The UK service sector turned in another weak performance in September

The latest S&P Global purchasing managers index for the sector came in at 50 - the boundary between growth and contraction - but this was down from 50.9 in August.

Even though there was disappointing manufacturing data on Monday, the composite PMI which includes both services and manufacturing also beat forecasts at 49.1. Although this shows contraction, it was better than the 48.4 expected.

Meanwhile the FTSE 100 continues to fall, and is now down 88.87 or 1.25% at 6997.59

9.14am: Car registrations pick up in September from a year ago

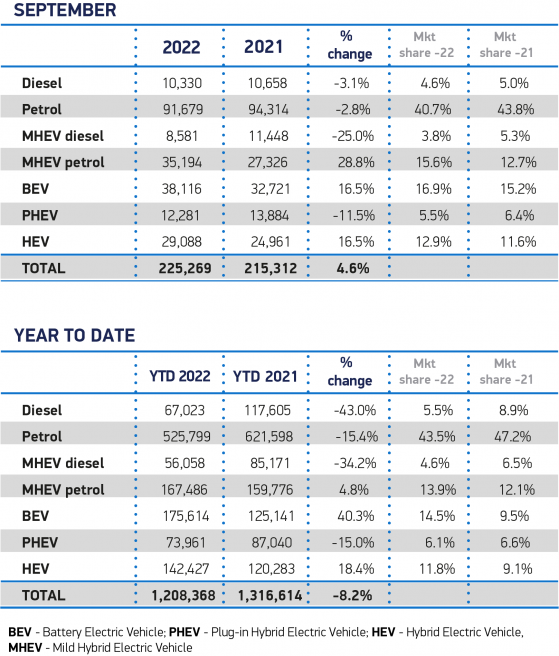

After a "torrid" first half of the year, the UK new car market recorded its second successive month of growth in September.

Registrations rose 4.6% compared to a year ago in what is typically the second biggest month of the year for the sector, according to the latest figures from the Society of Motor Manufacturers and Traders.

But they are still 34.4% down on pre-pandemic levels of 2019 as the industry continues to battle with supply constraints.

With electric vehicles accounting for more than one in five new cars joining UK roads in the month, UK drivers and fleets have now registered more than one million plug-in electric vehicles, a quarter of which in this year alone.

Despite the improvements, the industry is calling for action to shore up consumer confidence as market enters final quarter.

New car market up as plate change September marks one million EV milestonehttps://t.co/ANPcajU9UG pic.twitter.com/GX6x5qAetv— SMMT (@SMMT) October 5, 2022

Mike Hawes, SMMT Chief Executive, said: "September has seen Britain’s millionth electric car reach the road – an important milestone in the shift to zero emission mobility. Battery electric vehicles make up but a small fraction of cars on the road, so we need to ensure every lever is pulled to encourage motorists to make the shift if our green goals are to be met.

"The overall market remains weak, however, as supply chain issues continue to constrain model availability. Whilst the industry is working hard to address these issues, the long-term recovery of the market also depends on robust consumer confidence and economic stability."

8.47am: Markets await OPEC decision on output

Oil prices have eased ahead of the latest OPEC+ decision on production.

The 13 members of OPEC led by Saudi Arabia and 10 partners headed by Russia ( the + bit of the group name) will hold their first in-person meeting since March 2020 at the group's headquarters in Vienna.

Expectations are that the group could cut output by as much as 2mln barrels a day to help support the price. But after a surge yesterday, Brent crude is down 0.15% at US$91.66 a barrel while West Texas Intermediate, the US benchmark, is 0.17% lower at US$86.37 as investors await news.

Victoria Scholar, head of investment at interactive investor said: “OPEC+ is reportedly mulling an output cut that would amount to as much as 2 million barrels per day at its meeting today as the cartel looks to offset the recent oil market’s decline.

"On the one hand, the United States and other economies which have been fighting inflation and cost-of-living crises are desperate for oil prices to continue their recent declines, hoping the cartel at least sticks to its current output or possibly even pumps more. The United States in particular is keen that oil prices fall to more manageable levels ahead of the US mid-term elections. On the other hands, Saudi Arabia, Russia and other oil exporting countries are trying to steer oil prices in an upward direction to boost their crude revenues and economic growth.

"Oil prices are steady this morning after yesterday’s more than 3% surge as the market anticipates a possible further tightening in supply from OPEC+ today. Brent crude has been trading in a downward trendline since the peak at the start of June but has regained ground off the September low, now trading back above $90 a barrel.

"An increasingly pessimistic view of the outlook for global growth and expectations of a slowdown in China in particular have weighed on oil prices since the summer, prompting OPEC+ to mull a reduction in its supply to catalyse gains for oil once again.”

8.11am: Footsie pauses for breath

Leading shares have paused for breath after yesterday's gains, and despite a surge in US markets and a positive performance in Asia.

Ahead of the speech from prime minister Liz Truss at the Tory party conference and the latest UK service sector report, the FTSE 100 is down 43.47 points or 0.61% at 7042.99.

On Truss, Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown (LON:HRGV), said: "She is expected to brush away concerns about market volatility and double down on her promises that her policies will lead to growth.

"She’s facing an uphill struggle though to convince her colleagues that reductions in public spending, which will be necessary to fund tax cuts, won’t end up denting productivity over the longer term instead, especially if working families are made poorer."

Investors are also cautious about whether the US Federal Reserve may indeed ease off a little on its path of ever higher interest rates to curb inflation. Some recent data, including job openings yesterday, suggested to some analysts that the Fed might not need to be as hawkish as previously thought.

Streeter said: "Investors are clinging onto every shred of evidence which may point in this direction, such as US job vacancy stats which dropped sharply in September. But there is still every chance that the rays of light they are glimpsing will be eclipsed by a fresh determination by policymakers to stay the course on rate rises until inflation is brought down considerably further. Rather than a quick Fed pivot, it’s more likely to be a slow a gradual turn in policy, particularly if the US core inflation rate, remains stubbornly elevated around 6.3% at the temperature check next week."

Central banks are still generally in rate rise mode, with New Zealand lifting rates to a seven year high, up 50 basis points to 3.5%.

Tesco PLC (LON:TSCO) is up around 1% even though the supermarket group said profits were likely to be at the lower end of its expected range due to the cost of living crisis and rising costs.

It said: "Despite ongoing challenges in the market, we are able to maintain our profit guidance within our previous range, albeit towards the lower end.

"We therefore expect full year retail adjusted operating profit of between £2.4bn and £2.5bn. Significant uncertainties in the external environment still exist, most notably how consumer behaviour continues to evolve."

7.00am: FTSE 100 set to open lower

FTSE 100 set to make a weaker start on Wednesday, after strong gains yesterday, with UK Prime Minister Liz Truss set to deliver her keynote conference speech, and oil-producing nations meet to discuss their production strategy.

Spread betting companies are calling London’s blue-chip index down by around 23 points.

US markets enjoyed a second consecutive day of strong gains as weaker than expected US job postings gave investors hope that the Federal Reserve may take its foot of the accelerator with regard to the pace of future interest rate increases.

At the close the Dow Jones Industrial Average had stormed 825 points higher, or 2.8%, to 30,316, the S&P 500 had advanced 113 points, or 3.06%, to 3,791 and the Nasdaq Composite soared 361 points, or 3.34%, to 11,176.

In London, results from Tesco will lead the corporate news agenda.

Read more on Proactive Investors UK