FX Brief:

RBNZ’s Governor Bascand said the economy looks close to a turning point. NZD is the strongest major of the session (and the week). Overall data continues to be kind and surprise to the upside, and recently the government stimulus to aid with growth.Trump remains upbeat on US-China trade talks, saying they’re “moving along very well”. But he’s been saying this for a year now, so make of that what you will.Japan’s sales tax hike continues to bite the consumer (you know… the ones that are supposed to be inflating prices yet, for some reason have a deflationary mindset) with household spending plummeting -11.5% last month, or 5.1% YoY.Australian construction PMI contracted for a 15th consecutive month, but at a slower pace of 43.9 versus -40 prior.Price Action:

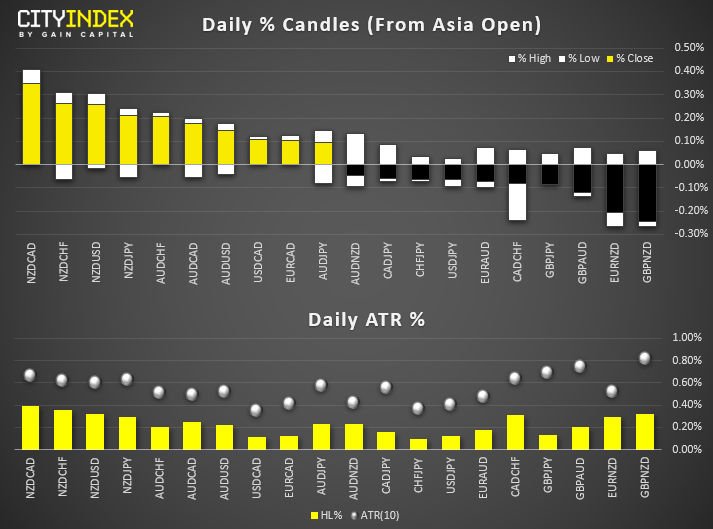

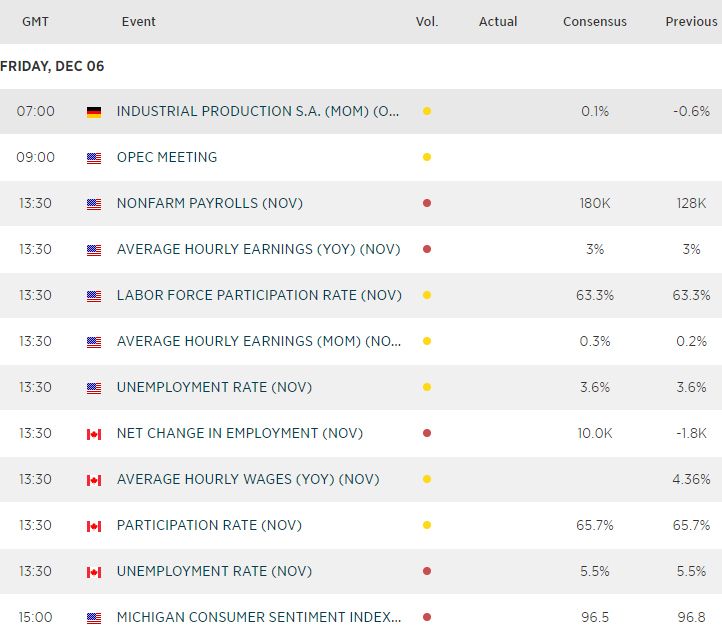

Volatility is typically low, as we’d expect ahead of the monthly NFP report. Daily ranges are around 40% of ATR, so we expect plenty of range expansion later in later sessions (more likely the US, after NFP).DXY hangs near its 5-week low ahead of today’s NFP. If it closes lower today, it will be its 7th consecutive lower close, an event that hasn’t happened for 6 years. is back above 1.1100, a level likely to be pivotal around today’s . A break above 1.1117 invalidates the bearish hammer, whilst a break beneath 1.1065 confirms the near-term reversal candle. is consolidating above the weekly low, positioned for a weaker NFP and stronger Canadian employment set (they’re both released together). This leaves room for a bounce if NFP doesn’t disappoint and CA data hit expectations or softens. Otherwise, it could be headed towards the 1.3112 lows. has found support at the monthly pivot point at 0.6813. With prices consolidating, it will take its directional cue from today’s NFP, where a miss (lower employment and / or higher unemployment) could send it to a positive close for the week. remains just off 17-week lows and above a key trendline and momentum points decisively lower. Yet with the monthly S1 level just above the 1.0400 level and no AU or NZ specific data due, be on guard for a close or potential rebound above this key level. Further out, path of least resistance is likely lower.Equities Brief:

