-

Uber stock surged ahead of its impending earnings report, building on last year's impressive performance.

-

With earnings projections at $9.76 billion, a 5% QoQ increase, and $0.39 earnings per share, a 14.7% rise, Uber aims to recover from a previous revenue dip while sustaining a 30% gross margin.

-

ProTips analysis reveals Uber's potential profit growth of 132% this year, but challenges include high operational costs, intense market competition, and concerns about an economic downturn.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Amid the continued rally for US stocks, ride-hailing giant Uber (NYSE:UBER) has managed to sustain its upward momentum from 2023, hitting an all-time high and reaching the $70 mark ahead of tomorrow's pre-market earnings report.

Let's take a deep dive into the company's financials with our best-in-breed fundamental analysis tool, InvestingPro, to better understand what are the company's risks and advantages ahead of the report.

Subscribe now for less than $9 a month and up your stock game today!

*Readers of this article enjoy an extra 10% discount on the yearly and by-yearly plans with the coupon codes OAPRO1 (yearly) and OAPRO2 (by-yearly).

What to Expect

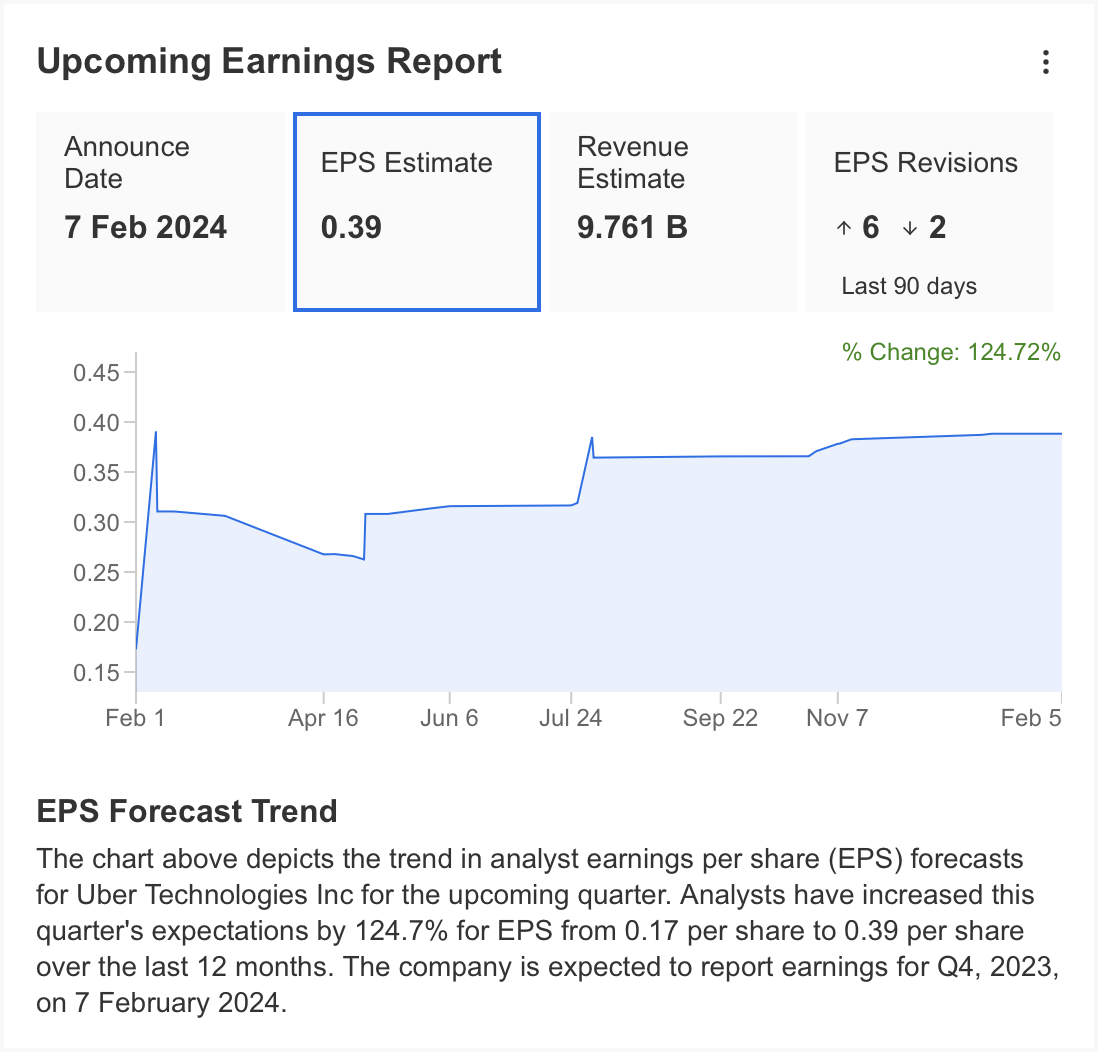

