Proactive Investors -

- FTSE 100 higher ahead of US PCE figures

- IAG slips despite return to profit and Air Europa deal

- Consumer confidence improves in February - GfK

Final screening for Cineworld?

“Is the end in sight for Cineworld as a listed business?” That was the question posed by AJ Bell’s Russ Mould after the cinema operator said it had received various expressions of interest for parts of its estate, suggesting a break-up of the group could be on the cards.

Shares in the firm crashed a further 21% on the news.

Mould said, ““From where we stand today, two things look almost certain – one, that we won’t see a bidder for the whole business; and two, that shareholders will be left with nothing.”

“Even if the company does sell some of its subsidiaries, the end game still appears to be a debt-for-equity swap whereby creditors take control of the business.”

He felt, “Cineworld has paid the price for being too aggressive with its growth ambitions, weighed down by significant debt when the pandemic struck and the subsequent reopening of the cinema industry being too weak to repair its finances.”

“Selling subsidiaries doesn’t mean it will be suddenly swimming in cash. Any interested party in Cineworld’s assets knows that the cinema group is desperate and so they are likely to pitch any offers at a low level.”

But no signs of a slowdown in the FTSE 100 which is close to session highs at 7,933.38, 25.66 points, or 0.32%.

Car production stable in January

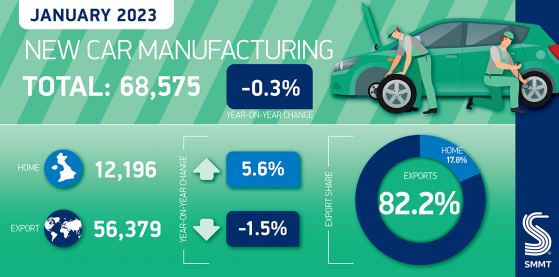

British car production was stable in January, down -0.3% with just 215 fewer units made, according to figures from industry body Society of Motor Manufacturers and Traders.

The decline was driven chiefly by structural changes, reflecting a move from car to van making at one major plant, but with supply chain shortages still afflicting some manufacturers.

The ongoing shift to electrified car production continued, with combined battery electric, plug-in hybrid and hybrid electric vehicle volumes up 49.9% to 28,329 units.

They represented more than four in every 10 (41.3%) cars made in January, a near record monthly share, and further evidence of the UK’s capability in making these important models, most of which (77.0%) are exported to meet global demand.

Production for the UK rose 5.6% to 12,196 units, while exports declined by -1.5%, largely due to the suspension of shipments to Russia, which accounted for 83.6% of the loss.

In total, some 56,379 cars – more than eight in 10 of all those produced – were destined for overseas markets, with over half of these (56.6%) for the EU, with next most important global destinations the US (9.3%), China (8.8%), Japan (4.4%) and Australia (3.3%).

Mike Hawes, SMMT chief executive, said, "Automotive manufacturing can drive long-term growth for the low carbon economy but the sector needs competitive conditions to attract investment."

“We now look to the forthcoming Budget for the necessary measures that will enable the automotive sector to deliver its undoubted potential.”

Germany on brink of recession as Q4 GDP falls

Not good news from Germany where fourth quarter GDP in Europe’s largest economy fell 0.4% compared to the third quarter.

The figure released by Destatis was worse than expected and below a previous estimate of negative 0.2%.

Economists said it left Germany on the brink of recession.

Good Morning from Germany where economy fared worse than exp. GDP shrank 0.4% in Q422 vs prev reading of -0.2%. Private consumption plunges 1% QoQ, cap investment crashed 2.5% QoQ. Public spending rose 0.6% QoQ. Economists predict another neg quarter, would tip GER into recession pic.twitter.com/HJDeVhF9zS— Holger Zschaepitz (@Schuldensuehner) February 24, 2023

ING Economics said, “today’s numbers mark the first part of what could become a technical recession in Germany.”

“We think that the risk of yet another contraction in the first quarter and, thus, a technical recession is high and that the German economy is still miles away from staging a strong rebound.”

Pantheon Macroeconomics agreed. “Looking ahead, the recent upturn in the surveys is positive, but we doubt that the economy has enough momentum to avoid another fall in GDP in Q1, and as a result, a technical recession.”

The news failed to stop the Dax opening higher but a gain of 0.1% meant it underperformed London, FTSE and Paris where the FTSE 100 and CAC 40 are botj up 0.3%.

Footsie kicks ahead

The FTSE 100 Footise remained in fine fettle on Friday after the GfK figures showing an improvement in consumer confidence.

At 9.00am the lead index stood at 7,930.08, up 22.36 points, or 0.28%.

Victoria Scholar, at interactive investor accepted, “consumer confidence has a long way to go to restore more normal levels, but the latest reading points to an encouraging trajectory with sentiment starting to shift away from near all-time lows.”

