I'm giving day trading a go and with hindsight, yesterday should have been an "easy" profit day, but the volatility swing on the economic data threw me off and I missed the big gains in the S&P 500 and Nasdaq; registering a loss for the day.

However, as an investor, yesterday was great news. I would like to see more from the Russell 2000 (IWM), but the Nasdaq made up for it. There wasn't a whole lot of volume to go with the buying, but if yesterday's moves can stick then this shouldn't matter.

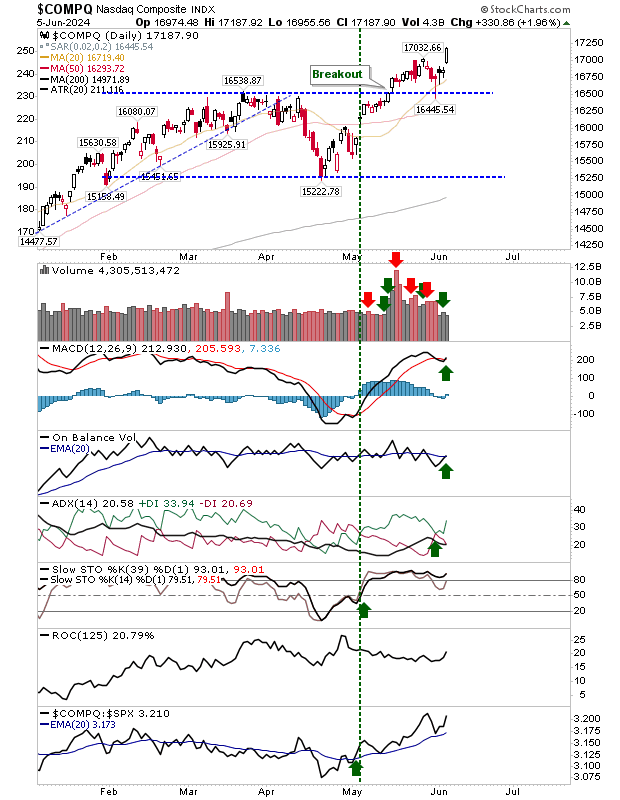

The Nasdaq is doing all the heavy lifting, and for now, the surge in relative performance should attract fresh money. Technicals are net bullish with new 'buy' signals in the MACD and On-Balance-Volume and a +DI/-DI bullish switch.

The S&P 500 was a little more low-key, but technicals are not as bullish as for the Nasdaq with the MACD still to switch to a new 'buy' trigger. However, On-Balance-Volume is showing strong accumulation, even though relative performance against the Nasdaq is falling off a cliff (again, its all relative!).

