- U.S. retail sales, PMI surveys, Fed speakers will be in focus this week.

- Hewlett Packard Enterprise is a buy as it holds its annual HPE Discover Event.

- Kroger is a sell with disappointing earnings, guidance expected.

- Looking for a helping hand in the market? Unlock access to InvestingPro’s AI-selected stock winners for just 60 cents a day!

U.S. stocks ended mixed on Friday, with the Nasdaq Composite scoring its fifth straight record closing high as investors continued to assess when the Federal Reserve might begin cutting interest rates.

For the week, the tech-heavy Nasdaq jumped 3.2%, the benchmark S&P 500 rose 1.6%, while the blue-chip Dow Jones Industrial Average declined 0.5%.

Source: Investing.com

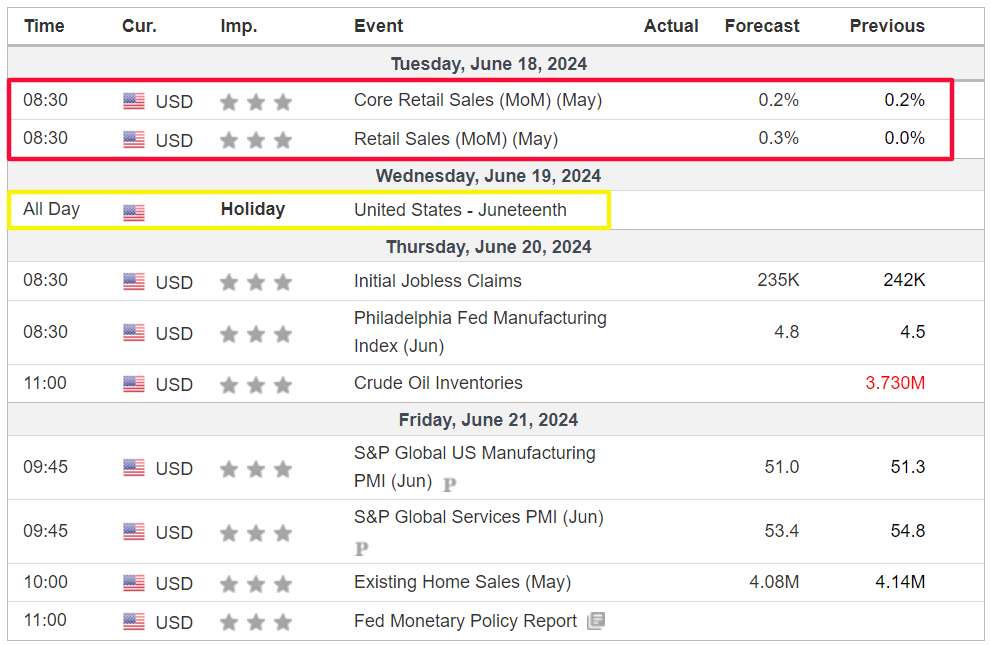

The holiday-shortened week ahead - which will see U.S. stock markets closed on Wednesday in observance of Juneteenth - is expected to be another busy one as investors weigh how much juice is left in the AI-inspired rally on Wall Street and when the Fed may decide to cut rates.

Most important on the economic calendar will be Tuesday’s U.S. retail sales report for May, which is forecast to show a small increase for the month.

Source: Investing.com

That will be accompanied by a heavy slate of Fed speakers, with the likes of district governors Lisa Cook, Thomas Barkin, and Adriana Kugler all set to make public appearances. Traders now see about a 70% chance of the first rate cut hitting in September, according to the Investing.com Fed Monitor Tool.

Meanwhile, some of the key earnings reports to watch include updates from Lennar (NYSE:LEN), KB Home (NYSE:KBH), Darden Restaurants (NYSE:DRI), and Kroger (NYSE:KR).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, June 17 - Friday, June 21.

Stock to Buy: Hewlett Packard Enterprise

I expect Hewlett Packard Enterprise’s stock to outperform this week as the edge-to-cloud company hosts its highly anticipated ‘HPE Discover summit’, at which it is likely to show off its latest advancements in edge-computing and AI applications.

The four-day conference, titled ‘Discover What’s Next’, will kick off on Monday from the Venetian Convention and Expo Center, in Las Vegas.

Most of the spotlight will fall on CEO Antonio Neri’s keynote speech scheduled for Tuesday at 12:00PM EST / 9:00AM PDT at the Sphere. He will be joined onstage by Nvidia (NASDAQ:NVDA) CEO Jensen Huang.

According to the description, Neri and Huang will showcase cutting-edge strategies and provide invaluable insights into emerging trends and innovations across edge & networking, hybrid cloud, and artificial intelligence.

Furthermore, other key members of HPE’s leadership team, including chief technology officer Fidelma Russo, are expected to share the latest announcements, partnerships and innovations coming from HPE and customers around the globe.

Shares of Hewlett Packard Enterprise (NYSE:HPE) tend to rally during the week of its annual ‘Discover’ event. The enterprise hardware, software, and consulting company has a history of attracting several analyst upgrades in the wake of its summit presentations.

Source: Investing.com

HPE stock ended Friday’s session at a fresh 52-week peak of $21.60, which was the highest level since February 2017. The Texas-based tech company has a valuation of $28.1 billion.

Shares have been on a major uptrend since the start of the year, gaining about 27% so far in 2024, thanks to soaring enterprise demand for its AI-driven edge computing and hybrid cloud solutions.

