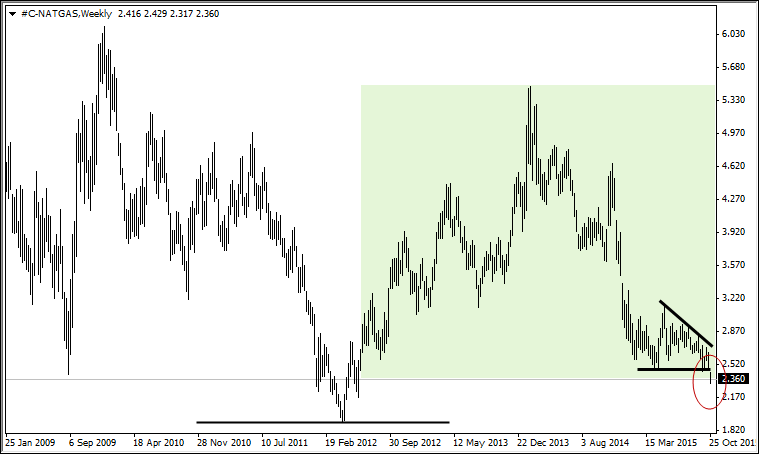

On Tuesday, the US stock market was in decline, influenced by the unexpected fall in US October consumer confidence and awaiting the results of the Fed two-day meeting on monetary policy and the US GDP to be released on Thursday. The markets were also concerned about the upcoming Apple (O:AAPL) earnings data. The trading volume on the US exchanges was in line with the 20-day average. The dollar strengthened, with the ICE US dollar index, a measure of the dollar’s strength against a basket of six major currencies, rising 0.06% to 96.92. The Dow Jones Industrial Average live chart showed the index dropped 0.24% and S&P 500 index fell 0.26%, with all its sectors being in the red except for healthcare (+1.11%). Starwood Hotels & Resorts Worldwide (N:HOT) added 9.13%, Corning Inc (N:GLW) increased 5.42%, Wyndham Worldwide Corp (N:WYN) edged 5.41% up while Cummins Inc (N:CMI) lost -8.70% and Xerox Corp (N:XRX) lost -7.34%. The natural gas prices fell recently to nearly three-year lows and to the bottom of August 2009, which weighed on the energy sector with CONSOL Energy Inc (N:CNX) slumping -21.2%, second-biggest U.S. natural gas producer Chesapeake Energy Corp (N:CHK) stocks plunging almost 6% and Range Resources Corp (N:RRC) extending Monday losses by 2.4%. The Consol stocks were also hurt by the weak earnings report in Q3. Meanwhile, Alibaba (N:BABA) stocks jumped 4% on the release of the better-than-expected earnings report. Today at 13:30 CET, the October US advance good trade balance will be released, the tentative outlook is positive. At 15:30 CET the various oil and gasoline inventories statistics will come out. Tonight at 19:00 CET, the Fed will announce its rate decision. Markets are currently estimating the probability of the US Fed interest rate hike this week at 7%, with the majority of market participants expecting the rates to be raised next year and waiting for clues from the policymaker.

The European market dropped on Tuesday, dragged down by the slump of BASF (OTC:BASFY) and Novartis (N:NVS) stocks. The EUR/USD pair was flat on Tuesday, showing insignificant fluctuations around 1.1050. The FTSEurofirst 300 index declined 0.7% yesterday, having reached the 9 week high last Friday. The STOXX 50 index lost 0.6%. The German DAX 30 and French CAC 40 indices fell 1% each. The multi-national chemical manufacturing corporation BASF stocks fell by 5% after the company reduced down its full-year earnings due to the weaker-than-expected sales in emerging countries. The pharmaceutical group Novartis stocks lost 1.4% on the news its Q3 core net income less than expected. Another pharmaceutical company Shire(O:SHPG) (UK) rallied 5.7% on Tuesday amid the positive results of its new medicine trials. Today in the Eurozone, the October German Consumer confidence survey was published, the reading was in line with consensus-forecast at 9.4. No more significant economic news are expected today from Europe.

Asian markets were declining too after the whole month of growth as investors were closing positions and staying out of the market awaiting the US Fed and the Bank of Japan meetings due on this week. The Japan’s Nikkei index lost 0.8% still staying close to its 8-week high. Meanwhile, Hang Seng and Shanghai Composite index edged up 0.1% each.

Crude oil prices continued extending losses for the third day yesterday with Brent losing 1.5% and hitting a six-week low at $46.81 a barrel. WTI fell 2.8% to $43.20 a barrel. The unseasonably warm weather made markets cautious about the possible decrease in oil products consumption and pushed oil prices lower. In general, commodities markets remain under pressure because of the descending demand from their major consumer China and the global supply glut.

Copper prices were steady at $5206 a tonne.