- In this article, we will discuss three undervalued stocks poised for strong performance in 2025.

- From banking to mining, these companies combine market confidence with impressive growth potential.

- We will take a closer look at why analysts see substantial upside in Citigroup, Uber, and Rio Tinto (LON:RIO).

- Kick off the new year with a portfolio built for volatility and undervalued gems - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

Savvy investors are always on the hunt for bargains—stocks that trade at steep discounts yet hold immense potential. When these undervalued assets also boast strong market backing and ambitious target prices, the opportunity becomes even more compelling.

As we step into 2025, three standout stocks share two critical traits:

- They trade significantly below their fundamental value.

- Market consensus assigns them high average target prices for the year ahead.

Let’s dive into the details of these promising picks.

1. Citigroup

U.S. banking stocks are poised for a strong 2025, supported by a mix of favorable economic and regulatory trends:

- The U.S. economy continues to perform well.

- Low interest rates fuel growth in borrowing, the lifeblood of banks' earnings.

- A rising trend in loan demand further strengthens the sector.

- Former President Trump’s policy promises, including lenient regulations and reduced provisioning requirements, could boost profitability and unlock additional shareholder returns.

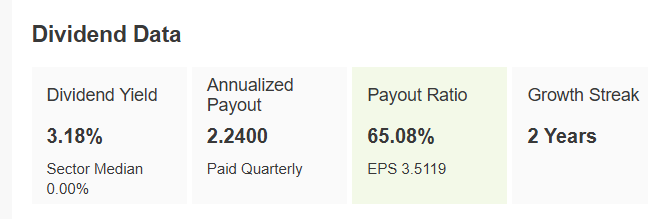

Citigroup (NYSE:C) stands out with a 3.18% dividend yield and expectations for earnings per share (EPS) to grow 6.5% in 2024 and a robust 22% in 2025. By 2026, the bank aims to lift its return on tangible equity to 12%, up from its current 7% year-to-date.

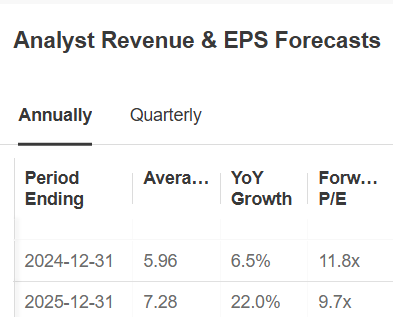

The bank derives 80% of its revenue from three key segments: global services (including international payments), investment banking, and credit cards. Despite its 40% gain this year, Citigroup remains the only major U.S. bank trading below tangible book value, with a fundamental price 19.3% above its current levels.

Source: InvestingPro

Source: InvestingPro

Market analysts see substantial upside, with some projecting the stock price could double in three years. The average target price is $80.25—a notable jump from its current valuation.

Source: InvestingPro

2. Uber

Uber's (NYSE:UBER) growth trajectory remains impressive as it prepares to report quarterly earnings on February 5.

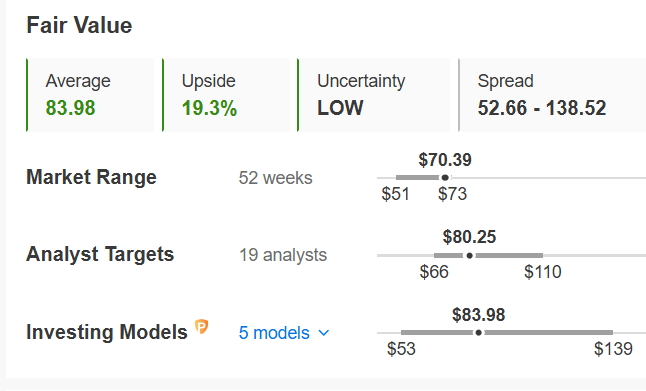

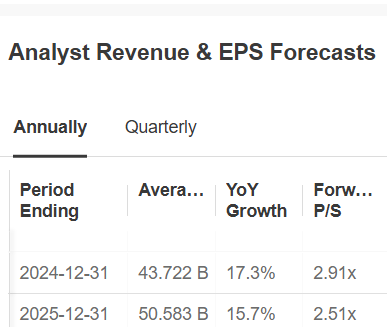

Analysts project earnings growth of 17.3% for 2024 and 15.7% for 2025. Additionally, Uber’s fundamentals shine, with an expected compound annual growth rate (CAGR) of 17% in revenue and 30% in EBITDA through 2026.

