The manager and the board believe this asset reallocation will differentiate BNKR from its peers, by making it one of the most concentrated investment companies in the AIC’s Global sector. Crooke stresses that this change does not represent a new strategy but is instead a refocusing of the trust’s existing approach.

His attention to valuations also remains unchanged. Crooke believes the portfolio now forms ‘a whole that is greater than the sum of its parts’. He is optimistic that, combined with the board’s more flexible attitude to the use of revenue reserves to support dividends if required, the asset reallocation means the portfolio is well-placed to boost capital returns, while ensuring the trust keeps delivering progressive dividend growth.

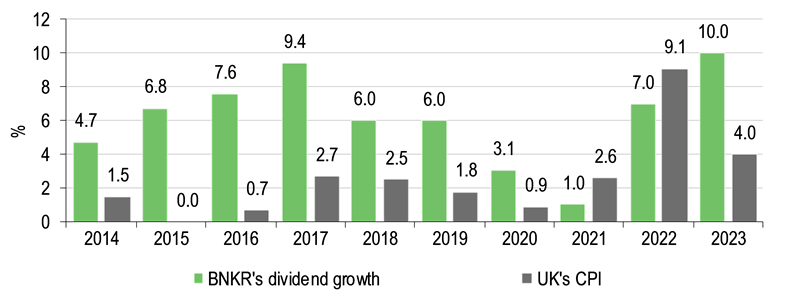

BNKR’s dividend growth consistently exceeds UK inflation

Source: LSEG Data & Analytics, Edison Investment Research. Note: *Dividends paid from BNKR’s fiscal year profits (ending 31 October), while CPI is for calendar years. Final dividend for 2024 not yet announced.

The analyst’s view

- BNKR may appeal to investors seeking a concentrated, geographically balanced and style neutral global equities portfolio, with a dual focus on valuations and income.

- The trust’s recent portfolio refocus follows an indication from BNKR’s board, early in 2024, that it would adopt a more flexible approach to using revenue reserves, to enable the manager to invest in a broader pool of investments, including non- or low-dividend-paying growth stocks that deliver capital growth, and hold out the prospect of attractive future dividend payments.

BNKR: Now a ‘best ideas only’ portfolio

BNKR’s twin objectives are to deliver capital growth above its global benchmark and income growth greater than UK inflation by investing in companies listed around the world. The manager adopts a long-term strategy with the aim of generating consistent returns against the benchmark. The trust’s focus on consistency is also manifest in its track record of providing shareholders with 57 consecutive years of dividend growth.

Crooke searches for ‘good companies’, which he defines as high-quality, mature, well-run, cash-generative businesses. Cash generation is especially important for Crooke, as he believes this gives businesses the means to invest in growth and to pay rising dividends. The trust adopts a balanced approach, with the ability to shift between growth- and value-oriented stocks. Crooke stresses that while he is not a value investor, he tries not to overpay for any company relative to its fundamentals.

Following a strategic review earlier this year, the manager has concentrated the portfolio into four regional sub-portfolios, down from six previously, and reduced the number of holdings from 170 to 100, to focus on the manager’s best investment ideas, and bring greater focus to the regional portfolios by reducing overlap within these regions and removing potential conflicts. The manager and the board believe this asset reallocation will differentiate BNKR from its peers, by making it one of the most concentrated in the Association of Investment Companies’ (AIC’s) Global sector, and much more concentrated than the benchmark, which comprises over 4,200 stocks. The portfolio’s active stance relative to its benchmark has increased accordingly.

The new regional breakdown comprises Pan Europe including the UK, Pan Asia including China, Japan and North America. This compares with the previous division, which included separate sub-portfolios for the UK and China. Each of the four sub-portfolios has its own experienced regional manager, while Crooke is responsible for the global picture and portfolio balancing. The strategic review also examined stock selection and portfolio construction and concluded that BNKR’s smaller holdings were not contributing to performance. The intention is that from November 2024, each sub-portfolio will hold 20 stocks, with slightly more in the North American portfolio due to the size and depth of that market.

Crooke stresses that these changes do not represent a new strategy but are instead a refocusing of the trust’s existing approach. As proof of this, he says he is not looking for new stocks, but rather seeking to identify the best ideas among the trust’s existing portfolio and increasing weightings of those at the expense of smaller holdings that were not contributing to returns. Crooke is equally insistent that his valuation-focused approach remains unchanged. He is ‘excited by the prospect of a focused portfolio, investing more in [the team’s] best ideas’, especially because investee companies are reporting positive developments in their fundamentals, performance and prospects.