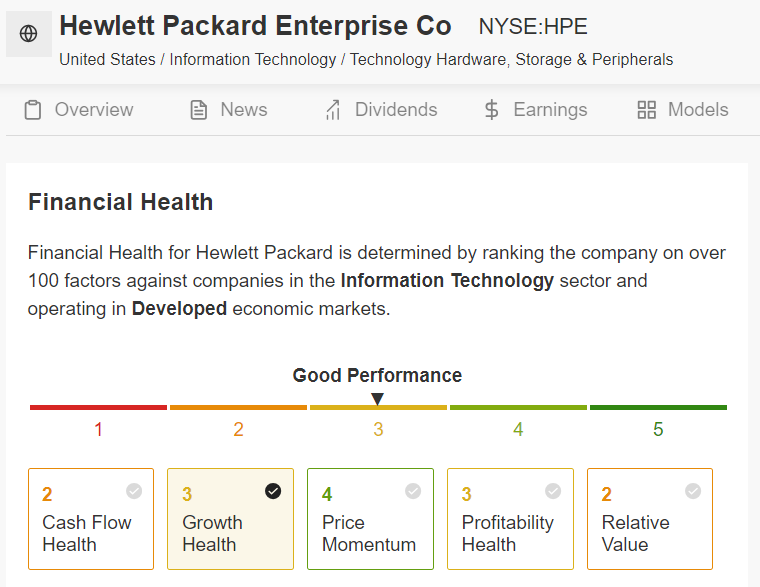

Source: InvestingPro

As ProTips points out, Hewlett Packard Enterprise boasts an above-average Financial Health Score of 2.9 out of 5.0, supported by its robust profitability outlook and strong sales growth prospects.

Subscribe now to InvestingPro and position your portfolio one step ahead of everyone else!

Stock To Sell: Kroger

I believe Kroger will suffer a difficult week ahead as the supermarket giant’s latest earnings will likely reveal a sharp slowdown in both profit and sales growth due to the uncertain macro environment.

The Cincinnati, Ohio-based company is scheduled to deliver its first quarter update before the U.S. market opens on Thursday at 8:00AM ET and results are expected to take a hit from rising operating costs and stiff competition from retail behemoths like Costco (NASDAQ:COST), Walmart (NYSE:WMT), and Amazon (NASDAQ:AMZN).

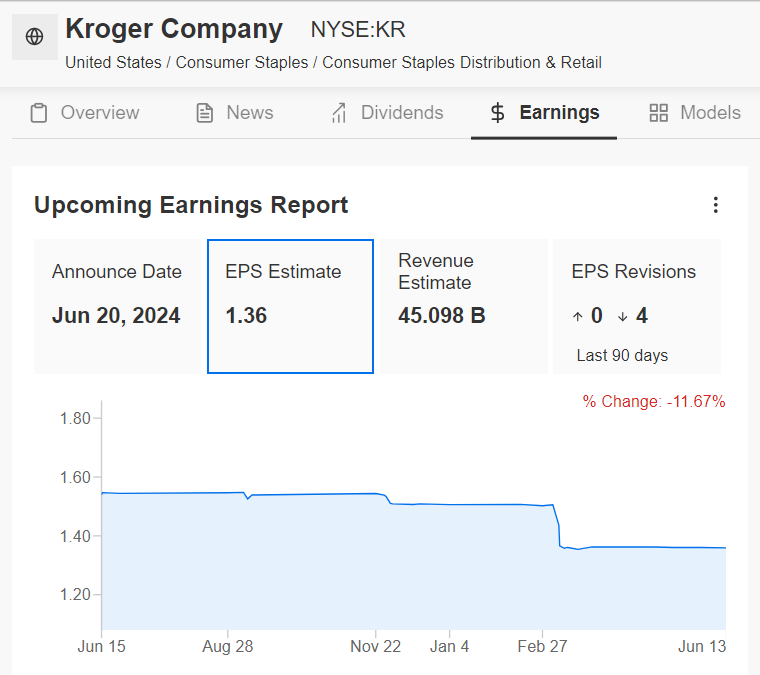

As could be expected, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the print. All four analysts covering the company slashed their estimates in the past 90 days as Wall Street grows increasingly bearish on the grocery store chain.

Market participants expect a sizable swing in KR stock following the update, with a possible implied move of about 6% in either direction, according to the options market.

Source: InvestingPro

Kroger - which operates more than 2,700 locations in 35 states across the U.S. - is expected to deliver Q1 earnings per share of $1.36, falling 9.9% from EPS of $1.51 in the year-ago period, amid higher cost pressures and decreasing operating margins.

Meanwhile, revenue is seen declining 0.3% annually to $45.09 billion as competition bites and consumer spending softens.

Looking ahead, it is my belief that Kroger’s management will provide underwhelming guidance for the current quarter to reflect declining operating margins and a slowdown in customer traffic at its stores amid the current macro climate.

KR stock closed at $50.38 on Friday, the lowest since March 6. At current valuations, Kroger has a market cap of $36.3 billion, making it the largest supermarket chain in the country.

Source: Investing.com

Shares have lagged the year-to-date performance of the broader market in 2024, rising 10.2% compared to the S&P 500’s near 14% gain.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy a limited-time discount of 40% OFF on the yearly and bi-yearly Pro plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of slowing economic growth, elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.