- Caution is advised for retail investors amid the current market breakout

- Weak market breadth, decelerating earnings, and high valuations of tech mega-cap companies indicate a not-so-favorable favorable market outlook

- Using the InvestingPro stock scanner, investors can identify stocks worth selling as hedges against a potential market decline

- Stocks that have P/E greater than 30

- That have returned more than 30% YTD

- That have a negative Fair Value estimate

- That have a Financial Health score of 3 or less on InvestingPro

- That are in the Information Technology or the Communication Sectors

- Hitek Global (NASDAQ:HKIT), with a 36.7% downside potential

- Intercede Group (LON:IGP), with a 24.1% downside potential

- AvePoint (NASDAQ:AVPT), with a 14.6% downside potential

- P/E Ratio of 108.2x

- Declining trend in earnings per share

- RSI suggests the stock is in overbought territory

- Stock generally trades with high price volatility

As the market finally shows signs of a breakout after being rangebound for over six months, retail investors are naturally inclined to dive in and make impulsive purchases without hesitation. This tendency intensifies with the fear of missing out (FOMO) on the AI trend, leading investors to favor stocks that are clearly overbought, such as NVIDIA (NASDAQ:NVDA).

However, it's crucial to remind ourselves that these feelings are often deceptive illusions created by our own minds. Institutional investors are well aware of this and will exploit these emotions to their advantage, leaving us at a disadvantage.

A rational examination of the market reveals a less optimistic reality compared to recent actions. Despite progress on the fronts of inflation and interest rates, corporate earnings and economic activity continue to display warning signs.

Market breadth has also been extremely weak. In fact, roughly 9.5% of the S&P 500's 11.5% YTD gain was driven by only seven stocks, namely Apple Inc (NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG), Meta Platforms (NASDAQ:META), Amazon.com (NASDAQ:AMZN), Tesla (NASDAQ:TSLA), and NVIDIA. And if that wasn't enough, tech mega-cap companies are currently trading at nearly 30 times their projected earnings for 2024.

Institutional investors seem to agree that the current setup is at least worrisome.

"The lack of market breadth, coupled with the past two quarters in a row of decelerating earnings, means there is still more downside risk ahead," says Michael Landsberg, chief investment officer at Landsberg Bennett Private Wealth Management.

Likewise, Robert Schein, chief investment officer at Blanke Schein Wealth Management said in an interview for TheStreet.com:

"We need the participation of other sectors. Investors should focus on actively diversifying their portfolios, with exposure to multiple sectors of the S&P and a variety of asset classes allowing for better risk management in an environment where uncertainty abounds,"

