Markets managed to hold on to early lows without the selling pressure from earlier last week.

While the buying was relatively modest, it still wasn't enough to see a return above 20-day MAs for indexes, although there is a good chance for a second bite of the cherry this week.

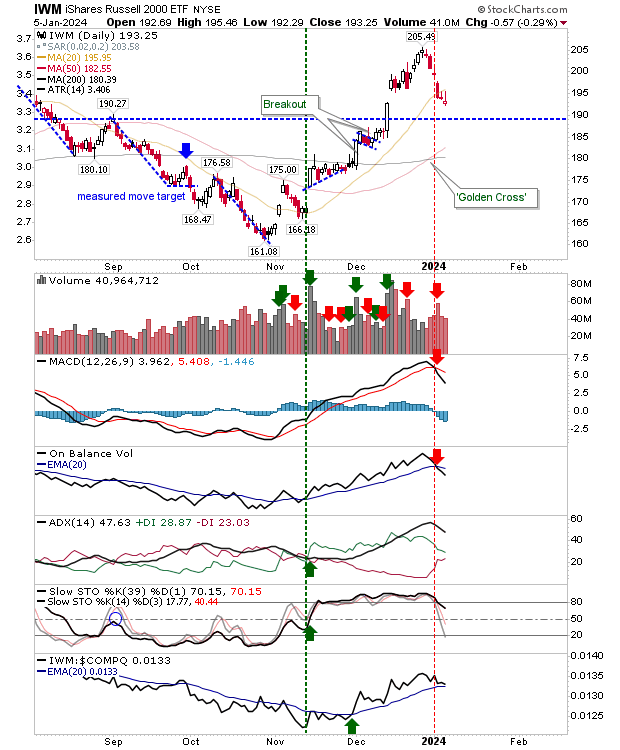

For the Russell 2000 (IWM) there was an "inverse hammer" at oversold near-term stochastics, but not at mid-level intermediate stochastics - a level often associated with support during bull markets.

There are 'sell' signals in the MACD and On-Balance-Volume to overcome but other technical supports are healthy.

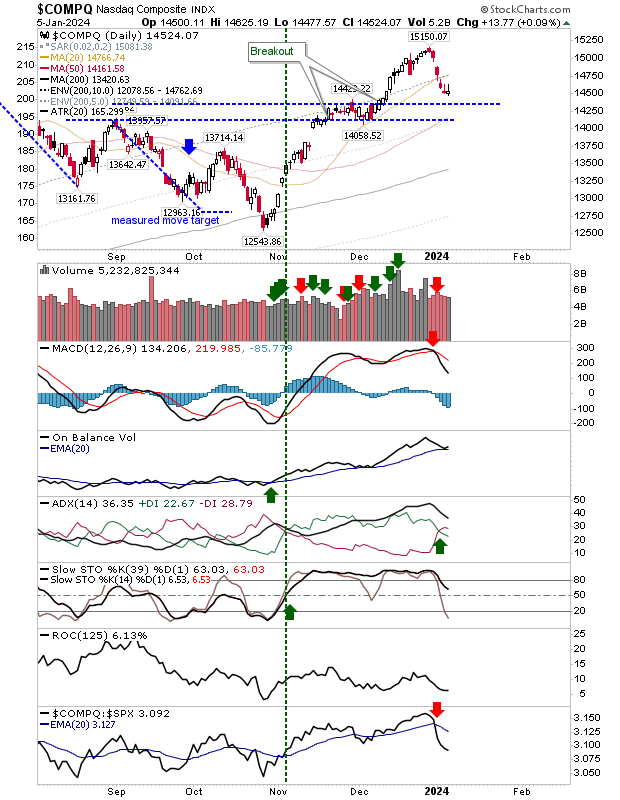

The Nasdaq is caught halfway between its 20-day MA and support defined by the narrow November consolidation.

While this is a bit of a 'no-mans' land, I still like the current level for a rally, but don't be surprised if there is an intraday spike down to the November congestion level.

There is only (a well-established) MACD 'sell' trigger to overcome, while the relative underperformance to the S&P 500 is less of a concern.

