Proactive Investors -

- FTSE 100 higher, up 23 points

- UK Q3 GDP revised downwards to fall of 0.3%

- Brexit not delivering for UK business - BCC

11.30am: City pubs empty as strikes keep drinkers away

There be some festive cheer in the markets but traders haven’t been emptying their pockets in the bars and restaurants in the square mile.

According to Bloomberg pubs and restaurants in the City have reported that sales were cut to almost half pre-pandemic levels during last week’s rail strikes.

The report quoted Kate Nicholls, chief executive officer of trade group UKHospitality, whi said takings were 46% lower in real terms than during the same week in 2019 as four days of strikes caused chaos on train services and convinced many people to work from home.

Across London as a whole, revenue was down 37% last week compared with 2019 and adjusting for inflation, Nicholls said.

Hospitality businesses across the UK reported a 30% cancellation rate on bookings, as Christmas parties were called off.

10.50am: Oil price advances

FTSE 100 has held its gains and oil stocks are providing support following further gains in the oil price.

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown (LON:HRGV) said: "The hoped-for Santa rally is running merrily through markets, but it may end up being a short-lived ride given the cost-of-living winds swirling, the confirmation that the UK is rolling into recession and worries about global economic growth.”

“The optimism shooting through markets has been prompted by stronger consumer confidence in the US and sturdier than expected corporate earnings.”

“Energy stocks again have a spring in their step, thanks to a rise in crude prices for the fourth straight session amid expectations of higher demand over the holiday period.”

Indeed, Brent crude was up 1.72% at US$83.62/barrel while the WTI price was 1.47% higher at US$79.44/barrel.

This helped push BP PLC (LON:BP) 0.9% higher while Shell (LON:RDSa) advanced 1.3%.

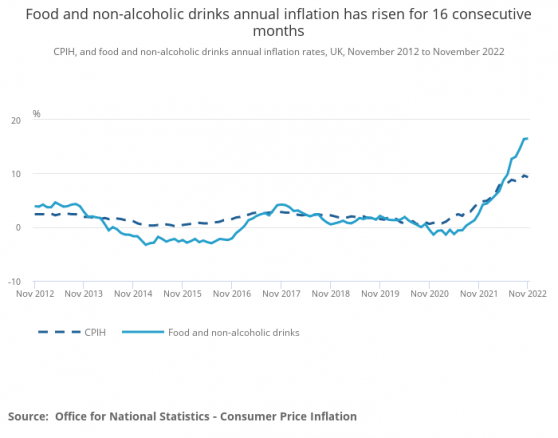

10.15am: Food and drink inflation the highest since 1977 - ONS

Overall inflation including housing costs fell from October to November 2022, but the cost of food and non-alcoholic drinks has continued to rise according to data from the Office for National Statistics (ONS).

The headline figure fell to 9.3% in November from 9.6% in October but food and non-alcoholic drink inflation rose by 16.5% in the 12 months to November 2022, the highest increase since September 1977 (17.6%).

Staple foods, such as breads and cereals, have seen the largest price increases in the last month, increasing by 1.9%, with the most vulnerable appearing to be the hardest hit, with 61% of those in the most deprived areas buying less food compared with last year, as opposed to 44% in the least deprived areas.

The inflation gap between low-income and high-income households is the largest it has been since March 2009 with annual inflation for low-income households 10.5% in the year to October 2022, while the figure for high-income households was 9.1%.

9.45am: Brexit not helping British business - BCC

More than three quarters (77%) of firms, for which the Brexit deal is applicable, say it is not helping them increase sales or grow their business according to a survey from the British Chambers of Commerce (BCC).

As a result “businesses feel they are banging their heads against a brick wall as nothing has been done to help them” according to Shevaun Haviland, director general of the BCC.

????️@BCCShevaun: "Businesses want political leaders on both sides to move on from the debates of the past and find ways to trade more freely. Otherwise the long-term competitiveness of the UK will be seriously damaged."Read our analysis on Brexit trade ????https://t.co/GZwHYMxp8L

— BCC (@britishchambers) December 22, 2022

More than half (56%) of firms face difficulties adapting to the new rules for trading goods, the survey found while almost half (45%) face difficulties adapting to the new rules for trading services, and a similar number (44%) report difficulties obtaining visas for staff.