InvestingPro anticipates Uber's earnings report to reveal a revenue of $9.76 billion, reflecting a 5% increase from the previous quarter and a 13% rise compared to the same period last year.

Analysts' estimates for earnings per share stood at $0.39, indicating a 14.7% quarter-on-quarter growth. In the previous earnings report, revenue fell 2.6% below expectations, while EPS surpassed expectations by 7.5%.

Despite a slowdown in revenue growth observed since the second half of 2022, the company continues to experience moderate profit growth, maintaining a gross margin of 30%.

Source: InvestingPro

Profitability Set to Grow?

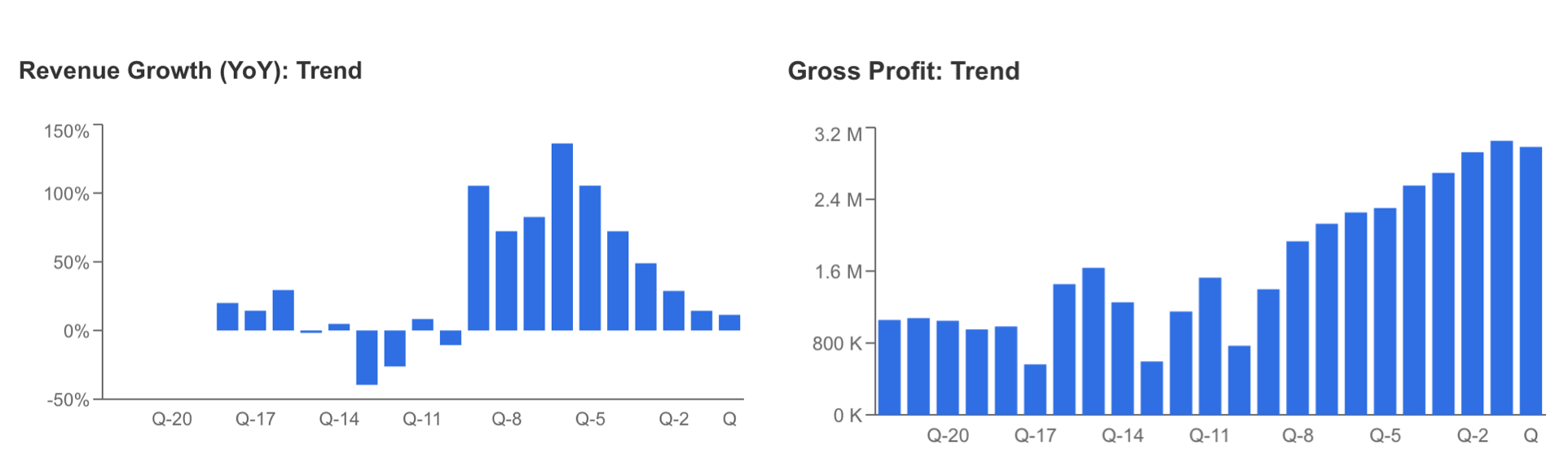

In addition, the company started to see net profit in the previous two quarters, with operating expenses remaining almost flat while sales and marketing expenses decreased throughout 2023.

Uber, which continues to remain a global power with its delivery service as well as passenger transportation, is expected to announce its revenue in the last quarter of 2023.

In addition, it is highly anticipated how the company, which continues with high costs, will manage its operational and marketing expenses.

Source: InvestingPro

Uber has recently taken some steps to improve its profit margins with advertising services and strategic partnerships.

