Since reporting H125 results, Picton (LON:PCTN) has agreed the sale of an office asset designated for alternative use, completed the small but accretive acquisition of an industrial unit, and undertaken several leasing and other asset management initiatives. Together, these demonstrate continuing progress with the active measures being taken to improve occupancy, grow income and dividends, and realise value embedded in the portfolio.

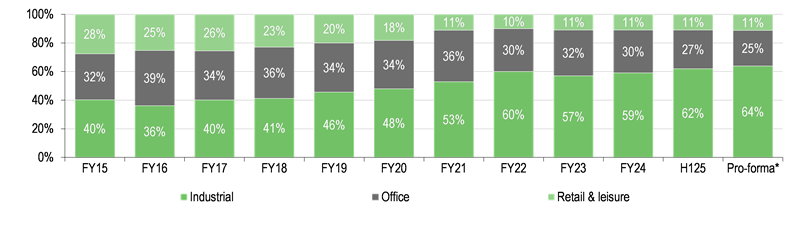

Note: *EPRA earnings exclude revaluation gains/losses and other exceptional items. **NAV measure is net tangible assets (NTA), currently the same as IFRS NAV.

Occupancy and income improvements

The agreed £13.1m sale of Charlotte Terrace, one of two alternative use office assets, at a 5% premium to book value, comes despite a more cautious post-budget tone to the market. The transaction is expected to complete in January 2025. The sale for redevelopment of Longcross (we estimate for c £8m) is expected to complete in early 2025.

The disposal of these substantially vacated properties will have only a small impact on gross income, far outweighed by a reduction in void costs, and provide the opportunity to deploy the proceeds accretively. The leasing and asset management initiatives provide evidence of continuing demand for Picton’s assets and its ability to meet evolving occupier needs. There are no material changes to our updated EPRA earnings forecasts, detailed in this report.

Attractive exposure to market recovery potential

Corporate activity has continued apace, with private equity investors emerging as acquirers. As a result, there are relatively few sector-diversified, predominantly regional, income-focused REITs available to investors wanting exposure to a broad market recovery. Among these, Picton has a long-term track record of upper-quartile outperformance versus the MSCI UK Quarterly Property Index since launch in 2005, outperforming in each of the past 11 years.

Reinvestment into the portfolio to enhance its quality, environmental credentials, as well as occupier appeal, also supports rental growth, capital values and total return. NAV total return (without reinvestment of dividends) is 9.2% pa over the past 10 years. Picton’s portfolio is strongly weighted to the industrial (62%) and retail warehouse sectors (7%), both supported by strong fundamentals but, as attractive opportunities emerge more widely, it is well positioned to adapt to market conditions.

Valuation: Property outperformance at a discount

FY25e DPS of 3.7p, fully covered, represents a yield of 5.4%, while the shares trade at an almost 30% discount to H125 NAV. There is significant reversionary potential to drive income and realise value, while the diversified and actively managed portfolio is well positioned for broad market recovery in capital values.

Active exposure to broad market opportunities

In this note we focus on the following:

- Picton’s strong long-term record of performance and why we think its diversified, unconstrained, opportunistic and primarily asset-driven approach to portfolio construction makes it an attractive way for investors to access a recovery in the commercial property market.

- Following the challenging market of the past two years, there has been a market reduction in the REIT universe as a result of corporate actions and management wind-downs. This is especially so for diversified, income-focused REITs, investing primarily in regional markets. While private equity investors have recently emerged as buyers of listed REITs, recognising the continuing wide discount to NAV and the potential for a recovery in the commercial real estate market, the opportunities for traditional investors to gain diversified exposure have drastically reduced.

- After falling by 20–25% from the 2022 peak, commercial property valuations have begun to stabilise. Occupier demand has remained robust and rents have continued to increase. The most recent Investment Property Forum consensus expectations survey points to 8–9% pa total returns over the next three years, with all sectors showing a positive performance. The results predate the budget, which has thus far led to a trimming back of expectations in GDP growth and the pace of interest rate declines, but we do not expect this to change the direction of travel.

- Picton’s valuation is attractive. It has significant opportunities to improve occupancy, grow net income and dividends, and realise the value embedded in the portfolio, while its discount to NAV is wide.

