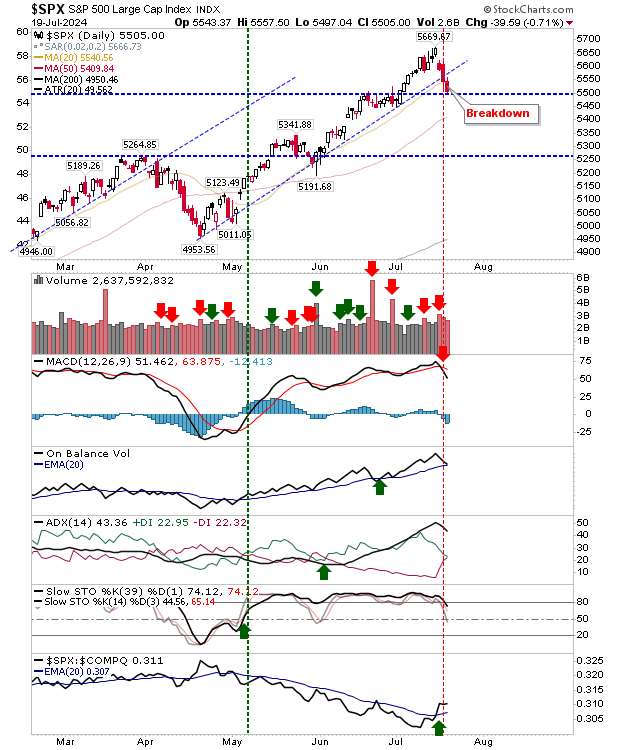

Monday will be decision time for the S&P 500 as last week's selling tags breakout support, but also breaks a bullish trendline. The selling undercut the 20-day MA with a 'sell' trigger in the MACD.

Signs point downward with money cycling away from Large Caps to Small Caps stocks but Monday is a chance for buyers to step in and defend support.

After Wednesday's gap down, selling volume eased, which may be a sign of complacency or a genuine lack of interest in taking profits at this point.

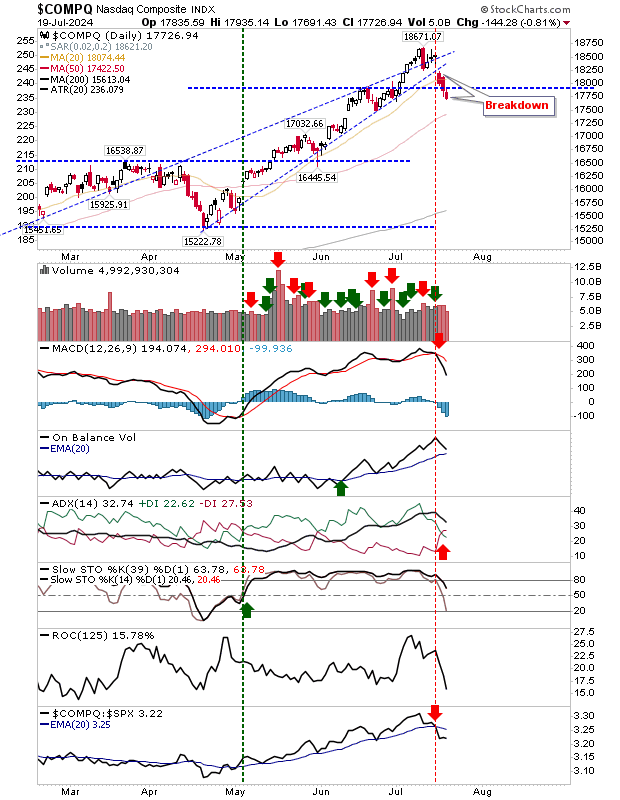

The Nasdaq may indicate what's to come for the S&P 500. It has already breached trend support, its 20-day MA, and breakout support. Next up is the 50-day MA before we start looking at the March swing high as a possible support level.

The Nasdaq has 'sell' triggers in the MACD and ADX, but there still hasn't been any confirmed distribution; a capitulation down to the 50-day MA may offer an anchor point for a swing low.