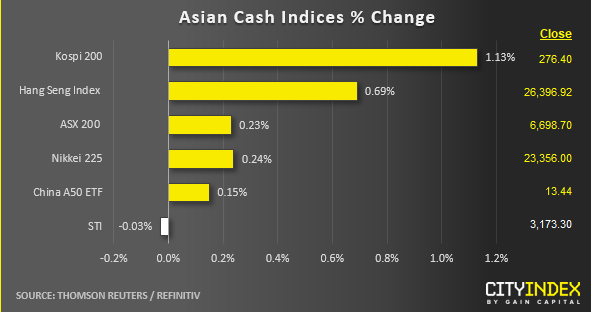

Key Asian stock markets have continued to inch higher in an upbeat mood after U.S. President Trump’s upbeat comment on the progress of the Phase One U.S-China trade deal (his 2nd “optimistic quote” after a more hostile comment made on 03 Dec where Tump was comfortable to delay a trade deal after Nov 2020 U.S. Presidential Election).Leading the gains is South Korea’s Kospi 200 which has rallied by 1.13% led by the Technology sector, upped by 2.03%.Meanwhile, the Hong Kong’s has started to give up some partial gains after it spiked up to current intraday high of 26500 in the first 2 hours of today’s Asia session as the city braces herself for a planned mass demonstration this weekend follow by a possible Monday strike that can disrupt the public transportation system. Anti-government protestors are still no showing any signs of backing down in the on-going 6-month protest.The S&P 500 E-Min futures is not showing any significant movement in today’s Asian session as it has traded within a tight range of 6 points below yesterday’s 05 Dec European session high of 3124.Price Acton (derived from CFD indices):

: Churning continues above supports at 23150 follow by 22980 (03/04 Dec 2019 minor swing lows & ascending trendline from 21 Nov 2019 low) with medium-term range resistance at 23650.: Squeezed up above 26300 (previous minor swing area of 04/05 Dec 2019) in today’s first 2 hour of trading in Asian session. Thereafter, it has formed an hourly bearish “Shooting Star” at the 26550 intermediate resistance (02 Dec 2019 minor swing high & 50% Fibonacci retracement of the recent decline from 26 Nov to 03 Dec 2019 low). No conviction of a further recovery at this juncture but bears needs to have an hourly close below 26250 (today’s opening gapped up & 05 Dec former minor swing high) to reinforce the start of a potential downleg towards 25920 in the first step.: Minor mean reversion rebound remains in progress with key short-term support now at 6670 (former minor swing high of 04 Dec that has been retested yesterday). Next intermediate resistance stands at6740/6780 (50%/61.8% retracement of the recent decline from 29 Nov high to 03 Dec 2019 low).: No change as it continues to churn within a medium-term sideways range configuration in place since 19 Nov 2019. Intermediate resistance to watch will be at 13200 (yesterday, 05 Dec high & 61.8% Fibonacci retracement of the recent slide from 02 Dec high to 03 Dec 2019 low). Near-term supports to watch will be at 13055 and 12980 (02/03 Nov 2019 swing low areas).US : In churning mode and interestingly, the current rebound from 03 Dec 2019 low of 3070 after the “optimistic” U.S-China trade related headlines has started to evolve within an impending minor bearish “Ascending Wedge” with its resistance now at 3132. Bears need to have an hourly close below 3108 (minor swing low areas of 05/06 Dec 2019 & close to the “Ascending Wedge” support) to gain a foothold for a potential slide back to retest 3070."Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."

Original Post