- We will take a look at high-growth opportunities with international stocks offering superior dividend yields.

- These three companies combine sector leadership with strong fundamentals and market confidence.

- A deep dive into PayPal, Cellnex, and Rheinmetall (ETR:RHMG) reveals why they stand out for 2024 and beyond.

- Kick off the new year with a portfolio built for volatility and undervalued gems - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

As U.S. stocks grapple with valuation concerns, savvy investors may find compelling opportunities abroad.

While Wall Street has outpaced its European counterparts, international markets present attractive dividend yields and untapped growth potential.

These three stocks—spanning Spain, Germany, and the U.S.—offer a mix of strong fundamentals, sector leadership, and market confidence.

Why Look Beyond Wall Street?

European stocks offer dividend yields between 3% and 6%, significantly outpacing U.S. indices. Additionally, while U.S. companies continue aggressive share buybacks, European firms are increasingly investing in their own stock, signaling confidence in future growth.

Here’s a closer look at three standout picks:

1. PayPal

PayPal (NASDAQ:PYPL) remains a dominant force in digital payments, even as competition heats up. The San Jose-based company has steadily expanded its global footprint, with over 400 million customer relationships in 200+ countries.

- Platform Innovations: PayPal’s focus on monetizing Venmo and optimizing Braintree’s pricing is driving transaction margin growth.

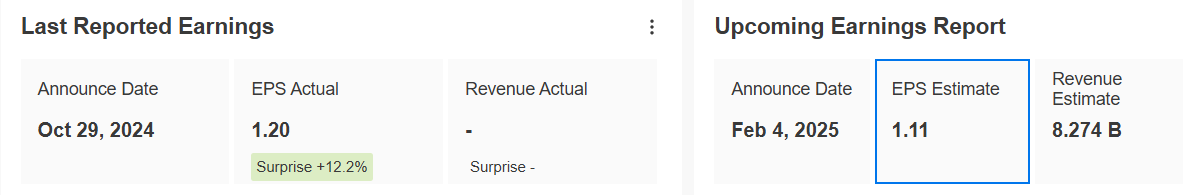

- Earnings Outlook: While revenue is set to grow at single-digit rates in 2024 and 2025, aggressive cost-cutting is fueling double-digit EPS growth.

- Shareholder Returns: With consistent free cash flow generation, PayPal plans to continue repurchasing shares, further enhancing shareholder value.

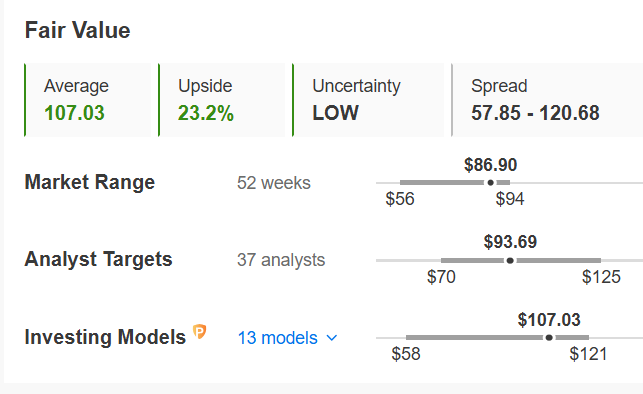

The company’s shares trade 23.2% below their intrinsic value, with a fundamental price of $107.03. After underperforming for three years, PayPal has rebounded in 2024, outperforming the S&P 500.

