Here is your Pro Recap of the top takeaways from Wall Street analysts for the past week: upgrades for Teradyne, XPO Logistics, Tractor Supply, and Brinker International, and a downgrade for Nike.

InvestingPro subscribers always get first dibs on market-moving upgrades. Start your 7-day free trial to see for yourself.

Nike Pulled From The Game, Cut at Jefferies

What happened? On Monday, Jefferies downgraded Nike (NYSE:NKE) to Hold with a $100 price target.

What’s the full story? Jefferies wrote that Nike’s wholesale channel is expected to face pressure due to tight inventory management, which is likely to reduce replenishment orders. Despite the company’s focus on increasing direct-to-customer (DTC) sales penetration, the current consumer environment could delay margin expansion, according to Jefferies. Their analysts wrote this puts Nike’s FY 2025 target of high-teens operating margin at risk.

Jefferies furthermore believes growth in China could be challenging due to potentially inconsistent macroeconomic headwinds and sales trends in this region due to a recent slowdown in apparel retail sales. Jefferies' forecast for fiscal 2024 is growth of 7%, lower than the consensus of 12%, per Jefferies' note.

Jefferies' survey results indicate a potential slowdown in US consumer spending, particularly in apparel/accessories and footwear. The analysts deduced from their survey also that most US consumers with student debt are concerned about meeting their monthly expenses, and a significant percentage plan to reduce spending on apparel/accessories and footwear. This could put further pressure on US consumer spending and contributes to the Hold recommendation.

A Hold at Jefferies “Describes securities that we expect to provide a total return (price appreciation plus yield) of plus 15% or minus 10% within a 12-month period.”

How did the stock react? Shares promptly sold off on the 4am premarket open, dropping $1.39 to $89.55. Nike ended the day at $90.60, down $0.25, or 0.3%.

Time to Shine, Teradyne

What happened? On Tuesday, Northland upgraded Teradyne (NASDAQ:TER) to Buy with a $126 price target.

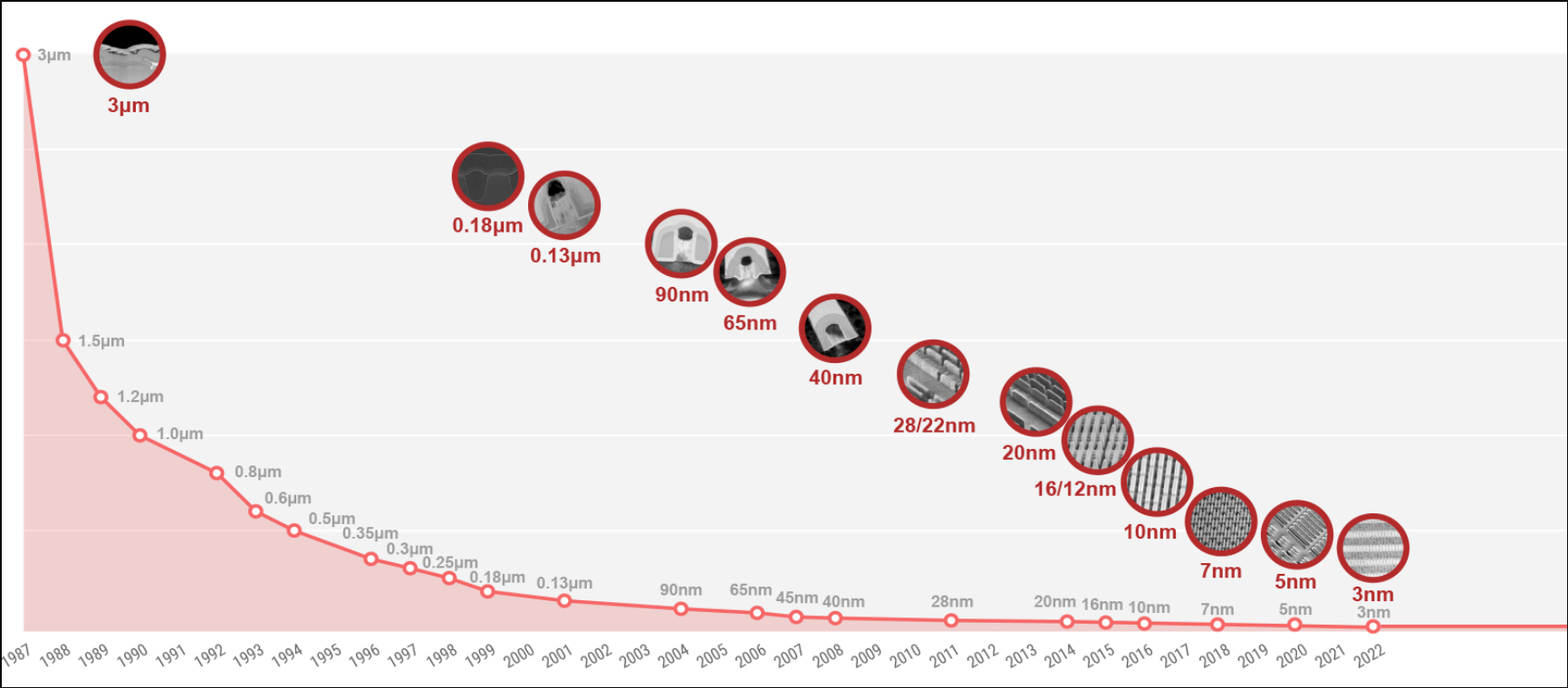

What’s the full story? Northland analysts believe TER will benefit from the transition to a 3-nanometer chip at Taiwan Semiconductor (NYSE:TSM). This is the smallest chip in over 30 years, as seen in TSMC's illustration below.