Portfolio refocus follows more flexible approach to reserves

BNKR has maintained a longstanding underweight to US tech names, and this, combined with its focus on valuations and income, means it has not fully captured the rally in US tech stocks, as most of these names do not pay dividends. This has seen the trust’s relative performance lag the benchmark in recent years. The recent portfolio concentration has been accompanied by a modification to the use of the trust’s revenue reserves intended to redress this underperformance.

In June 2024, the trust’s board indicated that it would adopt a more flexible approach to using revenue reserves, to enable the manager to invest in a broader pool of investments, including non- or low-dividend-paying technology and other growth stocks that deliver capital growth, while also offering the prospect of attractive future dividend payments. This greater flexibility provided the manager with the leeway to add a number of new positions in zero-yielding US tech companies, including Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN) and Meta in the early months of 2024.

BNKR now has greater exposure to the US, and to technology

Taking a broader view of the impact that these acquisitions, and the more recent portfolio concentration, have had on portfolio structure, the trust now has greater exposure not only to the US, but also to continental Europe, at the expense of the UK and Asia (including China), (Exhibit 4). At the sector level, it has heavier weightings to technology, utilities and real estate, offset by lower weightings in consumer discretionary and staples, basic materials and telecoms (Exhibit 5) (see the Portfolio allocation section for more details).

These changes will take time to be reflected in performance. But Crooke believes the portfolio now forms ‘a whole that is greater than the sum of its parts’, and he is optimistic that the changes have the potential to generate better capital returns, while ensuring the trust keeps delivering progressive dividend growth.

On track to deliver promised 5% dividend increase for FY24

Indeed, BNKR appears to be on track to meet its target to increase its FY24 dividend by 5%, making the financial year ended 31 October 2024 the 58th successive year of dividend growth. The trust’s manager reports that portfolio income was good in FY24, and dividends receipts are increasing, despite the rise in sterling.

According to Janus Henderson estimates (as at end July 2024), several of BNKR’s top holdings are projected to deliver double-digit growth in dividends over the coming 12 months. These include Visa (NYSE:V) (with projected dividend growth of +15%), BNKR’s third-largest position, American Express (NYSE:AXP) (+12%), its largest holding Microsoft (NASDAQ:MSFT) (+11%) and United Health, another top 10 holding (+10%). Other portfolio holdings are also doing well and have lifted their dividend payouts, albeit more modestly.

In addition, the broader environment for dividend payouts is improving. The authorities in several major Asian markets, including Japan, China and South Korea, are encouraging businesses to improve capital efficiency and increase shareholder returns by raising dividend payments and share buybacks. Indonesian companies are beginning to follow suit.

The trust’s first three interim dividends for FY24 were each 0.672p. If the final interim dividend, due to be paid in February 2025, is also 0.672p, this would mean the total dividend for the year would be 2.688p per share, consistent with the forecast 5% increase on the FY23 dividend of 2.56p per share. This increase is well ahead of UK inflation and thus consistent with is long-term dividend objective (UK CPI increased by just 2.3% in the year ended October 2024). A dividend of this magnitude represents a prospective yield of 2.3%, based on the current share price.

The reported strength of portfolio income over the past year suggests the company will not need to call on reserves to supplement the FY24 dividend payment. Such drawdowns have not been needed since FY21. However, the trust has ample reserves to deploy if required. Reserves totalled £43.2m at end-H124, equivalent to 3.6p per share, well above the projected FY24 dividend payment.

Discount may narrow if recent changes lift relative performance

Many investment companies, across a variety of markets and strategies, have seen the discounts at which their shares trade relative to their NAV widen over the past couple of years as investors have been attracted by the competitive rates on offer from cash and bond investment instruments. More recently, there have been reports that retail investors were harvesting capital gains ahead of the UK’s October 2024 budget, placing further pressure on share prices. BNKR’s share price is currently trading at a discount of around 11%, which is significantly wider that its historical average of around 4%.

The board has taken advantage of this wider-than-usual discount to buy back shares. It repurchased a total of 49.8m shares in the first half of the financial year (H124). This compares with buybacks of 24.1m in H123. Buybacks have continued in H224 and totalled an additional 38.6m by year end. These buybacks are beneficial to the NAV per share of remaining shares.