We begin with more details of the trading update and progress since the H125 results, which are reviewed later in the report, along with an update on our forecasts.

Further details on the trading update

The sale of Charlotte Terrace and all but one of the leasing and asset management transactions was completed after the budget, an encouraging indicator of the strength of occupier demand across the portfolio.

Alternative use assets

Picton’s active management of three office assets identified for alternative use has created additional value from the properties while reducing office sector exposure. Charlotte Terrace, in London W14, comprises four adjoining buildings, providing a mix of office and retail space. Having achieved vacant possession of one of the four buildings, and planning permission to covert this to residential use, the entire asset was marketed for sale. In total, EPRA vacancy for the asset is c 50%, representing the second largest portfolio void (c £0.7m of ERV).

The largest portfolio void (c £0.9m) is at Longcross in Cardiff, where the agreed sale to a developer of purpose-built student accommodation is expected to complete in early 2025 (we estimate a value of c £8m), subject to the receipt of a satisfactory Section 106 agreement planning notice.

The sale of Angel Gate in Islington was completed in April for a consideration of £29.6m, a 5% premium to the 31 December 2023 valuation, which followed the securing of planning consent for conversion of part-vacant office property to residential use.

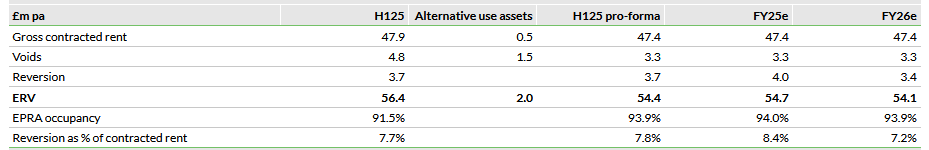

When completed, the sales of Charlotte Terrace and Longcross will reduce annual rent roll by c £0.5m, voids by c £1.5m, estimated rental value (ERV) by c £2.0m and increase EPRA occupancy2 by c 2 percentage points. The combined void represents almost one-third of the current portfolio total void, and we expect this to have a materially positive impact on void property costs (£2.2m in H125 and £4.1m in FY24), by far offsetting the loss of income.

1 EPRA occupancy compares the ERV of occupied space with the portfolio ERV.

Leasing and asset management

Within two months of two retail warehouse units becoming vacant, Picton has agreed their re-letting with aggregate annual rental income of £0.3m, in line with ERV. This included £0.2m at Gloucester Retail Park, where the company obtained planning consent for leisure use in the summer and has now secured a letting to Europe’s largest trampoline park operator. At end FY24, retail and leisure occupancy was 93%, with voids of £0.5m.

Other transactions demonstrate Picton’s active approach to managing its assets and its ability to work with tenants to meeting their evolving needs.

At Mill Place Trading Estate, Gloucester, Picton was able to provide the largest tenant with additional space to support its growth and extend its lease by an additional five years. This involved leasing a vacant unit, relocating another occupier, upgrading space and the demolition of a small unit, enabling open storage land to be leased and rentalised. The new lettings total £0.1m per year and, combined with the regear of their current leases, secure £0.3m per year, which is subject to a minimum uplift in 2026 at an open market rent review. The combined new rent is 8% ahead of the September ERV.

In a back-to-back transaction at River Way Industrial Estate in Harlow, Picton surrendered a lease from an occupier in financial difficulty and re-leased it to a new occupier. The new rent of £0.6m pa is more than 50% above the previous passing rent and 4% above end-H125 ERV.

In Milton Keynes, two office leases that were due to expire in 2025, covering c 25% of the space, were extended. The agreed rent of £0.4m is 37% above the previous passing rent and 17% above the end-H125 ERV. The transaction includes Picton undertaking a comprehensive upgrade to the air conditioning, which is then expected to achieve an A-rated Energy Performance Certificate (EPC).

Diversified, unconstrained investment strategy

Picton has an unconstrained, opportunistic and primarily asset-driven approach to portfolio construction, while maintaining a diversified portfolio. This provides the flexibility to adjust the portfolio to changing market conditions while also investing with conviction. It is an approach that is especially suited to investors that are unable or disinclined to choose between the broad range of single-sector, in many cases higher-risk, funds.

