Proactive Investors -

- FTSE 100 up 11 points at 8,284

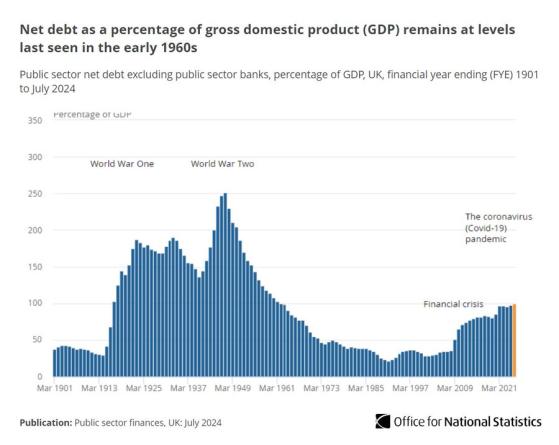

- UK public deficit higher than expected in July

- National Express (LON:MCG) owner Mobico impresses with results

Tit-for-tat-for-Temu

More tit-for-tat from China, but this time it's between two companies and it's not just catty but also it's gone legal.

Fast-fashion giant Shein has launched a legal attack on online marketplace Temu in the US.

In a complaint filed in the District Court of Columbia, the fashion site's legal team accused Temu of using an "illegal business model to build a massive counterfeiting and infringement machine in the US".

Temu is also accused of using Shein's trademarks in sponsored ads and creating fake social media accounts impersonating Shein to mislead customers.

Spicy!

China plays tit-for-tat

China has seemingly retaliated to the European Union's electric vehicle tariff increase by launching a probe into dairy products.

China's Ministry of Commerce on Wednesday announced the start of an "anti-subsidy investigation" into dairy produced in the European Union, local media are reporting.

Officials said the probe was prompted by complaints from domestic manufacturers over European subsidies.

BT keeps falling as analysts highlight pain points

BT Group PLC (LON:BTA) shares fell over 7% yesterday and are down 1.3% today, after BT Openreach wholesale customer Sky signed a broadband deal with rival CityFibre.

Analyst Polo Tang (the best name in the City?) at UBS expects this to have an impact of circa £120 million per year on BT’s free cash flow in the medium term.

"Sky is the largest customer of BT/Openreach spending >£950m pa and we expect it to sign at least one further deal," says Tang.

Separately, he notes that Virgin Media O2 is reportedly revisiting M&A discussions with TalkTalk, which is the second-largest customer of BT Openreach, spending £850 million a year.

"UK broadband infrastructure competition is increasing", the analyst says, also pointing to other risks to BT including the outcome of a £1.3 billion class action lawsuit about landline overcharging and pricing pressures in its consumer division, with altnets retail pricing at a 25-40% discount on broadband.

Analyst thoughts on results

Reviewing Costain's results (see earlier), analyst Andrew Nussey at Peel Hunt (LON:PEEL) says adjusted profits of £19.4 million are ahead of both its £18.5 million and consensus £17.5 million estimates.

This outperformance is attributed to higher interest income, with average net cash at £168 million.

"Notably, the pension has moved into surplus, enabling a £10m share buyback," Nussey adds, with the outlook largely unchanged, with management reiterating margin goals and order book growth, particularly driven by the water segment.

Shares trading at 6.7 times December 2025 expected earnings "do not fully reflect the strengthening opportunity and balance sheet, in our view", the analyst adds, retaining his positive recommendation.

Costain shares are up 2%.

Elsewhere, Peel's Alexander Paterson has looked at the interims from Mobico Group PLC (LSE:MCG), the owner of National Express coaches and found they were "slightly below our expectations, but not materially so".

Mobico shares have surged 10% on the back of the numbers this morning as the company said that a formal sale process for its North American School Bus business is underway, following a strong bidding season where more routes were won than lost for the first time in over a decade.

"However, we remain concerned that the value realised from a disposal of North American School Bus, after fees and provisions, would allow the group to delever sufficiently," Paterson says, with net debt of £988 million and covenant gearing of 2.8 times at the half year stage.

European markets just above flat

The FTSE 100 is just about holding onto its small gain, up less than four points now, while its European cousins have broken into positive territory too.

Germany's DAX and Spain's IBEX 35 are both just above flat, while France's CAC 40 has climbed 0.2%.

The continent-wider Euro Stoxx 600 is up 0.1%, with Austrian engineer Voestalpine the top riser, up 3.6%, while the UK's Softcat (LON:SCTS) and Rio Tinto (LON:RIO) are in the top 10.

Rio and fellow miners are the main things keeping the Footsie in positive territory, with heavyweight fallers including BT, AstraZeneca (NASDAQ:AZN), Shell (LON:SHEL) and a group of retailers and utilities companies.

Waitrose expansion

In the retail sector, Waitrose is set to open its first new site in six years in the coming month and plans to invest £1 billion in refurbishments and opening 100 Little Waitrose convenience stores over the next five years.

This is a Guardian report, which says the John Lewis-owned supermarket chain plans to also open four large stores under the plan, alongside the new local shops.

Ahead of ex-Tesco man Jason Tarry’s arrival as the new chair of parent company John Lewis Partnership next month, Waitrose returned to profit in March following a turbulent period as surging living costs squeezed consumers’ pockets, before the parent company slashed 3,8000 jobs in May.

FTSE starts higher

The FTSE 100 has opened higher, inching upwards in early trades thanks to mining sector gains, while the rest of Europe has opened in the red.

After 10 minutes the London benchmark is up five points at just under 8,279,

The top five risers are all miners, with Glencore (LON:GLEN) PLC, Antofagasta PLC (LON:ANTO), Anglo American (JO:AGLJ) and Fresnillo PLC (LON:FRES) rising 1.7% and Rio Tinto PLC up 1.4%.

BT Group PLC is continuing to fall after the Sky deal with CityFibre yesterday.

My colleague Billy Farrington had a think about that deal and wondered if BT might have gained wholesale bargaining chip with the regulator.

Costain confident as water contracts flow

Costain Group PLC has launched a £10 million share buyback but kept its dividend flat as profits doubled in the first half and the infrastructure construction group continues to snaffle large water sector contracts.

Adjusted operating profits rose 8.7% to £16.3 million as margins improved in transportation and natural resources and reported profits before tax doubled to £17 million, even though revenues dropped 4% to £639.3 million due to a reduction from its transportation arm, which focuses mainly on roads.

Forward work stood at £4.3 billion at the half-year stage, up from £4.0 billion a year earlier and with more than £500 million of water contracts won post the half year.

CEO Alex Vaughan said the buyback was "a result of our confidence in our long-term prospects" and a growing cash balance.

NatWest no longer a public company, says ONS

Alongside the public borrowing figures, ONS issued a separate statement to clarify that NatWest Group PLC (LON:NWG) is no longer a public company.

This follows the government's steady selling down of its bail-out stake in recent years, which reduced below 25% in June.

It is for statistical purposes only, though, and will have no impact on its headline public sector finances, as this excludes banks.

However, it will reduce the total measure of public sector net debt by around £372 billion, based on today’s publication for July 2024.