By Ambar Warrick

Investing.com -- Most Asian stock markets rose on Friday as softening inflation spurred growing expectations that global central banks will hold off from tightening policy further, although fears of slowing economic growth kept gains limited.

Singapore’s Monetary Authority became the latest in a growing list of central banks to pause future interest rate hikes. The move also came as data showed that the Singapore economy slowed more than expected in the first quarter of 2023.

Overnight U.S. data showed that producer price index inflation eased further in March. The data, which came a day after a drop in the consumer price index, pushed up hopes that a pause in the Federal Reserve’s rate hike cycle was imminent. Fed Fund futures prices show that markets are pricing in one more rate hike by the Fed in May, followed by a June pause.

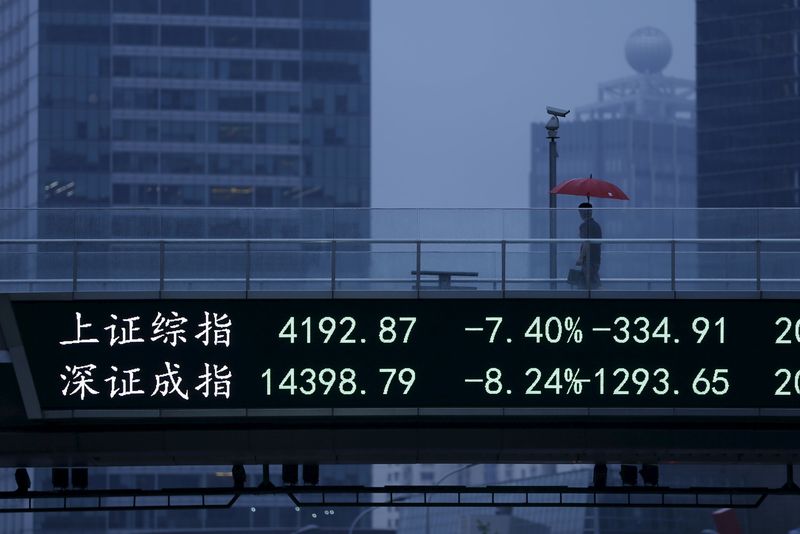

The prospect of a pause in global rate hikes supported Asian markets, with China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes up 0.3% and 0.2%, respectively. The two were also supported by an unexpected rebound in exports, which could herald a bigger economic recovery in the country.

Hong Kong's Hang Seng index was flat as local technology heavyweights nursed steep losses this week.

Japan’s Nikkei 225 shot up 1%, given that the Bank of Japan’s stance is far more dovish than most other central banks.

Singapore’s Straits Times Index rose 0.3%, while South Korea’s KOSPI and Australia's ASX 200 added 0.5% each.

The Monetary Authority of Singapore’s decision to halt future rate hikes comes shortly after similar moves from several regional peers, including India, South Korea, the Philippines, and Australia.

The trend comes amid a cooling in economic growth, as well as a drop in inflation from peaks seen during 2022. Most regional central banks had hiked interest rates sharply through 2022 to curb higher inflation.

But markets are now fearing that high interest rates will weigh on economic growth this year. Recent indicators already point to a cooling in activity, which could worsen with rates remaining relatively high in the near-term.

Signals from the Fed also showed that policymakers were wary of a “mild” U.S. recession this year, which could potentially spill over into other regions.

As such, markets remained wary of risk-heavy assets, which limited gains in Asian markets on Friday. Regional stocks also largely shrugged off positive overnight cues from Wall Street indexes.