Consistent property outperformance

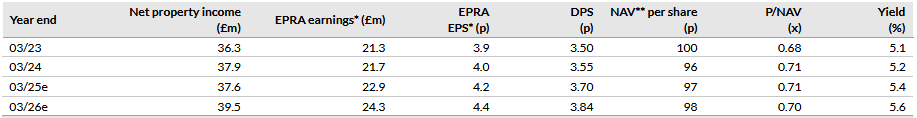

In combination with asset selection and active asset management, Picton’s portfolio has delivered consistent, long-term, upper-quartile outperformance of its benchmark MSCI UK Quarterly Property Index since it launched in 2005 and has outperformed in each of the last 11 years. Sector allocation has been positive in 10 of those years, with the only exception being the year to March 2023 when the overwhelming outperformance of industrial property outpaced even Picton’s high exposure to the sector. However, demonstrating the important contribution of active asset management, property-level performance was positive in eight out of the last 11 years.

Exhibit 1: Property performance attribution

Source: Picton Property Income

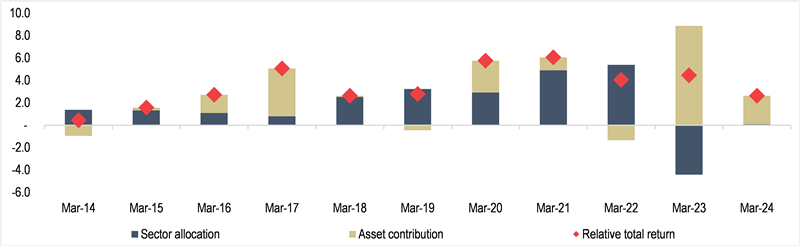

At the company level, capturing the impacts of gearing, financing expense and operating costs, Picton has generated a 10-year total return (NAV growth plus dividends paid) of more than 160%, or an average 9.2% per year. As interest rates increased, FY23 was challenging for capital values but less so in FY24. In H125, with valuations stabilising across the market, Picton’s portfolio increased by 0.8% on a like-for-like basis compared with a 0.3% MSCI capital return. NAV per share also stabilised and dividends paid drove a 2.2% six-month total return.

Exhibit 2: NAV/accounting total return

Source: Picton Property Income, Edison Investment Research

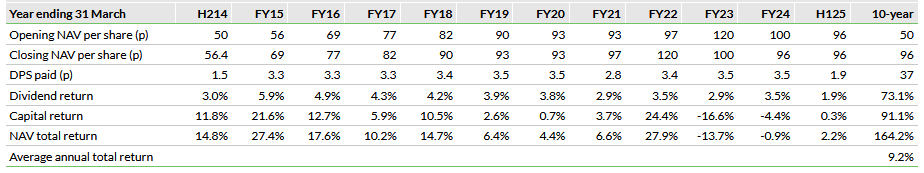

Active sector positioning driven by asset selection

Picton’s portfolio of 48 properties is significantly weighted towards industrial and logistics assets (62% by value at end H125), reflecting the depth of opportunities in the sector, which benefits from positive demand-supply fundamentals and continuing rental growth. Industrial and logistics assets have significantly contributed to Picton’s performance. Conversely, traditional retail has for some time offered only selective opportunities in the face of over-supply and falling rents and two-thirds of sector exposure is to retail warehouses, which are better supported by trend changes in consumer spending habits and underpinned by value-led retailers. Repositioning selected office assets has reduced exposure to the sector which, on completion of the Longcross sale, will be 25% on a pro-forma H125 basis.

Exhibit 3: Active weightings in a diversified portfolio

Source: Picton Property Income data. Note: *Adjusted for alternative use assets.

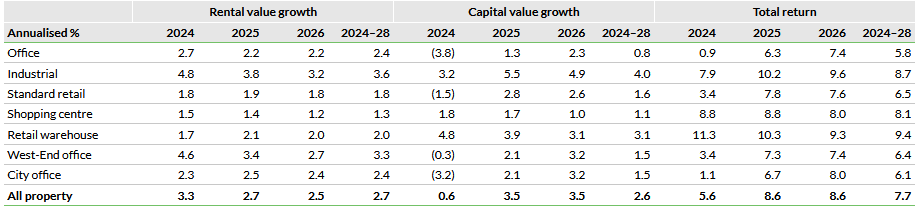

We believe the ability to adapt the portfolio to market conditions will continue to provide opportunities. The Investment Property Forum’s autumn 2024 survey shows a consensus expectation of strong property returns across the UK commercial property market in the next three years. While industrial and retail warehouse returns are expected to lead performance, there is nonetheless some convergence across sectors, with each expected to deliver a positive total return. Picton says that it now sees a broader set of capital allocation opportunities

Exhibit 4: Investment Property Forum autumn 2024 forecasts*

Source: Investment Property Forum. Note: *Based on data received by the Investment Property Forum from 17 organisations, the forecasts for which were generated between end-September and mid-November 2024.

