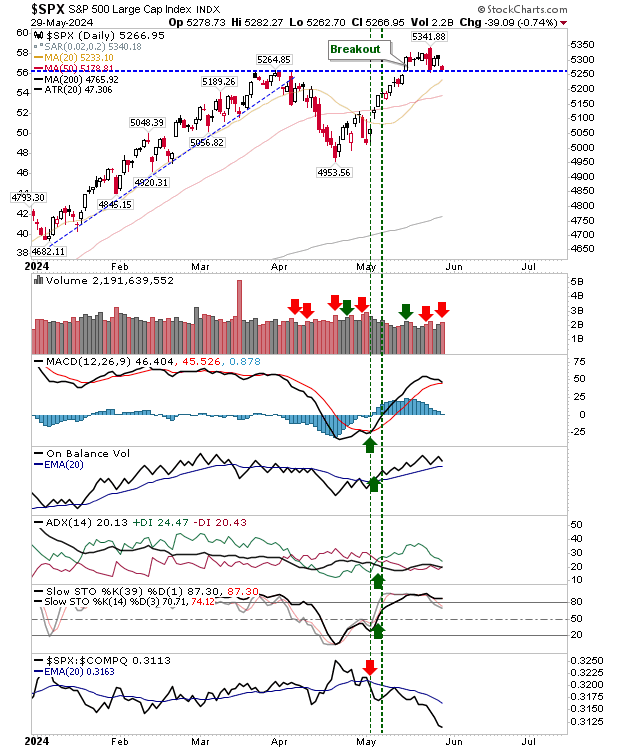

The S&P 500 has drifted back to breakout support, but it's no capitulation as the previous chart would suggest. Selling volume rose to register as distribution. Technicals are still net positive, although the index is underperforming relative to the Nasdaq. If there is any early morning selling then look to the 20-day MA as a buying opportunity.

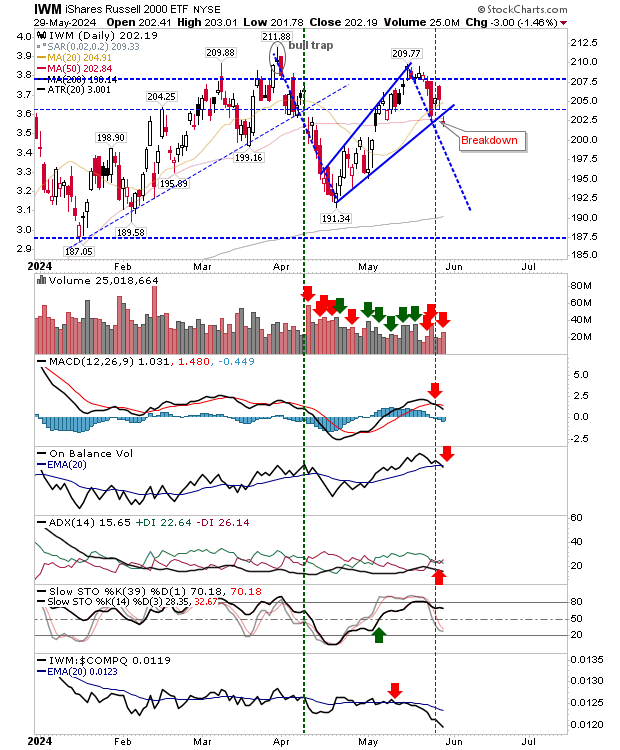

The Russell 2000 (IWM) gapped below its rising wedge, undercutting its 50-day MA in the process. Volume rose as distribution with 'sell' triggers in the MACD, On-Balance-Volume and ADX. The March 'bull trap' was the rally killer, what's happening now is action within a trading range and carries less weight.

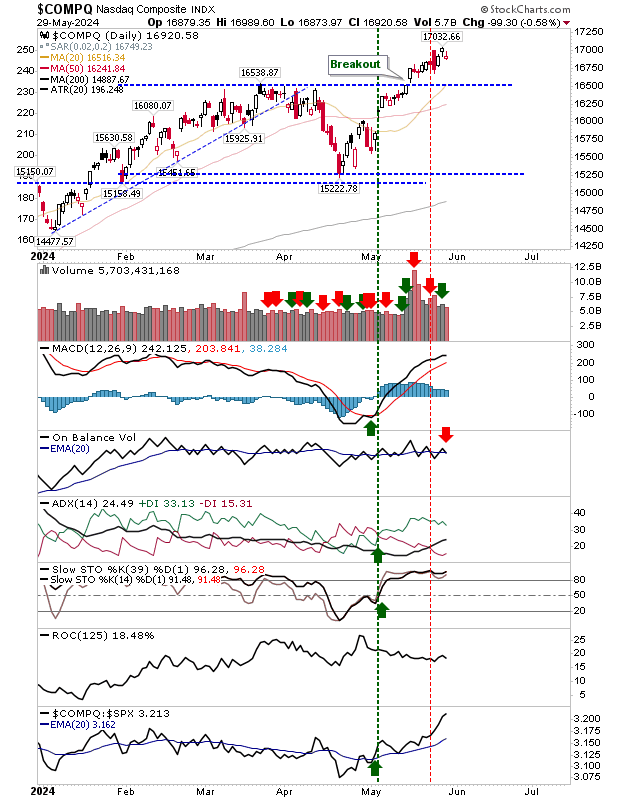

The Nasdaq dodged the selling experienced by the Russell 2000, and the S&P 500 to a lesser degree. Yesterday's loss was minor but remains well above support. On-Balance-Volume is whipsawing across a trigger line, but other technicals are good. Unlike other indexes, this is still in a bullish trend.

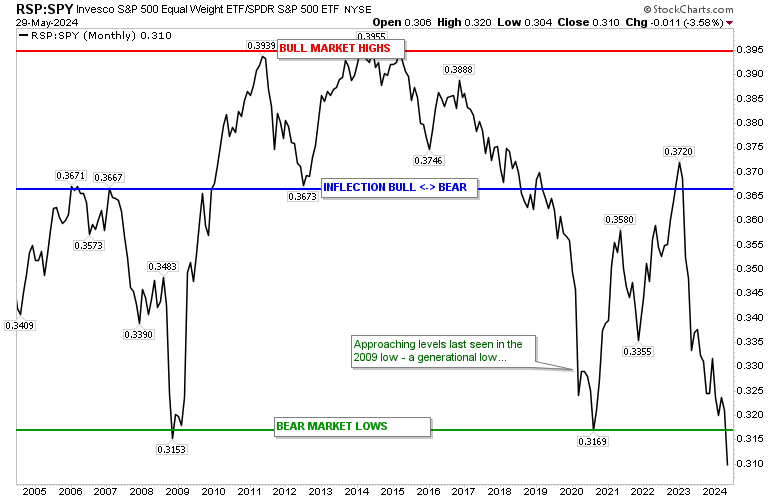

I was going through my charts and came across one I don't normally look at, but I thought it was interesting. The S&P 500 ratio of equal weight, $RSP, to the S&P 500, $SPY, has reached a value below that of the 2009 bottom. I'm not sure of the significance of this yet as the S&P 500 ($SPY) hasn't reached any capitulation low, but if there is a long trade, then this is one such opportunity.

For today, we will want to see the S&P 500 hold breakout support and perhaps benefit from the capitulation low in the $RSP:$SPY ratio. The Russell 2000 ($IWM) will drift in its trading range for the coming days and its unlikely to offer much guidance. Likewise, it will take a big loss in the Nasdaq to reverse its bullishness. Let's see what today brings.