- Friday's 2.4% jump on the S&P 500 came on the back of 'dovish' remarks by San Francisco Fed President Mary Daly

- But, in reality, the market now expects the Fed to raise rates to 5% by May 2023

- The bond market also keeps spelling trouble for the U.S. economy

- Brazilian iBovespa: +14%

- Indian BSE Sensex 30: +2.65%

- British FTSE 100: -5.62%

- Japanese Nikkei 225: -6.60%

- Spanish IBEX 35: -13.41%

- Dow Jones Industrial Average: -14.46%

- French CAC 40: -15.62%

- Euro Stoxx 50: -17.6%

- German DAX: -19.86%

- Italian FTSE MIB: -21.13%

- S&P 500: -21.26%

- Chinese CSI 300: -24.24%

- NASDAQ: -30.59%

The ups and downs in the S&P 500 last week gave way to a solid 2.4% gain on Friday, granting the U.S. benchmark index its best weekly performance since June. It is worth noticing that some of the volatility seen at the beginning of the week resulted from the expirations of $2 trillion worth of options.

The rally came on the back of San Francisco Fed President Mary Daly's comments that the Federal Reserve will likely discuss a smaller interest rate hike in December.

While the statement did come across as mildly dovish, the reality is that the market has been reacting quite strongly to any positive headlines, which is a risk in itself.

And I say this because Daly didn't actually say anything new, and, thus, nothing has fundamentally changed.

She said it is still not time to cut interest rates and that a slowdown to 25 basis point hikes will only be appropriate if inflation, especially core inflation, drops significantly, which is not yet close to happening.

Moreover, she also said that the Fed could be forced to raise rates above 4.5% next year if needed to bring inflation down.

Neel Kashkari, president of the Minneapolis Fed, also commented that if core or headline inflation doesn't start to come down significantly, he doesn't see why the Fed would have to stop at 4.5% or 4.75%.

Bonds Continue To Spell Trouble

For a financial world that is seeing sharp interest rate hikes, what is happening in the bond market matters a lot.

U.S. Treasury bonds are witnessing their biggest drop since 1984. Recall that the relationship between the price of a bond and its yield or return is inverse, i.e., if the price of the bond falls, its yield rises, and conversely, if the price of the bond rises, its yield falls.

Well, there is also an inverse relationship between the price of a bond and interest rates. In other words, if interest rates rise, the price of bonds falls, and vice versa.

A practical example will show you why this is so. Suppose we buy a 10-year bond paying an annual interest rate of 2% for a price of 100.

Then we happen to witness a rise in interest rates. In terms of maturity, other bonds like ours offer a higher yield and return of 3%+.

If we want to sell our bond, it will be difficult to find a buyer; after all, who will buy it at 100 for a yield of 2% when others are yielding 3% in the market?

And watch out because the Federal Reserve has already raised interest rates five times since last March, and a fourth consecutive 75 basis point hike is expected at the next meeting in November. In fact, the market now expects the Fed to raise rates to 5% by May 2023 versus the 4.6% it previously expected.

The latest to comment has been Federal Reserve Bank of St. Louis President James Bullard, who said that the strength of the U.S. labor market gives room to raise interest rates to curb inflation that is approaching four-decade highs. He was the first to publicly suggest 75 basis point hikes, which have become routine this year.

The reality is that the yield curve remains inverted between short- and long-term bonds, which is a serious warning of economic recession. An inverted yield curve occurs when short-term bond yields are higher than longer-term bond yields.

It usually is the other way around, and the longer the term of a bond, e.g., ten years, the higher the yield than a bond with a shorter term, e.g., two years, because the longer the term, the greater the risk of something negative happening.

Generally, there are two curves in a row. One is the spread between 10-year and 3-month Treasury bonds, and the other is between 10-year and 2-year Treasury bonds.

It is a good recession warning indicator since it has been right for the last eight recessions in the United States since December 1969.

However, the time lag between the flattening of the yield curve and the arrival of the recession is usually 1-2 years.

In the last five recessions, the 10-year to 2-year bond yield curve inverted earlier than the 10-year and 3-month yield curve, so arguably, the better indicator of the two would be the 10-year and 2-year bond yield curve, as it was always able to detect the recession earlier.

