- Fed meeting, FOMC dot-plot, Powell news conference will be in focus this week.

- Nvidia is a buy as its annual ‘GTC 2024’ conference kicks off.

- Nike shares are a sell amid weak earnings and sales growth.

- Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

U.S. stocks finished lower on Friday to suffer their second weekly loss in a row as investors weighed the outlook for interest rates amid renewed inflation fears.

For the week, the benchmark S&P 500 declined 0.1%, the tech-heavy NASDAQ Composite dropped 0.7%, and the blue-chip Dow Jones Industrial Average dipped 0.1%.

Source: Investing.com

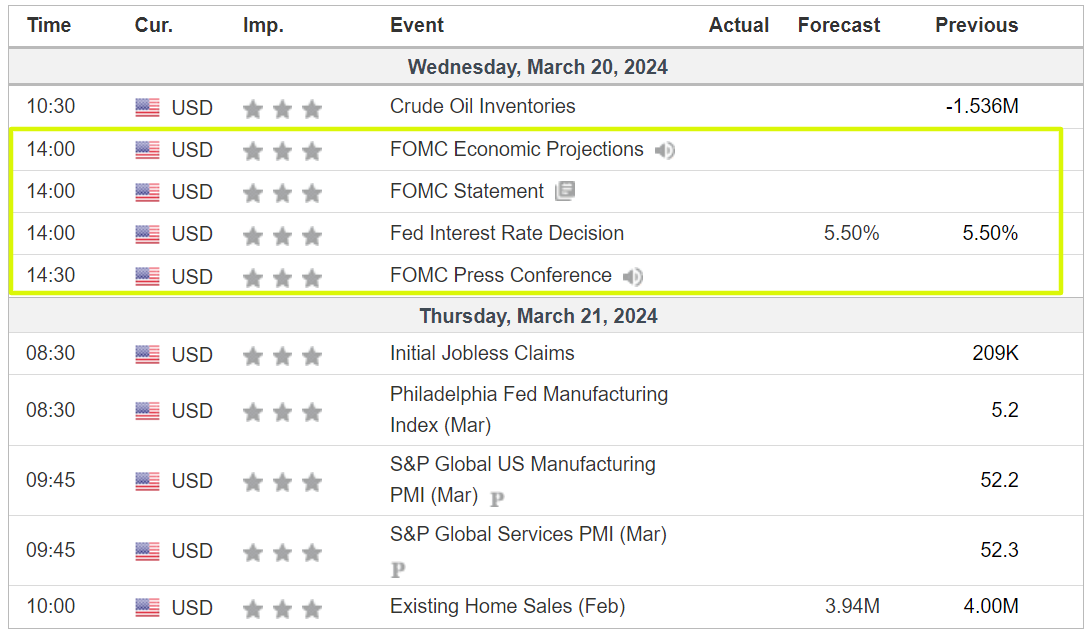

The blockbuster week ahead is expected to be an eventful one filled with several market-moving events, including the Federal Reserve’s latest monetary policy meeting.

The U.S. central bank is widely expected to leave interest rates unchanged on Wednesday, but Fed Chair Jerome Powell could offer hints about when rate cuts might start when he speaks in the post-meeting press conference.

Source: Investing.com

Investors have largely pushed back expectations for the Fed’s first cut to July following a recent batch of hot inflation data, as per the Investing.com Fed Rate Monitor Tool.

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including Nike (NYSE:NKE), FedEx (NYSE:FDX), Micron Technology (NASDAQ:MU), Lululemon (NASDAQ:LULU), and KB Home (NYSE:KBH).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, March 18 - Friday, March 22.

Stock to Buy: Nvidia

I expect Nvidia’s stock to extend its march higher in the week ahead as the AI technology darling hosts its highly anticipated ‘GTC 2024’ conference, at which it is likely to show off its latest advancements in generative AI, accelerated computing, large language models, robotics, and more.

The four-day event, which is the first in-person GTC in five years, will kick off late Monday from the San Jose Convention Center, in California. The company expects more than 300,000 people to register either in person or virtually.

Most of the spotlight will fall on CEO Jensen Huang’s keynote speech scheduled for Monday at 1:00PM PDT/4:00PM EST.

According to the description, Huang will share how emerging trends and innovations, such as the power of modern artificial intelligence, deep learning, and accelerated computing, are driving transformation in the tech industry.

In addition to the keynote speech, Huang will also participate in a panel discussion on Wednesday morning with all eight authors of ‘Attention Is All You Need’, the groundbreaking paper that introduced transformers to the world and revolutionized AI.

Furthermore, other key members of Nvidia’s leadership team are expected to reveal fresh details on the tech company’s new products and features, with some discussion on AI GPU chips anticipated, including the upcoming B100.

The graphics chip maker is also expected to show off its latest AI accelerator, as well as other computing innovations for data center hardware, PC gear, software and much more.

Shares of Nvidia (NASDAQ:NVDA) tend to rally during the week of its annual GTC event. At its last conference in March 2023, NVDA shares jumped after Huang said the “iPhone moment of AI has started.”

Source: Investing.com

NVDA stock ended Friday’s session at $878.36, not far from its recent record peak of $974 reached on March 8.

The Santa Clara, California-based AI giant recently overtook Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL) to become the third most valuable company trading on the U.S. stock exchange, trailing only Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL).

Shares have experienced a meteoric rise, increasing by 76% this year alone thanks to ongoing AI-related buzz. In 2023, Nvidia’s shares soared by a whopping 239%, cementing its status as a leader in the AI industry.

