Proactive Investors -

- FTSE 100 little changed, down 1 points

- Tesco (LON:TSCO) could sell banking arm - Sky

- Frasers advances on £80mln buyback

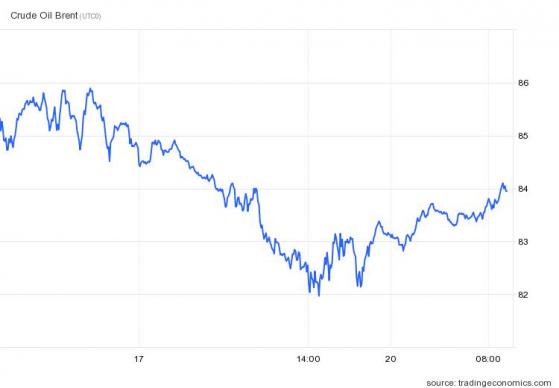

Oil price rallies

Oil prices rose on Monday after falling 4.3% last week on concerns of higher interest rates in the US.

Fiona Cincotta, senior financial markets analyst at City Index said “the risk on mood at the start of the week is helping risk assets, such as oil push high.”

“Optimism surrounding the reopening in China is also keeping oil prices supported. The EIA and OPEC have highlighted Chinese demand as a key river of demand growth this year.”

Brent crude rose 1.2% to US$83.94/barrel while West Texas Intermediate crude was priced at US$77.14/barrel, up 1/1%.

The rise helped underpin BP PLC shares, up 0.3%, although Shell PLC was little changed.

Footsie edges higher

FTSE 100 has made steady early progress in early exchanges, now at 8,016.20, up 11.84, or 0.15% but activity may be quiet with US markets closed for President’s Day.

Richard Hunter, Head of Markets at interactive investor noted: “The index remains protected by its mixture of defensive, higher yielding shares, with additional exposure to banks which are seeing the benefit of rising interest rates and mineral stocks which are poised to pounce on recovering demand from China as the year progresses.”

Frasers Group PLC remained top of the FTSE 100 risers, up 3.4%, after launching a £80mln share buy-back and lenders Barclays PLC and Lloyds Banking Group PLC recovered some of the ground lost last week in the wake of disappointing earnings updates in the banking sector. But NatWest (LON:NWG) Group PLC fell further, down 1.4%, on further consideration of its results on Friday.

Persimmon PLC, Taylor Wimpey PLC and Barratt Developments PLC all rose after the latest Rightmove house price index figures which showed house prices were little changed in February.

Recent surveys had shown falling prices as rising mortgage rates and worries of an economic downturn had hit the market.

Elsewhere Keystone Law shares advanced 8.1% after reporting "favourable market conditions" continued in its financial second half ended January 31.

Client demand "remained robust", the law firm said. It said annual revenue and adjusted pre-tax profit will now top current market expectations.

But on the downside was AIM-listed Verditek which dropped 28%. The solar panels producer said it has received a notice for its distribution agreement with partner Bradclad Group to be terminated.

FTSE steady at the start

FTSE 100 opened little changed on Monday holding above the psychologically important 8000 level.

At 8.15am London’s lead index was at 8,004.47, up 0.11, while the FTSE 250 rose 19.23 points to 20,108.16, up 0.096%.

Susannah Streeter, head of money and markets, Hargreaves Lansdown said: “’There’s a quiet pulse of positivity on the markets with investors still cautious about the direction of interest rates in the United States, but hopeful that recovery elsewhere will lend a hand to trade.”

But she noted: “Volumes are set to be more muted during the sessions in Europe given that Wall Street is closed for the President’s Day holiday, so traders are likely to be searching around for a bit of a sense of direction today, looking ahead to fresh data out this week.”

The data includes the release of the minutes of the last Federal Open Market Committee meeting due out on Wednesday.

Markets in China and Hong rose following the announcement of unchanged prime loan rates in China.

Back in London and Frasers Group PLC jumped 3.4% after the retailer started a £80mln share buy-back.

Tesco PLC gained 0.4% on reports the grocer was considering the sale of its banking arm.

Sky News reported Britain’s largest food retailer has lined up Goldman Sachs to advise on the future of Tesco Bank, which launched in 1997.

The report said Tesco Bank could be worth more than £1bn based on its book value, if sold.

But Trifast PLC plunged 41% after it warned profits would be significantly below current market expectations and that its boss had quit.

While full-year revenues are seen little changed adjusted pre-tax profits are forecast to tumble to around £9mln, down from previous guidance £14.3mln.

“We have continued to see macro-economic conditions contribute to some volatility in demand patterns, and in particular have, more recently, been impacted by significant destocking from one of our Asian manufacturing customers,” Trifast (LSE:TRI) said in a statement.

The warning was accompanied by news chief executive Mark Belton had resigned on Saturday replaced on an interim basis by non-executive director, Scott Mac Meekin.