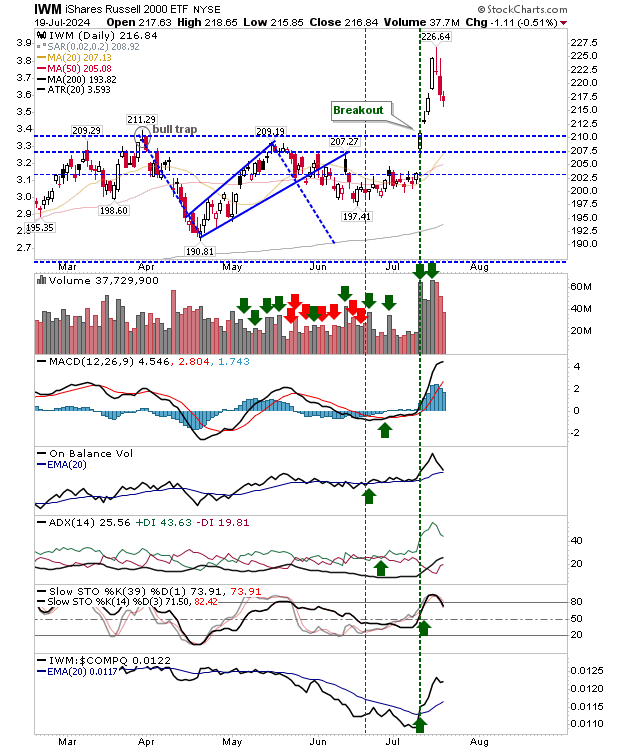

The index bucking the trend is the Russell 2000 (IWM). After a very successful breakout, it wasn't able to evade the selling that took the S&P 500 and Nasdaq by storm last week.

Technicals are net positive and even if selling was to continue it would likely take the full week for the index to get back to breakout support.

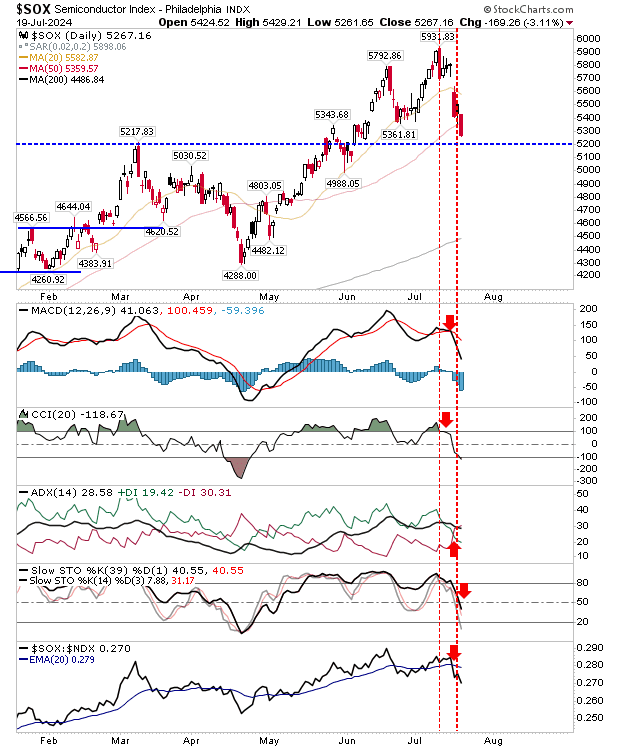

As a closing point, also watch the Semiconductor Index. It finished Friday with an undercut of its 50-day MA on net bearish technicals. Near-term stochastics are oversold but they haven't yet created a scenario that could deliver a signal 'buy'. Look for prices to stick around 5,200 as part of a support test. If there is an index that could post a spike low on Monday, then this is the one most likely to do so.

For Monday, watch for a support test in the S&P 500 and Semiconductor Index. If successful, then the week could deliver a nice rally for these indices. The Russell 2000 ($IWM) has been trading counter to the action in the S&P 500 and Nasdaq. If there is any hesitation in the S&P 500 and Nasdaq, then look for the Russell 2000 to benefit.