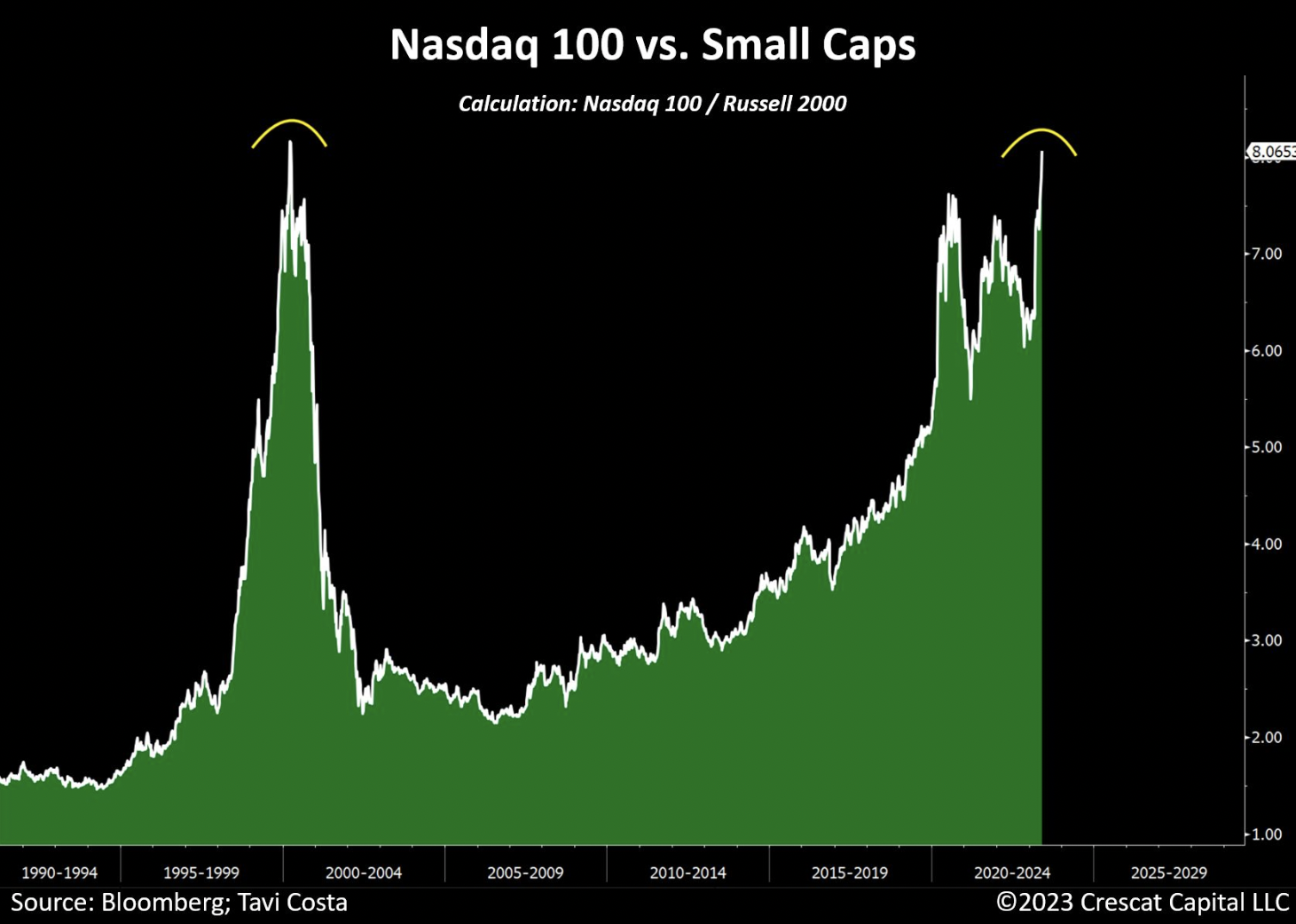

As Tavi Costa shows, furthermore, the Nasdaq-to-Russell ratio is flashing levels similar to the peak of the dot-com bubble of 1999-2000.

Source: Tavi Costa

In early January, I had set my target for the S&P 500 at 4,300 for the year. Considering the aforementioned scenario and my broader macro view (as explained in the article) I expect at least a healthy dip soon—if not something bigger.

With that in mind, I believe long investors should start hedging some of their yearly gains by selling overbought stocks. They can maintain their long positions on strong stocks in the meantime.

Let's use or InvestingPro stock scanner to find stocks investors should consider shorting now. Readers can do the same research just by clicking on the following link: Try it out for a week for free!