Active management underpins asset performance

As the attribution data above show, Picton’s asset selection and the active management of those assets have made a significant contribution to its property outperformance. Underpinned by the group’s occupier focus, it seeks to work closely with tenants to understand their needs, enhance tenant retention and occupancy, maximise income and support capital values. Reinvestment into the portfolio, including sustainability upgrades, to maintain its attractiveness to occupiers and enhance income and/or value, is an important element of its strategy. In H125, the company invested £4.2m in the portfolio prior to re-leasing, up from £4.5m in the whole of FY24. All works are carried out in alignment with Picton’s sustainable goals, including becoming net zero carbon by 2040, future-proofing the assets and meeting the evolving demands of tenants. 81% of the portfolio is now EPC rated A to C (end FY24: 80%), the expected minimum requirement by 2028.

Leasing activity across the portfolio has continued to demonstrate not only that there is good occupier demand for Picton’s assets but also that the company can work with existing tenants to meet their evolving needs. The exception to this rule has been pockets of the office portfolio, driven primarily by structural changes in the office market post-pandemic, where the company has responded proactively by repositioning selected assets for alternative use. Much of the remaining office void is under refurbishment for re-letting.

In H125, new lettings were on average at rents 9% above ERV, adding £1.6m pa to rent roll. Lease regears and renewals secured a 14% uplift in contractual rent of £0.5m at 7% above ERV. Rent reviews were also at a premium, settled at 9% above ERV and securing a 26% uplift on the previous passing rent.