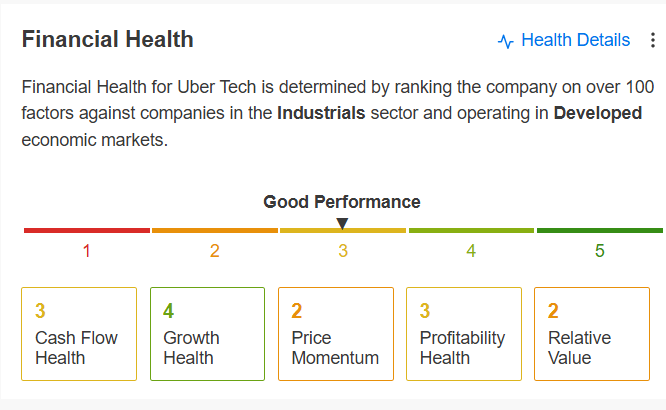

Source: InvestingPro

Director Amanda Ginsberg’s recent share purchases signal confidence, despite concerns about competition from autonomous vehicle technology like Alphabet’s Waymo.

Source: InvestingPro

While Robotaxi may eventually challenge Uber’s dominance, it faces high operational costs and years of scalability hurdles.

Source: InvestingPro

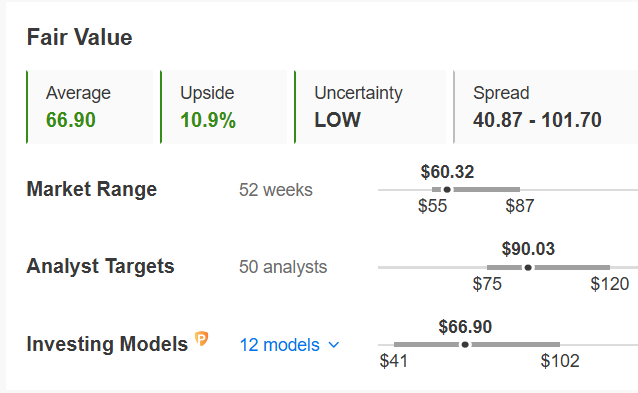

Uber maintains its position as the leading ride-hailing and delivery service, serving over 150 million users worldwide. Its stock, currently trading 10.9% below fair value, has a market-assigned target price of $90—offering a significant upside for investors.

3. Rio Tinto

Mining giant Rio Tinto (NYSE:RIO) operating across six continents, produces materials critical to modern industries, including iron, copper, and aluminum.

These resources also play a vital role in supporting the global shift toward green energy.

