- Investor sentiment remains bullish (44.3%) and remains above its historical average (37.5%) for another week.

- While Nvidia is soaring, other stocks could register bigger gains this year.

- In this piece, we'll take a look at those stocks and also how one can invest in the magnificent 7 through various funds.

- Investing in the stock market? Take advantage of our InvestingPro discounts. More information at the end of this article.

- Allstate (NYSE:ALL): An insurance company with an expected EPS increase of +1211%.

- Merck & Company (NYSE:MRK): A pharmaceutical and chemical giant forecasting a +466% growth, driven by drugs like Keytruda.

- Stanley Black & Decker (NYSE:SWK) (+184.6%)

- Estee Lauder (NYSE:EL) (+125.9%)

- Tyson Foods (NYSE:TSN) (+125.1%)

- Paramount Global (NASDAQ:PARA) (+115.3%)

- Eli Lilly and Company (NYSE:LLY) (+98%)

- Targa Resources (NYSE:TRGP) (+82.3%).

- Accuracy: it allows you to be invested in those stocks and take advantage of their movements.

- Simplicity: it is much easier to invest in this ETF than having to buy shares of the 7 companies.

- Costs: it is cheaper with its 0.29% annual commission than having to pay the purchase commissions of all the shares.

- Adaptation: it is rebalanced to have the same weight every quarter, which guarantees constant exposure to the Magnificent 7.

- Nvidia 20.03%.

- Target (NYSE:TGT) 17.12%.

- Amazon (NASDAQ:AMZN) 14.35

- Microsoft (NASDAQ:MSFT) 13.87% Alphabet (NASDAQ:GOOGL) 12.93

- Alphabet 12.93

- Apple 12.03% Tesla (NASDAQ:TSLA)

- Tesla 9.52

- Nikkei Japanese +17.24%.

- Euro Stoxx 50 +7,77%

- FTSE MIB Italian +7.74%

- Nasdaq +6.87%

- S&P 500 +6.74%

- Cac francés +5.61%

- Dow Jones +4.03%

- Dax alemán +3.99%

- Ibex 35 Spanish +0.28%

- FTSE 100 British -0.35%

- Hang Seng Chinese -1.89

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: Digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services we plan to add soon.

The technology sector has been a key driver of the S&P 500's strength, led by the Magnificent 7.

Nvidia (NASDAQ:NVDA) has stood out among the Magnificent 7, not just as the biggest gainer, but also in terms of the wide margin by which it beat other major stocks' performance.

After all seven companies presented results, the comparison is striking.

The other six stocks saw an average revenue increase of +15% (Apple (NASDAQ:AAPL) +2%, Meta (NASDAQ:META) +25%), while Nvidia boasted an impressive +265%.

Will the chipmaker continue to post staggering gains? Only time will tell. However, as investors, we should keep an eye out for alternative stocks that could perform even better this year.

While Nvidia has stolen all the headlines, over the past four years, some stocks have outperformed even Nvidia's +963% growth since February 19, 2020.

Examples include Celsius (NASDAQ:CELH) (+3,030%), Antero Resources (NYSE:AR) (+1,232%), Range Resources (NYSE:RRC) (+871%), Builders FirstSource (NYSE:BLDR) (+557%), Shockwave Medical (NASDAQ:SWAV) (+514%), and EQT (NYSE:EQT) (+509%).

Additionally, Advanced Micro Devices (NASDAQ:AMD), not part of the Magnificent 7 but noteworthy, has climbed to the 25th position in the S&P 500 and the 10th spot on the Nasdaq 100.

Looking at the earnings growth expectations for 2024, only a select group of companies is projected to outpace Nvidia:

Should You Consider Investing in This ETF to Gain Exposure to the Magnificent 7?

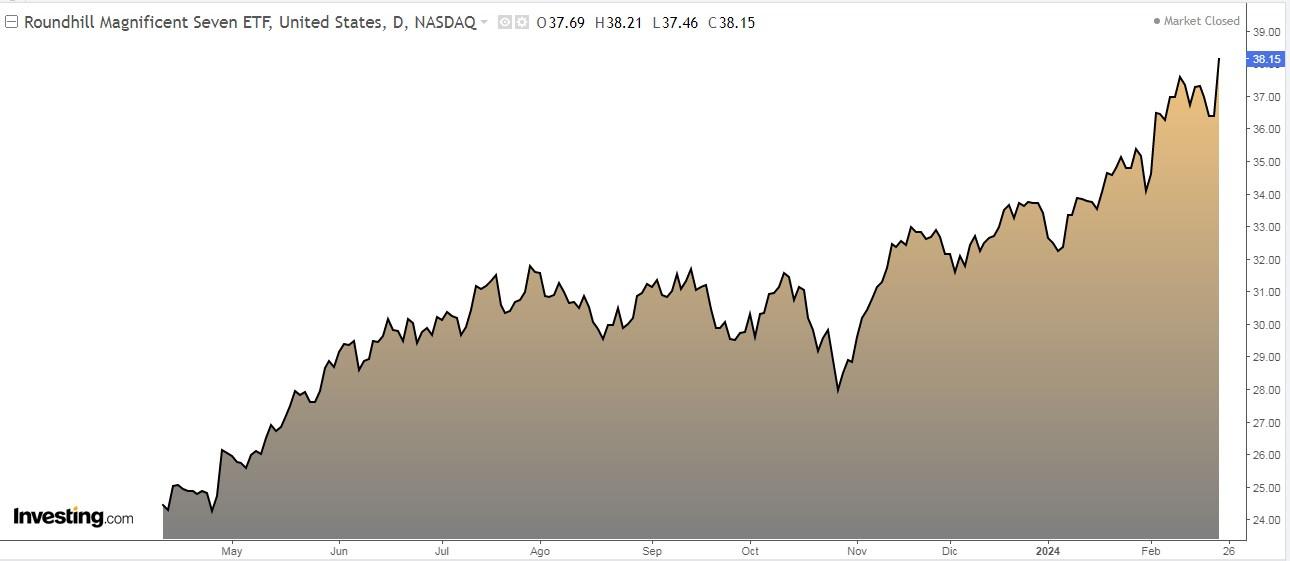

The Roundhill Magnificent Seven ETF (NASDAQ:MAGS) provides exposure to the Magnificent Seven stocks.

It started trading on April 11, 2023, under the name Roundhill BIG Tech (BIGT) and was later renamed Roundhill Magnificent Seven on November 9, 2023.

It has 4 advantages:

The exposure as of today is as follows:

Investor sentiment (AAII)

Bullish sentiment, i.e. expectations that stock prices will rise over the next six months, increased 2.1 percentage points to 44.3% and remains above its historical average of 37.5%.

Bearish sentiment, i.e., expectations that stock prices will fall over the next six months is at 26.2%, below its historical average of 31%.

Ranking of the main stock exchanges in 2024

***

Do you invest in the stock market? Set up your most profitable portfolio HERE with InvestingPro!

Apply discount code INVESTINGPRO1 and you'll get an instant 10% discount when you subscribe to the Pro or Pro+ annual or two-year plan. Along with it, you will get:

Act fast and join the investment revolution - get your offer HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.