- Chinese officials suggest President Trump lied about receiving a call to reopen trade negotiations

- 10-year yields are at lowest since July 2016

- Oil rebounds for third straight day

Key Events

Markets meandered, whipsawed by confusing, contradictory messages on the prospect of the U.S. restarting trade negotiations with China. U.S. futures contracts—including for the S&P 500, Dow Jones and NASDAQ—edged higher this morning, while European stocks dropped following a mixed Asian session.Yields posted a new low in the downtrend, while the dollar and yen are flat. Gold has kept most of yesterday’s gains while oil jumped on inventories and Iran's refusal to meet about sanctions relief.

Global Financial Affairs

The STOXX Europe 600 Index slumped, pressured by insurance and technology shares. In Asia, South Korea’s KOSPI (+0.86%) outperformed on improved sentiment in the Pharma sector, overshadowing Japan’s downgrade of South Korea’s trade status. Now Japanese manufacturers can’t sell their technology to South Korea without a case-by-case approval from government regulators.

China’s Shanghai Composite (-0.29%) lagged among the main benchmarks.

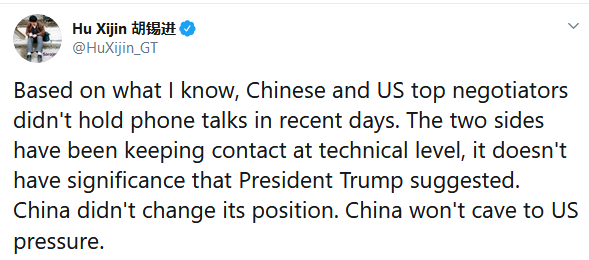

During yesterday’s U.S. session, equities gave back almost all of Monday’s gains after Chinese sources rebutted U.S. President Donald Trump’s weekend statement that China had called, hoping to restart negotiations because it wants a deal on trade. Yesterday, Hu Xijin, the editor-in-chief of China's state-run newspaper The Global Times, tweeted:

“Based on what I know, Chinese and U.S top negotiators didn't hold phone talks in recent days. The two sides have been keeping contact at technical level, it doesn't have significance that President Trump suggested. China didn't change its position. China won't cave to US pressure.”

Moreover, in a separate tweet, Hu XiJin said that the U.S. is losing leverage over China on trade since the Asian nation's economy is increasingly driven by domestic demand.

Adding to the distress for markets, Chinese officials who wouldn’t go on record revealed that China is losing faith in a trade deal, as President Trump sheds credibility. Meanwhile, hard liners are said to have solidified their anti-American position, further boxing in President Xi Jinping.

“Trump’s flip-flop has further enlarged the distrust,” said Tao Dong, vice chairman for Greater China at Credit Suisse Private Banking in Hong Kong. “This makes a quick resolution nearly impossible.”

U.S. Market sentiment turned, weighing on all four major indices, with the Russell 2000 particularly hard hit; it closed down -1.09%.

U.S. 10-year yields have slipped back below the psychological 1.5% level. Technically, yields remain suppressed beneath a bearish flag pattern, suggesting another leg down. As well, the yield curve is still inverted, stressing investors as recession fears linger, which will likely pressure equities lower too.

Gold looks set to move higher. It remains well above the top of a failed H&S bottom which is expected to catapult the precious metal higher along its ascending channel.

Oil's bounce continued for a third day, on a larger than expected drop in WTI stockpiles. In addition, Iran all but ruled out a meeting with the U.S about ending their nuclear standoff.

Technically, the price of crude jumped above the top of a falling channel since July, while the 200 DMA is expected to resist a full-on breakout. As long as trade uncertainty remains, the outlook for demand will continue to be murky.

Up Ahead

- The second reading of U.S. Q2 GDP, to be released Thursday, is expected to refine estimates of slightly lower economic growth.

- Bank of Korea's policy decision and briefing will take place on Friday.

- Eurozone CPI data for August is also due on Friday.

Market Moves

Stocks

- The Stoxx Europe 600 Index declined 0.4%.

- Futures on the S&P 500 Index increased 0.17%.

- The U.K.‘s FTSE 100 gained 0.3%.

- The MSCI All-Country World Equity Index decreased 0.1%.

- The MSCI Emerging Markets Index was little changed.

Currencies

- The Dollar Index increased 0.1%.

- The euro was little changed at $1.1088.

- The British pound declined 0.63% to $1.2208 on political developments in the U.K.

- The Japanese yen was little changed at 105.79 per dollar.

Bonds

- The yield on 10-year Treasuries rose less than one basis point to 1.47%.

- The yield on two-year Treasuries decreased less than one basis point to 1.52%.

- Britain’s 10-year yield declined one basis point to 0.493%.

- Germany’s 10-year yield sank one basis point to -0.70%.

- Japan’s 10-year yield dipped one basis point to -0.272%.

Commodities

- West Texas Intermediate crude climbed 0.85% to $55.79 a barrel.

- Gold fell 0.2% to $1,540.11 an ounce.