Source:InvestingPro

2. Cellnex

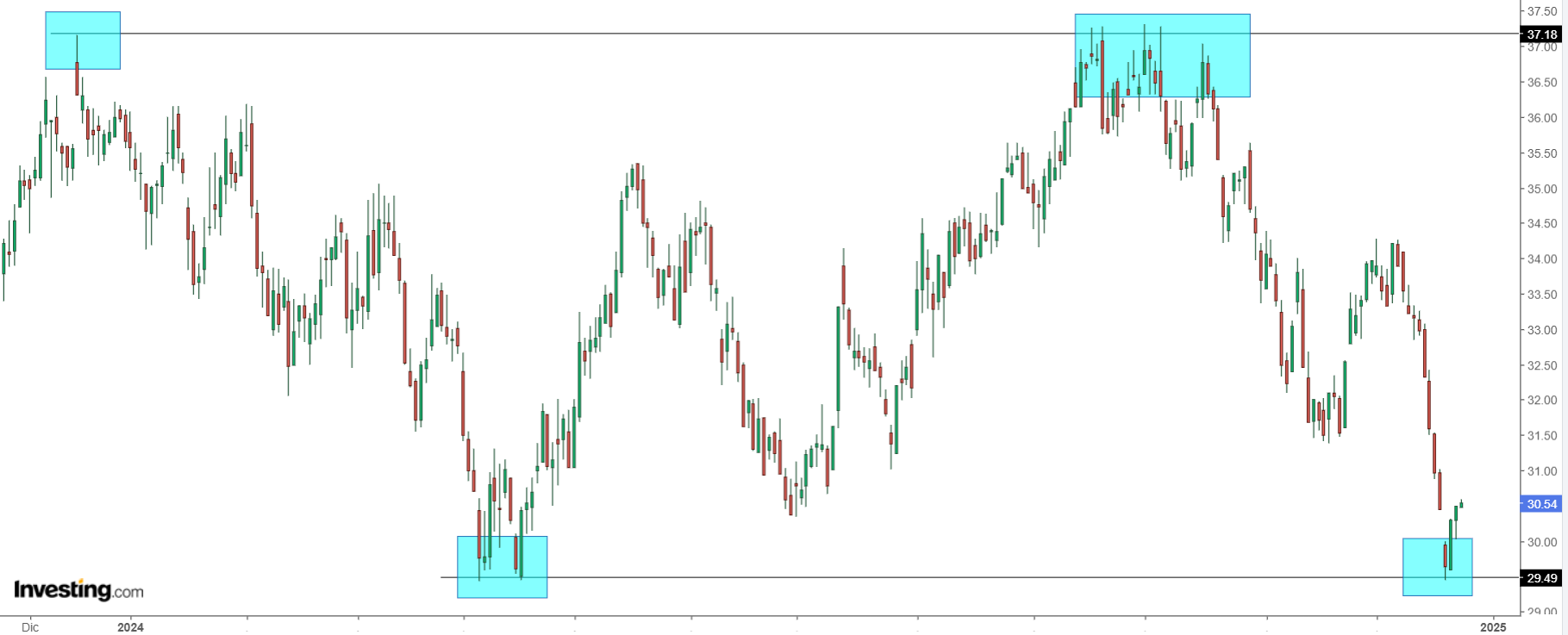

Based in Madrid, Cellnex Telecom (OTC:CLLNY) is a leader in wireless telecommunications infrastructure. The company is shifting from a growth-oriented model to prioritizing shareholder returns, and the numbers tell an impressive story.

- Dividend Potential: Cellnex plans to increase its dividend payout tenfold by 2026, with a 7.5% annual growth rate. It’s also considering accelerating this timeline to start boosting shareholder remuneration in 2025.

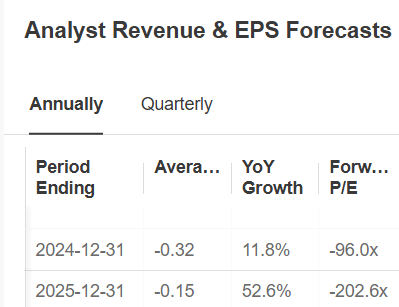

- Earnings Growth: EPS is forecast to rise by 11.8% in 2024 and an astounding 52.6% in 2025.

- Favorable Rates: As the European Central Bank eases interest rates, Cellnex’s financial costs—a critical factor for this leveraged company—are set to decline.

- Strategic Moves: The upcoming sale of subsidiaries in Ireland and Austria will further strengthen its cash flow. A planned share buyback reinforces its transition to a high-cash, shareholder-focused company.

Source: InvestingPro

Trading at attractive multiples, Cellnex boasts a high average market target price, making it a solid bet for growth and income-focused investors.

It will announce its results on February 21. The forecast for 2024 is for an increase in earnings per share (EPS) of 11.8% and for 2025 of 52.6%. In terms of earnings it would be an increase of 2.2% and 4.6% respectively.

Rheinmetall

It is a leader in the defense sector in Germany and its activity encompasses the development and manufacture of weapons systems, ammunition, armored vehicles and electronic equipment for armed forces. The company develops several components of the Leopard armored vehicles and is also one of the world's leading ammunition manufacturers. It was founded in 1889 and is headquartered in Düsseldorf.

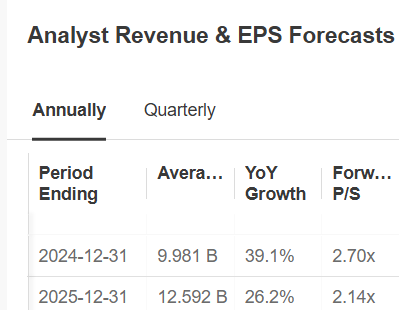

It will publish its quarterly accounts on March 12. EPS is expected to increase by 65.6% in 2024 and 41.7% in 2025. On the earnings side, the increase would be 39.1% and 26.2%.

Source: InvestingPro

It is forecast to double its turnover to €20 billion by 2027 as Western countries increase their defense spending.

The defense business accounts for the lion's share of Rheinmetall's sales. Trump's victory in the U.S. presidential election, and his threat to leave NATO should European countries not increase their defense spending, will mean billions will be spent in the sector.

Even a negotiated agreement unfavorable to Ukraine could increase the need for European nations to assume greater responsibility for regional security, given their dependence on U.S. support.

Thus, the structural shift toward higher defense priorities in the Old Continent suggests a bright outlook for the sector.

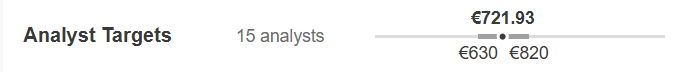

The market consensus gives it an average target price at €721.93.

Source: InvestingPro

Curious how the world’s top investors are positioning their portfolios for next year using strategies just like this one?

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Ready to take your portfolio to the next level? Click the banner below to discover more.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.