Source: Taiwan Semiconductor

The analysts note that the shift to 3nm for mobile app processors increased the number of transistors from 16 billion to 19B, and they say that ought to drive up test time and demand for Teradyne testers.

Northland also expects more phones to make this transition in calendar year 2024, and they anticipate an increase in mobile phone sales after two years of decline. The analysts additionally believe that many of the additional transistors will be used for phone artificial intelligence (AI) capabilities, which they posit will create more demand for TER testers. Northland’s analysts also anticipate a phone upgrade cycle to gain momentum into CY25 as more mobile AI apps emerge.

The analysts note that Intel (NASDAQ:INTC) is set to launch the Meteor Lake client CPU in Q4, which is slated to use advanced packaging techniques, and they expect this system-in-package to expand to the automotive market - which they expect, in turn, will create more demand for TER testers. The analysts believe that this will provide an additional growth vector for TER over the next couple of years.

Outperform at Northland means the stock is expected to “Outperform the S&P 500 by at least 10%.”

How did the stock react? Shares spiked at 6:46am in New York as the note was distributed. Shares rose nearly $1.50 to $97.91 within 5 minutes. The stock lingered at the mid $96 handle before opening the regular session at $97.32 - then closed down 0.6% to $95.83. A brutal shellacking for sure for those who bought on the headline and held.

Hauling a Load of Alpha, XPO Logistics Upgraded

What happened? On Wednesday, Evercore upgraded XPO Inc (NYSE:XPO) to Outperform with a $79 price target.

What’s the full story? XPO finds itself in a favorable position, according to Evercore, and the firm offered a slew of points for clients to consider.

First, XPO has directly benefited from the Yellow (OTC:YELLQ) liquidation: Volumes have increased since the beginning of July, pricing is likely taking an upward turn, and there is a significant margin expansion opportunity as the company integrates new business into a network that had already been expanding its capacity.

Second, per Evercore’s commentary, the early results from the new additions to top management indicate not only an enhancement in efficiency but also in service, as XPO’s claims ratio declined against a rally in volumes. Evercore specifically cited the entrance of the former Old Dominion Freight Line (NASDAQ:ODFL) CFO as an XPO board member, and ODFL's old operations head as XPO's current COO.

Similar to two XPO peers under Evercore’s coverage, the analysts believe there is more pricing upside for XPO, and related margin expansion, likely in the wake of ongoing disruption caused by YELL’s terminal liquidation.

Evercore believes that, while the stock has outperformed the peer group year to date, the multiple discount at which XPO has traded for years may fall back in line as management gains more credibility.

Outperform at Evercore means: “the total forecasted return is expected to be greater than the expected total return of the analyst's coverage sector.”

How did the stock react? Shares gained $0.63 on the news to trade at $68.73. Shares wrapped up the regular session at $70.07, up about 3%.

Yee-HAW! Tractor Supply is a Buy

What happened? On Thursday. DA Davidson upgraded Tractor Supply (NASDAQ:TSCO) to Buy with a $280 price target.

What’s the full story? Over the past two and a half years, TSCO's operating margins have remained relatively stable despite a significant near-40% sales increase, according to DA Davidson analysts. They wrote that this is largely due to the company’s strategic decision to reinvest its gains from the pandemic era into various areas such as store expansion, distribution, wages, and technology.

However, with the peak of this five-year investment cycle expected this year, DA Davidson anticipates a positive shift in margins starting from late 2023 and continuing into 2024. This is when TSCO is likely to start harvesting the returns from its previous investments.

TSCO’s strong position within DA Davidson’s newly launched “Best-of-Breed Bison” framework is primarily due to its leading role in a growing yet fragmented market. The analyst made clear also that the total addressable market (TAM) for TSCO has seen an impressive growth of over 60% since the onset of the pandemic. This growth can be attributed to demographic trends favoring “rural revitalization”, as well as TSCO’s expanding product range per the research note Friday.

These factors, combined with an aggressive store remodeling program and a robust schedule for new store openings, are expected to drive consistent sales growth for TSCO.

Buy at DA Davidson means “Expected to produce a total return of over 15% on a risk adjusted basis over the next 12-18 months.”

How did the stock react? Shares were excited for the first half of the day trading up to a mid $205 handle before reversing and ending the day at $203.41, marginally higher than the regular market opening trade of $205.25.

Dinner is Served, Brinker International Upgraded

What happened? On Friday. Stifel upgraded Brinker International (NYSE:EAT) to Buy with a $45 price target.

What’s the full story? Stifel’s analysts recently held investor meetings with management and came away with a more positive outlook on Chili’s turnaround efforts. The analysts believe that Brinker’s plan closely follows the strategic playbook of successful restaurant turnarounds, such as Olive Garden, Popeyes, and KFC, they wrote in a Friday note.

The biggest challenges for Chili’s, according to Stifel, are operational, with several opportunities to implement changes in the next few quarters that should enhance both team members’ and customers’ experiences. In addition to seeking quick wins, CEO Kevin Hochman is also shifting Brinker’s culture. He encourages executives and management to seek insights from team members involved in daily restaurant operations to help inform operational improvements that can benefit the entire system, the analysts wrote.

The analysts acknowledge that the current consumer backdrop is challenging, and a lower entry point may present itself. However, Stifel recommends starting to accumulate at this valuation (9x P/E NTM) given the potential for earnings upside and multiple expansion over the coming couple of years.

Buy at Stifel means “We expect a total return of greater than 10% over the next 12 months with total return equal to the percentage price change plus dividend yield.“

How did the stock react? Shares traded strong in the premarket (gaining near 1.7% or nearly $0.50. Then the regular session started and the equity just slid lower and lower. EAT opened Friday at 33.54 and ended $31.59.