The report followed a survey of UK forms which showed they faced significant challenges trying to use the Trade and Co-operation Agreement (TCA) which was agreed on Christmas Eve in 2020 to allow tariff-free trade with the EU once Brexit took effect.

But a high proportion of businesses say they are still having major problems trying to use the deal to trade with Europe.

The BCC has sent the government a report setting out the main issues the TCA is causing with solutions to many of the problems.

Haviland said: “Businesses want political leaders on both sides to move on from the debates of the past and find ways to trade more freely.”

“This means an honest dialogue about how we can improve our trading relationship with the EU.”

“With a recession looming we must remove the shackles holding back our exporters so they can play their part in the UK’s economic recovery.”

“If we don’t do this now then the long-term competitiveness of the UK could be seriously damaged.”

9.09am: Festive cheer in London

The FTSE 100 is in festive mood, extending its gains, now up 37 points, shrugging aside the downward revision to quarter three GDP numbers.

Victoria Scholar, head of investment, interactive investor said: “Markets are attempting a last-ditch effort to achieve a Santa rally with Wall Street closing significantly higher last night.”

“Better-than-expected US corporate earnings helped to spur a pick-up in risk appetite which when combined with lighter-than-normal volumes around the holidays resulted in US averages posting their best session since November and the Hang Seng jumping over 2.5%.”

The gains in Hong Kong helped propel Prudential PLC (LON:PRU) 1.3% higher while the results from Nike (NYSE:NKE) on Tuesday continued to support JD Sports Fashion PLC which rose a further 1.4%.

Ocado Group PLC (LON:OCDO) advanced 1% reflecting gains in Asia by online shopping and food delivery platform Meituan which surged 5.7% while further increases in the oil price supported oil majors and index heavyweights, Shell PLC and BP PLC (LON:BP).

But the end is nigh for made.com which has proposed that it enters into a members voluntary liquidation which will allow the company to wind up its operations with any residual value to be distributed to shareholders.

On November 9th, the company announced its intentions to appoint the administrators while agreeing to sell its brand, domain names and intellectual property to Next along with the suspension of shares from trading on the LSE.

8.15am: Upbeat start in London despite GDP numbers

FTSE 100 has opened higher, building on yesterday’s gains, and despite a downward revision to third quarter GDP figures.

A strong rally in the US has helped and at 8.15am London’s blue-chip index was up 25 points at 7,522 while the FTSE 250 was up 40 points at 18,903.

The latest figures from the Office for National Statistics showed the UK economy shrank by 0.3% between July and September, a downward revision from the previous estimate of a 0.2% decline.

Gabriella Dickens, senior economist at Pantheon Macroeconomics pointed out the figures confirmed “that the UK was the only G7 economy in which quarter three GDP still was below its pre-Covid level.”

“Indeed, GDP in the UK was 0.8% below its quarter four 2019 level, whereas it was 4.3% above in the U.S., 2.7% above in Canada, 1.8% in Italy, 1.1% in France, 0.9% in Japan and 0.3% in Germany” she noted.

“Looking ahead, the UK likely will continue to underperform; we expect Britain to suffer the deepest recession among major advanced economies in 2023, due to the severity of the headwinds from both monetary and fiscal policy” Dickens forecast.

“We expect a 2% peak-to-trough fall in GDP, leading a year-over-year decline of 1.5% in 2023.”

On a quiet day for corporate news as the markets wind down ahead of the holiday period, NWF Group PLC rose 3.2% after it said trading in the first half has been strong with all three divisions trading ahead of the board's expectations.

The update came together with the £10mln acquisition of Sweetfuels Limited.

Discoverie Group PLC rose 2.2% after its US deal which is expected to be earnings accretive on completion.

Peel Hunt said “This is another attractive little deal from discoverIE and we see it as reassuring that M&A activity levels remain high, plus it is good to see further expansion of the footprint in the US.”

The broker has raised its fiscal year 2024 and 2025 EPS estimates by c.2%, to 34p and 35.3p, respectively.

7.51am: GBP leading on USD, though rough GDP figures could hit Cable sentiment

Sterling appears to be in the driver's seat this morning after seeing nearly one percent of losses in the GBP/USD pair come Wednesday’s session close.

