Proactive Investors -

- FTSE 100 drops 40 points to 8,114

- Results out from AstraZeneca (NASDAQ:AZN), Unilever (LON:ULVR), BAT (LON:BATS), Lloyds (LON:LLOY)

- ...and BT (LON:BT), Vodafone (LON:VOD) , Centrica (LON:CNA), Airtel, Rentokil (LON:RTO), Mitchells & Butler and more

US futures in the red

Futures markets are eyeing an extension of the US tech sell-off when trading starts in just over an hour.

Nasdaq 100 futures are down 0.35%, while those for the S&P 500 are 0.24% lower and Dow Jones futures are down less than 0.1%. Russell 2000 futures are flat.

Tesla and Nvidia (NASDAQ:NVDA) shares are down over 1% premarket, while Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL) and Meta Platforms are all down around 0.5%.

Chart of the day from DB

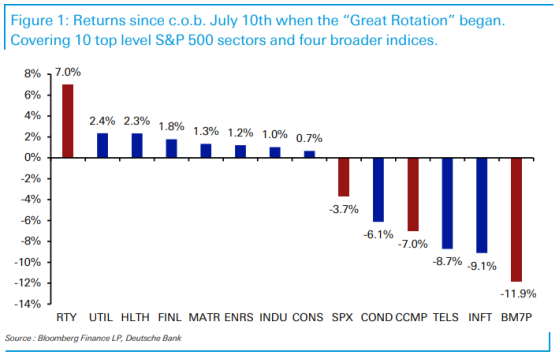

Another interesting 'chart of the day' from Deutsche Bank (ETR:DBKGn)'s macro strategy team has dropped into the inbox, looking at the rotation in stock sectors.

The analysts noted that in the 1999-2000 tech bubble, fom the peak until the end of 2000, there was a "ginormous rotation" into defensive sectors like consumer staples, utilities and healthcare, up 35 percentage points to 45% in the nine months after the bubble burst, while tech fell over 50%.

Today’s chart shows the rotation from the current tech sell-off, which started on July 11 (the blue bars show the 10 top-level S&P 500 sectors and the red bars show four broader indices).

Since then, the S&P 500 has dropped 3.7%, even though seven out of ten sectors are higher over this period, the DB team point out, led by utilities and healthcare again.

Amid yesterday's big tech sell-off, which was the first 2% fall for the S&P 500 in over a year, utilities rose 1.2% and healthcare 0.8% among four sectors that rose.

Small and mid-caps are also part of this rotation, with the Russell 2000 falling 2.1% yesterday, but still up over 7% since the opening bell on July 11.

"So the conclusion is that if tech continues to correct, we should see decent up moves in other sectors, especially as the size of tech dwarfs other sectors. So even a small rotation out of tech could mean a big rotation into other sectors."

Univeral Music, Stellantis and Nissan all crash

Looking overseas, the biggest faller in Europe is Universal Music Group (AS:UMG), where shares have breakdanced 27% lower after the record label colossus reported slower growth than expected in subscriptions as streaming revenues were hit by the TikTok standoff between January and May.

The Amsterdam-based group, which represents acts including Taylor Swift, Adele and warring rappers Drake and Kendrick Lamar, reported revenues up 8.7% to €2.9 billion, though recorded music subscription revenue of 6.5% was lower than analysts had forecast, as streaming revenue fell 4.2%.

In the car industry, profits at giant manufacturers Stellantis NV (LON:0QXR) and Nissan both plummeted, coming two days after the disappointing Tesla results.

Shares Nissan fell 7% in Tokyo and Stellantis 9% on the Euronext.

Stellantis, maker of Peugeot, Fiat and Jeep vehicles, reported a 48% fall in profit, which was much worse than expected.

In the car industry, profits at giant manufacturers Stellantis and Nissan both plummeted, coming days after the disappointing Tesla results.

Shares Nissan fell 7% in Tokyo and Stellantis 9% on the Euronext.

Stellantis, maker of Peugeot, Fiat and Jeep vehicles, reported a 48% fall in profit, which was much worse than expected.

At Nissan, operating profits crashed from Yen 128.6 billion to just Yen 1.0 billion in its fiscal first quarter, leading the Japanese giant to cut its full-year outlook, even though it expects an improvement in the second half from launches of new models.

Stellantis’s finance chief Natalie Knight said: “What has been happening on the industry side and competitiveness has been faster and more difficult than we expected this year, and the transition has been bumpier."

UK car production drops

UK car sales were out earlier but got missed amid the deluge of company results.

Production of new petrol, diesel and electric cars all fell in the first half of the year, with total UK car production down 7.6%, according to the Society of Motor Manufacturers and Traders (SMMT).

Just over 416,000 vehicles rolled out of factories in the six months to the end of June, down 34,094 on the same period in 2023.

June saw a 26.6% decline due to various model changes as carmakers bring out more electric vehicles, as reflected in the reports from car companies this week.

"The UK auto industry is moving at pace to build the next generation of electric vehicles – a transition that can be a growth engine for the entire British economy," says Mike Hawes, SMMT chief executive.

But the SMMT called on the government to halve VAT on new battery electric cars for three years, estimating it will increase sales by 250,000 units, to exempt EVs from the 'expensive vehicle' supplement excise duty that applies to cars costing more than £40,000.

It also wants to equalise VAT on vehicle charging, with a 5% paid by consumers at home versus the 20% levied at on-street charging points.

China rate cut fails to move needle

Earlier, China's central bank surprised markets for a second time this week with another monetary stimulus for its struggling economy, while Beijing administrators also announced new subsidies for trading in vehicles, with larger payments for EVs.

Another interest rate cut was made by the People’s Bank of China, though it does not seem to be helping market sentiment.

The one-year loan rate was cut by 20 basis points after the PBOC cut the short-term rate earlier this week.

Julian Evans-Pritchard at Capital Economics says the PBOC’s decision to cut interest rates is "unusual for two reasons": being double the size of its usual adjustments and that normally adjustments to rates are done on the 15 of each month.

"So the PBOC made a conscious decision not to wait until the middle of August to carry out the latest cut," he says, suggesting "something looks to have changed" in policymakers' thinking since Monday.

"Our best guess is that they had intended to wait and do a 10bp cut next month but that the underwhelming market response to the Third Plenum and Monday’s rate cuts pushed them to act with greater urgency."