Proactive Investors -

- FTSE 100 makes strong start, up 34 points

- BP (LON:BP) posts record profits, new buy-back

- House prices stabilse in January - Halifax

11.10am: HSBC (LON:HSBA) cuts mortgage rates below 4%

HSBC has made its “most significant” set of rate cuts this year, with reductions “across almost every fixed rate mortgage” for new and existing residential borrowers by up to 45 basis points.

The high street bank added that this includes reducing its five-year 60% loan-to-value offer, with a £999 fee, to under 4.00% for the first time since September.

The lender is also offering more cashback options and has lowered rates on buy-to-let loans as well.

HSBC is now offering a 3.99% deal on a five year mortgage - rates are coming down! https://t.co/sYsFquZ6ux— Grace Gausden (@gracegausden93) February 7, 2023

HSBC said this is the “third and most significant set of reductions” it has made across its home loans this year and comes as the bank recently lifted interest rates on savings accounts for the seventh time in a year.

Rates spiralled after the infamous mini-budget in September but have been falling steadily since as financial markets cut their forecasts for how high UK interest rates will peak.

10.38am: Ferrexpo (LON:FXPO) falls on Ukranian probe

Shares in Ukraine-focused miner Ferrexpo PLC fell 2.9% on Tuesday after it was told by a court to freeze the bank accounts of its largest Ukraine subsidiary, as part of a probe relating to the potential underpayment of iron ore royalty from 2018 to 2021.

Ferrexpo denied all accusations made as part of the ongoing investigation and added it would appeal the decision.

“The group has consistently followed the established legal due process for such disputes, and the Group has fully cooperated with local authorities throughout this process to date” it said in a statement.

“Furthermore, the group notes that the nature of the Investigation is similar to two separate investigations previously faced by other major international metals and mining companies operating within Ukraine” it added.

Shares were 2.9% lower in London on Tuesday at 148.10p.

10.00am: Industrial production slumps in Germany

Not good news from Germany where industrial production dropped by 3.1% in December, according to new figures from the Federal Statistical Office (Destatis)., and was 3.9% lower than a year ago.

Production at energy-intensive industries fell by 6.1% during December, month-on-month, as soaring gas and electricity prices continued to hit manufacturers.

This “terrible industrial production report” confirmed that Germany’s economy’s came to a “sudden and hard halt in December,” said Carsten Brzeski, economist at ING.

He warned: “The former growth engine of the German economy is stuttering and no improvement is in sight.”

“Despite the recent return of optimism as illustrated by improving sentiment indicators, the sharp drop in new orders, the inventory build-up in recent months and the lagged impact of high energy prices all still bode ill for the short-term outlook.”

“Today’s industrial production was the last hard data for the month of December. It is a month to forget.”

“Retail sales, exports and imports all fell sharply. Either this data will be strongly revised upwards in the coming months or the German economy entered hibernation in December.”

9.28am: UK retail sales slip in January

UK retail sales took a dip in the first four weeks of January, according to the BRC-KPMG Retail Sales Monitor.

Total retail sales increased by 4.2% in January, compared with 11.9% in January 2022.

This is below the three-month average growth of 5.2% and above the 12-month average growth of 2.5%, according to the data covering January 1 to 28, 2023.

"With inflation running at around 10%, sales growth for January nearly halved in comparison to December to just over 4% - sending a clear signal that consumers have started the year with a tight rein on spending as they face another period of rising costs," KPMG analyst Paul Martin commented.

Sales of clothing remained strong, with men’s clothes and shoes the strongest category in January, whilst purchases of energy efficient appliances remained a top purchase for consumers.

Helen Dickinson OBE, chief executive, BRC said: “As Christmas cheer subsided, retailers felt the January blues as sales growth slowed.”

“Many retailers discounted heavily to entice consumer spend, and while there were bargains to be had in the January sales, retailers continue to be hit by lower margins and falling volumes.”

“Own brand ranges remain popular across food and non-food products, and big ticket items are seeing customers trade down.”

“The coming months will continue to be challenging for retailers and their customers.“

9.00am: Footsie extends gains

The Footsie has made strong progress, extending its gains, now up 46 points at 7,883.