Having opened at 1.207, GBP/USD added 30 pips to 1.210 in the opening Asia trading hours.

However, with gross domestic product (GBP) growth in the UK coming in considerably weaker than expected in this morning’s reading, we could expect to see a Cable contraction as investors capitulate on recession worries.

With the FTSE 100 expected to make further gains throughout the day, a Cable bet could be even riskier.

Yearly GDP growth in the year’s final read was 1.9% compared to the 2.4% forecast, while quarter-on-quarter GDP growth of -0.3% beat out expectations of -0.2%.

Will investors capitulate on the pound? – Source: capital.com

The US has its own GDP reading due later this afternoon, with QoQ growth of 2.9% forecast.

EUR/GBP was sitting at a five-week high after gaining 0.8% yesterday to close at 87.83p. Despite inching back to 87.81p this morning. The euro still appears to have the upper hand.

The euro has already recouped the 17 pips it ceded to the dollar in Wednesday's session, with the EUR/USB pair rising 0.3% to 1.063 so far this morning.

The US Dollar Index (DXY) currently sitting 0.3% lower at 103.57.

7.47am: discoverIE expands US operations

discoverIE Group PLC has bought Magnasphere, a US-based designer and manufacturer of magnetic sensors and switches for industrial electronic applications for £19.1mln.

The cash deal is on a debt free basis and will be funded from existing debt facilities.

The acquisition is expected to be completed by the end of the financial year and is forecast to be immediately accretive to underlying earnings and operating margins.

Nick Jefferies, group chief executive said: “The transaction brings another high quality business into discoverIE, which is accretive to both underlying earnings and margins, and strengthens our US footprint.”

7.15am UK GDP revised downwards in quarter three

UK gross domestic product (GDP) is estimated to have fallen by 0.3% between July to September, downwardly revised from a first estimate fall of 0.2%, according to figures from the Office for National Statistics.

GDP fell 0.3% in Quarter 3 (July to Sept 2022), revised down from a 0.2% fall, with:▪️ services at 0.1% (revised up from 0.0%)

▪️ manufacturing at -2.8% (revised down from -2.3%)

▪️ construction at -0.2% (revised down from 0.6%)

➡️ https://t.co/ALn0Sl72UV

— Office for National Statistics (ONS) (@ONS) December 22, 2022

In output terms, the services sector grew by 0.1% while the production sector fell by 2.5% in the quarter (including falls in all 13 manufacturing sub-sectors) as well as a fall in the construction sector of 0.2%.

The level of real GDP in quarter three 2022 is now estimated to be 0.8% below where it was pre-coronavirus at quarter four (October to December) 2019, downwardly revised from the previous estimate of 0.4%.

The implied GDP deflator rose by an upwardly revised 6.4% in the year to quarter three 2022, primarily driven by an 9.2% increase in the implied price of household consumption.

The household saving ratio increased strongly to 9.0% in quarter three 2022, from 6.7% in the previous quarter.

But real households' disposable income fell by 0.5% this quarter; the fourth consecutive quarter of negative growth.

7.00am: Further gains expected in London

FTSE 100 is expected to open higher extending yesterday’s gains following a strong rally in the US and gains in Asia.

Spread betting companies are calling the lead index up by around 22 points.

In the US, the Dow was 1.6% higher at 33,376, while the Nasdaq and the S&P 500 both posted gains of 1.5% to close at 10,709 and 3,878 points respectively.

Positive earnings from Nike and FedEx (NYSE:FDX), coupled with strong US consumer confidence number for December, helped push yields slightly lower as the major indices all closed well in the green.

In Asia on Thursday, the Japanese Nikkei 225 index closed up 0.5%. In China, the Shanghai Composite was down 0.5%, while the Hang Seng index in Hong Kong was rallying strongly, up 2.3% in late trade. The S&P/ASX 200 in Sydney closed up 0.5%.

In the absence of any planned corporate updates the early focus in London will be on the final GDP figures for quarter three which should confirm the UK economy shrank between July to September.

The preliminary fall of 0.2% was slightly better than expected.

Read more on Proactive Investors UK