Gold prices set for weekly gains on dovish Fed outlook; silver near record high

- Europe's corporate warnings and low German consumer sentiment send U.S. futures lower

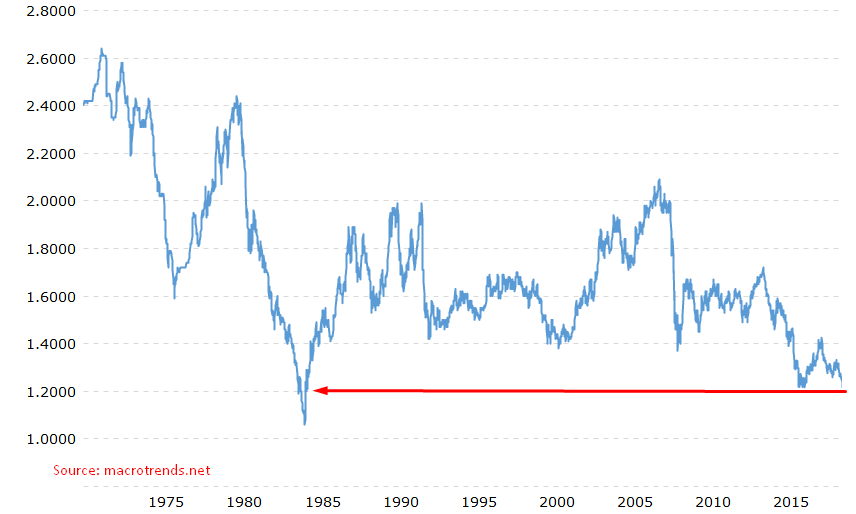

- Growing prospects of no-deal Brexit push pound towards 1985 levels

- Oil climbs on lower rates, weaker dollar outlook

Key Events

Futures on the S&P 500, Dow and NASDAQ 100 were dragged down by a earnings-led selloff in Europe this morning, as the market held its breath for a new round of U.S.-China trade talks kicking off in Shanghai today.

SPX contracts finally caved to the broader downward trend, after initially enduring in positive territory. Technically, they are headed to a top on the hourly chart, after Dow futures already topped out.

The STOXX 600 dropped, erasing two days of gains, after a pessimistic outlook from German heavyweight Bayer (DE:BAYGN) mainly due to trade disputes, pushing its stock 4.4% down, and Lufthansa (DE:LHAG) fell over 6% to the lowest in two and a half years, as rising fuel costs and price competition with lower-cost companies on short flights painted a bleak future for the airline.

Weak earnings from these German bellwethers corroborated a weak Gfk survey, revealing that consumer sentiment in the Western European country fell for the third straight month, reminding investors trade headwinds are still threatening the world's economies with a looming slowdown.

The euro held onto gains after rebounding from the lowest level since May 2017—after a continuation H&S pattern, below the 200 DMA, added pressure to the single currency.

The pound also pared losses that had thrown it to the lowest level since January 2016, post-Brexit vote bottom, which in turn had set it only a few inches away from the lowest price since 1985. The British currency now hovers at the lowest level since March 2017 as newly-elected Prime Minister Boris Johnson strengthened his no-deal Brexit rhetoric. A weaker Sterling made shares on the FTSE 100 more affordable, prompting a higher open that bucked the European trend.

Global Financial Affairs

In the earlier Asian session, stocks flashed green across the board. South Korea’s KOSPI (+0.45%) outperformed as traders spurred a rebound from oversold condition after the index lagged yesterday. Japan’s Nikkei 225 (+0.43%) followed right behind. Australia’s S&P/ASX 200 (+0.28%) hit an all-time high. At the bottom of the ranking, Hong Kong’s Hang Seng "only" climbed 0.14% amid continued civil protests.

Meanwhile, the dollar advanced for the eighth straight session—even as it approaches a widely expected Fed rate cut and possibly more easing down the line—while the yield on 10-year U.S. Treasurys dropped.

In commodities, oil jumped, advancing for a fourth consecutive day on speculation that lower borrowing costs and a weaker greenback—following the next FOMC meeting—would boost demand. Technically, the price is still trapped within a continuation consolidation, and a powerful death cross of the moving averages is still in effect, though the price jumped back above the 200 DMA.

Up Ahead

- Earnings include: Qualcomm (NASDAQ:QCOM), Siemens (OTC:SIEGY), Credit Suisse (SIX:CSGN), Nomura (NYSE:NMR), Toyota (NYSE:TM), Honda (NYSE:HMC), Ferrari (NYSE:RACE), General Motors (NYSE:GM), BMW (MI:BMW), Rio Tinto (LON:RIO), Shell (LON:RDSa), Vale (NYSE:VALE), General Electric (NYSE:GE).

- U.S. Trade Representative Robert Lighthizer and his team meet their Chinese counterparts in Shanghai from Tuesday.

- Fed officials begin their two-day meeting on monetary policy in Washington on Tuesday. Chairman Jerome Powell will hold a press conference following the FOMC’s decision on Wednesday.

- The Bank of England policy decision is due on Thursday.

- The U.S. July jobs report is due on Friday.

Market Moves

Stocks

- The U.K.‘s FTSE 100 increased 0.4%, to the highest in almost a year.

Currencies

- The Dollar Index gained 0.1% and a 1.35% advance in a straight eight-day climb to the highest in exactly two months.

- The euro fell 0.1% to $1.1138.

- The British pound dipped 0.6%, the weakest in more than two years.

- The Japanese yen advanced 0.1% to 108.64 per dollar, the biggest gain in more than a week.

Bonds

- The yield on 10-year Treasurys fell one basis point to 2.06%.

- Germany’s 10-year yield declined less than one basis point to -0.39%.

- Britain’s 10-year yield slid two basis points to 0.634%, the lowest in about three years.

- Japan’s 10-year yield declined one basis point to -0.152%.

Commodities

- West Texas Intermediate crude increased 0.7% to $57.26 a barrel, the highest in two weeks.

- Gold declined 0.1% to $1,425.99 an ounce.

- The Bloomberg Commodity Index advanced 0.1% to 79.10.