Stocks on Wall Street slipped in a volatile session on Friday to wrap up another losing week amid the ongoing sell-off in big tech shares.

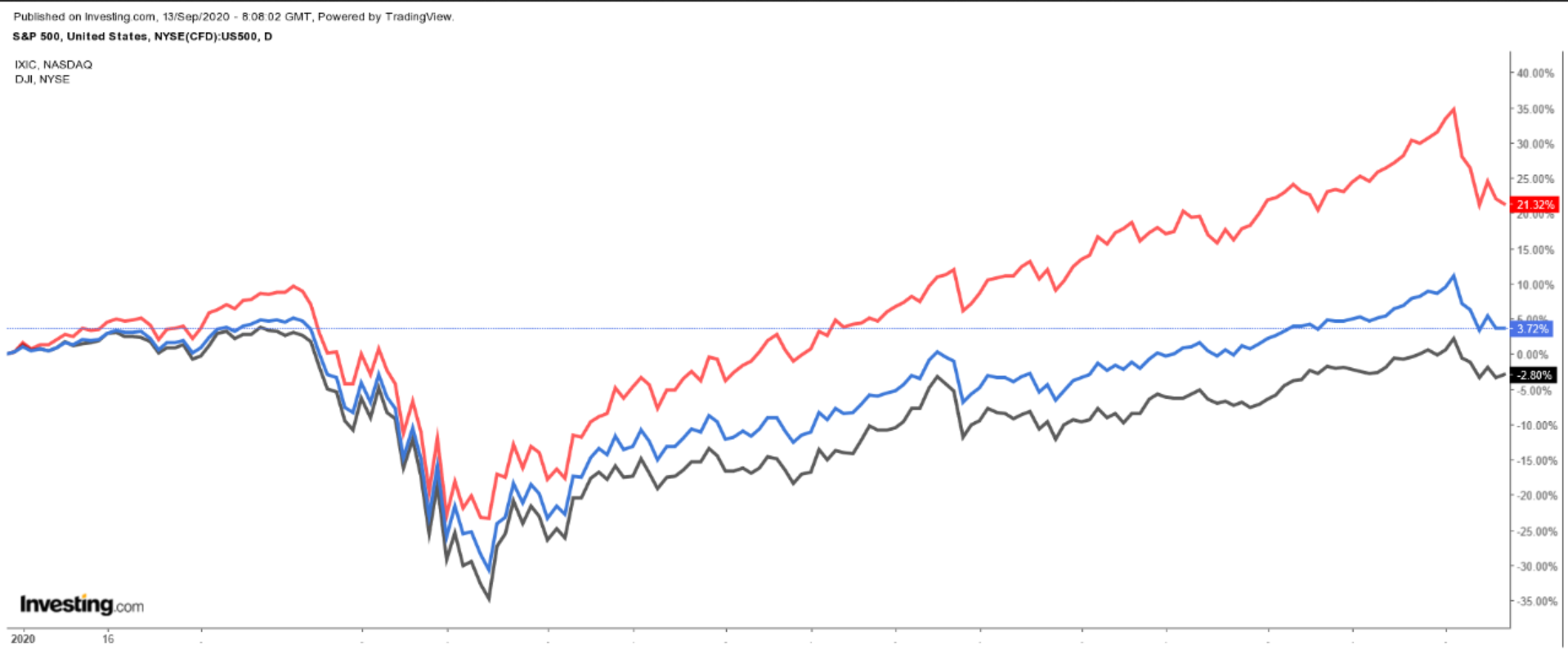

All three of the major US indices posted steep declines for the week. The NASDAQ slumped 4.1% to notch its biggest weekly fall since March. The S&P 500 had its worst one-week performance since June, falling 2.5%, while the Dow dropped 1.7%.

As we head into a new week, we’ll highlight one stock set to reveal underlying strength while navigating the whipsawing market and one on track to see further losses.

Nike: Digital Sales See Rapid Growth

Nike (NYSE:NKE) has been a powerful performer in the retail space in recent months, with shares rebounding 96% from their March lows, thanks in large part to rapid growth in its digital sales amid the ongoing coronavirus pandemic.

Shares of the Beaverton, Oregon-based sportswear and sneaker behemoth have displayed robust relative strength during the recent tech-driven sell-off, with the stock settling at $118.00 by close of trade on Friday. The stock touched a new all-time high of $119.25 earlier in the session, giving it a valuation of roughly $184 billion.

Nike, which missed on earnings and revenue estimates in the first quarter, is projected to report second quarter results on Tuesday, September 22 after the closing bell.

Consensus estimates call for the world’s top sports apparel and footwear maker to post earnings per share of $0.39, an improvement from a loss of $0.51 per share in the last quarter. Revenue, meanwhile, is expected to increase almost 40% quarter-over-quarter to $8.82 billion.

Perhaps of greater interest, Wall Street will pay close attention to expansion in Nike’s e-commerce figures, which soared by a record 75% in the previous quarter.

The company’s update regarding its outlook for the rest of the year and beyond will attract notice too since Nike didn’t provide any guidance for full-year fiscal 2021 in the last quarter. CFO Matthew Friend did say on the post-earnings Q1 conference call that he expected gradual stabilization worldwide as "retail reopens and each market normalizes supply and demand."

Nike's stock should continue to offer strong upside potential in the week ahead, as investors position themselves for a better-than-expected earnings report later this month.

Nikola: Fraud Accusations Weigh

On the other hand, in sharp contrast to the strong weekly performance seen in Nike, Nikola's (NASDAQ:NKLA) stock plunged late last week following a scathing report by a short-selling investment firm that accused the electric truck startup of being a "fraud."

Nikola’s shares lost 14.5% on Friday to end at their lowest level since July 31. The stock, which is down 65% since hitting an all-time high of $93.99 on June 9, closed the week at $32.13, giving it a market cap of roughly $17.4 billion.

Hindenburg Research published a report on Sept. 10 alleging that Nikola founder and executive chairman Trevor Milton made a series of false claims about possessing proprietary technology to form partnerships with large automakers.

The Phoenix-based EV startup, in which General Motors (NYSE:GM) recently took an 11% stake, warned on Friday that it could take legal action against the short-seller.

“To be clear, this was not a research report and it is not accurate. This was a hit job for short sale profit driven by greed,” Nikola said in a statement.

“We have nothing to hide and we will refute these allegations.”

On Friday, Hindenburg founder Nathan Anderson responded that his firm would welcome a lawsuit by Nikola, saying:

“The company answered none of the 53 questions we raised in our report after promising a full rebuttal.”

Chief Financial Officer Kim Brady said that Nikola—whose planned products include its debut hydrogen fuel cell electric pickup truck, called the Badger, as well as a range of large electric trucks fueled by zero-emission battery-electric or hydrogen-electric systems—will issue a detailed public response to the short-seller report at some point this week.

Taking all this into consideration, Nikola shares look set to remain under pressure in the coming days as it deals with mounting legal troubles.