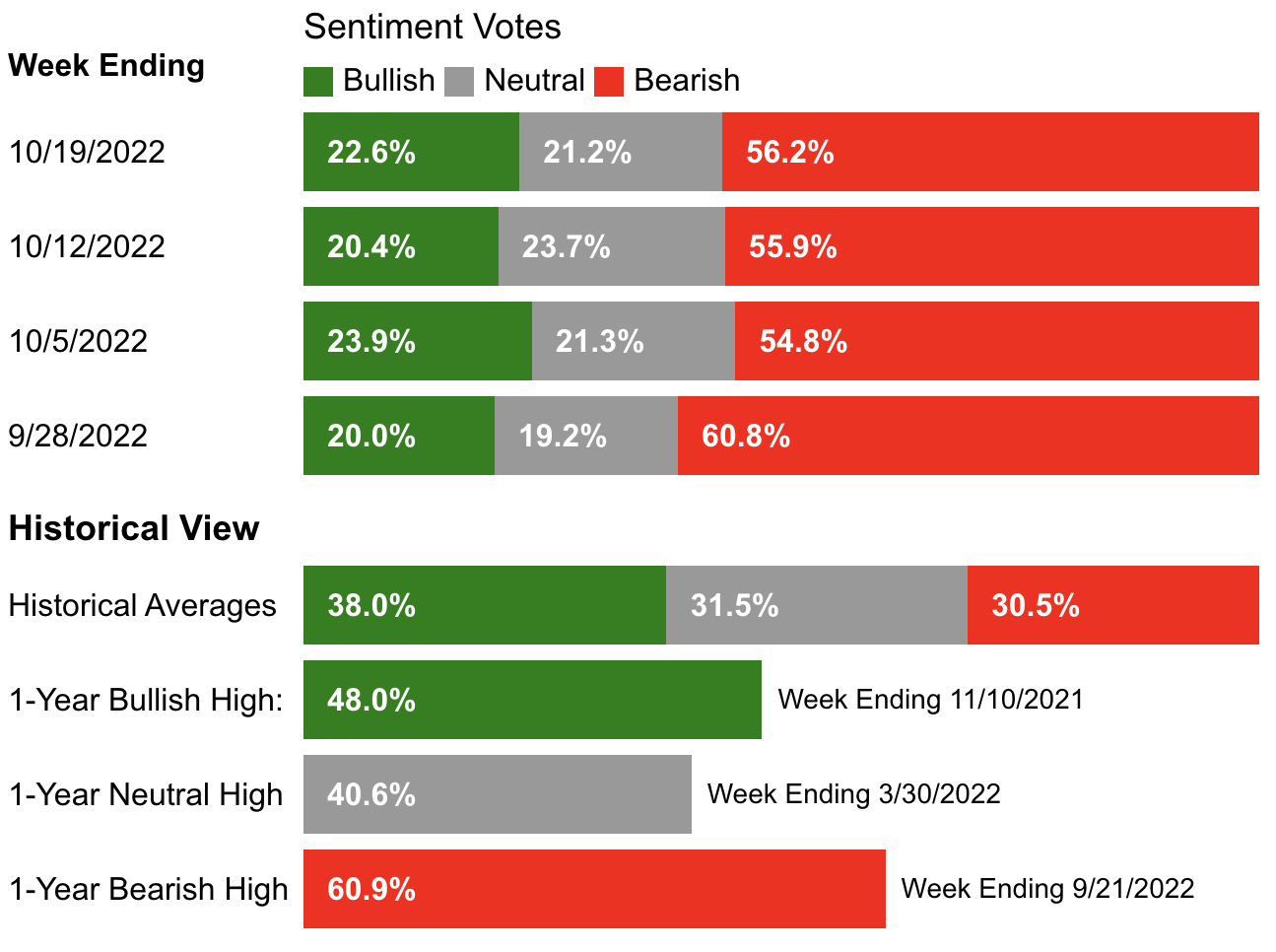

Investor Sentiment AAII

Despite last week's rebound, investor sentiment remains unchanged and bearish overall.

The bullish sentiment (expectations that stock prices will rise over the next six months) rose 2.2 points to 22.6% but remains below its historical average of 38%.

The bearish sentiment (expectations that stock prices will fall in the next six months) increased 0.3 points to 56.2% and remained above its historical average of 30.5%.

Global Stock Market Performance In 2022

Last week's positive global market performance led to some changes in the ranking of the major stock exchanges in 2022, which goes as follows:

Disclosure: The author currently does not own any of the securities mentioned in this article.