BNKR’s discount has scope to narrow back towards its longer-term average as and when the trust’s recent portfolio re-focus lifts relative performance and as investment trusts return to favour with investors.

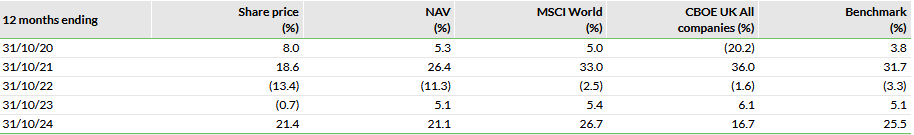

Performance

-

Exhibit 1: Five-year discrete performance data

Source: LSEG Data & Analytics. Note: All % on a total return basis in pounds sterling.

In the year ended 31 October 2024, BNKR’s absolute returns were strong. The portfolio returned 21.1% in NAV terms and 21.4% on a share price basis. However, this performance lagged the benchmark return of 25.5%; this was the third year in the last four in which the portfolio has underperformed (Exhibit 1).

Performance in the past year has been supported by a range of holdings. A number of zero-yielding US tech companies acquired in the early months of 2024 (discussed above) have all done well since, supported by growing revenues and cost cutting, which have boosted margins. The trust’s Japanese portfolio has also contributed to performance, thanks to a recovery in financials following the Bank of Japan’s monetary tightening and government efforts to improve dividend returns. Japanese conglomerate Hitachi was notable contributor. There was also a favourable performance impact from BNKR’s overweights in a mix of other businesses, including US IT services provider Oracle (NYSE:ORCL), American Express and UK drug-maker AstraZeneca (LON:AZN). The trust’s out of index positions in Taiwanese semiconductor manufacturer TSMC, Meituan, a Chinese online retailer, and Cranswick (LON:CWK), a UK packaged foods company, have also enhanced recent returns.

Although exposure to technology has increased, the performance of the US portfolio continued to lag the benchmark, thanks mainly to the decision not to hold Nvidia (NASDAQ:NVDA), which has outperformed other members of the so-called ‘Magnificent seven’ US tech stocks over the past year. The lack of exposure to Nvidia is due to the manager’s concerns that new orders will start to plateau, creating pricing pressures and, ultimately, share price weakness. Other detractors from recent performance included the trust’s underweight to Apple (NASDAQ:AAPL), which continued to perform well over the period, and its overweights to Japanese automaker Toyota (NYSE:TM) Motor, Korean consumer electronics producer Samsung Electronics (LON:0593xq), US sportswear manufacturer Nike (NYSE:NKE) and Accenture (NYSE:ACN), a global business consultancy firm.

Portfolio allocation

- Portfolio consolidation cuts holdings and raises position sizes

One example of the manager’s efforts to concentrate the portfolio is provided by changes to exposure to the medical devices industry. Crooke is attracted to this area because medical procedures have increased following the end of the COVID-19 pandemic and the sector is seeing good growth. He has opted to concentrate exposure to this trend by retaining the portfolio’s holding in Stryker (NYSE:SYK), while closing positions in its less appealing competitors Medtronic (NYSE:MDT) and Abbott Laboratories (NYSE:ABT). He has also sold US pharmaceutical company Merck (NS:PROR), but still holds US drug manufacturers Eli Lily and Amgen (NASDAQ:AMGN), UK pharma AstraZeneca and Denmark’s Novo Nordisk (CSE:NOVOb), the manufacturer of a hugely successful anti-obesity drug. Crooke has also closed a position in UK oil and gas producer BP (LON:BP) and increased exposure to French energy suppler Total (EPA:TTEF), which is more active in the transition to renewable energy. The sharp but short-lived summer sell-off in global equity markets provided the manager with the opportunity to top up the trust’s holdings in some US names, including Apple and Amazon.