Investors will be looking for clues, especially in tomorrow's earnings report, on how new initiatives will affect the company's revenue stream.

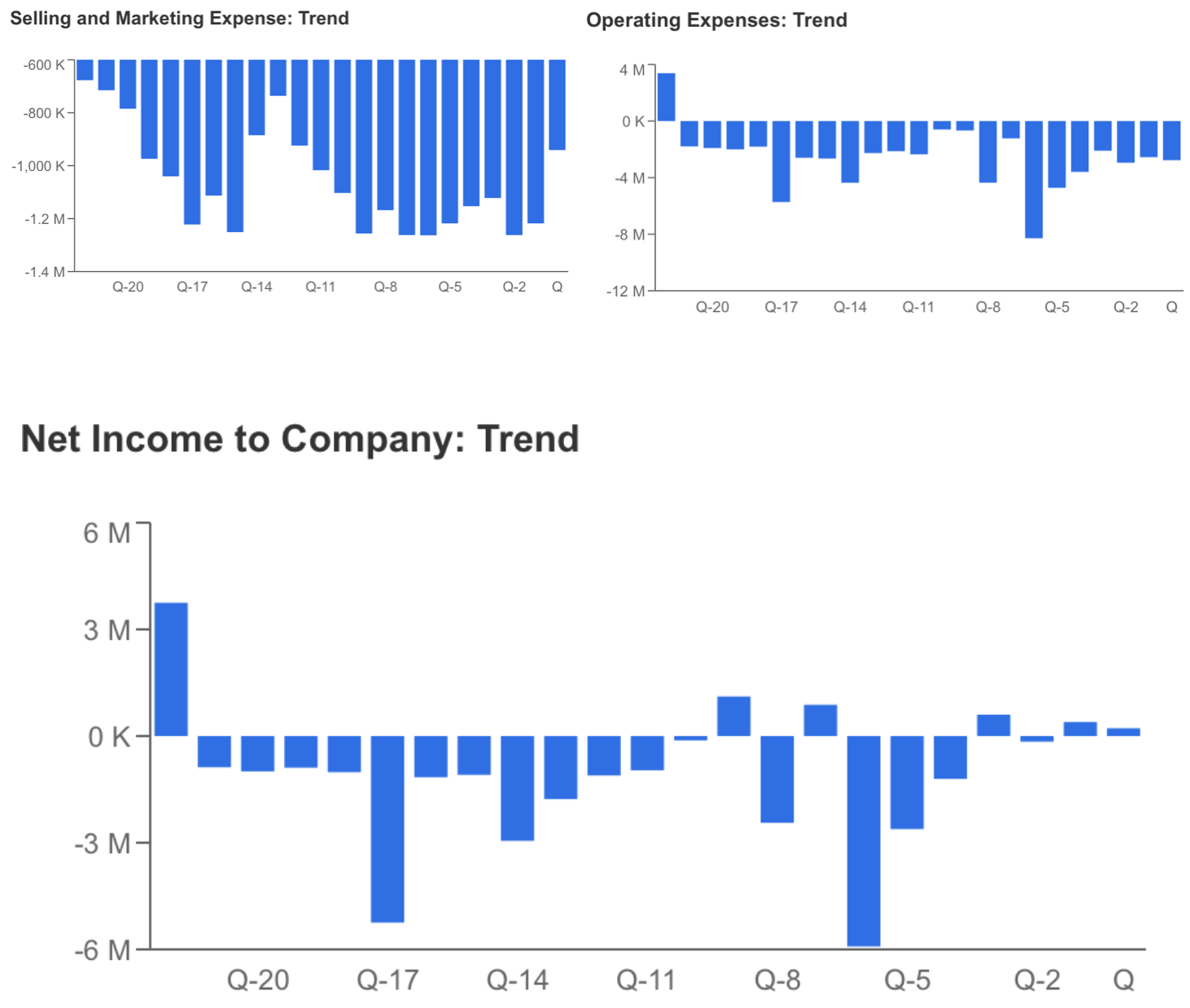

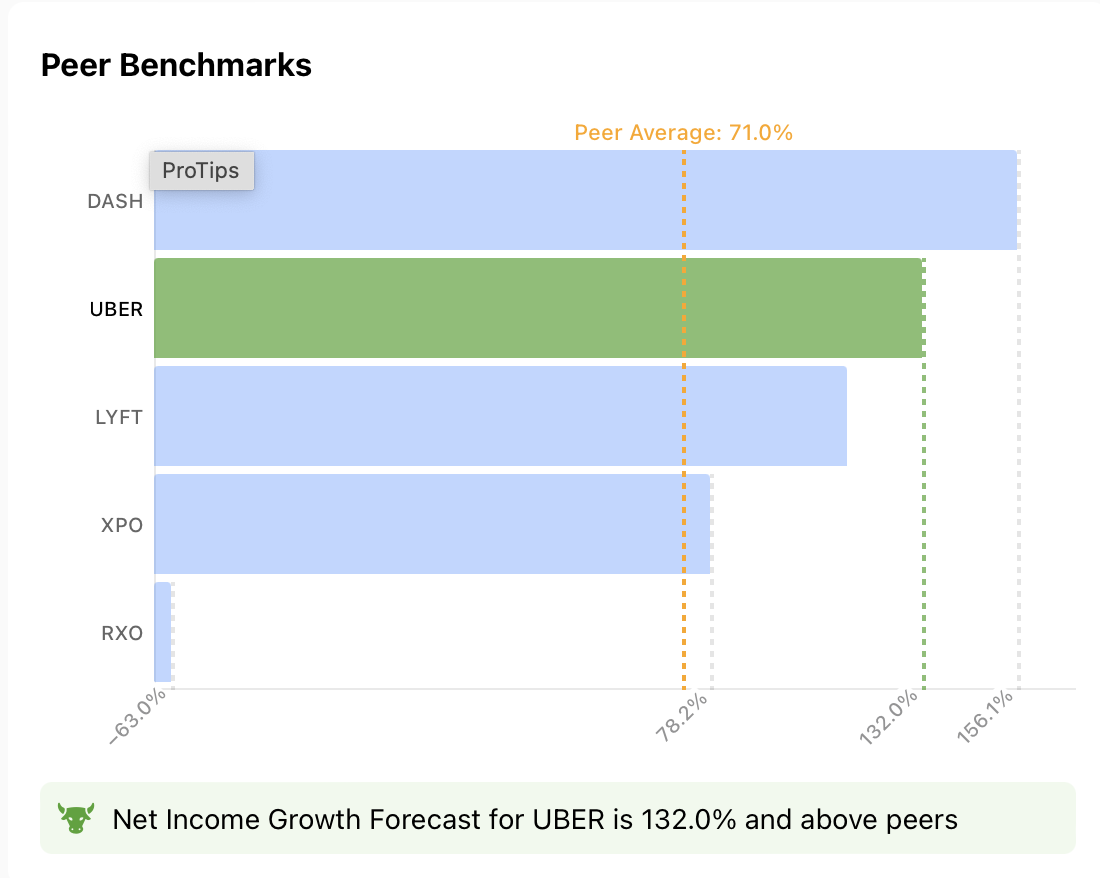

Let's take a look at the strengths and weaknesses of Uber's fundamentals with a ProTips report from InvestingPro - available exclusively for Pro users.

Subscribe here for less than $9 a month and up your stock game today!

Source: InvestingPro

According to ProTips, the company is expected to grow its profits this year. Currently, Uber's net profit growth forecast is expected to be 132%, well above the peer average of 78%, which stands out as a positive factor for the company's stock.

Source: InvestingPro

Potential Headwinds Going Ahead

Uber's share has showcased robust performance, aligning with the company's improved financials, suggesting a potential for further ascent.

The company, which caters to individual consumers, is capitalizing on the resilience of the US economy post-pandemic.

While this currently benefits Uber, there is a looming concern that it could pose a significant challenge during a potential economic downturn.

Moreover, the intense competition in the passenger transportation and delivery sector necessitates Uber to maintain elevated marketing and operational costs, despite holding a substantial market share.

This factor may exert a negative influence on net income.

