- Chinese accommodation continues to stimulate investors...and markets

- 7-year high for gold but lower yields and stronger dollar provide conflicting picture

Key Events

After signals this morning that China will reduce its loan prime rate on Thursday, part of an effort to pump billions of dollars of stimulus into the Asian nation's ailing coronavirus-hit economy, U.S. index futures—including for the S&P 500, Dow Jones and NASDAQ—advanced, along with regional and global stocks. Today's rise in U.S. contracts trimmed Tuesday's losses for the underlying benchmarks.

Gold, however, extended its rally, but the yen dropped.

Global Financial Affairs

Wednesday's market activity suggests that investors remain prepared to take stocks to unprecedented heights, despite uncertainties and concerns over the global economic impact of COVID-19's disruption to manufacturing and shipping. Once again, the exuberance comes on the backdrop of a promise to more cheap money flowing from central banks coffers.

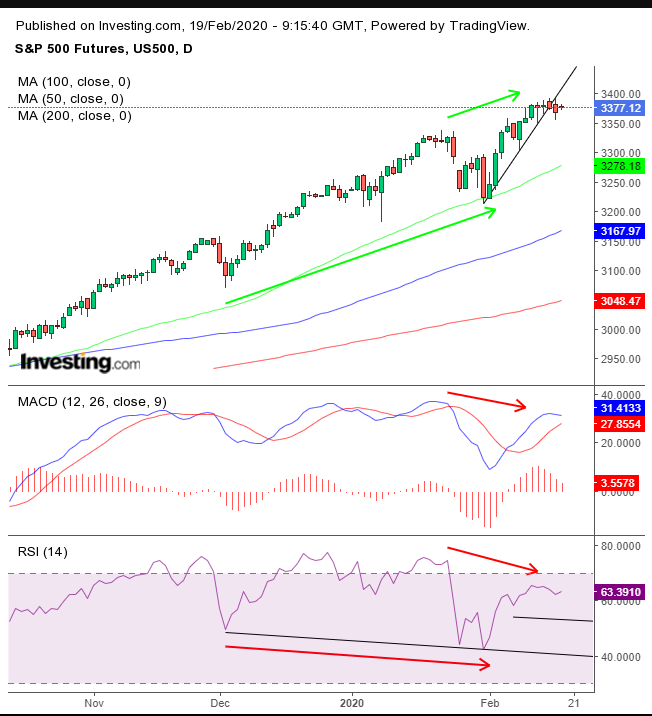

S&P 500 futures are rising today, but have been seesawing since last Wednesday, with no apparent direction.

Momentum is slowing as the price is unable to maintain its ascent.

Energy and mining shares boosted the STOXX Europe 600 Index after news surfaced that China is considering everthing from cash injections to mergers in order to bail out its airline industry now that travel in and out of the epidemic plagued nation has collapsed.

Ironically, for a second day running, the Shanghai Composite performed opposite to what might have been expected. While, yesterday it rose, despite a global selloff, today it was the outlier, slipping 0.32%, despite a global rally. Perhaps the Chinese index's counterintuitive moves are an example of buying the rumor and selling the news.

Benchmark 10-year U.S. Treasury yields edged lower, extending the downtrend, with the 50 DMA falling further below the 200 DMA, as momentum failed to pick up from the Jan. 31 low.

The dollar was little changed, hovering near its highest levels since October, with an overextended MACD and RSI.

Nevertheless, the greenback reached its highest level since May versus the Japanese yen.

While a stronger dollar weighed on the yen, it didn’t seem to slow down gold.

The yellow metal hit its highest point since January 2013, after completing a bullish pattern.

Brent crude climbed for the 7th straight session, its longest advance in over a year. This came after the U.S. sanctioned Rosneft (OTC:OJSCY), Russia’s largest oil producer, for helping to sell Venezuelan crude. As well, an ongoing conflict in Libya continues to significantly reduce supply expectations.

Technicals may be signaling something different for the global oil benchmark, however. Its 50DMA just crossed below the 200DMA, creating a Death Cross which often indicates a major sell-off could be on the way.

Up Ahead

- Earnings season rolls on. Results from heavy equipment manufacturer Deere & Company (NYSE:DE) are expected to be released on Friday, before the open.

- Minutes from the most recent Federal Reserve meeting will be published on Wednesday.

- Indonesia is expected to cut interest rates on Thursday, following emerging-market peers that have already eased.

- G-20 finance ministers and central bank chiefs are scheduled to meet Feb. 22-23 in Riyadh, Saudi Arabia, where they're expected to discuss efforts to support economic growth amid the coronavirus threat.

Market Moves

Stocks

- Futures on the S&P 500 Index advanced 0.2%.

- The Stoxx Europe 600 Index advanced 0.3%.

- The MSCI Asia Pacific Index increased 0.3%.

- The MSCI Emerging Markets Index advanced 0.5%.

Currencies

Bonds

- The yield on 10-year Treasuries advanced less than one basis point to 1.56%.

- The yield on 2-year Treasuries advanced one basis point to 1.42%.

- Germany’s 10-year yield gained less than one basis point to -0.40%.

- Britain’s 10-year yield gained one basis point to 0.616%.

- Japan’s 10-year yield gained one basis point to -0.047%.