- U.S. indexes continue to thrive, but small caps and China stocks have traded sideways and could be at attractive valuations, making them intriguing for long-term investors

- Given the sideways trend with occasional declines, it could be a good time to consider accumulating these two in your portfolio.

- With potential interest rate cuts on the horizon, small caps historically perform well in such environments, presenting investors with an opportunity to consider these assets for portfolio diversification.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The year kicked off much like its predecessor, 2023, characterized by a handful of prominent stocks propelling the U.S. equity indexes and subsequently, the global indexes.

However, outside the U.S., both valuations and sentiment have yet to turn positive. In many cases, we are still witnessing sideways movement rather than outright bear market conditions.

Since the end of last year and particularly in the early months of 2024, I have found two asset classes particularly interesting: Small Cap and China.

I'm drawn to these asset classes because, from a valuation standpoint, they have significantly lagged.

From an investor's perspective — thinking not in terms of a month, but rather a minimum of five years — they hold substantial potential for appreciation in portfolios.

Let's delve into more detail and find out whether it is the right time to add these two to your portfolio.

As we can see from the charts above, both have been traveling sideways for a long time now, Small Cap (represented by Russell 2000 here) since early 2022, while China (Shanghai Composite) even since 2015.

Both asset classes are currently trading below historical average valuations on the valuation side.

Considering China's substantial 19% share of the world's GDP, it is challenging to exclude at least a fraction of its weight from any diversified portfolio, particularly given the current attractive valuations.

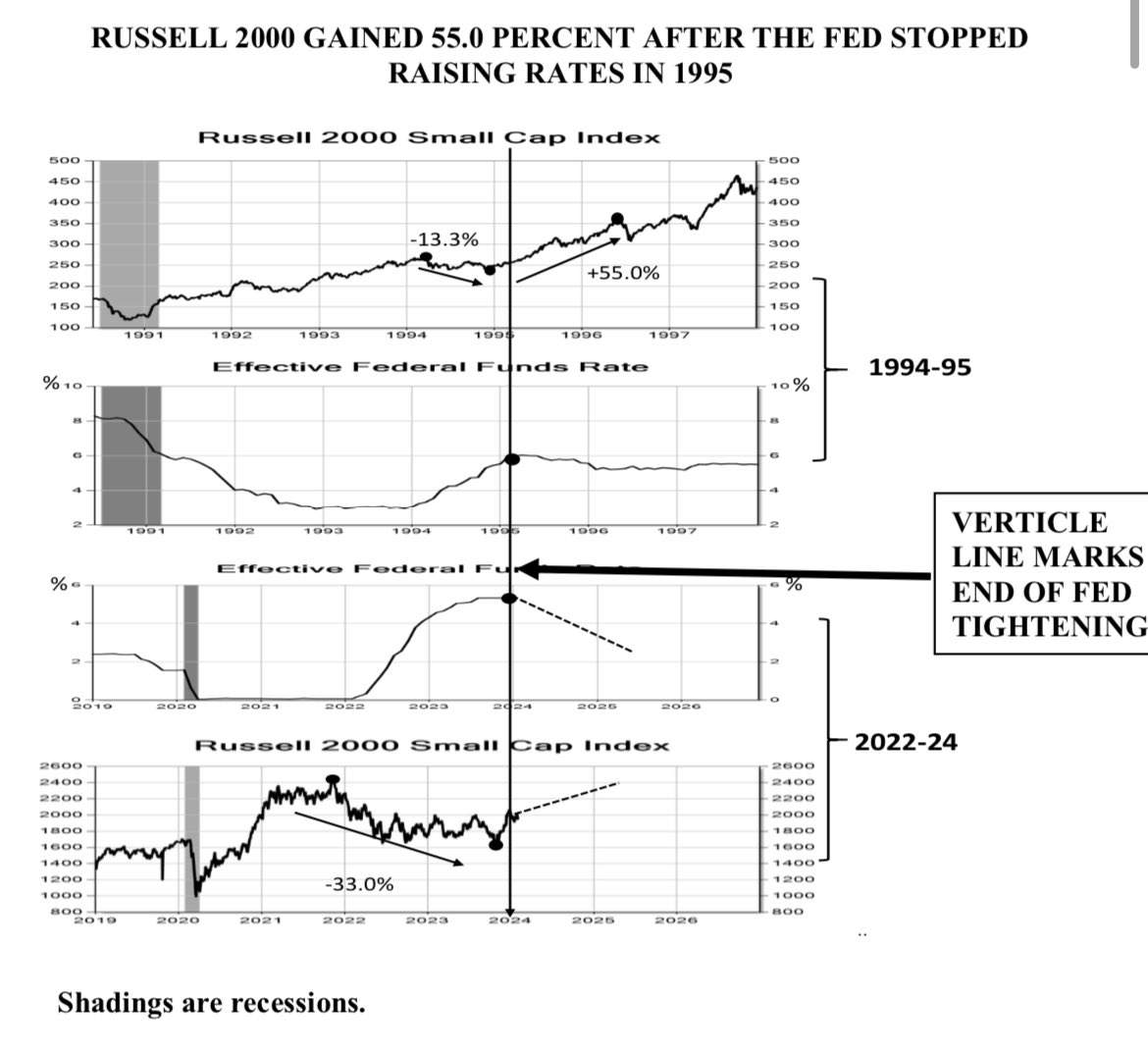

Moreover, the potential scenario of an imminent interest rate cut, whose timing remains uncertain, is expected to be favorable for small caps. Historically, small caps have demonstrated strong performance in such environments (see below).

Conclusion

Consider initially evaluating the percentage weight limit in portfolios (which don't necessarily have to be core assets).

If declines persist over time, you can gradually accumulate these assets. Always maintain the right time horizon, avoiding expectations of an immediate rally. Allow the market the necessary time to stage an eventual comeback.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code UKTopDiscount at checkout to claim an extra 10% off on the Pro yearly and by-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.