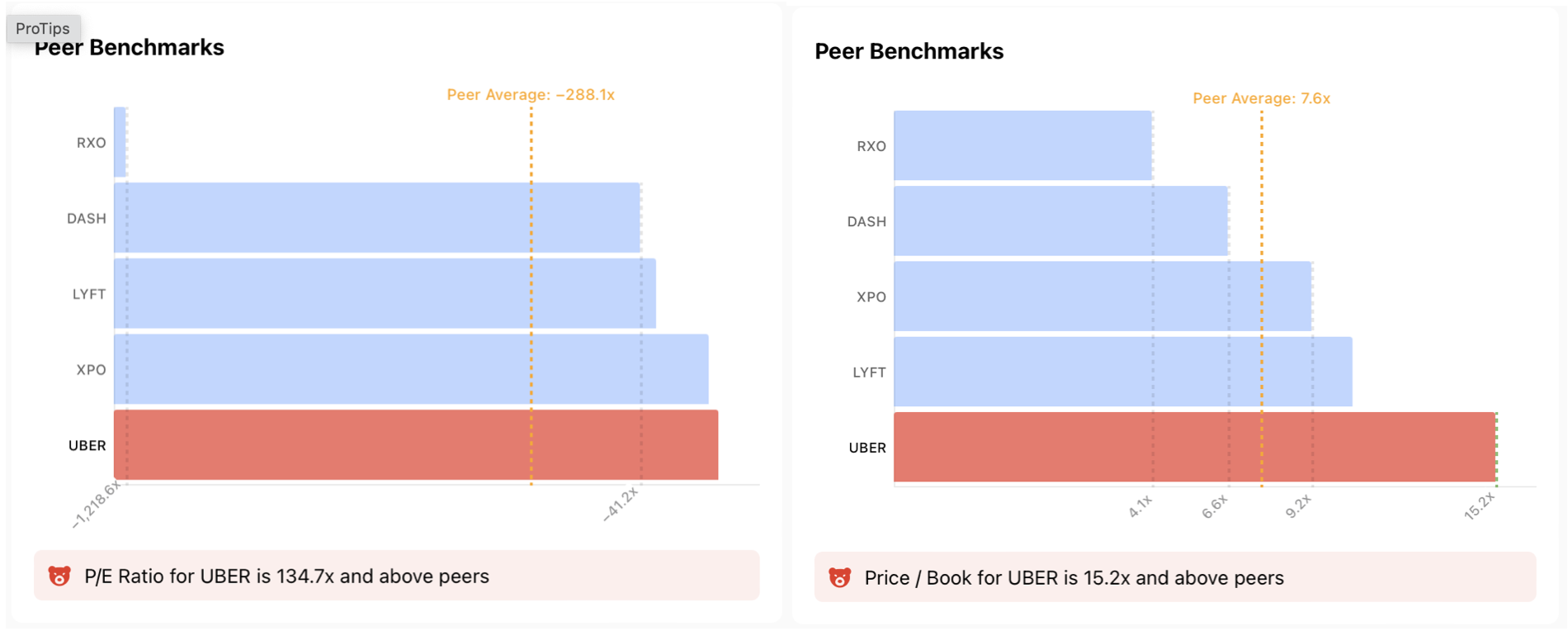

Source: InvestingPro

If we look at other weaknesses for UBER on ProTips; the company has a high P/E of 134.7x compared to its peers.

While the high valuation of UBER's share is well above the company's earnings, this indicates that the stock continues in the overbought zone.

Although the company continues to increase its earnings, it will continue with a high P/E relative to the current share price increase.

The company's P/E also remains above the industry average at 15.2x, another factor that could challenge the rally.