BP PLC is top of the risers, up 4.1%, after its results and strategic update.

Neil Wilson, chief market analyst at markets.com, said they were “truly great results and the strategy update displays a confidence with more investment in short cycle oil and gas projects to deliver what we need now, and more investment in transition growth and green stuff to deliver what we will need in the future.”

“Scaling back plans to reduce oil and gas production signals that for all the chatter, energy security right now is all about fossil fuels. Until you have the green bridge you have to keep pulling it out the ground” he stated.

But Morgan Morgan Advanced Materials plc remained lower, down 4.7%.

Steve Clayton, fund manager at HL Select pointed out: “We are seeing more and more companies reporting cyber breaches. Vesuvius Plc (LSE:LON:VSVS) has also reported an attack on their data networks, the impact of which is not yet fully known.”

“What we are learning is that recovering from attacks can be complex. Modern manufacturing methods can require hugely co-ordinated operations to be efficient.”

“Restarting these plants is not just a flick of a switch and the costs of restoring optimal production patterns can be significant.”

“Some of Morgan’s IT system has proven to be irrecoverable and new software solutions are being accelerated into place” he added.

Elsewhere, and AstraZeneca PLC (NASDAQ:AZN) edged higher after it announced that the EU has approved its drug Forxiga for the treatment of symptomatic chronic heart failure.

The approval comes after the European Medicines Agency's Committee for Medicinal Products for Human Use recommended approval in December.

Lloyds Banking Group PLC (LON:LLOY) also firmed as Citi ranked it top in its UK bank sector picks.

On the sector Citi said: “We expect 2023 outlook commentary to be upbeat on net interest margins and cost of risk.”

The broker said its order of preference in the sector was Lloyds (Buy), Natwest (LON:NWG) (Buy), Barclays (LON:BARC) (Buy), Virgin Money (LON:VMUK) UK (Buy), HSBC (Buy) and Standard Chartered (LON:STAN) (Neutral).

8.16am: Bright start by blue-chips

FTSE 100 pushed higher in early exchanges boosted by record profits and plans for a further hefty share buy-back from oil major, BP PLC (LSE:BP.).

At 8.15am London’s blue chip index was up 29 points although the FTSE 250 dipped 50 points to 20,360.

BP took centre stage with shares up 3.7% after it reported record annual profits, raised its fourth quarter dividend by 10%, launched a US$2.75bn share buy-back and raised earnings targets out to 2030.

“Performing while transforming” said CEO, Bernard Looney.

Joshua Warner, market analyst at City Index said: “Shareholders will welcome the US$2.75bn share buyback considering this was significantly larger than expected, as well as the 10% dividend increase.”

“Those increased returns came after BP generated significantly more cash than anticipated, allowing it to spray investors with cash and reduce its net debt for an eleventh consecutive quarter.”

But Morgan Advanced Materials plc (LSE:MGAM) slumped 7.3% as it warned it expects around £8mln to £12mln in exceptional costs from the cyber attack it suffered last month.

As a result of the disruption, Morgan said it expects adjusted operating profit for 2023 to be around 10% to 15% below previous expectations.

On the upside, Morgan said it expects its 2022 annual trading performance to be slightly ahead of market expectations.

Peel Hunt has cut its 2023 EBITDA forecast by 15% to £143mln.

“The frustration for the company is that it is operating at pretty much full capacity and cannot make this up in the balance of the year - highly engineered products cannot be outsourced” it noted.

Housebuilders were a weak feature despite the latest figures from the Halifax showing house prices stabilised in January with Barratt Developments (LON:BDEV) P L C, Persimmon PLC (LON:PSN), Redrow PLC (LON:RDW) and Bellway PLC (LON:BWY) all just the wrong side of the line.

Comments by Bank of England policymaker Catherine Mann yesterday that interest rates are likely to be increased further continue to weigh.

Martin Beck, chief economic advisor to the EY ITEM Club suggested that, “January’s flatlining in values may prove only a temporary interruption to a trend of falling prices. Although mortgage rates have dipped from post-mini-Budget peaks, they’re still at their highest in a decade.”

