By Nichola Saminather

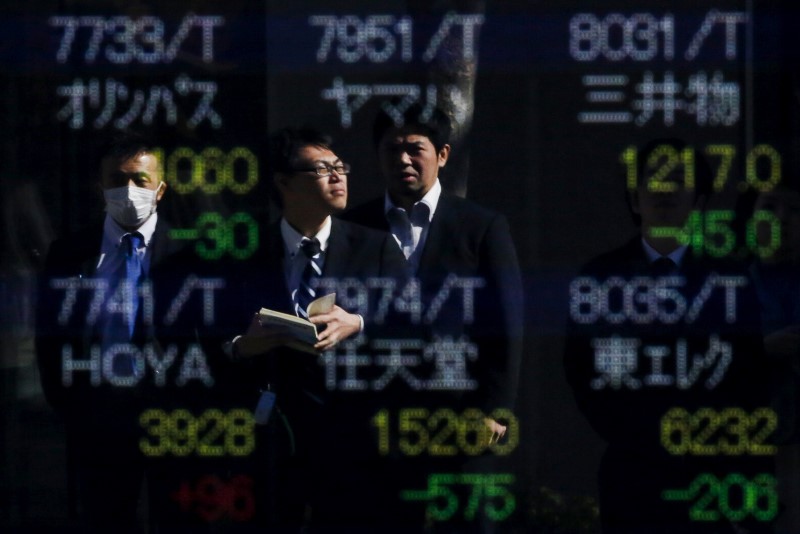

SINGAPORE (Reuters) - Asian stocks advanced on Monday, taking their cue from Wall Street, while the dollar moderated but retained most gains made on stronger-than-expected July jobs growth and the promise of a U.S. tax plan that will repatriate corporate profits.

MSCI's broadest index of Asia-Pacific shares outside Japan (MIAPJ0000PUS) added 0.5 percent.

Japan's Nikkei (N225) was up 0.6 percent.

Chinese blue chips (CSI300) rose 0.1 percent, while the Shanghai Composite (SSEC) was flat. Hong Kong's Hang Seng (HSI) climbed 0.4 percent.

South Korea's KOSPI (KS11) was up 0.5 percent, while Australian shares (AXJO) surged 1 percent.

The dollar moderated on Monday following a strong climb on Friday after data showed U.S. nonfarm payrolls rose by 209,000 jobs last month, and June's employment gain was revised higher.

Growing signs of labour market tightness offer Federal Reserve policymakers some assurance that inflation will gradually rise to the central bank's 2 percent target, and likely clear the way for a plan to start shrinking its massive bond portfolio.

The dollar was also buoyed by comments from National Economic Council director Gary Cohn that the U.S. administration is working on a tax plan that would bring corporate profits back to the United States.

But the pull back in the dollar backs some views in markets that Friday's rally may not have legs yet.

The dollar index (DXY), which tracks the greenback against a basket of six global peers, inched back 0.2 percent to 93.343. It rallied 0.76 percent on Friday, its biggest one-day gain this year.

The dollar slipped 0.2 percent against the euro to $1.17985 per euro

The greenback rose 0.1 percent to 110.78 yen

"The most logical view here is the moves on Friday were clearly just a sizeable covering of USD shorts, from what was one of the biggest net short positions held against the USD for many years," Chris Weston, chief market strategist at IG in Melbourne, wrote in a note.

For the dollar rally to gain momentum, the market needs to change its interest rate pricing, and that hasn't happened yet, Weston added.

Markets are pricing in about an even chance of a U.S. interest rate hike in December.

Benchmark 10-year U.S. Treasury notes (US10YT=RR) inched back slightly to 2.2673 percent. They closed at 2.269 percent on Friday, up from Thursday's close of 2.228 percent.

The lift in sentiment from Friday's jobs data also supported Wall Street. The Dow (DJI) closed 0.3 percent higher, its eighth consecutive record high. The S&P (SPX) and Nasdaq (IXIC) ended the session up 0.2 percent.

The Australian dollar

In commodities, oil prices edged lower but retained most of Friday's gains, posted as the strong jobs data bolstered hopes for growing energy demand.

Officials from a joint OPEC and non-OPEC technical committee are set to meet in Abu Dhabi on Monday and Tuesday to discuss ways to boost compliance with their supply reduction agreement.

U.S. crude (CLc1) slipped 0.1 percent to $49.53 a barrel on Monday, after rising 1.1 percent on Friday.

Global benchmark Brent (LCOc1) also lost 0.1 percent to trade at $52.37, after Friday's 0.8 percent gain.

Gold