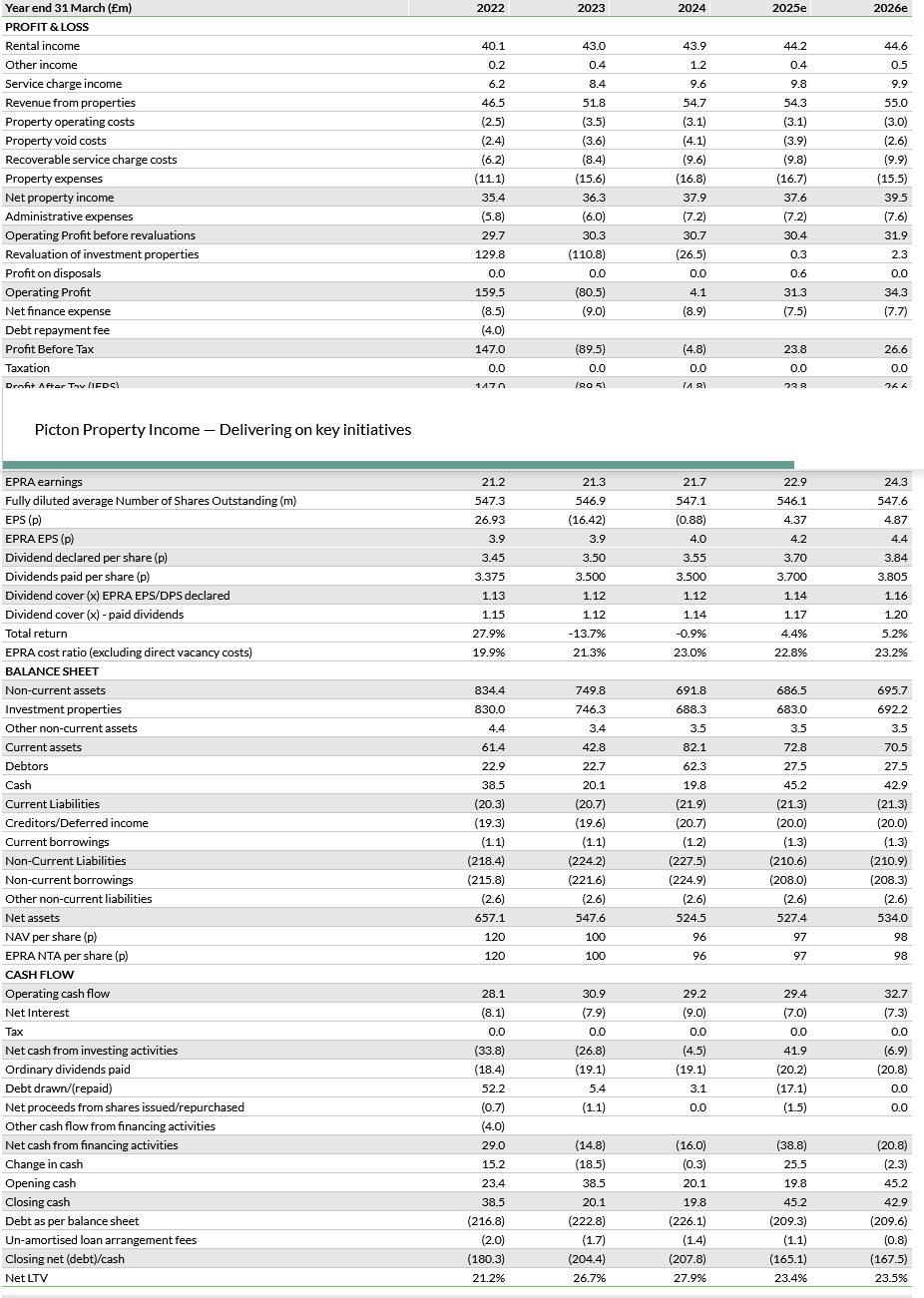

Forecasts and valuation

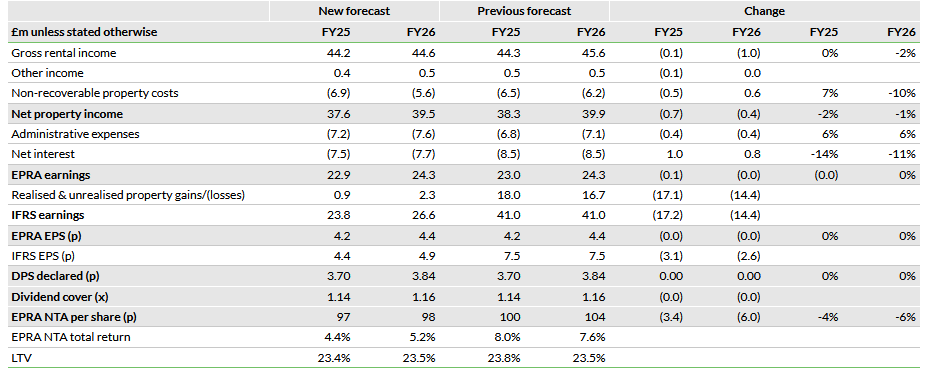

Modest changes to EPRA earnings forecasts

Updated for the H125 results, the changes to our EPRA earnings forecasts are modest and we continue to expect DPS to increase further in FY26, on a strongly covered basis.

Aside from the impact of the expected sale of the alternative use assets, we assume only modest like-for-like growth in ERV, no material change in occupancy and no reversionary capture through leasing events. These assumptions may prove to be prudent but recognise the continuing level of economic uncertainty. As a result, the estimated potential upside from contracted rent to ERV remains high at almost £8m, a little less than 50% from void reduction and the balance from rent reversion (increasing existing contracted rents to ERV).

Exhibit 5: Key rental data assumptions

Source: Picton Property Income H125 data, Edison Investment Research forecasts

We expect the small negative gross income impact of the alternative asset sales to be significantly offset by the reduction in void property costs.

In other adjustments, we have allowed for higher administrative costs than previously, more than offset by interest income from placing disposal proceeds on deposit pending more strategic deployment.

We have also taken a more prudent approach to portfolio valuation. It seems increasingly likely that valuations have stabilised but, with market expectations for the pace of interest rate declines tempered, we have not assumed any material yield shift. Given our rental growth assumptions, the change in property valuations through FY26 is modestly positive and our NAV forecasts are reduced.