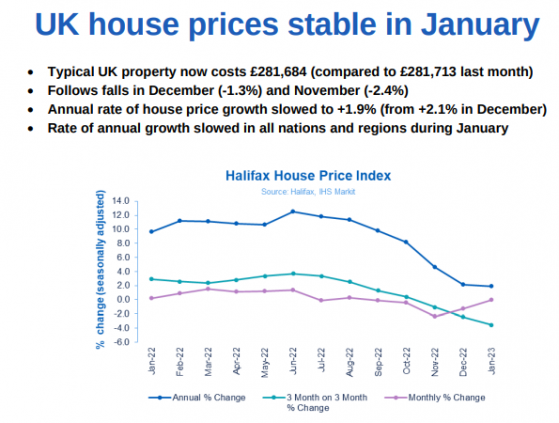

7.53am: House prices stabilise in January

House prices stabilised in January with the average house price remaining broadly unchanged, according to the Halifax House Price Index.

The latest figures from the lender showed that the typical UK property cost £281,684 in January, little changed on December’s £281,713.

Kim Kinnaird, Director, Halifax Mortgages, noted: “This followed a series of significant monthly falls at the end of last year (-1.3% in December and -2.4% in November).”

“The pace of annual growth has continued to slow, to +1.9% (from +2.1% in December), which is the lowest level recorded over the last three years” he noted with the average house price is now around 4.2% below its peak in August last year.

7.41am: Profits flow at BP despite dip in quarter four

BP PLC has given investors plenty of ood for thought today with results and a strategic update to plough through.

The oil giant delivered record annual profits, an increased dividend, a further hefty share buy-back and raised earnings targets out to 2030.

“Performing while transforming” was how chief executive, Bernard Looney described it all.

But it wasn’t all good news with fourth quarter underlying replacement cost profits of US$4.8bn, below City expectations of US$5bn, and down from US$8.2bn in the third quarter.

Nevertheless, annual profits reached US$27.6bn in 2022, more than double 2021’s US$12.8bn, lifted by a surge in energy prices which followed Russia's invasion of Ukraine.

The fourth quarter dividend was up 10% at 6.6c when compared to last year and the oil giant launched a further US$2.75bn buy-back.

Compared to the third quarter, the result was impacted by a below average gas marketing and trading result after the exceptional result in the third quarter, lower oil and gas realizations, a higher level of refinery turnaround and maintenance activity, and lower marketing margins and seasonally lower volumes, BP said.

The FTSE 100 listed oil giant set new targets for EBITDA of US$46bn to US$49bn in 2025 and is aiming for US$51bn to US$56bn in 2030 (assuming a US$70/barrel oil price environment), up from previous forecasts of around US$38bn in 2025 and US$39-US46bn in 2030 at $60/barrel. The FTSE 100 listed company also pledged up to US$8bn in green energy projects and the same amount into its oil and gas business.

7.00am: FTSE expected to nudge higher

FTSE 100 is expected to edge higher at the open with results from oil major BP PLC (LSE:BP.) the early focus in London.

Spread betting companies are calling the lead index up by around 8 points.

In the US, the Dow closed Monday down 36 points, 0.1%, at 33,890, the Nasdaq Composite dropped 120 points, 1%, to 11,887 and the S&P 500 shed 26 points, 0.6%, to 4,111.

In Asia, the Reserve Bank of Australia raised its benchmark interest rate by another 25bps.

As Michael Hewson at CMC Markets said it is “perhaps hoping that the December surge in headline CPI from 7.3% to 8.4% was a one-off that is likely to be reversed quite quickly.”

“With its headline rate now at 3.35% it remains quite a bit below its peers which means the central bank may well have to keep hiking a lot more in the months ahead.”

Other Asian markets were mixed. The Nikkei 225 index closed marginally lower in Tokyo while in China, the Shanghai Composite was up 0.3% and the Hang Seng index in Hong Kong was up 0.5%.

Otherwise the focus will be on a speech from Federal Reserve chair, Jerome Powell, US President Joe Biden’s State of the Union address and the latest Halifax house price index.