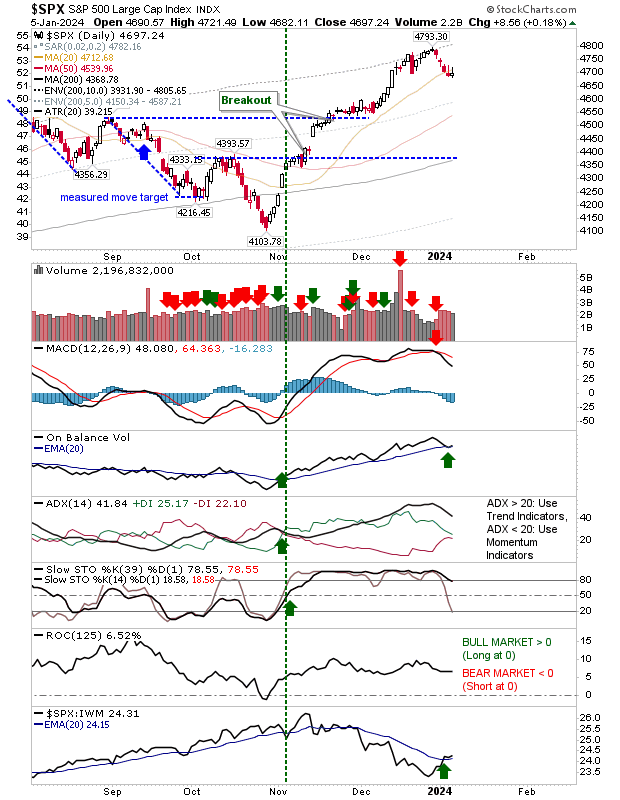

The S&P 500 has been the dominant index for the latter part of 2023 and is gaining relative performance to peer indexes in 2024.

The index is well above November congestion and only has the 20-day MA to consider.

And of the core indexes, it's the best placed to recover the moving average. As with the Nasdaq and Russell 2000, it has a MACD trigger 'sell' to overcome, but other technicals are all in good shape.

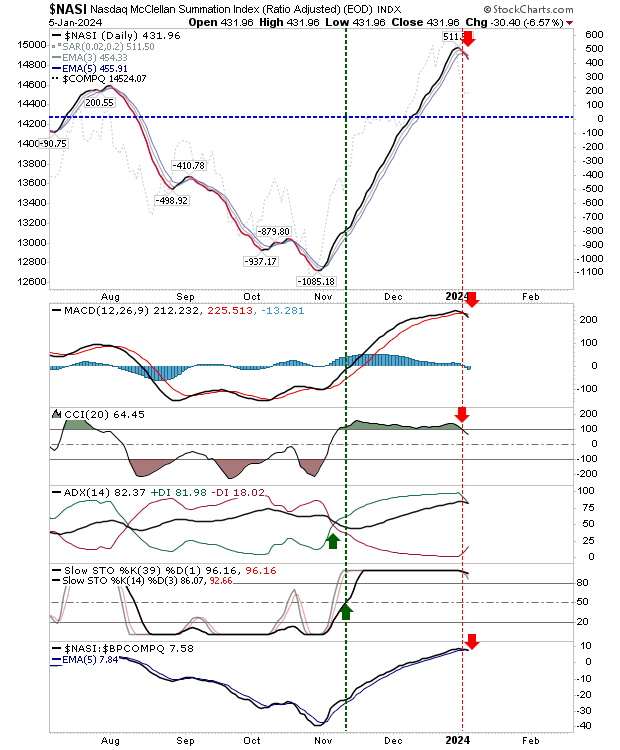

One metric I'll be watching is the Nasdaq Summation Index ($NASI). It's a reliable signal trigger and after a period of consistent strength since November, it has switched to a 'sell' trigger at a level typically associated with Nasdaq tops.

It may not lead to any significant decline in the Nasdaq, but a period of sideways action would not be surprising.

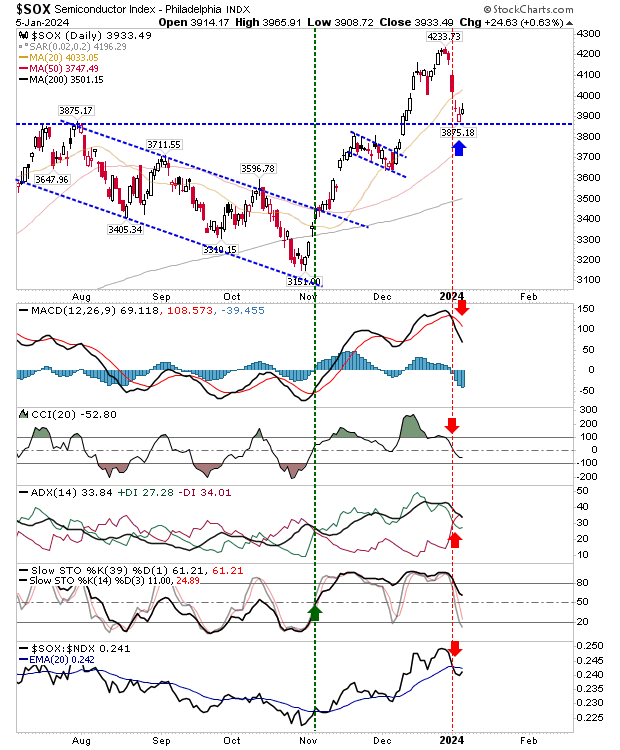

The other index to watch is the Philly Semiconductor Index. It has come back to July breakout support and bounced off it, but not very strongly.

If it falls below 3,875, then watch for a move back to the prior swing low at 3,150, which would tie in with the above 'sell' signal in the Nasdaq Summation Index.

For this week, watch for weakness in Tech indexes that could benefit the S&P 500 with rotation out of speculative Tech stocks, although a falling tide sinks all ships.

If indexes can get above their 20-day MAs, then we are looking at the challenges of recent swing highs.