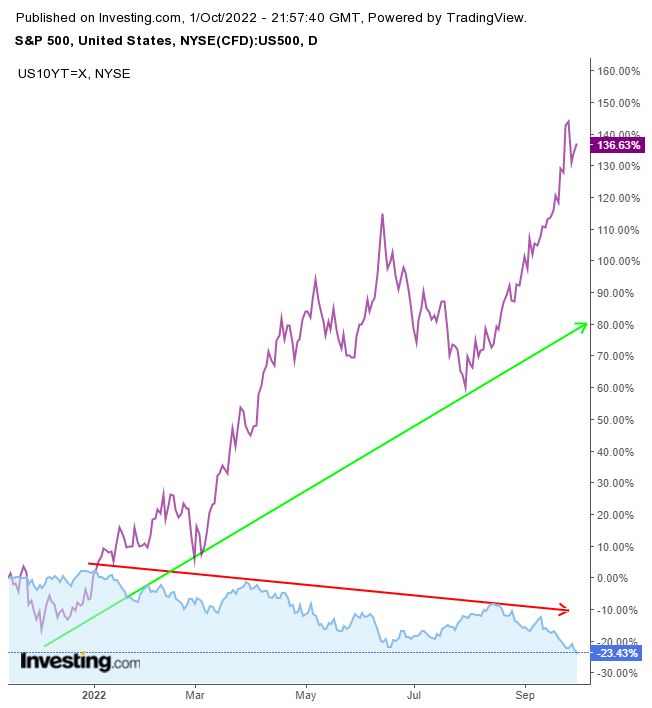

- Soaring yields demonstrate investors believe Mester's path to higher interest rates

- The three major averages extended downtrend

- Nonfarm Payrolls will create inflation expectations

- Increases poor countries' debt as they borrow in dollars.

- They are forced to raise their rates to defend their currency, slowing their economic growth.

- We are exporting America's inflation to other countries, as commodities are quoted in dollars.

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

This past January, I was still operating according to a near-zero interest rate environment, so I interpreted rising yields as positive for stocks. Yields rise when investors sell their bonds. In that environment, investors have sold to rotate into risk assets - increasing demand for equities.

However, I reversed that outlook by January 31st after the Fed turned hawkish on the 27th. When yields rise in an environment of rising rates, the correlation between yields and stocks shifts from positive to negative. Higher rates would "make stocks more expensive and means Treasuries provide a safer, more attractive investment avenue than equities for some investors."

Then on March 27 stocks roared back, paring a 15% drop to 5%, as the Fed gave investors confidence that the economy was strong enough to handle aggressive tightening and that the central bank would finally combat runaway inflation. However, I reiterated the risk of sharply rising yields and predicted that the three major averages would soon join the Russell 2000 in a bear market.

And September suffered the worst monthly rout since the nefarious Mar 2020 sell-off, where the world panicked in the face of a frightening global pandemic, and on the same theme - continuously increasing interest rates.

However, the S&P 500 capped its third quarter of losses in a row for the first time since 2009, after the notorious 2008 crash instigating the Great Recession. At the same time, US Treasuries registered the sharpest outflow in three months, pushing yields to the highest in a decade, with 10-year notes touching 4% on Wed.

10-year notes climbed nine weeks straight, their longest winning streak since Apr 1994, according to Refinitiv data. While last week's long upper shadow and the preceding week's resistance suggest a potential pullback in yields, the chart below shows a bottom, threatening another move higher in yields and rates. If that outlook follows through, I expect the same theme to keep pushing stocks lower: higher rates make stocks expensive, while higher yields provide an attractive, safe alternative.

On Friday, Fed Vice Chair Lael Brainard acknowledged her bank is concerned over emerging market vulnerabilities and increasing risk of instability for three reasons:

Bloomberg characterized Brainard's acknowledgment of the need to monitor the impact borrowing costs could have on global market stability as to have "assuaged concerns on Friday." I humbly disagree with this assessment. All four US indexes closed close to the session's bottom, as there were only sellers but no buyers at these prices. After easing within the hour of Brainard's speech, yields took off again, closing near session highs. In my estimation, Brainard's comments on the inadvisability of prematurely retreating from the fight against inflation left a stronger impression on investors. And the fact that even a centrist as Brainard is espousing continuing to raise rates is telling. On Thursday, hawkish Federal Reserve Bank of Cleveland President Loretta Mester expressed the same sentiment. Mester will speak again on Tue, 9:15 ET, and I expect volatility around her speech.

The next big tell regarding inflation will be Friday's Nonfarm Payrolls. Will America have created more jobs and kept raising wages? If so, it will lead to higher inflation as consumers keep driving up demand and prices. Economists expect another 250,000 jobs, with unemployment remaining at 3.7%, just above a five-decade low. While, if proven correct, it would be the smallest employment gain since the end of 2020, it would still be higher than the five-year average. Such sustained demand for labor keeps supporting wages, fighting against the Fed's path to lowering inflation via raising interest rates, forcing them to become even more aggressive.

Bulls were expecting that the recent rally would have bottomed the market. There is a "50% indicator" when a rally halves the bear market losses that are considered a perfect record for calling bull markets. However, I'm a simple analyst. I followed the trendlines, peaks, and troughs, which is why I stuck to my bearish claws. Now that the three primary US gauges made new lows, I reiterate my August S&P 500 prediction to 3,000. Since then, Morgan Stanley's chief US equity strategist, Mike Wilson, joined me in that assessment, saying the S&P 500 could fall to the low 3,000 range.

Robert Pavlik, Senior Portfolio Manager at Dakota Wealth in Fairfield, Connecticut, also joined my prediction, saying he is looking at a worst case of 3,000 for the S&P as a support level. However, I wouldn't be surprised if the S&P 500 Index and the other averages keep falling lower. While inflation is not controlled and the Fed does not stop raising rates, and yields do not ease, I foresee equities continuing to fall. An average bear market sell-off is 39% over 20 months, implying another 19% drop.

All four major US averages have been developing flags. The S&P 500 is the only one whose flag isn't up-sloping, which makes me less confident in its potency, even though Martin Pring writes in his Technical Analysis Explained that flags don't have to slope. The Russell 2000 is the only flag that did not yet complete. The S&P 500 Index is the only one that found support above its 200-week MA, while the others already fell below theirs as early as two weeks ago.

The S&P 500 Index's (flat) flag implies a drop to 3,443.36, based on the flag pole, and based on the preceding sell-off, that could even happen as quickly as in the next three days.

Disclosure: The author has no positions in any securities mentioned in this article.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »