Proactive Investors -

- FTSE 100 posts modest gains, up 4 points

- Mark Carney says higher rates are here to stay

- ECB set to raise interest rates, Wall Street seen lower

Weaker start expected on Wall Street

US stocks are expected to open lower on Thursday after the Federal Reserve hit pause on interest rate hikes but indicated there may be up to two more increases in lending rates this year as it battles to get inflation back into its target range.

Futures for the Dow Jones Industrial Average (DJIA) fell 0.2% in pre-market trading, while those for the broader S&P 500 index declined 0.4% and contracts for the Nasdaq-100 were 0.8% lower.

The main US indexes initially tumbled on Wednesday when the Fed made its rates announcement but comments from Chair Jerome Powell helped stem the selloff when he told a post-meeting news conference “the conditions that we need to see in place to get inflation down are coming into place.”

The Dow retraced some of its losses to close 0.7% down at 33,979, the S&P 500 added 0.1% to 4,373 and the Nasdaq Composite rose 0.4% to 13,626. The small-cap Russell 2000 index slid 1.3% to 1,871.

“Mixed messages from the Federal Reserve provoked a mixed market reaction, while any thoughts of rate cuts this year finally evaporated,” commented Richard Hunter, head of markets at interactive investor.

“Although rates were unchanged for the first time in many months, the Fed surprised investors with a suggestion that two further rises could be in the pipeline this year, depending on ongoing economic data. The accompanying comments led investors to dub the decision as a 'hawkish hold' as Chair Powell gave an overview of the latest thinking.”

Today, market participants will keep an eye on further US data for indications of the duration of the Fed's current “pause,” said TickMill Group’s Patrick Munnelly.

“May's retail sales figures will be of particular interest, as April's numbers surprised on the upside, suggesting that consumer activity remains relatively strong,” he added.

“Although May is expected to show some weakness, core sales are anticipated to remain solid. Jobless claims will also be monitored, as they provide insights into employment market conditions and any potential easing of pressures in that area.”

Consumers paying down debt ahead of rate rise says NatWest boss

NatWest Group PLC (LON:NWG) chief executive Dame Alison Rose said UK households and businesses are over-paying mortgages and paying down debt as rates jump.

But speaking at the Goldman Sachs (NYSE:GS) European financials conference in Paris, Dame Alison said she was seeing resilience among the bank's customers and "very rational behaviour" from borrowers, despite nerves about the economy.

She said customers are becoming more confident despite the ongoing cost of living crisis and worries over rising interest rates.

She pointed out borrowers were over-paying on their mortgages and paying down more expensive debts as rates jump, with no signs yet of customers across the board struggling with repayments.

But she thinks the recent jump in mortgage rates will have some impact on margins and customer behaviour.

She said NatWest's "all-weather balance sheet" will help the group withstand any impact, as will the "still underlying, resilient performance from our customers"

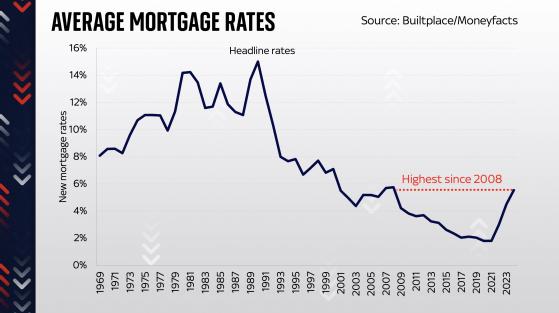

Her comments come amid turmoil in the mortgage market as lenders pull and re-price deals due to market forecasts for rates to keep rising.

Dame Alison said: "We're not seeing any material signs of distress."

But she said lower income households are "really struggling with high inflation and high interest rates". "Typically these are not significant borrowers with us," she said.