As ProTips points out, Nvidia is in ’Excellent’ financial health condition, thanks to robust earnings and sales growth prospects. ProTips also underscores Nvidia's anticipated substantial surge in free cash flow due to its high operating margins.

Stock to Sell: Nike

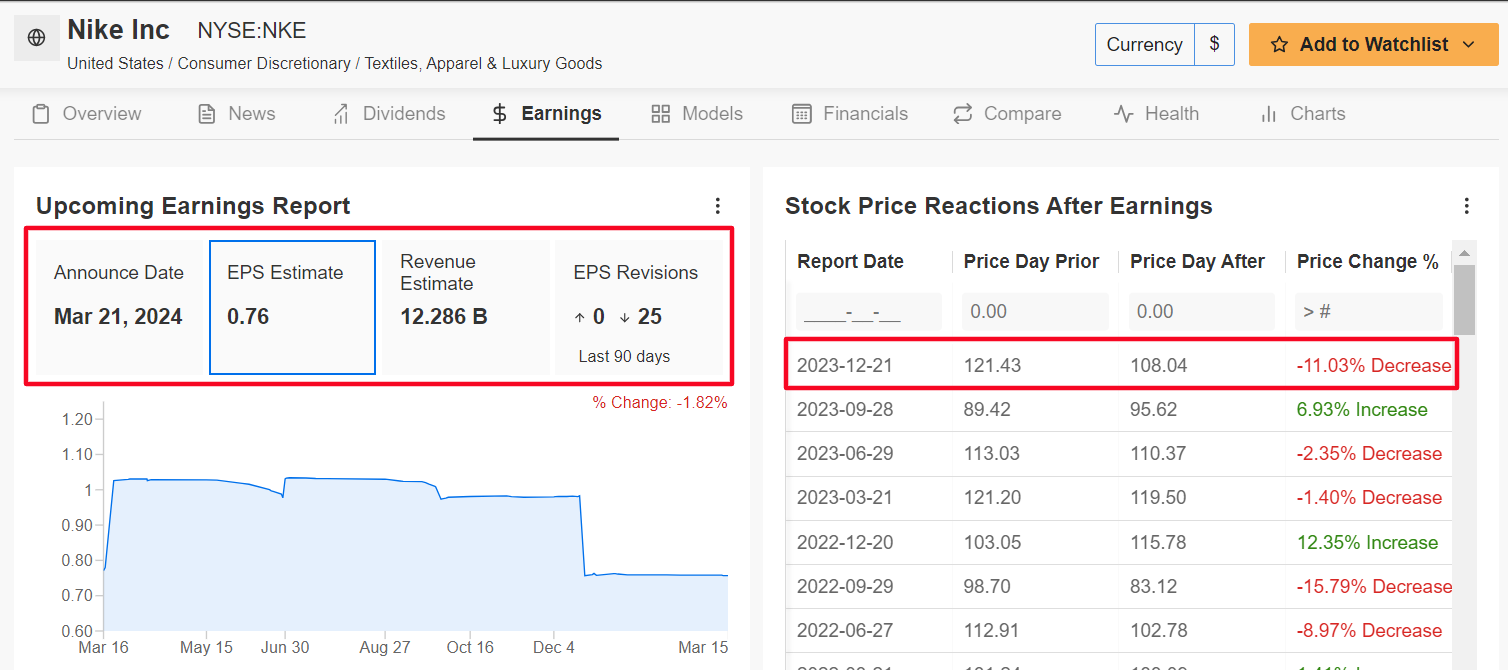

I foresee a weak performance for Nike’s stock in the coming week, as the sneaker giant will likely deliver another quarter of shrinking profit and sales growth and provide disappointing guidance due to the challenging operating environment.

Nike’s update for its fiscal third quarter is scheduled to come out after the close on Thursday at 4:15PM ET and results are likely to take a hit from slowing consumer demand for athletic apparel and equipment amid the current backdrop.

Market participants expect a sizable swing in NKE stock following the print, with an implied move of about 7% in either direction as per the options market. Notably, shares plunged 11% to after the company’s FQ2 report in December.

Underscoring several near-term headwinds Nike faces, all 25 analysts surveyed by InvestingPro slashed their EPS estimates in the past three months as Wall Street turned bearish on the maker of Air Jordan basketball shoes.

Source: InvestingPro

The Beaverton, Oregon-based company is seen earning $0.76 per share for its key holiday quarter, falling 3.8% from EPS of $0.79 in the year-ago period, amid declining operating margins.

Meanwhile, revenue is forecast to decline 1% year-over-year to $12.28 billion, as the sportswear retailer faces a difficult economic climate which is seeing consumers around the world cut back spending on discretionary items.

If that is confirmed, it would mark the fifth straight quarter of slowing sales growth. Like other retailers, Nike has had to increase promotions to appeal to price-sensitive consumers amid the current macro environment.

As such, it is my belief that Nike executives will disappoint investors in their full-year outlook and strike a cautious tone due to choppy sales in North America as well as weak demand from China.

Source: Investing.com

Nike (NYSE:NKE) stock - which fell to a 2024 low of $97.06 on March 6 - closed at $99.67 on Friday. At its current valuation, the Dow Jones athletic apparel and footwear giant has a market cap of $151 billion.

Shares are off to a downbeat start in 2024, falling 8.2% year-to-date. That compares to a 4.8% gain recorded by the Consumer Staples Select Sector SPDR® Fund (NYSE:XLP) over the same period.

It should be noted that Nike currently has a below average InvestingPro ‘Financial Health’ score of 2.6 out of 5.0 due to ongoing concerns weakening gross profit margins and spotty sales growth.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.