Finding Potential Losers With InvestingPro

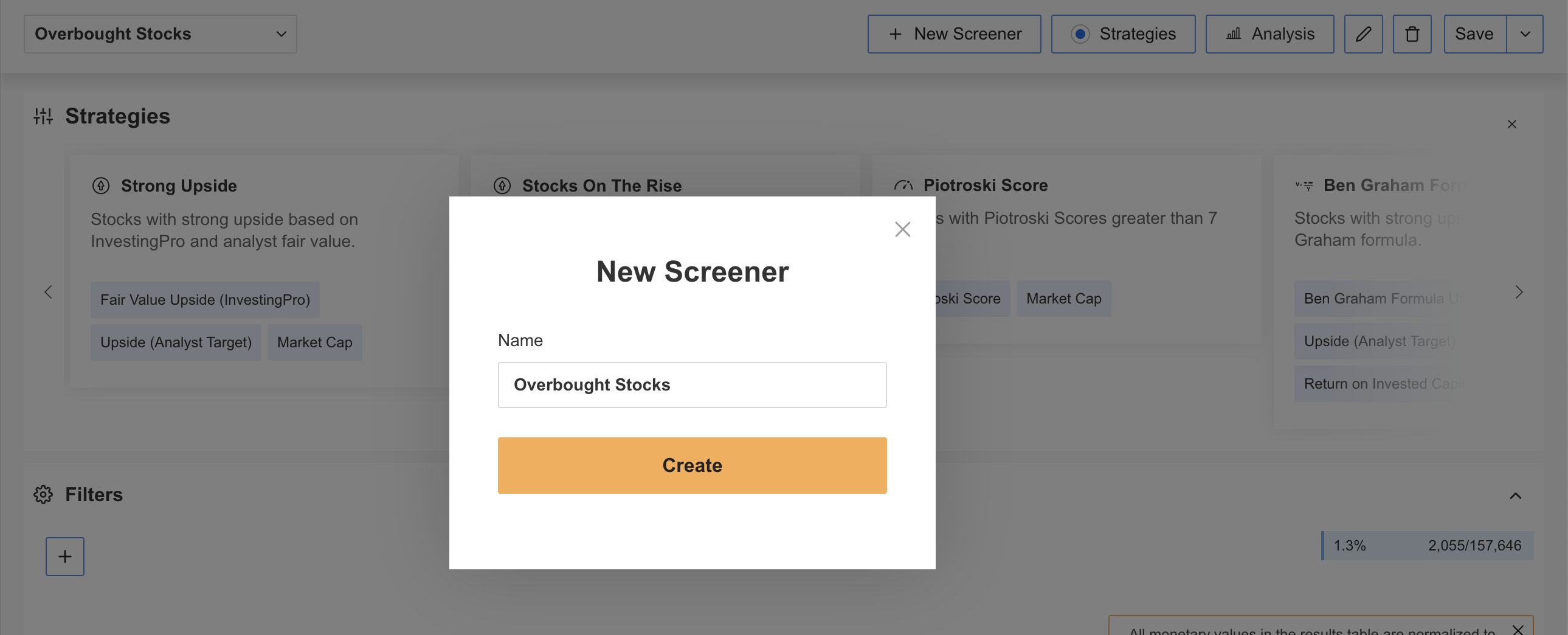

This time we will use the InvestingPro stock scanner a bit differently; instead of looking at strong stocks, we will find stocks that are worth selling now. I started my research by creating a new screener called "Overbought Stocks."

Source: InvestingPro

To find potential losers among the thousands listed in the market, I used the following setup:

That search yielded three stocks, namely:

Let's take a deeper look at Hitek Global to better understand why investors can use those stocks to hedge against a potential market decline.

Investors can do the same research by themselves just by clicking on the following link: Try it out for a week for free!

Hitek Global

China-based Hitek Global is a provider of IT consulting and solutions catering to the needs of small and medium-sized enterprises across different industries in China. The company specializes in offering anti-counterfeiting tax control system (ACTCS) devices, such as sophisticated tax disks and printers, along with ACTCS services and other IT support.

HKIT stock has been on a fantastic bull run since its March IPO, mostly driven by the Chinese economic reopening, the AI play, and the rise of tech stocks.

However, after rising a whopping 95%, the stock is beginning to show signs of vulnerability. Should the market turn on its head, it is likely that Hitek will suffer fast and steep losses—making it a perfect target for those looking to short the AI play.

Here are the main remarks on the stock found on the InvestingPro stock page:

