- Shares of interactive fitness platform Peloton have lost over 77.5% in the past 12 months.

- Once loved as a pandemic growth story, PTON stock is now considered an acquisition target.

- Long-term investors could consider buying Peloton around current levels.

- Roundhill MEME ETF (NYSE:MEME)

- ProShares On-Demand ETF (NYSE:OND)

- VanEck Social Sentiment ETF (NYSE:BUZZ)

- iShares Virtual Work and Life Multisector ETF (NYSE:IWFH)

- Global X Millennials Consumer ETF (NASDAQ:MILN)

Over the past 52 weeks, shares of interactive fitness platform operator Peloton Interactive (NASDAQ:PTON) have plummeted, dropping 77.6% in the past year and 3.0% year-to-date in 2022. What a difference a year can make on Wall Street.

On Feb.16, 2021, PTON stock hit $155.52, a 52 week high. Before that, in mid-January 2021, it went even higher, surpassing $170, a record for the stock.

Notwithstanding year-ago gains, over the past year, PTON shares have been in a downward trajectory, making lower highs and lower lows. On Feb 11, the stock closed at $34.68. Its 52-week range has been $22.81 - $155.52, while the market capitalization (cap) stands at $11.5 billion.

Recent PTON Metrics

Peloton Interactive went public in September 2019 at an opening price of $27. During March 2020, in the early days of the pandemic, it slipped below $18, but ended 2020 around $160. In other words, it returned about 800% between the record low and the record high.

The New York City-based company, which mostly sells stationary bikes and treadmills, became a household name during the pandemic when most people were sheltering in place rather than going out, thus exercising at home. However, recent months have not been kind to the shares which came under pressure due to decreasing subscription numbers as the economy began reopening.

Customers who buy PTON's equipment can also purchase the All-Access membership at $39 a month. Others who do not own or use the equipment, can opt for an app membership at $12.99 a month.

Management announced FY 2022 Q2 metrics on Feb. 8. The top line number came in at $1.13 billion, registering 6% year-over-year (YOY) growth. Yet, the company showed a net loss of $439.4 million or $1.39 per diluted share. Put another way, with decreasing demand came higher operating losses.

The connected fitness company also decreased its full-year revenue target to $3.7-$3.8 billion. Investors were not impressed.

Following the earnings release, Peloton also announced key executive changes. Barry McCarthy, former CFO of Spotify (NYSE:SPOT), is replacing co-founder John Foley as CEO.

In the shareholder letter issued prior to his departure, John Foley said:

“The comprehensive restructuring actions we are announcing today will streamline our teams and reporting structures, increase P&L accountability…”

As part of this plan, the company is laying off close to 3,000 employees. Once fully executed, there could be $800 million in savings.

Meanwhile, also in February, rumors began circulating suggesting that Peloton might soon become an acquisition target. Potential buyers named included Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL) and Nike (NYSE:NKE). Though there's been no official confirmation yet from any of the companies involved, understandably, shareholders are excited.

Prior to the release of its quarterly results, PTON stock was trading around $30.00. Then, on Feb. 8, in the wake of the acquisition rumors, it hit a multi-month high of $40.35. But on Feb. 11, shares closed at $34.68.