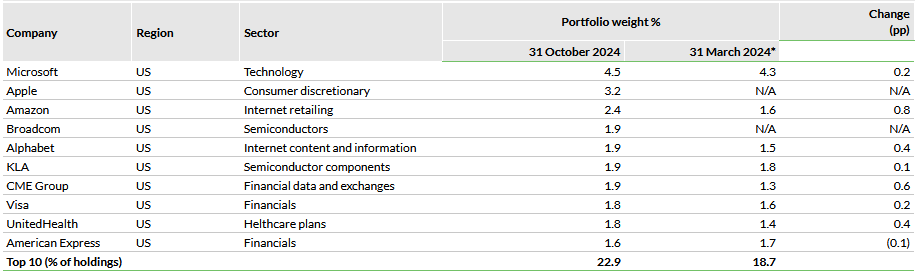

A look at BNKR’s top 10 holdings illustrates the move to larger, more concentrated positions. The trust’s top 10 holdings now represent 22.9% of the portfolio, up from 18.7% at 31 March 2024, and, in general, the holding sizes of all the companies on this list have risen slightly.

- Exhibit 2: Top 10 holdings (at 31 October 2024)

Source: Janus Henderson Investors, Edison Investment Research, Bloomberg, Morningstar. Note: *N/A = not among top 10 holdings at 31 March 2024.

A few new names have been added

Despite the general focus on honing existing holdings, rather than adding new names, the portfolio has acquired a few new names in recent months as opportunities have arisen. The manager opened a position in US utility company American Power Group, which is benefiting from the structural shift towards electrification and renewable energy (see further discussion below). He also purchased Prologis (NYSE:PLD), a market-leading US industrial property real estate investment trust, which owns distribution centres. Amazon, one of Prologis’s key clients, is upping its investment in distribution centres as it wants to move merchandise closer to its clients. Prologis will also benefit from the decline in interest rates, as this will boost the valuations of its property assets. Another recent acquisition is Australia’s Macquarie Bank, which the manager believes is underrated, as the market does not appreciate the extent to which the bank’s commodity trading business benefits from volatility in the price of oil and other commodities. Macquarie’s retail banking operations are also taking market share from competitors.

Profit-taking proceeds used to reduce gearing

These top-ups and new purchases have been funded by profit-taking on several holdings as markets hit all-time highs. But some of the proceeds of these sales have also been used to reduce portfolio gearing, which has declined from 7% at 31 March 2024, to 2% at end October 2024. Crooke insists that this is not an indication of any bearishness regarding the market outlook, but rather an attempt to build cash reserves to take advantage of opportunities that emerge as a result of any future market sell-offs.

Structural themes permeate the portfolio

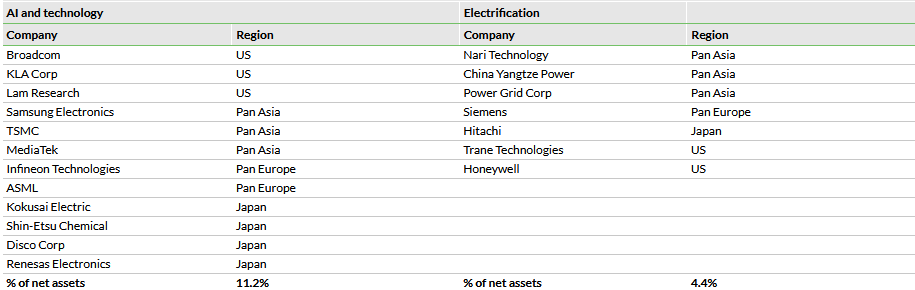

- Exhibit 3: BNKR’s exposure to two structural themes

Source: Janus Henderson Investors (as at 31 August 2024), Edison Investment Research

Several key structural themes run through the portfolio. The most notable of these are the AI revolution and the spread of technology more generally, electrification and climate change mitigation, deglobalisation and supply chain reshoring. These themes underpin the portfolio positioning across regions. As an illustration of this, Exhibit 3 shows the portfolio’s exposure to two of these themes, via its exposure to semiconductor producers, whose products are integral to the large language models that drive generative AI, and to companies at the forefront of the transition to electrification and renewable energy generation.

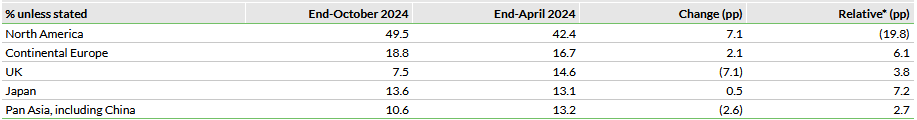

Targeting 50% US exposure, but still wary of China

At the regional level, the changes of the past year have resulted in increases in exposure to North America and continental Europe at the expense of the UK and Asia (including China), as mentioned above. Exposure to Japan has remained relatively stable (Exhibit 4).

