- Delay in reopen of Freeport LNG—a bearish factor—sends gas rallying instead

- Henry Hub gas breached $10 this week, first time in 14 years; could retest level

- US gas storage estimated at 58 bcf for last week versus previous 18 bcf

Another delay in the operational return of Freeport LNG has resulted in another rally instead in US natural gas, proving that it's impossible to beat hedge funds bent on driving this thing to the hilt—despite growing bearish fundamentals screaming of a market that’s overbought.

After Tuesday’s first double-digit pricing in 14 years when the $10 per thermal unit resistance was cracked, gas futures on the New York Mercantile Exchange’s Henry Hub only fell 5% intraday—a relatively modest correction by today’s standards. Since then, funds long the market have dug their heels in, engineering a modest rebound the next session itself.

The sheer excessiveness of the market’s upside was on full display on Wednesday when Freeport LNG pushed its start date from October to mid-November. The Texas-based facility, the second-biggest US LNG export plant, was consuming about 2 billion cubic feet per day of gas before it was shut on June 8 by an explosion that suddenly left the market oversupplied. Right after the explosion, the Henry Hub’s front month plunged from a high of $9.66 to a low of $5.36 by the end of June.

However, by July, the front month was back at a peak of $9.41 as surging summer heat led to a spike in cooling demand and the air-conditioning that needed to be driven by gas-fueled power. But as temperatures began dissipating, gas futures continued to ramp higher as hedge funds in the game got deeper into the long side.

'Bearish News Doesn’t Count These Days'

Dan Myers, analyst at Houston-based gas markets consultancy Gelber & Associates, told the firm’s clients in an email seen by Investing.com on Wednesday:

“Logical thinking would suggest that … news of the Freeport LNG export being delayed in its restart would trigger a much more bearish response in NYMEX gas futures, but since prices are being dominated by some deep-pocketed hedge funds that are massively long on futures and options, it seems that bearish news doesn’t count these days.”

Myers said it was interesting that just a few weeks ago, news of the Freeport terminal’s return in October elicited such a bullish response that lingered for days.

Shortly thereafter, a similar situation occurred when news of the Mars offshore oil and gas platform in the Gulf of Mexico was shut-in due to a leak, sending Henry Hub’s front-month spiking to over $8.50. Yet, when it turned out that the shut-in of the platform lasted less than 24 hours, gas futures kept climbing.