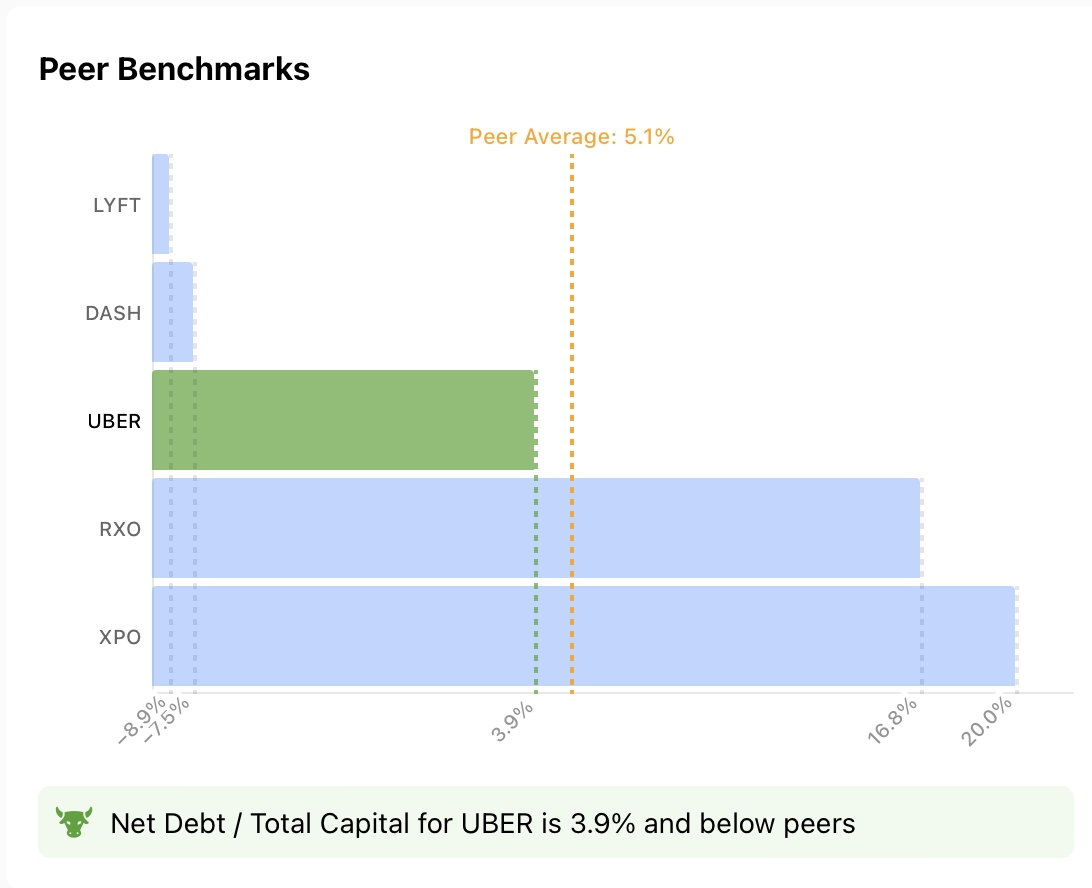

Source: InvestingPro

Another issue that could pose a problem for Uber is its average debt level.

Although the company continues to be below the peer average with a Net Debt / Total Capital ratio of 3.9%, it may experience liquidity problems in case of a deterioration in cash flow during a possible recession.

Moreover, the company's cash flow situation has an average performance after profitability.