Exhibit 4: Geographical split of BNKR’s portfolio versus the benchmark

Source: BNKR, benchmark’s factsheet. Note: *Compared to benchmark.

It is Crooke’s intention to continue increasing exposure to North America until it reaches 50% of the portfolio, as the US economy is performing more strongly than Europe or the UK. However, he acknowledges that the US is relatively expensive. This market is currently trading at 19x earnings, compared to a corresponding earnings ratio of c 12x for the rest of the world. This gap is at a 30-year high. In the manager’s view, valuations do matter and will prevail eventually, so Crooke expects to see an eventual rotation away from the US into other markets. This expectation explains the fact that while the trust’s US exposure has increased, and will continue to do so, so too has exposure to Europe.

The Chinese authorities’ recent, more coordinated efforts to support the stock market, stimulate domestic demand and stabilise the property sector have not altered the manager’s cautious view on China. He welcomes efforts to improve capital efficiency and shareholder returns, but in his view, China still has a lot of problems, especially given that the property sector’s ongoing difficulties are having such a profound effect on consumer confidence and discretionary spending. This ongoing caution means that within the Pan Asian portfolio, the manager favours other markets, most notably Indonesia, South Korea, Taiwan and Singapore – markets that offer attractive financial and tech names, and, in some cases, rising dividend payout ratios.

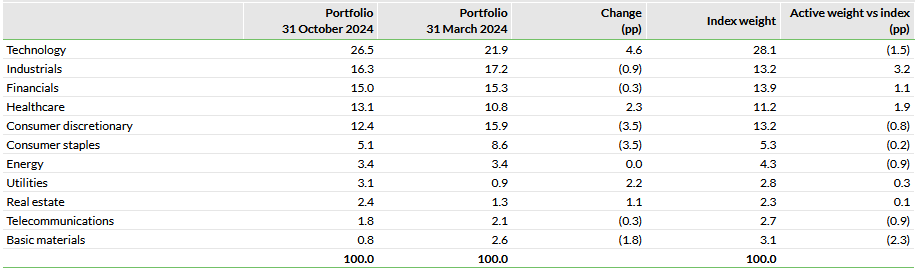

Key overweights to industrials, healthcare and financials

At the sector level, industrials were the portfolio’s largest overweight (as at end October 2024), a position underpinned by the manager’s view that the US and most other economies need to undertake significant infrastructure spending to upgrade their energy grids to cope with electrification and the transition to renewable energy (Exhibit 5). For example, the US has not invested in energy infrastructure for a long time yet demand for electricity is forecast to rise by almost 40% by 2040, so upgrades are now overdue and urgent.

Healthcare is BNKR’s second-largest overweight, despite the consolidation of the portfolio’s exposure to pharmaceutical companies discussed above. The manager points out that, consistent with his new, concentrated approach, the trust owns two of the sector’s largest and most successful names, Novo Nordisk and Eli Lily. Unlike many other big pharma companies, these companies have long-term patent protection for their most popular drugs. The trust’s third-largest overweight is to financials, reflecting the fact that banks in many countries are at the forefront of the broadening trend to lift shareholder returns. BNKR’s overweights to industrials and financials are also in part because many stocks in these sectors are available at attractive valuations and should do relatively well over the medium term as equity markets adapt to structurally higher interest rates.

Exposure to tech names has seen the largest increase, although the portfolio remains slightly underweight in this sector. The prospect of further meaningful declines in interest rates in the US (and other developed economies) is supportive of rate-sensitive sectors and opens the way for follow-on actions by Asian central banks. Developments on the US monetary policy front over recent months have prompted BNKR’s manager to increase positions in utility and real estate companies, which are likely to benefit most from the decline in rates. Exposure to both these sectors is now close to benchmark.

The trust remains underweight energy, as this sector mainly comprises traditional oil and gas companies, which are highly regulated, heavily indebted and on a declining trajectory as the world adopts cleaner sources of energy. BNKR now also has a modest underweight to consumer discretionary, due to the sale of some mainly European and Chinese names. In China, consumer sentiment remains poor and savings rates have increased, reducing spending on discretionary and luxury goods. Holdings of consumer staples names have also declined, as has exposure to basic materials and telecoms, increasing the underweights in these latter two sectors.

Exhibit 5: Portfolio sector exposure at 31 October 2024 (% unless stated)

Source: Janus Henderson Investors, Edison Investment Research