- Distinct mood shift has traders wondering how quickly gas could return to $3

- Despite cold forecast for March, bloated storage could hold back a big rally

- Benchmark April gas’ first test would be $2.95, eventually $3.30 near term

A week ago, I mused about where natural gas could go after the much awaited break of its long-held $2 support.

Those tracking one of the world’s most heavily speculated commodities weren’t too sure at that point on whether the 2½-year bottom of $1.967 — which gas plumbed on Feb 22 — was really the bottom of a selloff that began in December and rapidly went from bad to worse.

Some expected a journey further south to mid-$1 levels as the warmest winter in decades led to miserable demand for the heating fuel.

As we’ve witnessed in the five sessions since gas bulls are not just coming back but trying to come back with a vengeance. The market has tacked on 80 cents or a whopping 40% — or an average of 8% each session.

Houston-based energy markets advisory Gelber & Associates said in its daily note on gas futures:

“Short covering in the futures market has been ramping up since last Friday, providing the gas market with ample buying pressure.”

The distinct mood shift has traders wondering how quickly gas futures could return to $3 levels on the New York Mercantile Exchange’s Henry Hub.

Despite the upward momentum, some are warning against over-exuberance. And the reasons are clear.

Firstly, there are just about three weeks of winter weather left officially, though forecasts call for some surprising late-season chill (perhaps a vengeance approved by Mother Nature itself?)

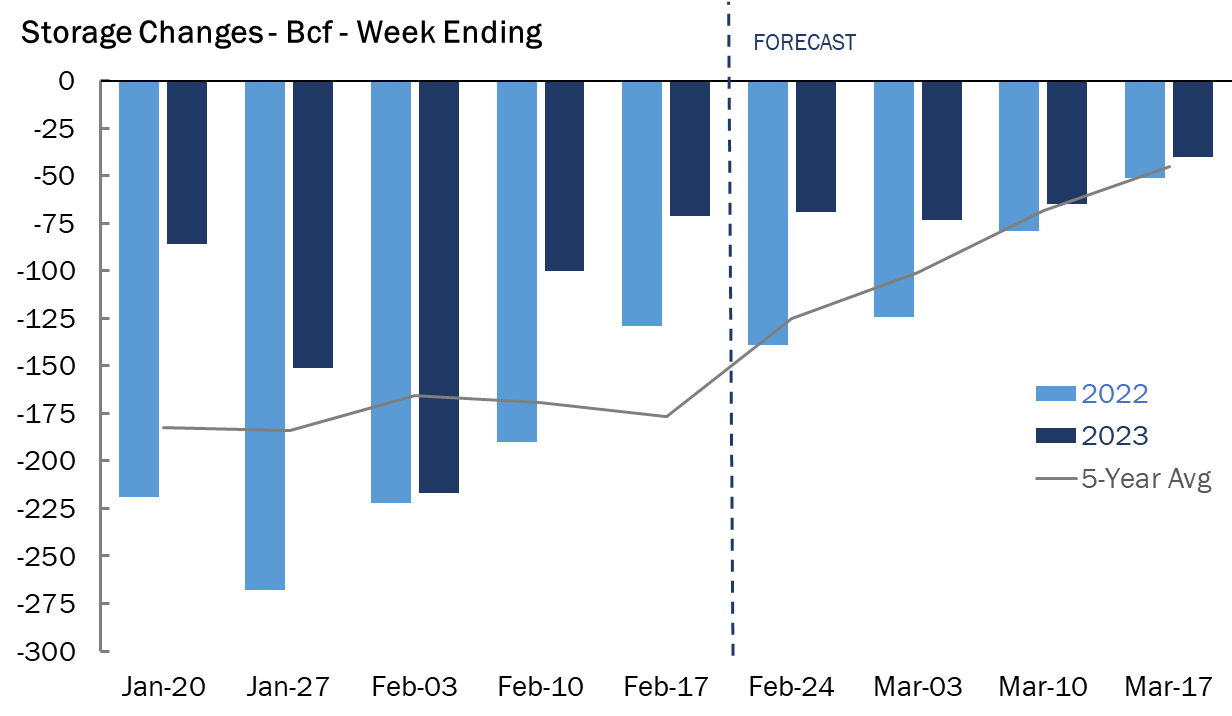

Next is the eye-watering level of gas in storage, standing some 15% above the five-year average, at 2.2 tcf, or trillion cubic feet, no thanks super-high production which mostly held above 100 bcf, or billion cubic feet, per day from end-December through late-February.

