In the ever-volatile world of tech stocks, NVIDIA Corporation (NASDAQ:NVDA) has been a standout performer.

As we navigate through September 2024, a month historically known for market turbulence, NVIDIA's stock is experiencing a notable correction.

For savvy investors, this pullback might just be the opportunity they've been waiting for. This piece is not really intended for traders, but more for investors. The goal is to own a share of a succesful company at a good price, right? I cover strategy below.

The AI Boom and NVIDIA's Meteoric Rise

NVIDIA's stock chart tells a compelling story. From early 2023 to mid-2024, the company's share price more than doubled, riding the wave of artificial intelligence enthusiasm. As the go-to provider of GPUs crucial for AI development and implementation, NVIDIA found itself at the epicenter of a tech revolution.

However, as September 2024 unfolds, we're witnessing a correction in NVIDIA's stock price. While some investors might view this with alarm, it's important to remember the words of Warren Buffett: "The stock market is a device for transferring money from the impatient to the patient."

A Healthy Correction?

This pullback could be seen as a healthy market behavior, possibly even overdue.

Stocks, even those of excellent companies, can become disconnected from their intrinsic value due to market sentiment and investor psychology.

As one astute market observer noted (me, myself), "There are two things that determine a stock's price; one is the underlying profits or value the company is producing, and the other is the perceived value by the public, which can under-appreciate or over-appreciate a stock's value. This creates imbalances which good investors can take advantage of."

In NVIDIA's case, the AI hype may have pushed valuations to unsustainable levels in the short term. This correction provides an opportunity for the stock price to realign with fundamental values.

Key Levels to Watch

For investors looking to "buy the dip," here are key price levels to monitor:

1. $90.75 - This level previously acted as resistance before becoming support, indicating a significant psychological and technical price point.

2. $78.30 - A key support level from early 2023, which could provide strong buying interest if reached.

3. $49.83 - The major breakout point from late 2022, representing a critical long-term support level.

These levels could provide attractive entry points for long-term investors who believe in NVIDIA's future prospects.

Interpreting the chart correctly

First of all, this is a MONTHLY chart, so it means that it's going to take a while to unfold. That's a good thing. It's not time-sensitive, meaning investors have several weeks or more to consider their plans.

The 3 levels highlighted are the 3 most-likely locations where price will turn around, if this stock (in the future) is going to recover or rebound.

How different investors might re-enter

Which of the 3 levels ultimately turn out to be the next base, is really up to the gods. This can be dissatisfactory for someone itching to get in.

So, there are 2 different ways to think about an entry strategy:

Investor 1: Allocates a percentage 'budget' to accumulating shares, and buys some at each level. Savvy?

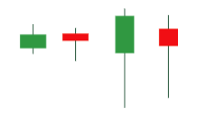

Investor 2: Waits for a small indecision candle on the MONTHLY timeframe, or a small bullish candle- they look like this, and might only show up at the end of October or December. Fyi, yes, I will write a fresh article at that time. (Because I'll be adding to my portfolio)

Here's an example from a real investment setup:

FACT: no stock's price ever goes up without an eventual correction. We must anticipate this!

NVIDIA's Fundamental Strength

Despite the current pullback, NVIDIA's fundamental story remains compelling:

1. Market Leadership: NVIDIA continues to dominate the GPU market, especially in high-performance computing and AI applications.

2. Financial Performance: The company has consistently delivered strong financial results, with robust revenue growth and profitability.

3. Future Prospects: As AI adoption accelerates across industries, NVIDIA is well-positioned to benefit from increased demand for its products.

Risks to Consider

However, potential investors should also be aware of risks:

1. Increased Competition: Other tech giants are investing heavily in AI chip development.

2. Market Saturation: The high-end GPU market could face saturation as the initial AI infrastructure buildout slows.

3. Regulatory Challenges: Particularly in key markets like China, regulatory issues could impact NVIDIA's growth.

The Value of Patience

As we consider NVIDIA's current situation, it's worth remembering Benjamin Graham's wisdom: "Successful investing is about managing risk, not avoiding it."

This correction in NVIDIA's stock price doesn't eliminate risk, but it may provide a more favorable risk-reward balance for those who have been waiting for a better entry point.

Timing expectations

This is a potential opportunity that could take several months to unfold. Let me repeat that- several months to unfold. This means that I would expect to know the buyers have returned by late October through to December.

NVIDIA's recent price correction, while potentially unsettling for some, could be viewed as a second chance for investors who missed the initial rally. However, it's crucial to approach any investment decision with thorough research and careful consideration of your financial goals and risk tolerance.

NVIDIA's long-term prospects appear strong, individual investors should carefully evaluate their own financial situations and consult with financial advisors before making investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investing in stocks carries risk, and past performance does not guarantee future results.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NVIDIA's Price Correction: A Second Chance for Investors? (what to look for)

Published 05/09/2024, 10:01

Updated 08/05/2024, 09:06

NVIDIA's Price Correction: A Second Chance for Investors? (what to look for)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.