“With the UK narrowly staving off a recession, financial markets picking up, inflation starting to ease and interest rates approaching their peak, there are incipient signs of hope for the UK consumer,” she felt.

But the economic was not all good with worse than expected GDP numbers in Germany and a jump in inflation In Japan. While in the US, futures are lower ahead of PCE figures, the Fed’s preferred inflation measure which could mean a volatile end to the trading week.

Rolls-Royce (LON:RR) sat top of the FTSE 100 risers, extending yesterday’s gains, when the engineer soared over 20%. Better-than-expected results and new CEO Tufan Erginbilgic’s seven-pronged transformation plan continues to attract investors.

JP Morgan raised its price target to 90p from 70p but still remains ‘underweight’ on the stock. They felt Erginbilgic’s “aims to de-lever RR’s balance sheet organically,” was “a risky strategy and leaves RR highly vulnerable to any unexpected shocks in the next few years.”

But Deutsche Bank (ETR:DBKGn) remained a fan reiterating a ‘buy’ rating.

IAG, the owner of British Airways, remained top of the blue-chip fallers, down 1.8% despite better than expected results and the Air Europa deal.

Shares are up 25% year to date and could be susceptible to some profit-taking.

Richard Hunter, at interactive investor, commented, “a pre-tax profit for the year of €415mln compares with a loss of €3.5bn the year previous, and exceeds expectations for a number of €398mln.”

But he added, “the journey ahead is one which will need careful and constant monitoring as the airline attempts to regain its financial footing.”

He also pointed out, “IAG has a major task in repairing its balance sheet after the pandemic tore through revenues and forced the group into substantial borrowings.”

Footsie higher as consumer confidence improves

FTSE 100 opened Friday in upbeat fashion as a closely watched survey pointed to an improved mood amongst UK consumers.

At 8.15am London's blue-chip index was at 7,934.51, up 26.79, or 0.34% while the FTSE 250 was slightly more sedate, at 19,829.95, up 39.46 points, or 0.20%.

GfK’s long-running consumer confidence Index increased seven points in February to -38. All five measures were up in comparison to the January 20th announcement.

Joe Staton, client strategy director, GfK said, “despite widely reported headwinds of inflation continuing to outstrip wage rises, and the ongoing household challenge from the cost-of-living crisis, consumers have suddenly shown more optimism about the state of their personal finances and the general economic situation, especially for the coming year.”

“While it's too early to talk about ‘green shoots of recovery’, the uptick across all measures should be welcomed. “

Gabriella Dickens senior UK economist at Pantheon Macroeconomics said the improvement made “sense, given that motor fuel prices and mortgage rates have fallen, equity prices have risen, and firms have not moved decisively to reduce employment yet, as many households feared.”

But she cautioned, “the rise in February does not necessarily suggest consumers are willing to spend; confidence remains weak.”

The economic news wasn’t so good in Europe though where GDP in Germany fell 0.4% quarter-on-quarter, below consensus and initial estimates.

ING Economics said, “today’s numbers mark the first part of what could become a technical recession in Germany.”

“We think that the risk of yet another contraction in the first quarter and, thus, a technical recession is high and that the German economy is still miles away from staging a strong rebound.”

International Consolidated Airlines Group (LON:ICAG), the owner of British Airways, failed to impress the market despite an improved financial showing in 2022. The airline swung back into profit on much improved revenue as the bounce back in international travel continued to gather pace post-pandemic.

IAG also announced a EUR400mln deal for the remaining shares in Air Europa that it doesn’t already own.

Sophie Lund-Yates, at Hargreaves Lansdown (LON:HRGV) said the return to profit was an “impressive regaining of altitude comes as a direct result of Covid restrictions easing and a return to more normal travel.”

She felt debt “at 3.1 times cash profits the debt pile is too heavy following efforts to keep liquidity in check during the pandemic.”

But she added, “should enough passengers continue to be funnelled on to planes, that should start to come down relatively quickly.”

Shares fell 1.6% to 162.82p.

A rise in oil prices pushed index heavyweights, BP PLC (LON:BP.) and Shell (LON:RDSa), higher, up 1.2% and 0.7% respectively.

But the woes of Cineworld Group PLC (LON:CINE) continue. Shares tumbled 33% as the cinema operator said it is looking at “a number” of proposals to buy some or all of the group, but that it does not expect shareholders to see any recovery.

It stressed that none of these proposals involves an all-cash bid for the entire business, and that any sale of the whole group “would not include the sale of the equity interests in Cineworld itself” and so would not be subject to the rules of the London takeover code.

Consumer confidence improves - GfK

GfK’s long-running consumer confidence Index increased seven points in February to -38. All five measures were up in comparison to the January 20th announcement.

Joe Staton, client strategy director, GfK said, “despite widely reported headwinds of inflation continuing to outstrip wage rises, and the ongoing household challenge from the cost-of-living crisis, consumers have suddenly shown more optimism about the state of their personal finances and the general economic situation, especially for the coming year.”

“While it's too early to talk about ‘green shoots of recovery’, the uptick across all measures should be welcomed. “

But he cautioned, “the headline consumer confidence score is still severely depressed and the mood as well as the economy remain a long way off pre-lockdown levels, but a little consumer resilience might be what we need to soften any downturn in 2023.”

Confidence in the general economic situation over the next 12 months is up by 11 points but remains at negative 43 while confidence in personal finances looking ahead to the next 12 months increased by nine points to negative 18, which is four points lower than this time last year.

The major purchase index, an indicator of confidence in buying big ticket items, is up three points to negative 37 – 22 points lower than a year ago.

CVS reports solid growth in profits and revenue, sees full-year in line

CVS Group PLC reported on Friday solid growth in half-year revenue and profit and remained confident the outcome for the full-year would be in line with market expectations.

The providers of integrated veterinary services said revenue in the six months to December 31 rose 8.2% to £296.3mln from £273.7mln a year ago while pre-tax profit totalled £28.0mln compared to £22.9mln in the same period in 2021. Earnings per share were 29.6p against 24.7p.

Organic growth has continued with 7.5% like-for-like sales1 growth, within the organic revenue growth ambition of between 4% and 8%, the company said in a statement.

Adjusted EBITDA margin improved to 19.5%, a like-for-like improvement of 0.5 percentage points, while membership of its preventative healthcare scheme, Healthy Pet Club increased to 481,000, up 4.3%.

CVS said demand for our high-quality veterinary services remains robust and the positive performance of the first half has continued into the first month of the second half.

“The board remains confident that full year results will be in line with market expectations,” the statement said.

Chief Executive Richard Fairman said, “The robust performance in H1 2023 has continued into the second half of the year and we look forward to reporting further growth in the future."

BA owner swings back into profit, buys rest of Air Europa

British Airways owner, IAG, has reported a healthy improvement in profits and revenue and a much anticipated deal to kick Friday off. For the year to December 31 pre-tax profits were EUR431mln compared to a loss of EUR2.93bn in 2021 as revenue jumped to EUR23.07vbn from EUR8.46bn.

The results came as the FTSE 100 listed airline agreed to EUR400mln to Spain's Globalia for the remaining 80% of airline Air Europa it does not already own.

“The board of IAG believes that the acquisition remains strategically important for the group and positions it to benefit from growth opportunities in the Latin America and Caribbean market, as well as to increase connectivity to Asia,” the company said.

IAG also gave guidance for 2023. The airline forecast full year 2023 capacity of around 98% of the 2019 level, with the first quarter seen at about 96% of the quarter one level in 2019.

Full year 2023 operating profit before exceptional items is seen in the range of EUR1.8bn to EUR2.3 billion, with most of the improvement over 2022 in the first half of the year.

In quarter one, 2023 an operating loss of around EUR200mln is expected assuming no further setbacks related to COVID-19 or material impacts from geopolitical developments.

“We are transforming our businesses, with the intention of returning IAG to pre-COVID levels of profit within the next few years, through major initiatives to improve customer experience and operational performance,” said Luis Gallego, IAG Chief Executive Officer.

Bright start in London

FTSE 100 is expected to make a bright start to the final day of the trading week ahead of a key inflation reading in the US.

Spread betting companies are calling London’s lead index up by around 26 points.

The early focus will be results British Airways owner, International Consolidated Airlines Group SA, and encouraging figures from GfK which showed a rebound in consumer confidence in February.

The mood should also be lifted by gains in the US which ended the day in the green. The Dow closed Thursday up 109 points, 0.3%, at 33,154, the Nasdaq Composite added 83 points, 0.7%, to 11,590 and the S&P 500 improved 21 points, 0.5%, to 4,012.

Attention will then shift to US January core PCE deflator numbers, which is the Fed’s preferred inflation measure, and which has fallen back sharply in the last few months from 5.2% in September, falling to its lowest level since October 2021 in December at 4.4%.

Michael Hewson at CMC suggested given “given the strength of recent economic data, today’s January numbers may call time on the trend of lower prices, with expectations that the PCE core deflator could fall only modestly from 4.4% to 4.3%.”

In Asia on Friday, the Nikkei 225 index closed up 1.3%. Japan's consumer prices rose 4.2% in January from a year earlier, a level not seen since September 1981, fuelled in part by higher energy bills. In China, the Shanghai Composite was down 0.5%, while the Hang Seng index in Hong Kong was down 1.2%.

Read more on Proactive Investors UK

ICAG: A Bull or Bear Market Play?

Don't miss out on the next big opportunity! Stay ahead of the curve with ProPicks – 6 model portfolios fueled by AI stock picks with a stellar performance this year..

In 2024 alone, ProPicks' AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech Stocks, and Mid Cap stocks, you can explore various wealth-building strategies.

So if ICAG is on your watchlist, it could be very wise to know whether or not it made the ProPicks lists.