Exhibit 6: Summary of forecast changes

Source: Edison Investment Research

Valuation does not reflect asset management opportunities

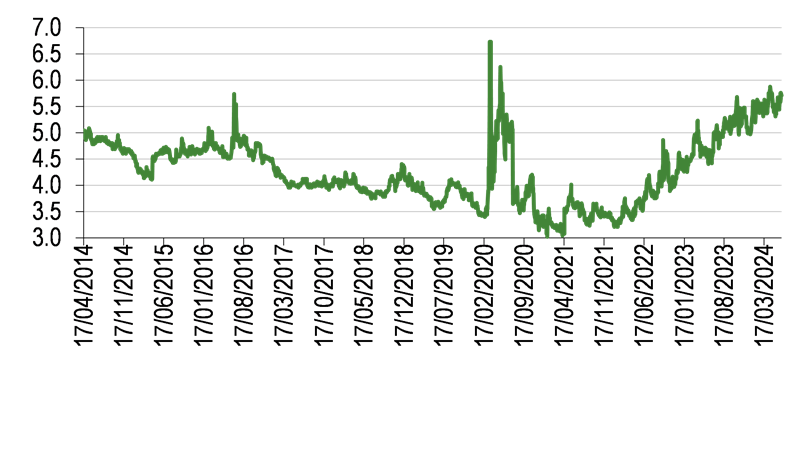

The level of quarterly DPS (0.925p) represents an annualised rate of 3.7p or a 5.4% yield. We forecast an increase to 3.84p for FY26.

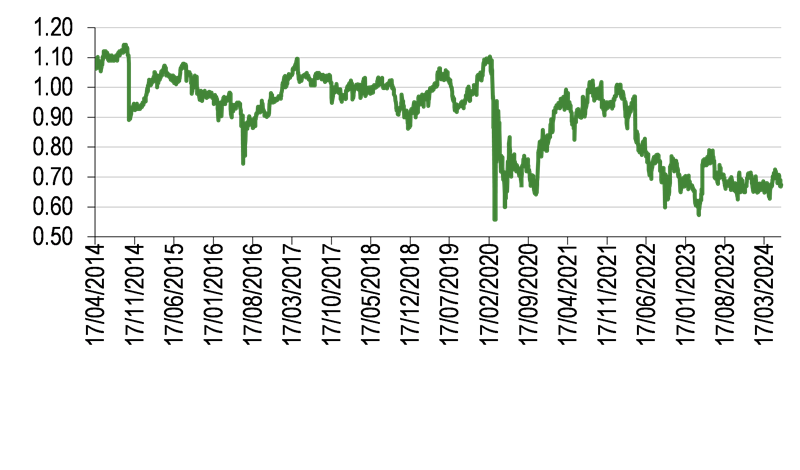

The shares trade at c 0.70x the 96p end-H125 NAV3 per share, well below the 10-year average of 0.9x and a high of c 1.1x. In common with the UK REIT sector, Picton’s shares have de-rated as interest rates have risen and the current valuation is broadly in line with its level at the height of pandemic uncertainty in early 2020.

2 Defined as EPRA net tangible assets (NTA) per share.

Exhibit 7: 10-year dividend yield history (%)

Source: LSEG Data & Analytics, Picton’s trailing DPS data, Edison Investment Research

Exhibit 8: 10-year price to NAV history (x)

Source: LSEG Data & Analytics, Picton’s trailing NAV data, Edison Investment Research

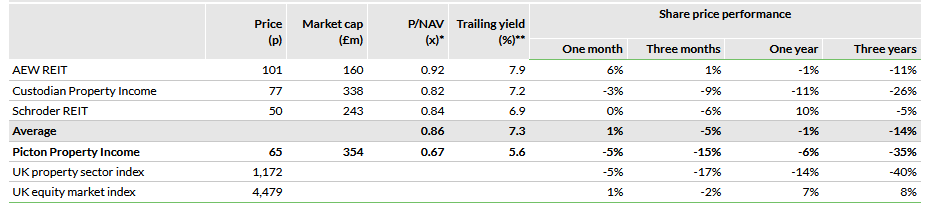

The list of regionally focused, diversified REITs that represent Picton’s close peers has shrunk materially as a result of corporate activity and company wind-downs. Picton’s shares trade on a lower yield than the group average, primarily reflecting its greater focus on total return, balancing sustainable fully covered dividends with the capital requirements of active management.