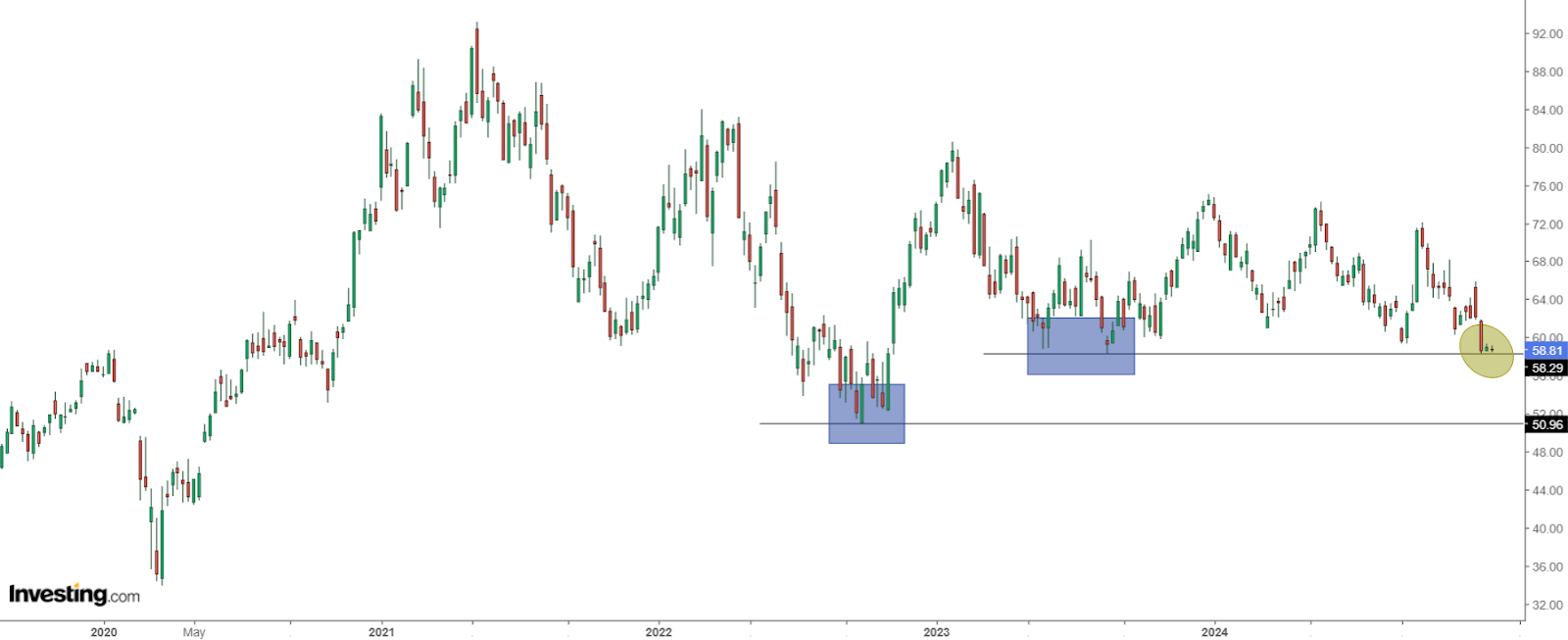

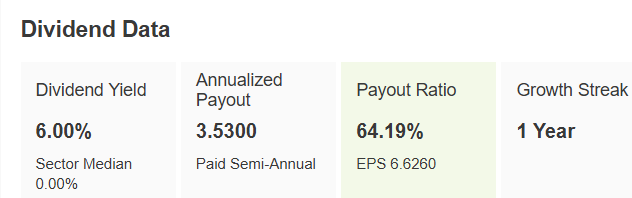

Despite a 21% drop in 2024, Rio Tinto’s fundamentals remain solid. Its forward price-to-earnings ratio of 8.5x is well below the industry average of 15.81x, making it a bargain at its current valuation. The stock offers a strong dividend yield of 6%, further enhancing its appeal.

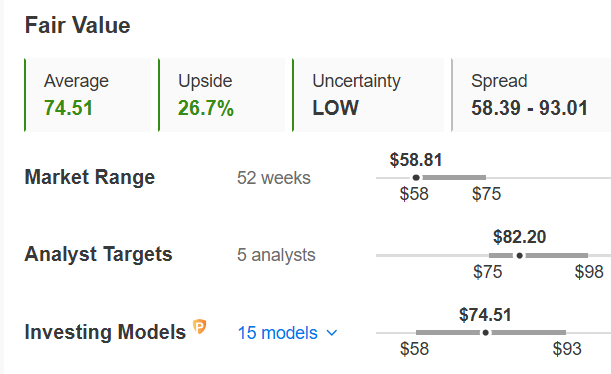

Source: InvestingPro

Strategic initiatives bolster its long-term prospects:

- The $6.7 billion acquisition of Arcadium Lithium will make Rio Tinto the world’s third-largest lithium producer by mid-2025.

- An expansion of its copper operations through a partnership with Sumitomo (OTC:SMMYY) Mining aligns with the rising demand for electrification and renewable energy systems.

Source: InvestingPro

Rio Tinto’s shares trade at a steep discount to their fair value of $74.51, with a market-assigned target price of $82.20.

Bottom Line

These three stocks—Citigroup, Uber, and Rio Tinto—offer a compelling combination of undervaluation and strong market potential. For investors seeking opportunities in 2025, these picks are worth a closer look.

Curious how the world’s top investors are positioning their portfolios for next year?

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Ready to take your portfolio to the next level? Click the banner below to discover more.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.