- German exports plunge

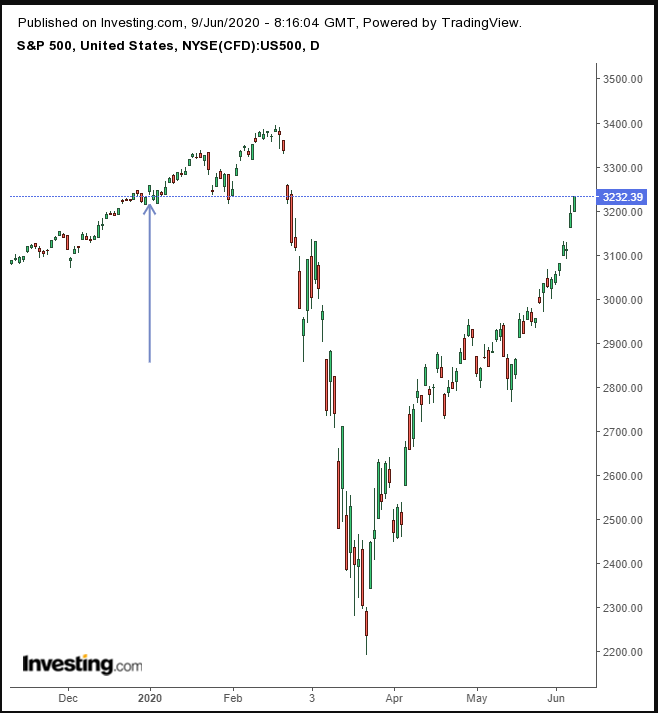

- S&P 500 yesterday erased all YTD losses

- NASDAQ posts new record

- Gold rises despite dollar strength

- The Fed’s next policy decision will be announced on Wednesday. Officials are expected to leave rates where they are, above zero.

- The OECD releases its economic outlook Wednesday, a twice-yearly analysis of the economic prospects of member countries

- Euro-area finance ministers meet Thursday to discuss the EU’s recovery package and Eurogroup presidency succession.

- The Stoxx Europe 600 Index dropped 1.3%.

- Futures on the S&P 500 Index decreased 1%.

- Nasdaq 100 futures declined 0.6%.

- The MSCI Asia Pacific Index increased 1%.

- The Dollar Index increased 0.4%.

- The euro declined 0.3% to $1.1254.

- The British pound dipped 0.7% to $1.2631.

- The Japanese yen strengthened 0.4% to 108 per dollar.

- The yield on 10-year Treasuries sank four basis points to 0.83%.

- The yield on 30-year Treasuries dropped five basis points to 1.59%.

- Germany’s 10-year yield declined one basis point to -0.33%.

- Britain’s 10-year yield declined two basis points to 0.313%.

- Brent crude was little changed at $40.82 a barrel.

- Gold was little changed at $1,697.79 an ounce.

- Iron ore decreased 1.5% to $100.76 per metric ton.

Key Events

US futures for the S&P 500, Dow Jones, NASDAQ and Russell 2000 all slumped on Tuesday along with European stocks after German economic data for April proved to be markedly worse than anticipated.

The dollar jumped along with Treasurys. Gold and the yen strengthened for the second day while oil's retreat continued after yesterday's declines.

Global Financial Affairs

Contracts on the S&P 500 Index were higher during a mostly green Asian session, but after data released this morning showed Germany's exports in April, as well as its trade balance for that month had collapsed, US futures have been falling.

Futures on the SPX completed an hourly double-top, which might be part of a larger hourly H&S top. The MACD and the RSI both provided sell signals.

An advance in travel shares as reopening boosted airline stocks was outweighed by a selloff in bank shares, pressuring the Stoxx Europe 600 Index. Traders took the 24% dive in German exports and its falling trade surplus as a cue to cash in.

Most Asian indices were closed ahead of the release so were unaffected by the bad news from the eurozone's economic steam engine. This morning, Asia's regional shares followed yesterday's powerful US rally, in which the NASDAQ posted a new record, higher.

The Nikkei 225, (-0.4%), was the only major index in the red, after Japan reported overall wage income of employees dropped to -0.6% both on a monthly and annual basis, missing +0.1% expectations for both. The surprise decline came after an apparent second wave of coronavirus cases prompted Japan to retighten its lockdown after already having reopened the economy.

Australia’s ASX 200 surged to a 3-month high on Tuesday, (+2.4%), after having been closed on Monday for a holiday. The exuberance was fueled by optimism of a quick economic recovery after Friday's surprisingly positive US nonfarms jobs data and could have led to a short squeeze. This morning's NAB Business Confidence release, a measure of business conditions, revealed that activity picked up and confidence had rallied from April’s lows, as the economy down under restarted.

The beat—although still in recessionary territory—bolsters the economic recovery narrative that has taken hold of markets.

Yesterday, the S&P 500 advanced 1.2%, to the highest level since Feb. 21, and within 4.8% of the Feb. 19 record.

This year's losses were wiped out by yesterday's moves and the benchmark index is now in the green YTD. Its leap from the March bottom is approaching an amazing 45%.

Yields, including for the 10-year Treasury note, fell for the second day, as they did yesterday, even amid a rise in equities. Nevertheless, recently, risk-hungry investors have mostly been cycling out of safe haven government bonds.

Yields have topped out and will retest an uptrend line at 0.8 percent. If that doesn’t hold, the next presumed support is the 0.7% May range top.

The dollar followed Treasurys higher. If the USD were to retain this advance at the close of today's trade, it will have confirmed yesterday’s inverted hammer which itself confirmed an earlier potential hammer.

A close above 97.07 would complete a short-term bottom, which may be the catalyst for a return move after the dollar’s downside plunge out of a range. If the previous range holds, it may support a Bloomberg Opinion that a crash is coming for the global reserve currency.

Gold climbed for the second consecutive day, for the first time this month.

Today’s advance, albeit small, is impressive considering a strengthening dollar is weighing on the precious metal. Demand has likely increased with the futures and equity selloffs and the support provided by the H&S and symmetrical triangles (smaller, which it completed, and larger, in which it still trades).

Oil had its first back-to-back decline in more than a month, since May 7.

The WTI futures slip occurred after seven sessions in which the contract hugged its uptrend line. The price was unable to replicate its earlier rebound, in which it scaled well higher.

Of course, everything is relative. The advance from $30 to $40 is, naturally, very impressive. However, momentum has slowed since the jump from $10 to $30. The RSI demonstrates that momentum is waning as well, while the more momentum-sensitive ROC shows how it spiked in early May but has sputtered since. The MACD is about to provide a negative cross.