Darktrace PLC rose 1.5% after it appointed Ernst & Young to provide an independent third-party review of its key financial processes and controls.

The embattled cybersecurity firm has been accused of irregular sales, marketing and accounting practices raised by US-based hedge fund Quintessential Capital Management.

"The board and management are confident that Darktrace 's independently audited public company financial statements fairly represent Darktrace's financial position and results," the company said on Monday.

Earlier this month chief executive Poppy Gustafsson published a strong defence of the company after its share price collapsed to a record low after the publication of a highly critical report by New York-based QCM.

UK house prices little changed in February according to Rightmove

UK house prices were largely unchanged in February, figures from Rightmove PLC showed on Monday, in a sign of buyer confidence despite robust mortgage rates.

The online real estate company said the average price of properties coming on the market was £362,452 little changed from £362,438 in January.

The online property website said it was the smallest February increase on record but the reading "could be seen as a positive indicator for the year ahead".

"This month's flat average asking price indicates that many sellers are breaking with tradition and showing unseasonal initial pricing restraint. In addition to market conditions demanding greater realism on price, we are transitioning into a slower paced market, where buyers will take longer to find the right property at the right price due to the higher cost of servicing a mortgage," Rightmove analyst Tim Bannister said.

Tesco exploring sale of Tesco Bank - Sky

Tesco PLC, Britain's biggest supermarket chain, is to kick off a review of its presence in the UK banking sector - a move that could lead to a sale of the business, according to a report.

Sky News has learnt that the grocery giant is lining up Goldman Sachs to advise on the future of Tesco Bank, which launched in 1997.

City insiders said this weekend that the review was at a very preliminary stage and may not lead to a formal sale process.

Exclusive: Tesco, Britain’s biggest retailer, is to kick off a review of its presence in the financial services sector that could lead to a sale of the banking arm it launched in 1997. Goldman Sachs is being lined up to advise Tesco on the situation. https://t.co/3anaC1k0OJ— Mark Kleinman (@MarkKleinmanSky) February 18, 2023

One source suggested that a partial sale or joint venture could also be an option for the retailer.

A banking analyst suggested this weekend that if it was sold, Tesco Bank could be worth more than £1bn based on its book value.

The company has more than 5mln customers, offering products including pet insurance, savings accounts and credit cards.

Ken Murphy, who has been Tesco's chief executive since 2020, has been publicly supportive of its presence in the banking sector.

Harland & Woolf wins new deals

Harland & Wolff Group Holdings PLC has secured contracts worth over £10mln within the defence, cruise & ferry and commercial fabrication markets.

The Belfast-based shipbuilder said the six contracts are expected to be completed during the next 12-18 months.

The AIM-listed firm did not disclose further details, due to confidentiality terms, but said that work on four of the contracts will commence this month in Belfast.

These contracts will involve fabricating a drydock gate for a client that operates a defence facility, repairs on a jack up barge that is used for installation of offshore structures, as well as regular repair works on five vessels comprising a product tanker and four ferries.

In Arnish, the company has been contracted to undertake additional fabrication works for an ongoing mining project while it has been contracted to fabricate a frame at its Appledore facility for a prime contractor as part of its ongoing defence programme.

Chief Executive John Wood said: “Since the commencement of 2023, we are seeing an uptick in the level of enquiries flowing through all the yards for multiple projects.”

Firm start seen by Footsie

FTSE 100 is expected to open higher back above 8,000 on what could be a quiet day with little in the way of company and economic news expected and with US markets closed for President’s Day.

Spread betting companies are calling the lead index up by around 16 points.

“Today looks set to see markets in Europe open modestly higher against a backdrop of continued weakness in energy prices, which is relieving some of the worst case economic scenarios that were being modelled at the end of last year. Its also likely to be a relatively subdued session given the absence of the US due to the President’s Day holiday,” commented CMC’s Michael Hewson.

In Asia, he People's Bank of China left its benchmark lending rate unchanged, an outcome in line with market expectations.

The move provided support to the Shanghai Composite which was up 2.0% in late trade while the Hang Seng climbed 1.1% in Hong Kong. In Tokyo, the Nikkei 225 edged up 0.1% on Monday. The S&P/ASX 200 in Sydney also climbed 0.1%.

US markets ended mixed on Friday with the Dow up 130 points, 0.4%, at 33,827, the Nasdaq Composite down 66 points, 0.6%, to 11,787 while the S&P 500 shed 11 points, 0.3%, to 4,079.

Comments by a number of Federal Reserve officials forecasting further interest rates rises unsettled investors who had hoped that cooling inflation would prompt a pivot in Fed policy.

A quiet day for company news in London is expected on Monday ahead of a busy week with Lloyds, HSBC, International Consolidated Airlines, Rolls-Rocye BAE Systems among the firms reporting.

Read more on Proactive Investors UK