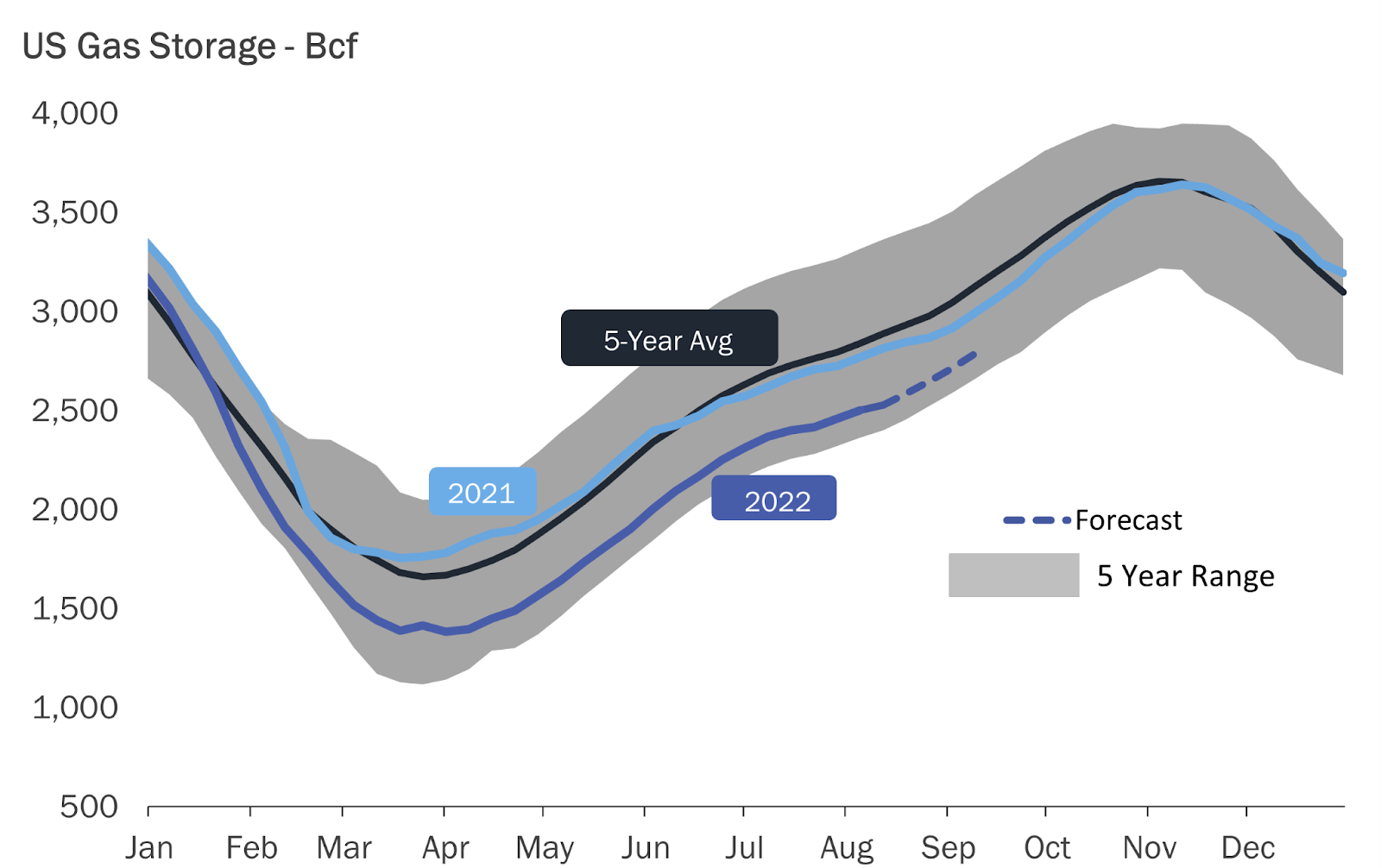

As it stands, the Freeport facility won’t see volumes return until about mid-November with daily demand not likely to reach 2.0 billion cubic feet (bcf) per day until possibly early December. The current situation will likely add about another 100 bcf to gas storage inventories at the end of the injection season.

As dry gas production continues to grow beyond 98 bcf per day and the onset of the shoulder season between summer and fall emerges in the weeks ahead, it’s becoming clearer that the end of the refill season is getting ever closer to reaching 3.5 bcf—which is a comfortable amount of gas storage for even a colder-than-average winter.

Gas Futures Keep Rising As Summer Heat Keeps Falling

The absence of a bearish response to the weather change and the all-time highs in gas production in recent weeks also makes clear that bulls in the market aren’t ready to throw in the towel yet—despite the looming potential for a warmer first half of winter.