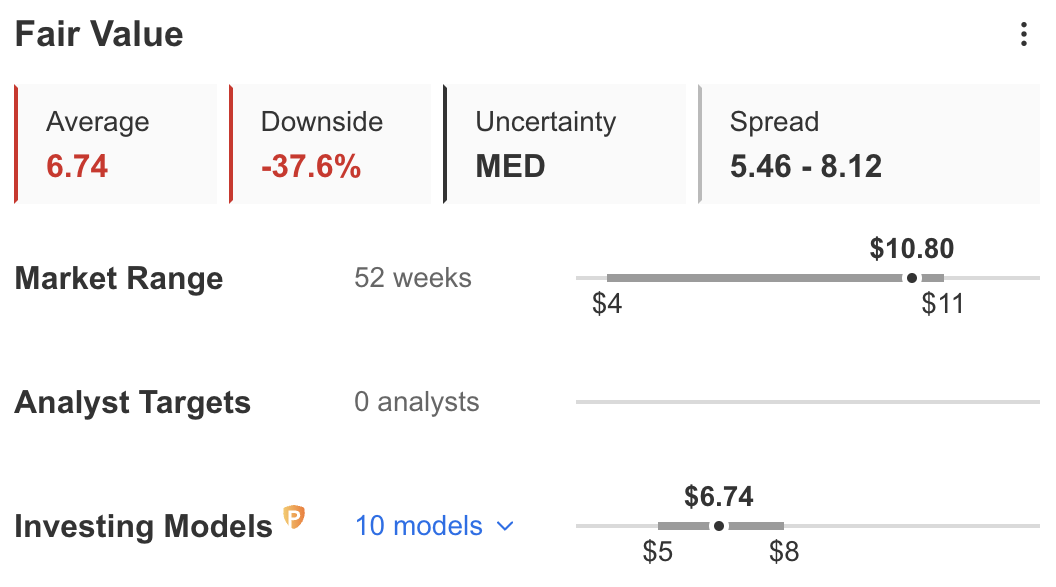

Accordingly, the stock currently has a 37.6% downside risk, according to InvestingPro's Fair Value score.  Source: InvestingPro

Source: InvestingPro

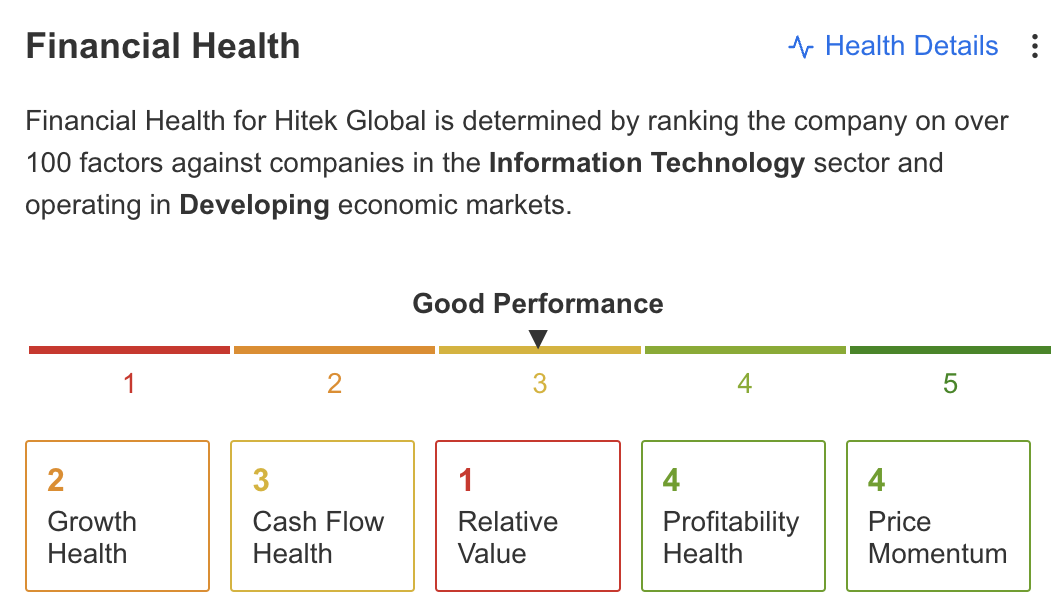

On the positive side, the stock has an impressive gross profit margin and liquid assets exceed short-term obligations, which has granted the stock a "good" Financial Health score on InvestingPro.  Source: InvestingPro

Source: InvestingPro

Still, the combination of high multiple, slowing earnings, and the permanent risks incoming from the Chinese government make the stock a good target for hedging against a decline.

Bottom Line

Retail investors should exercise caution and resist the temptation to buy overbought stocks driven by FOMO. While the market may seem promising, underlying factors such as weak market breadth, decelerating earnings, and inflated valuations of tech mega-cap companies warrant a rational assessment of the current situation.

By using the InvestingPro stock scanner, investors can identify stocks worth shorting as potential hedges against a market decline. Hitek Global, a China-based IT consulting company, exemplifies one such stock with its high P/E ratio, declining earnings per share, and overbought conditions.

***

Disclosure: The author is long on Apple, Microsoft, and Alphabet.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.