This article was written exclusively for Investing.com

European equity indices are continuing to make good progress thanks mainly to the ECB’s ongoing stimulus measures and a recovering world economy boosting demand for European goods and services. But with demand for travel and tourism not as strong as had been hoped for earlier in the year—due to the Delta variant of COVID-19—not all EU indices are hitting record or multi-year highs. Spain’s IBEX, for example, dropped sharply during June and July, when Delta cases were rising rapidly. However, the IBEX has started August on a positive note and so it may be able to play catch up with the rest of Europe and rise more strongly going forward.

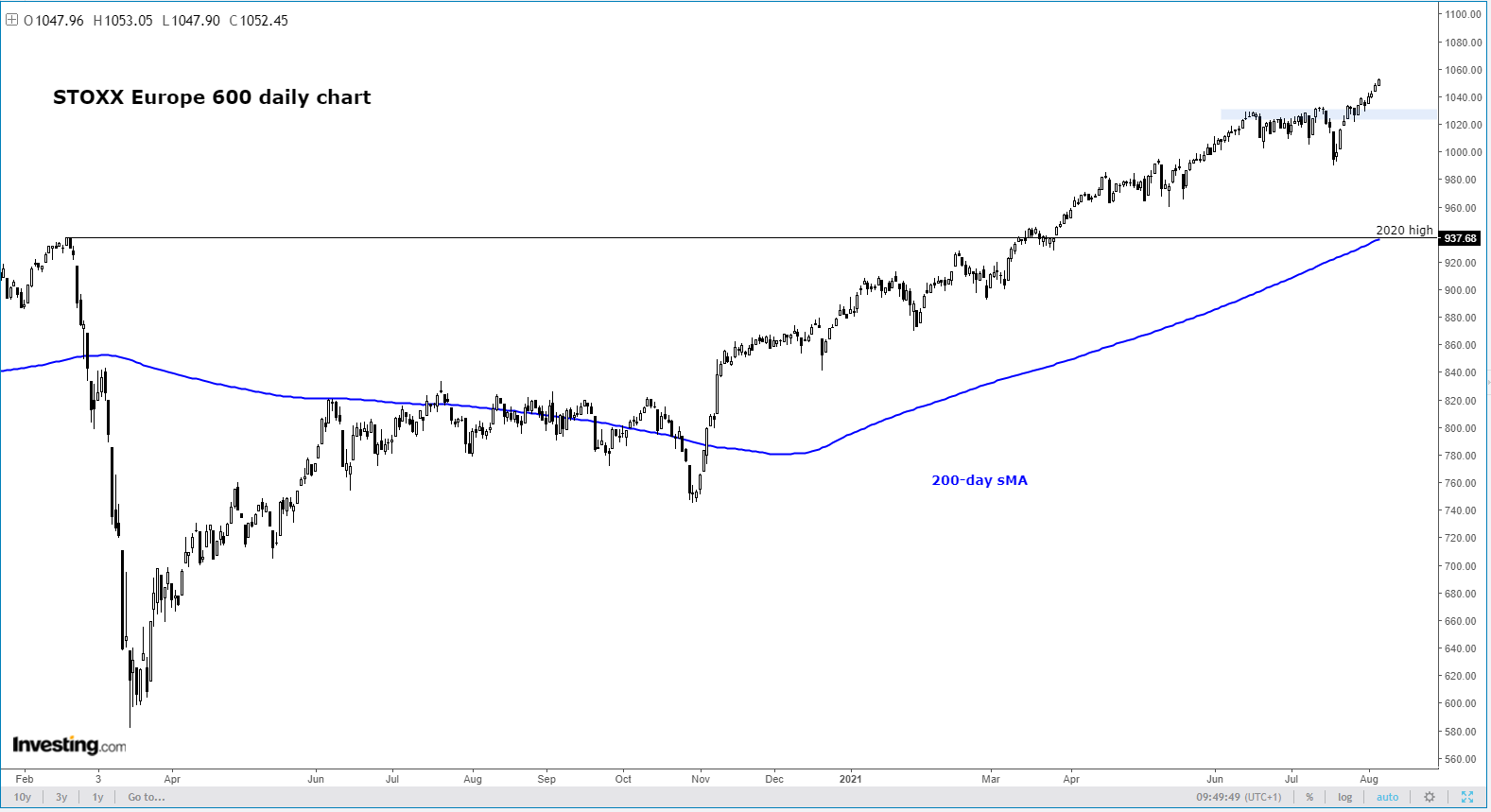

The gains for European equity indices have been led by the DAX, although the German index has remained in consolidation mode near its record highs for the best part of three months now. This has allowed some of the other EU indices to play catch up with both the French CAC and Italian FTSE MIB surging noticeably higher since mid-July. The large cap European stocks (including those of the UK) have performed the best. This has caused the European STOXX 600 to hit repeated all-time highs:

