- Bitcoin broke out of its post-halving consolidation to hit fresh record highs above $100K, before pulling back below that level.

- Despite the big Q4 2024 rally, multiple indicators suggest that we still may be a way, in both time and price, from a cycle top in Bitcoin.

- To the topside, the next levels to watch are at $123K (the 200% extension of the 2021-2022 drop) and $156K (the 261.8% Fibonacci extension)

You snooze, you lose as they say.

Our Q4 Bitcoin Outlook report was titled “Reasons Not to Sleep on the Lackluster Price Action,” and sure enough, shortly after publication, we saw Bitcoin break out of its prolonged sideways price action to explode to record highs above $108K in December 2024. The proximate catalyst for the breakout was the “Red Wave” US presidential election that ushered in a far more crypto-friendly administration in the world’s largest economy.

As we head into 2025, traders are keen to see if the Trump Administration delivers on its promises and, as ever, how that impacts the price of the world’s largest cryptoasset.

Bitcoin 2025 Outlook

It took longer than some Bitcoin bulls would have preferred, but the cryptocurrency has kicked into gear in its historically bullish post-halving period.

For the uninitiated, the Bitcoin Halving is when the reward for mining new bitcoins is cut in half. This reduces the rate at which new bitcoins are created and thus, lowers the total supply of new bitcoins coming into the market. The halving tends to increase scarcity and historically has led to an increase in the price of bitcoin, though of course it's not guaranteed to do so in the future. As any Bitcoin bull will tell you, the April 2024 halving took the “inflation rate” of Bitcoin’s supply to below 1% per year, less than half of gold’s annual inflation rate.

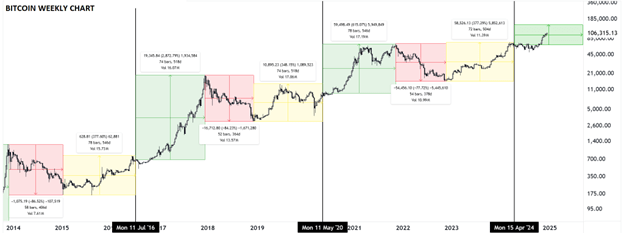

Looking at my favorite chart, which I colloquially call “The Only Bitcoin Chart You'll Ever Need™”, previous Bitcoin halvings have marked the transition from the (yellow) post-bottom recovery rally stage to the (green) full-blown bull market stage. As Bitcoin continues to mature as an asset class, we’re likely to see smaller percentage moves in each stage even if the general pattern continues to hold (i.e. a 29X rally like we saw in 2016-17 would take Bitcoin over $2,000,000 for an absurd market capitalization of $40T), but the time-based projection for a ~1.5-year bull cycle to late 2025 is developing generally in-line with the 4-year cycle:

Source: TradingView, StoneX. Past performance is no guarantee of future returns.

As we noted in our last report, there are both macroeconomic and “fundamental” bullish arguments for Bitcoin beyond this simple cycle analysis, though it’s critical to watch how those catalysts evolve in the coming year and beyond.

