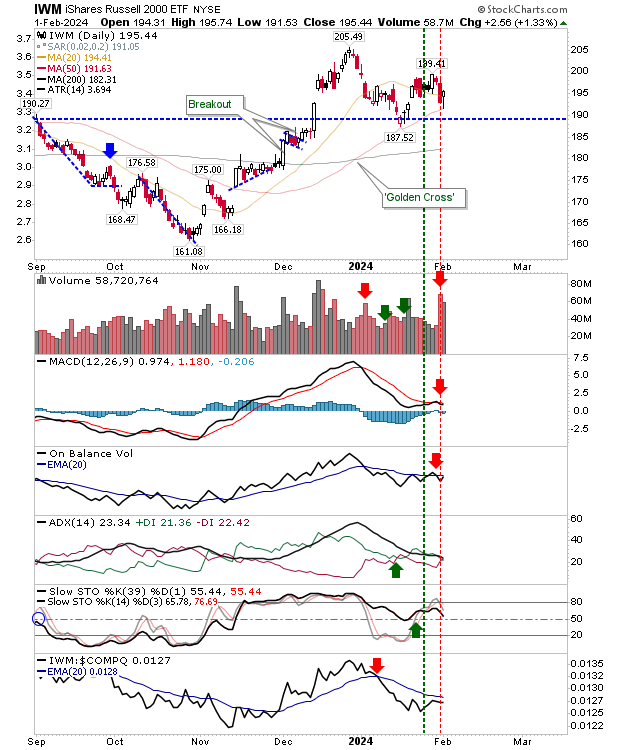

It was a good finish for the Russell 2000 (IWM) as the index closed the day with a bullish 'hammer' at its 50-day MA. Taken in combination with yesterday's red candlestick makes a bullish harami, a reliable reversal pattern.

The appearance of this candlestick when intermediate stochastics [39,1] are at the midline is another bullish marker. The only negative against a possible bullish day today is the fresh 'sell' trigger in the MACD.

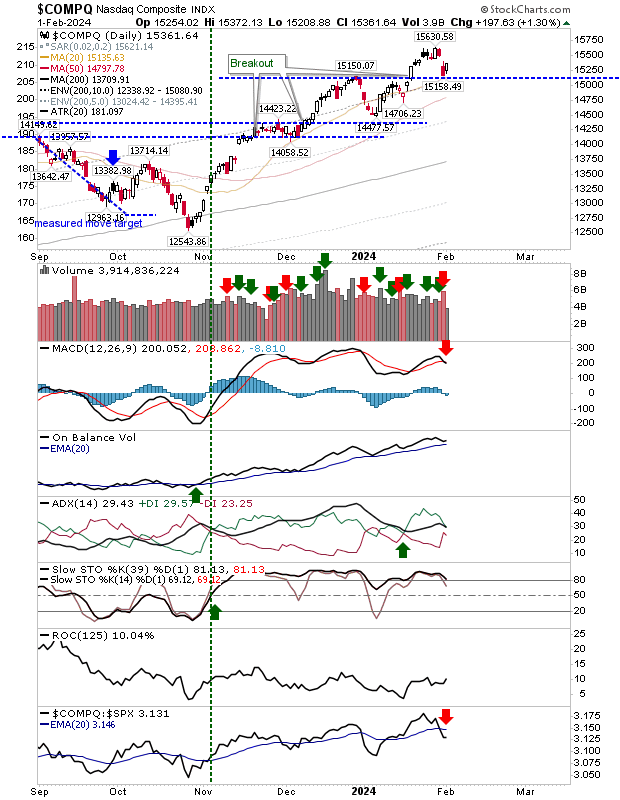

The Nasdaq was able to bounce from its 20-day MA and horizontal support around 15,150.

There is a breakdown gap from Tuesday to fill and I would be looking for this as a minimum for today.

As for negatives, there was a new MACD 'sell' to go with an underperformance switch against the S&P 500. Yesterday's buying also fell well short of yesterday's selling distribution.

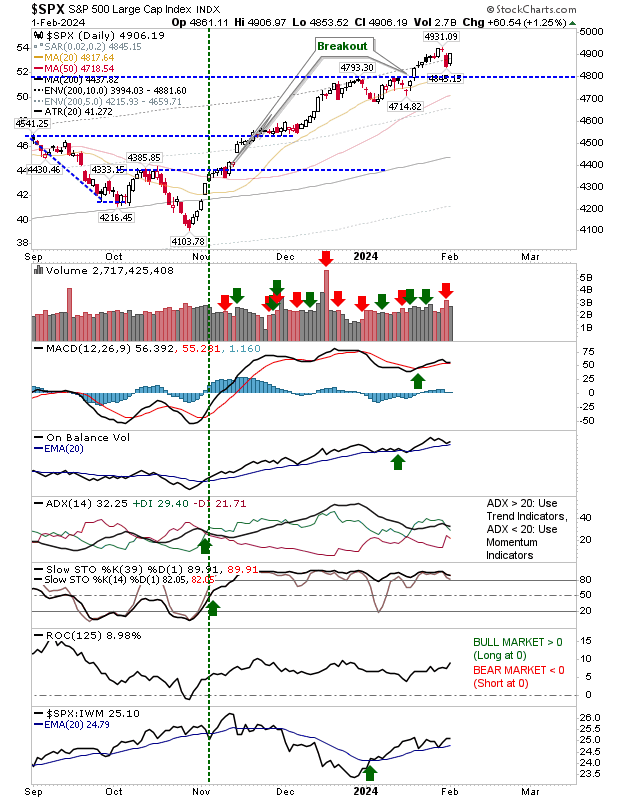

The S&P 500 finished with a paired reversal that undid yesterday's selling.

As with the Nasdaq, yesterday's buying was below yesterday's distribution volume, but there were no corresponding 'sell' triggers in the MACD, On-Balance-Volume or index relative performance.

The S&P 500 is the index most likely to make new all-time highs, but has the smallest trade potential to close Tuesday's breakdown gap.

New secular bull markets are in the making for the S&P 500, Nasdaq and (eventually) the Russell 2000.

It's hard to fight the tape and with the election coming up later this year we can look for further gains.

In addition, breadth metrics for the S&P 500 and Nasdaq such as the percentage of stocks above their 200-day and 50-day MAs, and stocks on bullish percent 'buy' signals are on the bullish side of the fence, but are not overbought.

As for today, I'm looking for upside.