Its P/NAV ratio is below the average, suggesting that the market is not anticipating a continuation of Picton’s strong track record of property-level performance despite the future income and valuation growth potential embedded in its portfolio. We also note the company’s low gearing and attractive long-term, fixed-rate funding. As it is externally managed, its administrative costs would not be directly linked to a recovery in property valuation across the market, unlike externally managed peers with fees linked to NAV.

Exhibit 9: Peer performance and valuation

Source: Company data, LSEG Data & Analytics. Note: *Based on last reported EPRA NAV/NTA. **Based on trailing 12-month DPS declared. Prices as at 19 December 2024.

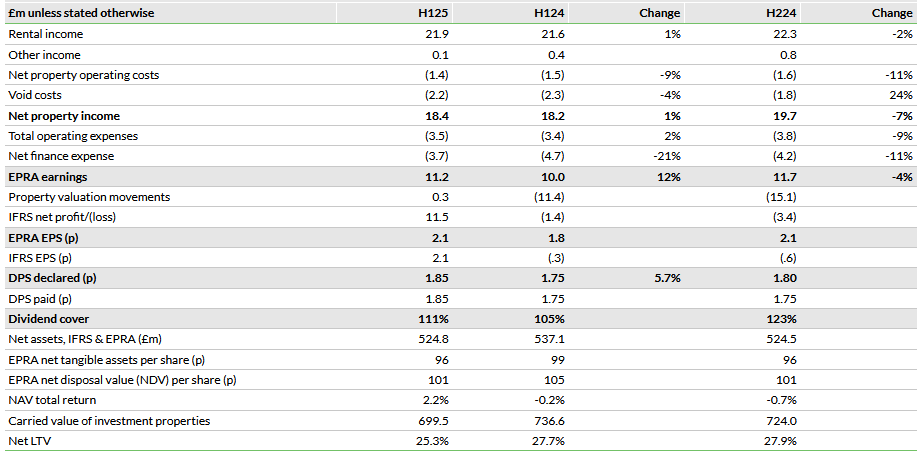

H125 financial performance

H125 EPRA earnings of £11.2m were 12% or £1.2m ahead of H124 and would also have increased versus H224 other than for a £0.7m half-on-half reduction in volatile and unpredictable dilapidation receipts. Underlying performance was stronger still when adjusted for the near-term impact of the alternative use assets.

Rents continued to grow in H1 and, on a like-for-like basis, contracted rent roll increased by 1.0% to £47.9m compared with end FY24, and ERV by 1.6% to £56.4m.

Exhibit 10: Summary of H125 financial performance

Source: Picton Property Income data, Edison Investment Research

At £3.5m in H125, operating expenses have been well-controlled, rising modestly versus H124 (£3.4m) and falling versus H224 (£3.8m), which includes annual performance payments.

Finance expenses (£3.7m) have benefited from the complete repayment of the relatively more expensive floating rate revolving credit facility early in H125, from the proceeds of the Angel Gate disposal, reducing versus H124 (£4.7m) and H224 (£4.2m). The remaining debt is all fixed rate and long term with an average cost of 3.7%. The first maturity is not until 2031.

In aggregate, operating and finance expenses were £0.9m lower in H125 versus H124, making a significant contribution to the increase in EPRA earnings. Compared with H224, aggregate operating and finance expenses were £1.0m lower but the benefit was offset by a £1.3m reduction in net rental income, with the lower dilapidation receipts accounting for around half. The near-term impact of the remaining alternative use assets accounts for the other half, primarily the result of obtaining vacant possession ahead of sale. Picton calculates that, adjusted for the impact of the change of use assets in each period, H125 net rental income would have increased by £0.9m or 4.2% versus H124, compared with the £0.2m increase reported.

Quarterly DPS increased by 5.7% with effect from Q424, and the aggregated H125 DPS declared of declared DPS 1.85p was up 5.7% compared with H124 with cover of 111%.

NAV per share was unchanged at 96p. Reflecting the fair value of the long-term debt, the EPRA net disposal value per share was 101p.

Exhibit 11: Financial summary

Source: Picton Property Income historical data, Edison Investment Research forecasts