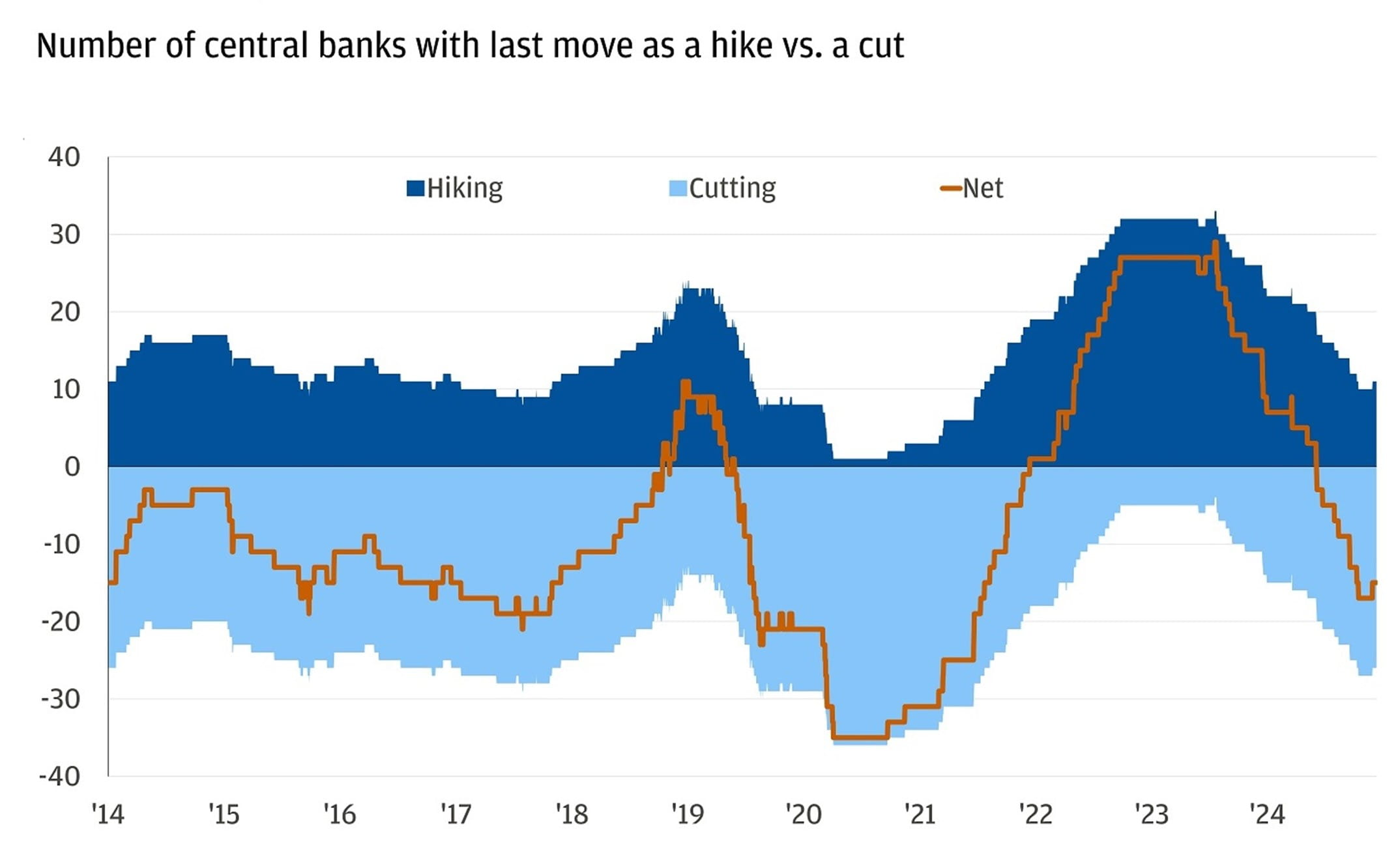

From a macroeconomic perspective, the monetary policy backdrop remains generally supportive, though we may be nearing a turning point for interest rate cuts. As the chart below shows, global central banks have still been cutting interest rates generally, but we have seen a small uptick in net interest rate changes in late 2024:

Source: Chase Bank

If the nascent trend toward interest rate hikes accelerates (especially if accompanied by pauses or small rate hikes among the major central banks – the Fed, ECB, BOJ, ECB, and PBOC) as central banks shift focus back to the risks of re-accelerating inflation, it could develop into a potential headwind for Bitcoin in the latter half of the year.

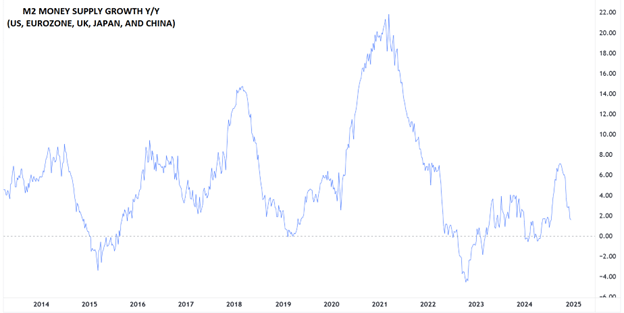

Likewise, the amount of fiat money in the financial system is also turning to a more stimulative direction. So-called “M2” is central banks’ estimate of the total money supply, including all the cash people have on hand, plus all the money deposited in checking accounts, savings accounts, and other short-term saving vehicles such as certificates of deposit (CDs).

After spiking above 6% in mid-2024, the year-over-year growth in global money supply has ticked down to closer to 2% as of writing:

Source: TradingView, StoneX.

One of the key narratives driving Bitcoin’s value is the idea of “hard money” or a hedge against fiat currency debasement, and if global money supply starts to contract in 2025, that could weigh on the cryptocurrency.

One other narrative driving Bitcoin higher has ben hopes of the US establishing a “National Strategic Reserve” holding up to 1M Bitcoin. Incoming President Trump has hinted at such a strategy, though it risks sowing doubt on the US dollar’s current status as the global reserve currency and therefore may not ultimately be enacted. Regardless, if we do see clear steps toward formally adding Bitcoin as a national reserve asset in the US, it could drive prices to new heights as other countries scramble to secure their own stashes of Bitcoin.

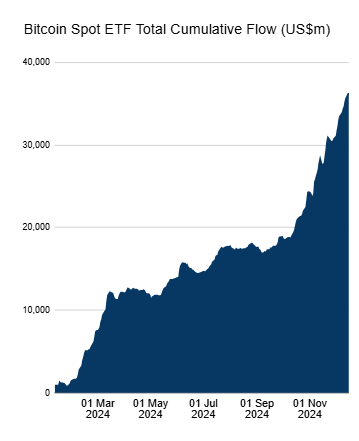

Speaking of large entities accumulating Bitcoin, the impressive inflow of “TradFi” institutional capital into spot Bitcoin ETFs has reaccelerated following the US election. In some of the most successful ETF launches of all time, total inflows into Bitcoin ETFs have exceeded $35B in less than a year:

Source: Farside Investors

As long as Bitcoin ETFs continue to pull in $1B+ in inflows per week, dips in Bitcoin itself are likely to remain shallow and short-lived as Wall Street “catches up” with smaller retail investors’ allocations to the Bitcoin and other cryptoassets.