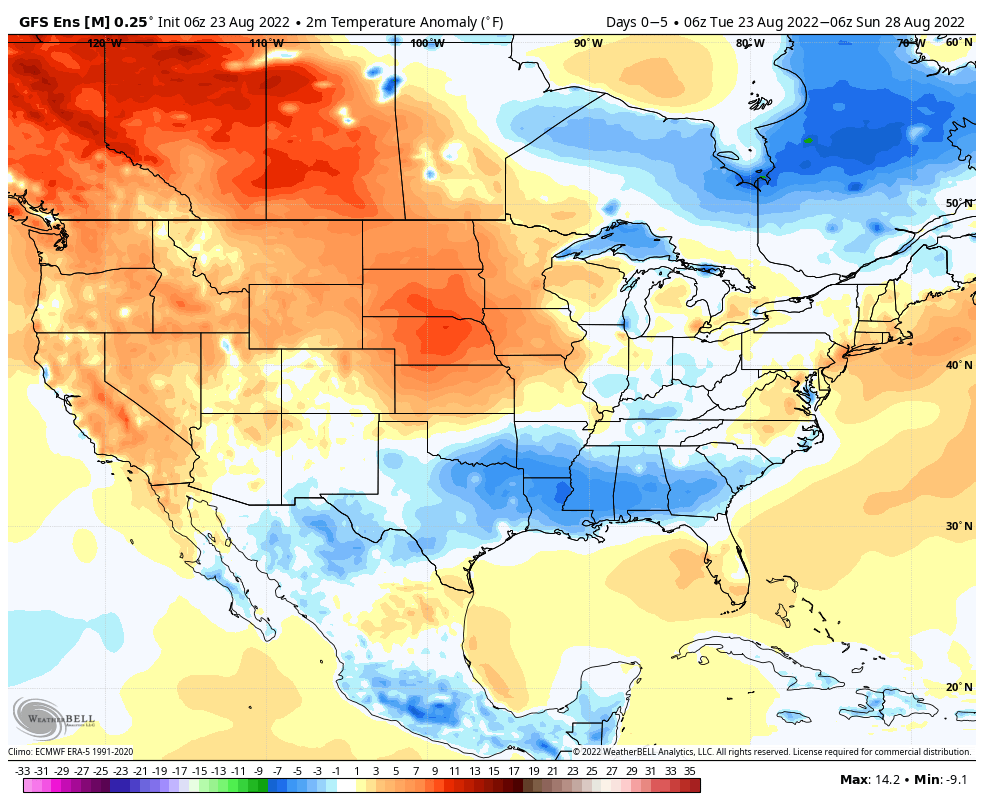

Temperatures across the near entirety of the southern tier of the US, also known as the air-conditioning belt of the nation, are simply not bullish for gas futures as most of the region is seeing daytime highs that are upwards of 15 degrees below average. This includes Houston and Dallas, Texas in the low-to-mid-80s, New Orleans, LA in the mid-80s, Little Rock, Arkansas near 80 degrees, and Jackson, Mississippi only in the upper 70s.

These kinds of temperatures are more reminiscent of early fall-like temperatures instead of late August conditions. The longer-range models are suggesting that the peak heat of the 2022 summer is now in the rear-view mirror.

Source: Gelber & Associates

The Folly Of Tying US Gas With European Prices

The main culprit behind this week’s run-up in gas prices is the notion that Henry Hub gas futures should somehow be tethered to the surge in European gas prices. The Dutch Title Transfer Facility, the benchmark for European gas pricing, shot up on Monday, up an eye-popping 485% year-over-year and is trading at a near 740% premium to the Henry Hub.

The spike in European prices stems from the intent of Russia’s Gazprom (MCX:GAZP) to reduce volumes to the Nord Stream 1 pipeline to zero for three days at the end of the month for maintenance. There is speculation that flows may not resume when the maintenance is completed as part of Russia’s retaliation against the West’s sanctions.

Presently, European natural gas storage inventories are sitting at 2,973 bcf, which are up 575 bcf or 24% year-over-year, which is more than adequate for this period of their gas storage refill season. However, there are legitimate winter storage concerns should the Russia-Ukraine war persist into the winter months, which is elevating European gas prices.

Somehow, in some twisted fashion, hedge funds want to make speculators believe that US natural gas prices should also be rallying along with European prices. This premise actually doesn’t make sense at all because the United States has limited export capacity for liquefied natural gas (LNG)— 3 bcf actually. The US doesn’t have the ability to send out more LNG supply beyond current capacity, therefore whatever gas prices are doing abroad shouldn’t have any bearing on Henry Hub gas.

On the storage front, US utilities likely added 58 bcf for the week ended Aug. 19 against the previous week’s injection of 18 bcf, according to a consensus of gas-market analysts tracked by Investing.com.

The US Energy Information Administration will release its weekly storage report at 10:30 ET (14:30 GMT).

Source: Gelber & Associates

Will Henry Hub Retest $10?

There’s no doubt that US gas futures are overvalued at the current price levels. It will be a factor behind more US inflation as there are countless products tied to the cost of natural gas. While dry gas production is hovering near 97 bcf/d amid pipeline maintenance, it is still up about 4 bcf/d yoy, which isn’t bullish but is being construed to be.

Until cooler weather emerges across the entire United States and gas storage inventories look to reach 3.5 trillion cubic feet (tcf), buyers will likely continue to remain in control. However, once all of these bearish catalysts combine forces, there will likely be a major correction to the downside with prices cascading back well below $6 later this year.

Myers observed:

“Gas bulls are still pointing to the storage deficit of around 300 bcf versus the five-year average as the reason to underpin prices, and overall momentum continues to be with the gas bulls despite all of the bearish drivers in the market. This suggests that there could still be more attempts of buyers to retest the $10 area.”

Technical charts for gas futures show a sustained break above the $10 high, the first for gas futures since 2008, which will add confirmation to bullish extension.

Said Sunil Kumar Dixit, chief technical strategist at SKCharting.com:

“Short term direction is controlled by the $9.06 support and $9.45 resistance.

“The daily chart shows natural gas has completed the formation of a potentially bullish 'cup with handle' pattern which targets a bigger rally in a longer time horizon.”

But if the momentum reverses, then $8.007 will be the level to watch. “A break below $8.007 will invalidate the bullish pattern,” Dixit added.

Meanwhile, there’s evidence that dry gas volumes could be on the cusp of pressing up to north of 99 bcf, sooner than the market expects. It will be interesting to see if gas bulls ignore this data as well.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.