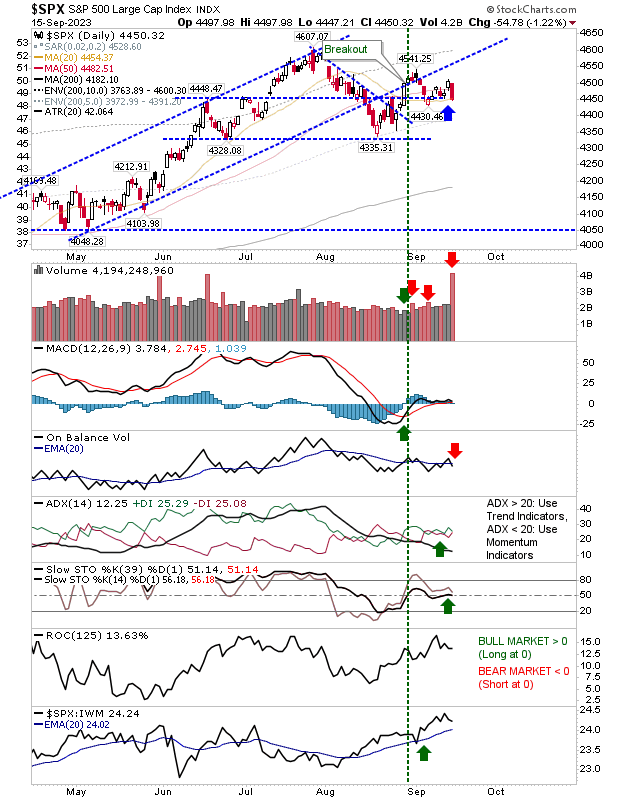

All headlines this week will focus on the Fed's decision, but markets had their own big end-of-week finish last week with triple witching options expiration combined with a sell-off to leave the S&P 500 and the Nasdaq in a little trouble.

Having managed to edge past the 50-day MA on Thursday, the S&P 500 quickly found itself on the wrong side of the line by Friday's close. While triple witch volume clouded the volume, Friday's selling likely counts as distribution.

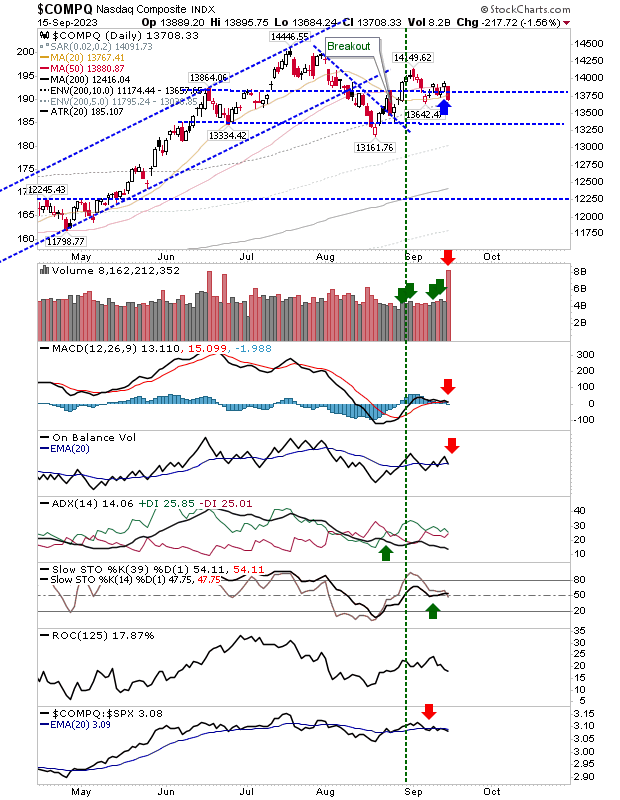

It was more of the same for the Nasdaq as it cut below its 50-day MA on higher volume. There was a MACD trigger 'sell' to go with an On-Balance-Volume 'sell'. Slow stochastics are okay, holding the bullish mid-line, but there is very little room for further weakness in this indicator. There is also an emerging underperformance relative to the S&P 500 that needs to be monitored.

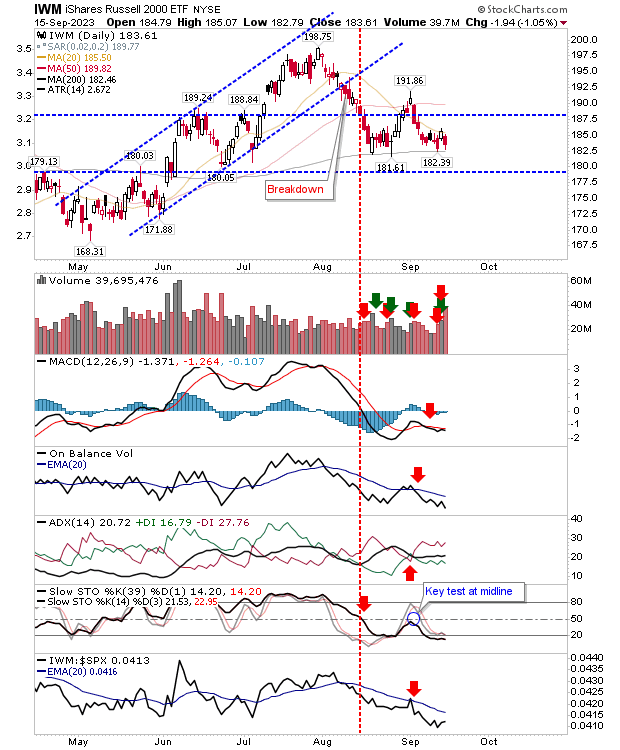

The Russell 2000, via (IWM), is lingering around its 200-day MA, experiencing its own confirmed distribution but without the support break to give it's weighting. Unlike the aforementioned indices, technicals are net bearish; a bad omen for a support break.

As we head into next week, we want to see how markets react (vis-a-vis support) to the Fed decision, rather than the Fed decision itself. If no support breaks, and I'm looking at the Russell 2000 (IWM) here, it becomes a bit of a non-event.