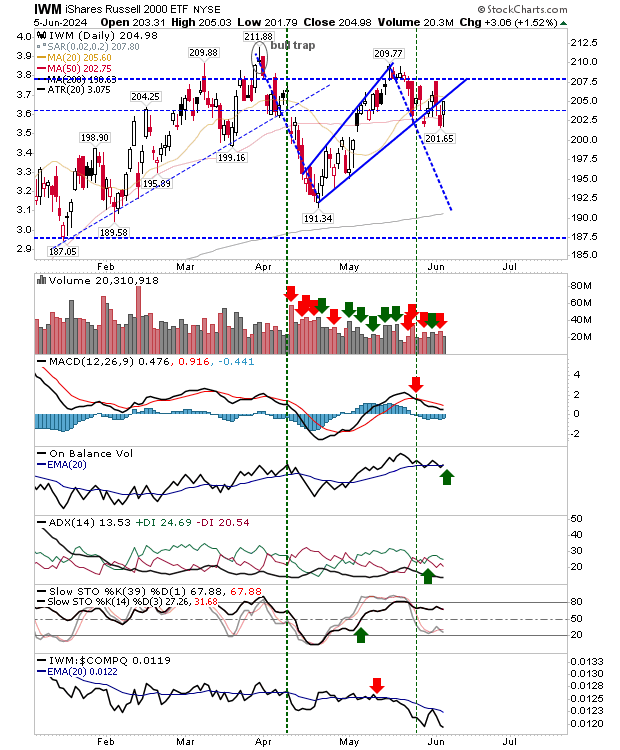

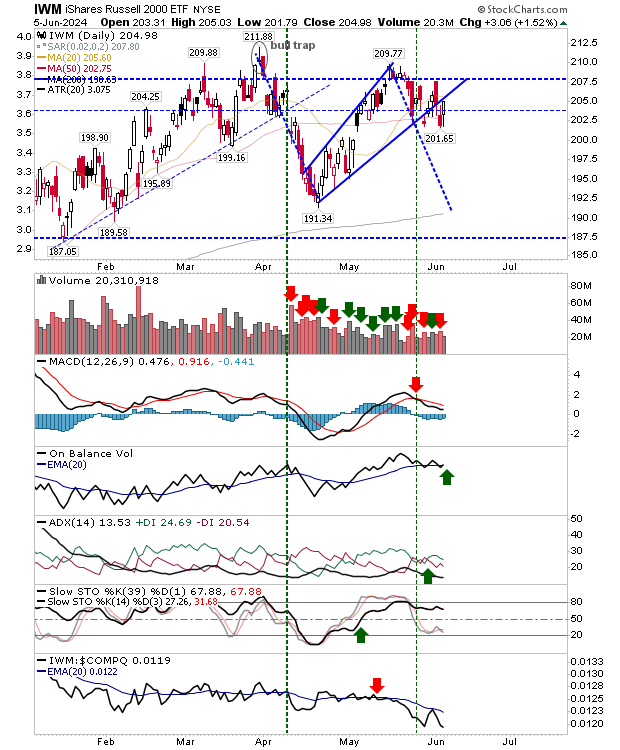

The Russell 2000 ($IWM) also posted gains but did so from within its trading range which lessens the significance of such moves. Not until it takes out the 'bull trap' will bulls have something to shout about it. Technicals are in a similar situation as the S&P 500 with the MACD stuck on prior 'sell' triggers.

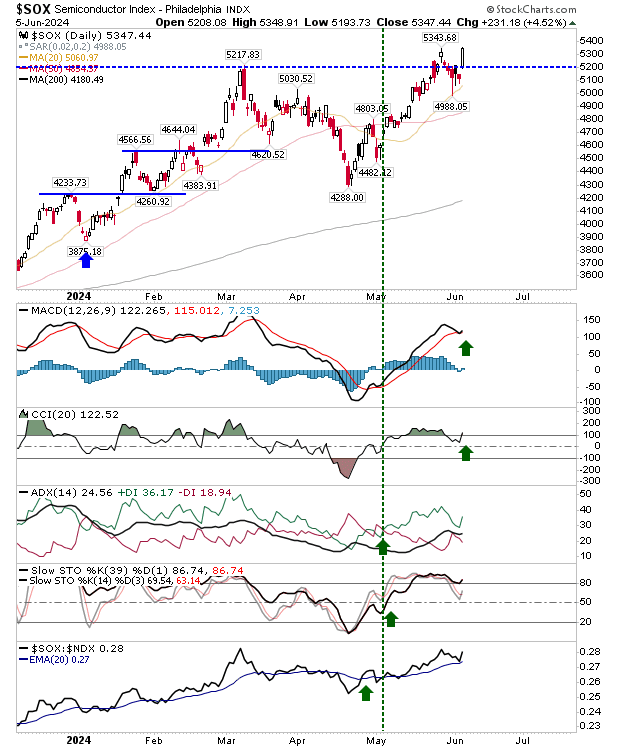

The other index to watch is the Semiconductor Index. Like the Nasdaq, it enjoyed a fresh breakout with a return to net bullish technicals.

Yesterday was one for bullish optimism. There were clear moves away from breakout support with technicals improving in line with price. We now have room for losses without reversing the larger bullish picture. Let's see what the rest of the week brings; Friday's weekly candlestick will be of interest now.