Source: Gelber & Associates

But all’s not lost for gas bulls, who would’ve experienced a mind-numbing 65% loss on paper at least had they held to their positions through that stretch (prior to that, they could’ve been partying on bubbly and caviar all week, when gas was the king of energy in terms of returns, gaining 170% year-to-date by August as futures hit a 14-year high of $10 on fears of a global supply squeeze from Ukraine-related sanctions on Russian gas).

Fundamentally, the advent of March seems to have brought better tidings for those long gas. Dry gas production has dwindled to around 97.5 billion cubic feet per day versus early February highs of well over 100 bcf daily.

There’s an anticipated rise in US heating demand over the next fortnight due to colder-than-normal weather. In a forecast that ran on naturalgasintel.com, NatGasWeather pointed to colder national average temperatures during the eight- to 15-day time frame. Both the US Global Forecast System and Europe’s models showed colder-than-normal temperatures over most of the country for March 8-15, the firm said.

The European model remained “notably colder” than its American counterpart by around 15-20 heating degrees, NatGasWeather said Wednesday. This “likely has the attention of traders,” considering the European model “historically has a little higher skill score.”

Subsequent model runs will be “closely watched to see which of the two major weather models concedes to the other,” the forecaster added.

Another upshot is the improving feed demand for liquefied natural gas at the Freeport LNG terminal in Texas. Freeport had been a rock-solid base of more than 2 bcf per day of gas demand until it was knocked out by a fire in June. The plant is reportedly on track to return to full service of around 2.38 bcf per day by spring.

Several US exploration and production companies said during recent earnings calls they likely would scale back output this year, following a mild second half of winter and low prices relative to last year. Despite the recent rally, prompt month prices are about half the level of late 2022.

Rystad Energy analyst Ade Allen said in comments carried by naturalgasintel.com that lower prices “serve as a signal for producers to curtail production growth to sustainable levels.”

EBW Analytics Group’s Eli Rubin, Senior Analyst, said on the same site that production this week pointed to decreases in the Permian Basin and Haynesville Shale. That helped the four-day rally on the Henry Hub.

Still, intraday price swings — like Tuesday’s 16-cent, or 6%, drop — will likely continue due to the appalling demand for heating during much of 2022/23 winter, said Gelber’s analysts. They added:

“Many market players are still recovering from the black eye left by freezing early winter forecasts which never materialized. As storage inventories remain well in excess of the 5-year average, US natural gas in storage will be the large counter-balancing factor providing significant downward pressure on price.”

The forecast for storage in the latest update due from the EIA, or Energy Information Administration, is an underwhelming pull of 75 bcf for last week, versus the prior week’s 71 bcf, according to analysts tracked by Investing.com.

The draw is also smaller than the 137-bcf pull seen during the same week a year ago and the five-year (2018-2022) average decline of 134 bcf.

If correct, the forecast for the week ended Feb. 24 would cut stockpiles to 2.120 tcf — leaving them about 27.5% above the same week a year ago and 19.6% above the five-year average.

In terms of demand, there were around 145 HDDs, or heating degree days, last week, which was less than the 30-year average of 167 HDDs for the period, according to Reuters-associated data provider Refinitiv. HDDs, which are used to estimate demand to heat homes and businesses, measure the number of degrees a day’s average temperature is below 65 degrees Fahrenheit (18 degrees Celsius).

All these bring us back to the question: How far could gas prices go this time — ostensibly on the positive side — and how quickly could that happen?

Chart-wise, the first test for Henry Hub’s benchmark April gas contract would be at $2.95 and eventually $3.30 and above, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com.

The current bullish momentum is supposed to continue subject to prices holding above the 5-Day EMA, or Exponential Moving Average, of $2.69, said Dixit. He added: “If this level breaks with selling pressure, expect some downward shift in momentum pushing prices down towards major support of $2.45.”

In Wednesday’s overnight US trading and Thursday’s late-afternoon session in Asia, April gas hovered at around $2.78 per mmBtu or million metric British thermal units.

Said Dixit:

“The daily EMA is dynamically positioned at $2.69, providing consistent support for upward mobility towards the next leg higher of $2.88 and $2.95. Further stability above $2.95 can help April gas rise to $3.18, above which the 50-Day EMA of $3.31 should be seen as a major upside potential target.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.