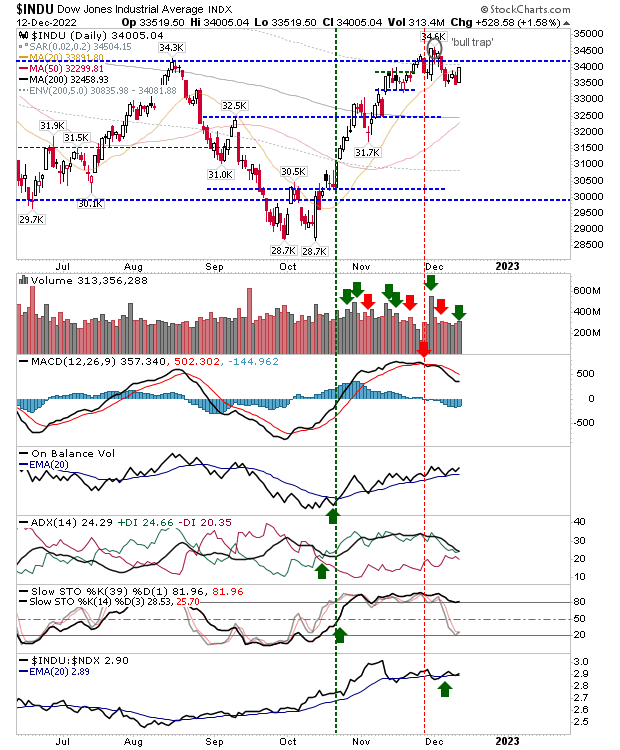

While last week had a disappointing finish for bulls watching the S&P, NASDAQ, and Russell 2000 - they still have the Dow Jones Industrial Average to rely on. Yesterday, again, the Dow outperformed other US indexes and positioned itself for a solid setup for a challenge on the current 'bull trap.'

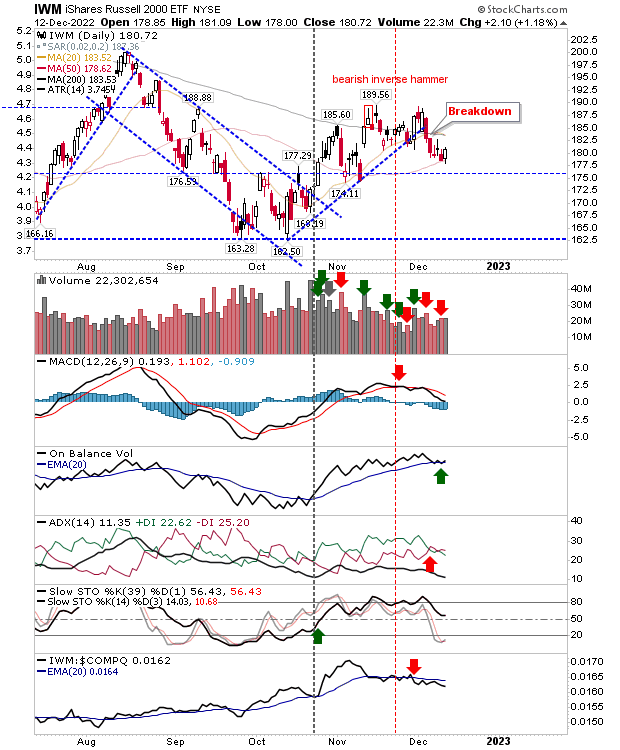

While the Russell 2000 ($IWM) is not challenging highs like the Dow, it is performing relatively well in defending its 50-day MA. Today's buying did not register as accumulation as with the Dow, but it did generate a 'buy' trigger in On-Balance-Volume. Momentum remains on the bullish side of the (Stochastic 39,1) mid-line despite the past couple of weeks of losses.

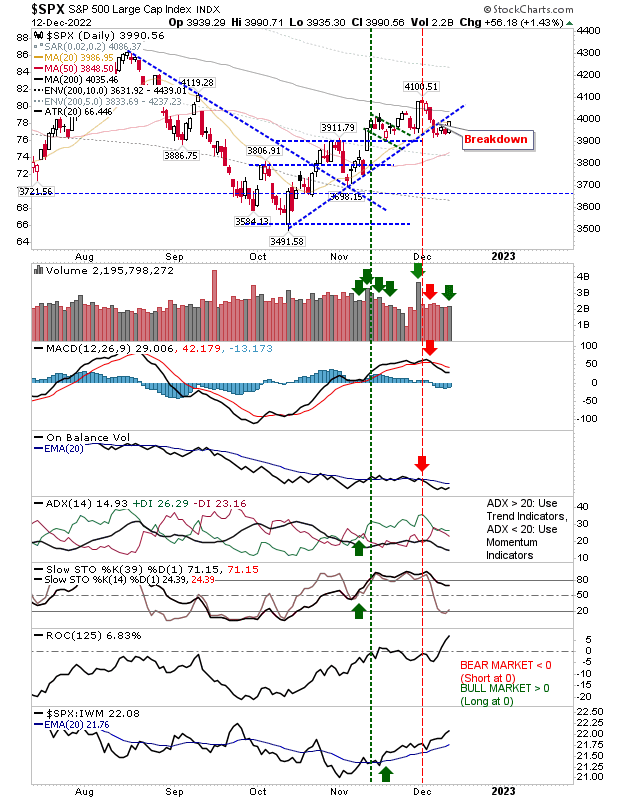

In the S&P 500, technicals are in reasonable shape with a MACD and On-Balance-Volume trigger 'sell' offset by strong bullish momentum and relative performance against the Russell 2000.

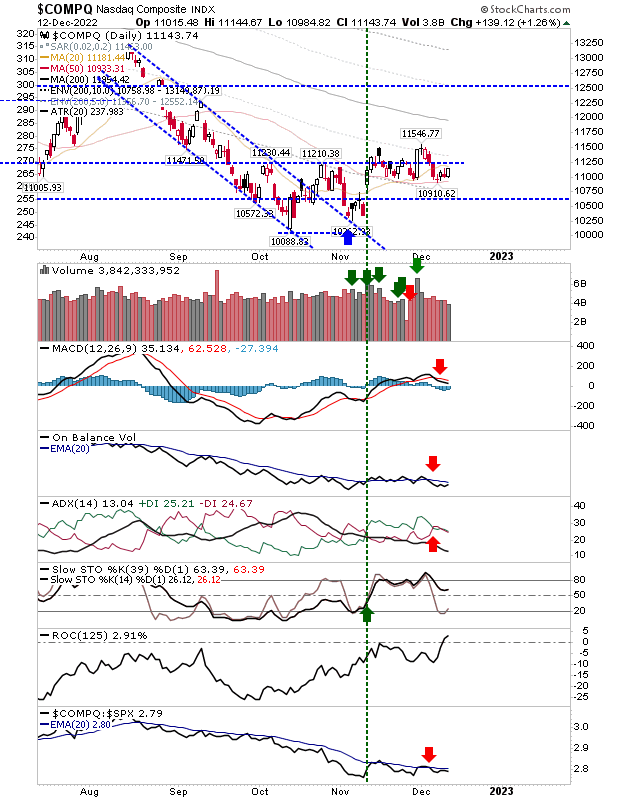

The Nasdaq was the quiet man on the day. It posted a gain, but it didn't move the dial too much.

Had markets delivered losses yesterday it would have been the easier path to follow after Friday's close (really, for most of last week). We need some quick follow-through if today is not to be a flash in the pan, but the buying was welcome.