What To Expect From Peloton Shares

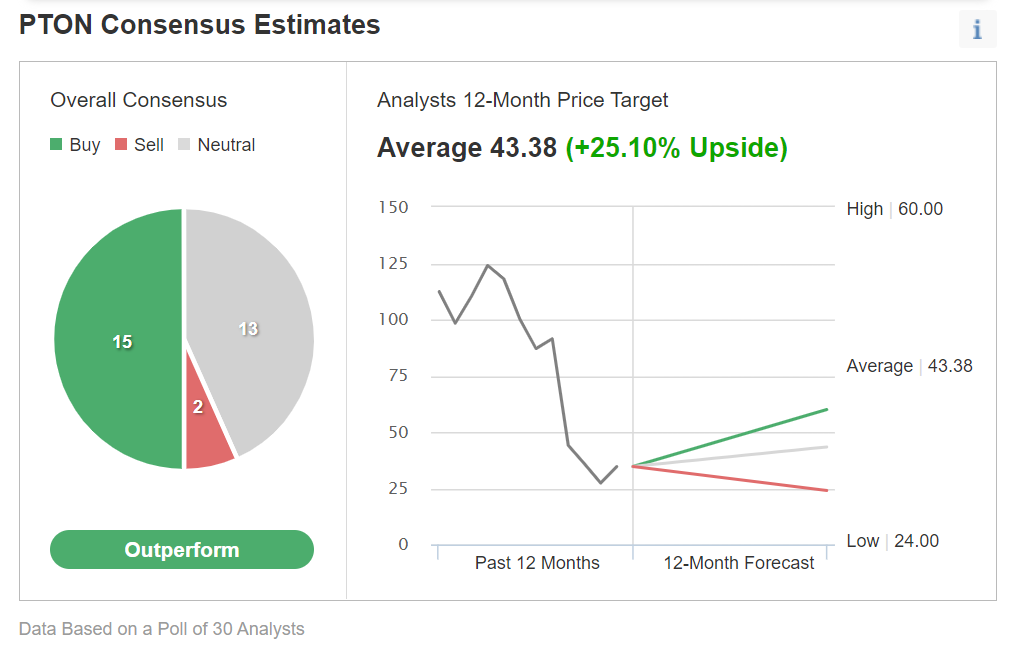

Among 30 analysts polled via Investing.com, PTON stock has an “outperform" rating.

Chart: Investing.com

Wall Street also has a 12-month median price target of $43.38 for the stock, implying an increase of over 25% from current levels. The 12-month price range currently stands between $24 and $60.

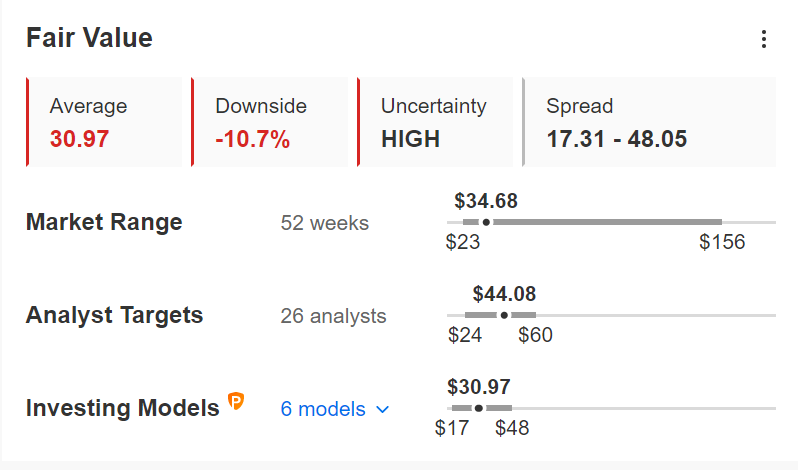

On the other hand, according to a number of valuation models, like those that might consider five or ten-year terminal values, the average fair value for PTON stock via InvestingPro is $30.97.

Source: InvestingPro

In other words, fundamental valuation suggests shares could decrease around 10%.

We can also look at Peloton’s financial health as determined by ranking more than 100 factors against peers in the consumer discretionary sector.

In terms of cash flow and growth, Peloton scores 2 out of 5. Its overall score of 2 points to a weak performance ranking.

At present, PTON stock’s P/B and P/S ratios are 4.9x and 2.8x. In comparison, those metrics for its peers stand at 4.2x and 3.0x.

We believe the current volatility in PTON stock will continue in the coming weeks. Shares will likely trade between $30 and $40, and build a base between these levels. Yet, in the case of a potential takeover offer, Peloton stock could easily rally much higher.

Adding PTON Stock To Portfolios

It is too soon to tell if cost-reduction efforts will yield positive results for the company, or if it will be acquired by a leading name on Wall Street. For Peloton bulls who are not concerned about short-term choppiness, consider buying into the declines. The target level would be $43.38, or the analysts’ price consensus estimate.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has PTON stock as a holding. Examples would include:

Finally, traders who believe the decline in PTON stock will come to an end soon might consider selling a cash-secured put option—a strategy we regularly cover. As it involves options, this set-up is not appropriate for all investors.

Cash-Secured Put Selling With PTON

Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own Peloton Interactive shares for less than their current market price at $34.68.

This strategy may be appropriate when investors are slightly bullish or neutral on PTON stock at this time. Selling cash-secured put options on Peloton would generate income as the seller receives a premium.

For instance, if investors sold the $32.00 strike put that expires on Apr. 14, they could collect about $3.60 in premium.

Therefore, the maximum return for the seller on the day of expiry would be $360, excluding trading commissions and costs, if the option expires worthless.

But if the put option is in the money (meaning PTON stock is lower than the strike price of $32.00) any time before or at expiration on Apr. 14, this put option can be assigned.

The put seller would then be obligated to buy 100 shares of Peloton stock at the put option strike price of $32.00 for a total of $3,200 per contract. In that case, the trader ends up owning PTON stock for $32.00 per share.

If the put seller gets assigned Peloton shares, the maximum risk is similar to that of stock ownership (in other words, the stock could theoretically fall to zero) but is partially offset by the premium received ($360 for 100 shares).

The break-even point for our example is the strike price ($32.00) less the option premium received ($3.60), i.e., $28.40. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on any choppiness in Peloton stock in the coming weeks, especially as takeover rumors ebb and flow.

Investors who end up owning PTON shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI