Investing.com-- Most Asian stocks moved in a flat-to-low range on Monday, with Chinese markets markets logging sharp swings on mixed economic and policy cues, while investors turned cautious ahead of key U.S. inflation data this week.

Chinese stocks were pressured by the prospect of more U.S. trade tariffs against the country. A string of reports last week said that the Biden administration was preparing to impose import tariffs on several key sectors including electric vehicles and solar energy technology.

But a rally in Chinese property stocks helped offset bigger losses, as Beijing signaled more support for the beleaguered sector.

Regional markets took middling cues from a muted Friday close on Wall Street, while U.S. stock index futures moved little in Asian trade on Monday, with focus squarely on upcoming inflation data that is likely to factor into U.S. interest rates.

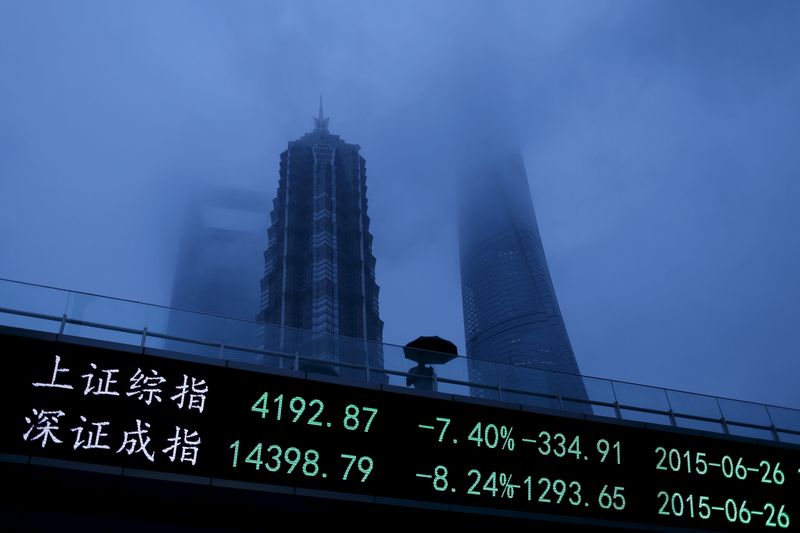

Chinese stocks sink on mixed inflation, trade jitters

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite traded sideways after falling as far as 0.8% each earlier in the session. The two remained below seven and eight-month highs hit last week.

Data over the weekend showed Chinese consumer price index inflation picked up pace in April, signaling some strength in spending. But this was largely offset by Chinese producer price index inflation shrinking for a 19th consecutive month.

Sentiment towards China was also battered by reports of more potential U.S. trade tariffs against the country, which could potentially stymie economic growth and also spark a renewed trade war with Washington.

But a rally in property stocks helped limit losses in Chinese indexes, after several major Chinese cities relaxed restrictions on home buying over the past week.

Hong Kong’s Hang Seng index rose 0.5%, also supported by a rally in property stocks.

Focus this week is also on Chinese retail sales and industrial production data, due on Friday.

Broader Asian markets traded lower on Monday. Japan’s Nikkei 225 index shed 0.1%, while the broader TOPIX lost 0.3%/

Australia’s ASX 200 shed 0.1%, while South Korea’s KOSPI fell 0.2%.

Futures for India’s Nifty 50 index pointed to a muted open, as local markets faced increased volatility amid the 2024 general elections.

Major Asian earnings on tap this week

Regional markets were also bracing for earnings reports from several key companies this week.

In Japan, technology giant SoftBank Group Corp. (TYO:9984) is set to report earnings later in the day, while majors Sony Corp (TYO:6758), SMC Corp (TYO:6273), Resona Holdings, Inc. (TYO:8308) and Asahi Group Holdings, Ltd. (TYO:2502) are due on Tuesday.

China’s biggest technology companies- consisting of Baidu Inc (NASDAQ:BIDU) (HK:9888), Alibaba Group Holding Ltd (HK:9988) (NYSE:BABA) and Tencent Holdings Ltd (HK:0700), are set to report earnings through the week.

In India, earnings reports from Hindustan Aeronautics Ltd (NS:HIAE), Tata Steel (LON:TISCq) Ltd (NS:TISC) and Zomato Ltd (NS:ZOMT) are due this week.