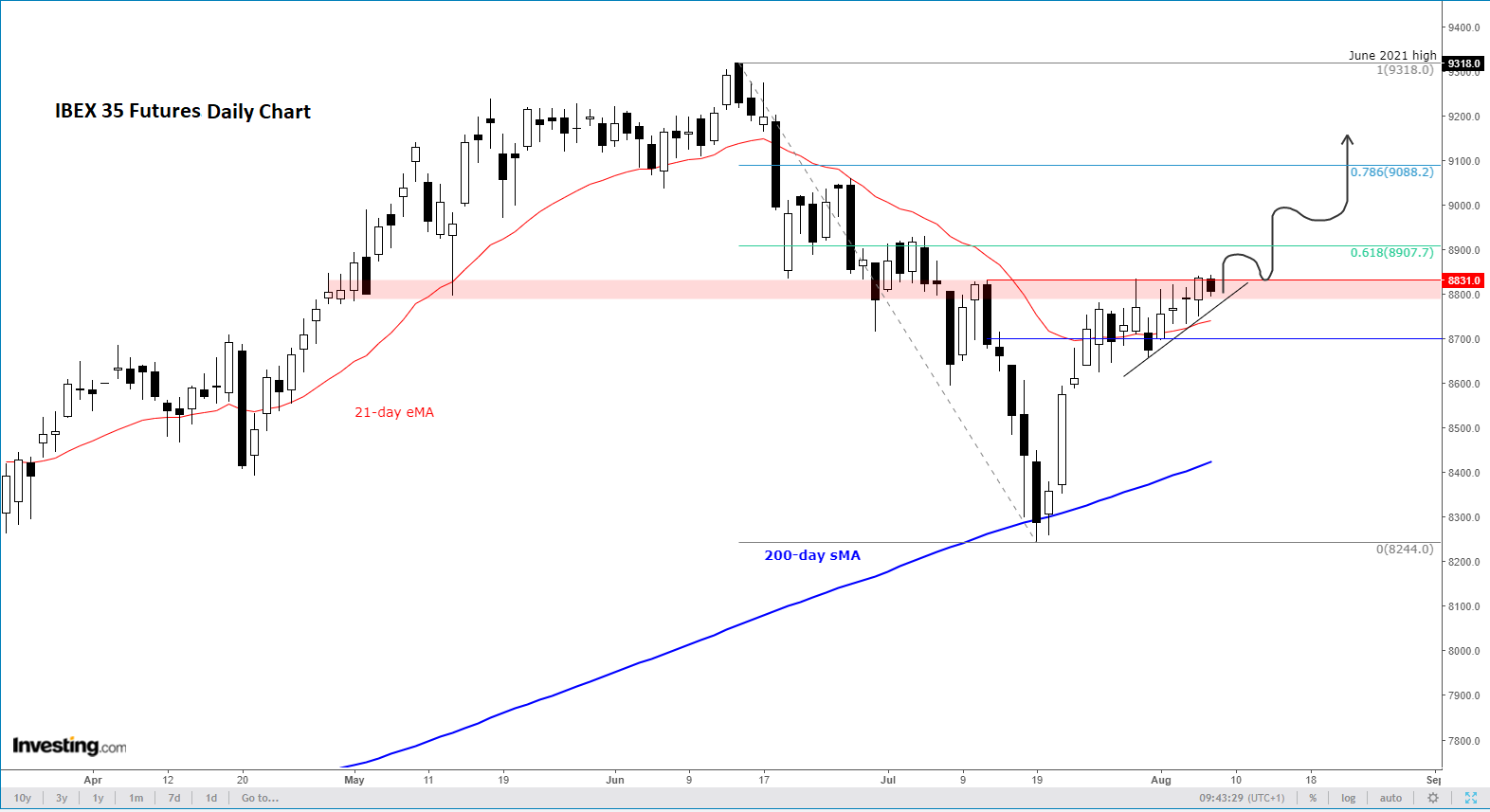

In contrast, however, the IBEX has underperformed badly as it remains well below its 2020 high (unlike nearly all other major EU indices):

However, the Spanish index looks like it may have ended its bearish run and may be about to break higher after forming that bullish piercing weekly candle a couple of weeks ago.

Meanwhile, the daily chart shows the index is holding tightly below resistance around the 8830 area after bouncing back strongly from its rising 200-day moving average in July:

Thursday’s bullish-looking close certainly looks strong.

From here what I would be looking for is a clean break above the 8830 resistance, which is needed before the bulls eye the Fibonacci retracement levels shown on the chart, ahead of the June’s peak at 9318 thereafter.

However, if resistance holds and the index falls back below the recent support zone circa 8700, then this would be a short-term bearish development, in which case the bulls must wait for fresh signals before potentially stepping in.

All told, the positive macro backdrop (ECB support) and technical outlook both point to rising levels for the Spanish IBEX.