- Small-cap stocks may benefit from the upcoming Fed rate cuts.

- They’ve underperformed large-caps but could rebound with rate reductions.

- Invest via individual stocks or ETFs like Vanguard’s S&P Small-Cap 600 for potential gains.

- Start beating the market now by following our best-in-breed selection of AI-picked stocks for less than $9 a month.

That's right, the time for small-cap stocks to shine may have finally arrived.

The catalyst is the U.S. Federal Reserve, which is set to begin its interest rate cut cycle later this week. These cuts could take place at each of the remaining meetings in 2024 and extend into early 2025.

This is undoubtedly positive news for small-cap stocks, which have been underperforming compared to large-cap stocks for some time, but the landscape is about to shift.

The reality is that small-cap stocks suffer more when interest rates rise and stay elevated. This is because they tend to carry higher levels of debt and rely heavily on bank financing. Additionally, their operations are often more domestically focused—particularly in the US—so when inflation is high and rates increase, the decline in consumer spending hits them harder.

As mentioned, small-cap stocks have lagged behind their larger counterparts for quite a while. Just compare the Russell 2000 index (representing small-cap stocks) with the S&P 500 index (large-cap stocks) over the past 10 years.

The difference in annualized returns is striking:

- Russell 2000: +8.91%.

- S&P 500: +15%.

How can you invest in small stocks to take advantage of this turnaround in the medium or long term?

Should You Invest in Small-Cap Stocks Via Individual Picks or ETFs?

If you're looking to capitalize on this trend, here are the two best options: you can either pick the top individual stocks or invest in an ETF that offers diversified exposure to the sector.

While choosing the former presents a higher risk-reward scenario, it can also deliver greater returns for those who successfully identify the top performers. However, this approach demands thorough research in what is known to be a challenging market segment.

That’s where ProPicks comes in as a game-changer. With a monthly-updated selection of AI-driven small- and mid-cap stocks, it helps you find the top performers for under $9 a month.

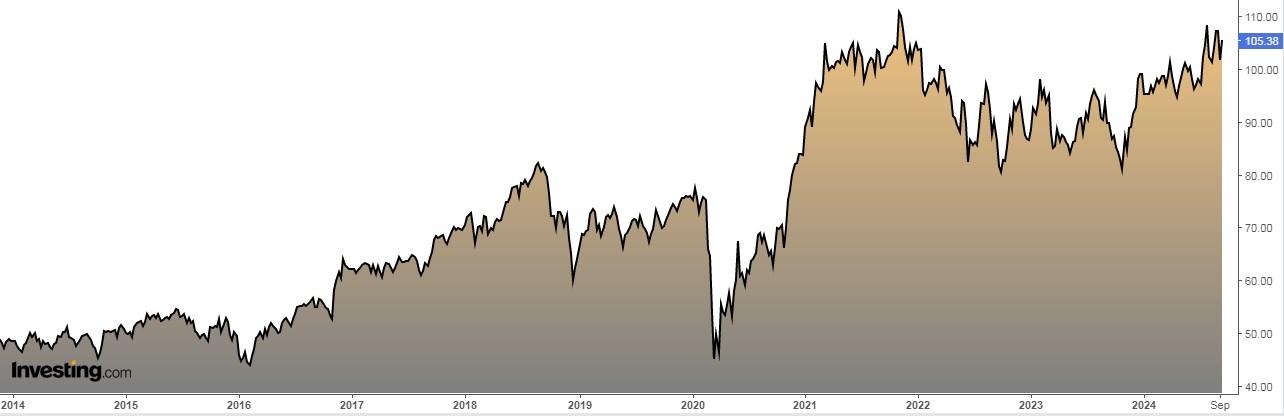

In our 10-year backtest, ProPicks outperformed the benchmark Mid-Cap 400 Index, delivering an impressive 17.5% annualized return. See the chart below:

Another way to take advantage of this trend is by investing in a sector-focused ETF.

One option worth considering is the Vanguard S&P Small-Cap 600 Index Fund ETF Shares (NYSE:VIOO), which manages $2.9 billion in assets.

This ETF offers exposure to all companies in the S&P SmallCap 600, with no single company representing more than 0.64% of the total assets.

It was created in September 2010 and its expense ratio is 0.1%. Currently, its main positions are:

- ATI (NYSE:ATI)

- Mueller Industries (NYSE:MLI)

- SPS Commerce (NASDAQ:SPSC)

- Fabrinet (NYSE:FN)

- The Ensign Group Inc (NASDAQ:ENSG)

- Meritage Homes (NYSE:MTH)

- Comerica (NYSE:CMA)

- Carpenter Technology (NYSE:CRS)

- Robert Half (NYSE:RHI)

Bottom Line

After several years of underperformance, small-cap stocks may be poised for a resurgence. However, this is a sector where the risk-return equation demands careful consideration.

To succeed in this space, you’ll need a strategic and focused investment approach. Simply diving in without a plan could expose you to unnecessary risks. By making informed decisions and managing your portfolio wisely, you can reduce your risk exposure while positioning yourself for stronger long-term gains.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.