Source: InvestingPro

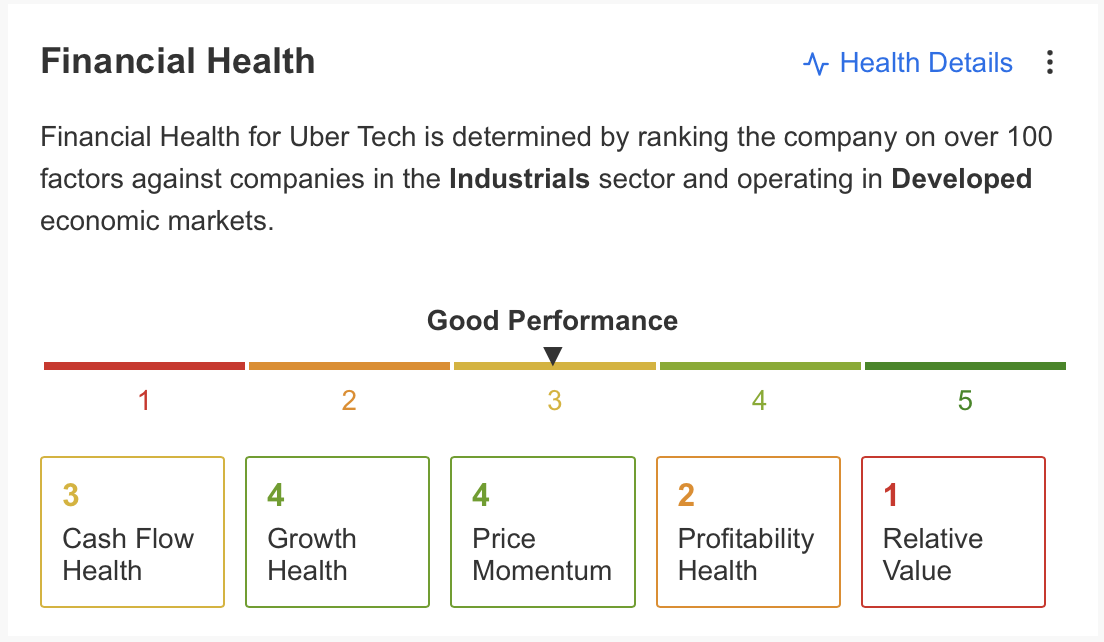

Finally, if we summarize the financial health of the company via InvestingPro; we see that growth and price momentum are the best-performing items.

Profitability is still in need of improvement, while cash flow has an average performance.

Source: InvestingPro

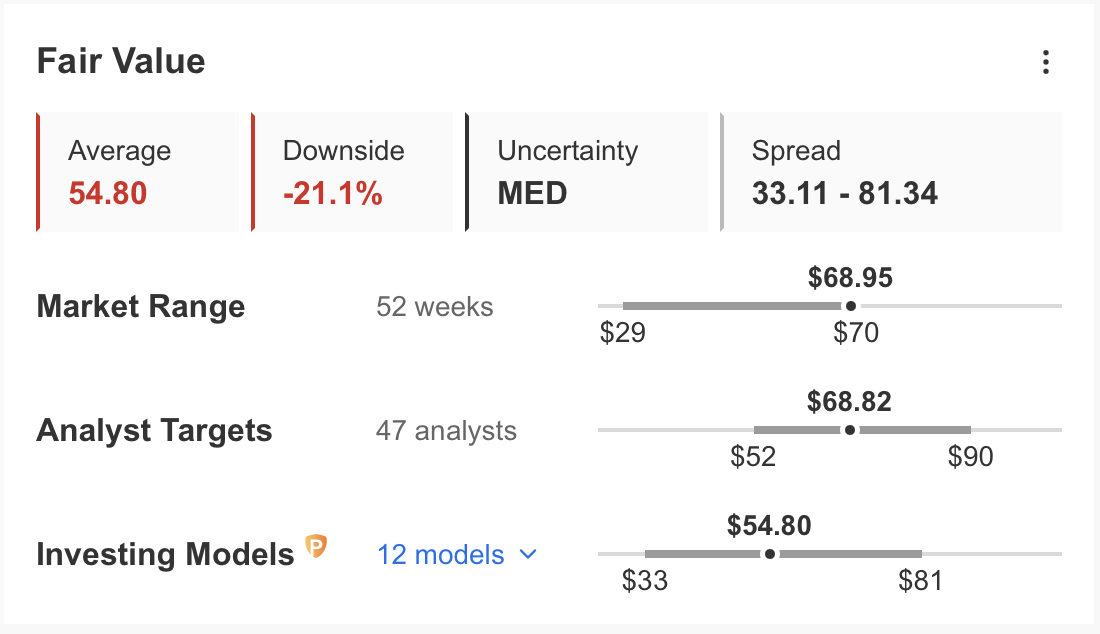

InvestingPro fair value analysis estimates a 20% correction for the UBER price within a year based on 12 financial models and medium uncertainty.

According to this analysis, while the stock is expected to continue at a premium, the possibility of a correction towards $ 55 in one year is emphasized.

According to most analysts who maintain their optimistic expectations, the consensus forecast is that UBER is currently moving at its fair value.

Technical View

Technically, UBER, rallying since the second half of 2022, is progressing towards the long-term Fibonacci expansion zone in the $70-$85 range.

This movement comes after the recovery of all losses from the downward momentum that began in 2021 last month.

Accordingly, the $ 71 level may appear as an important resistance point for the share.

In possible retracements, the short-term EMA value around $ 65 will be followed as the first support, and the possibility of a retracement towards the $ 50 - $ 55 region increases in the continuation of the possible correction.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.