- September often brings market volatility, but it can also be a prime time to find undervalued stocks.

- InvestingPro’s Fair Value tool offers a simple, yet professional way of spotting such names.

- You can use this link to get access to InvestingPro's Fair Value tool for less than $9 a month.

September often brings more than just cooler weather - it also ushers in what many call the “September Effect,” a notorious seasonal pattern of market turbulence.

Historically, this month has earned its reputation as the weakest for stocks, frequently delivering disappointing returns.

Since 2019, the S&P 500 has ended every September in negative territory, with losses becoming increasingly pronounced in recent years:

- 2019: -1.7%

- 2020: -3.9%

- 2021: -4.8%

- 2022: -9.3%

- 2023: -4.9%

While past performance is no guarantee of future performance, so far, this year has been no exception, with the S&P 500 already down 4.25% in the first week of trading of the month.

But don’t let the gloomy statistics get the best of your gains. For the savvy investor, this might actually be more of a golden opportunity than a looming threat.

Market dips, especially those triggered by unexpected macroeconomic data, are often the perfect chance to scoop up quality stocks poised for significant gains, particularly in a secular bull market such as the one we are currently experiencing.

As the Fed plans to make its first rate cut in more than four year in its next meeting on September 18, now might be the perfect time to scoop up undervalued gems trading at a reasonable discount.

But how can you efficiently spot these potential bargains amid the myriad of conflicting data and opinions out there?

Fair Value Tool Offers a Simple, Yet Effective Solution

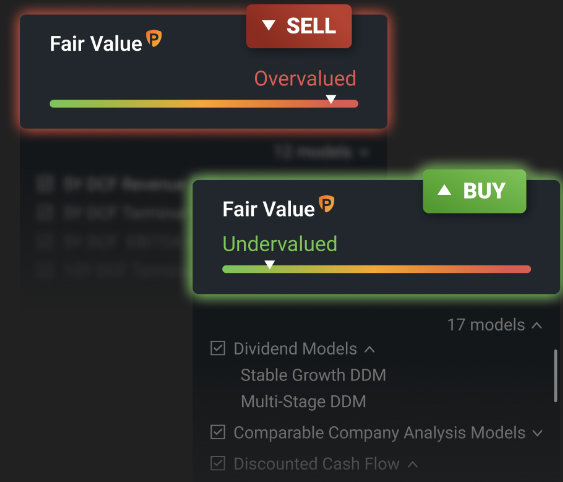

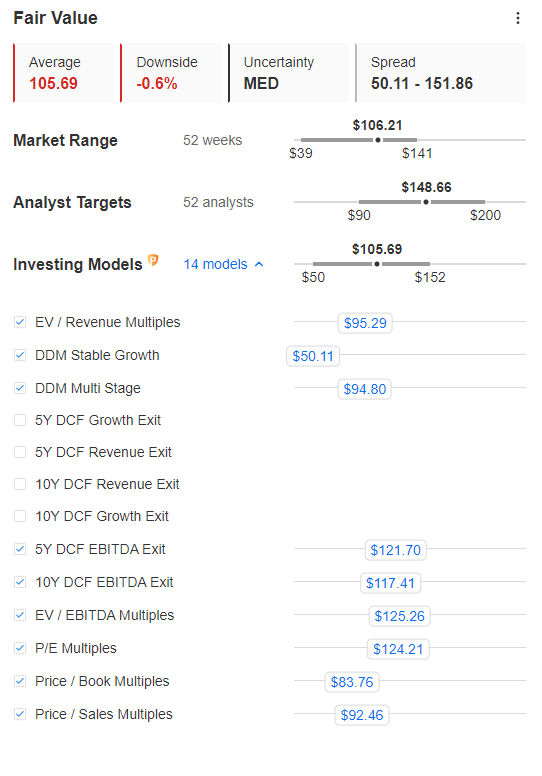

By integrating up to 15 industry-recognized valuation models, it provides investors with a professional, yet straightforward target for any stock in the market.

InvestingPro's tool also lets you take a deeper dive in any of the individual metrics used to provide the final calculation, allowing you to assess and even exclude any of them for an instant recalculation of the price target.

Source: InvestingPro

By combining transparency with best-in-breed financial modeling, Fair Value has proven a game-changer for investors during both good and challenging times.

In fact, just to talk about the previous broad market downturns, here are a few examples of the fantastic results our premium users managed to notch:

Travelers Companies (NYSE:TRV)

- FV Potential: 43.99% (3/20/2023)

- Total Returns Since: 37.43%

Salesforce Inc (NYSE:CRM)

- FV Potential: 41.09% (3/13/2023)

- Total Returns Since: 40.23%

Qualcomm Incorporated (NASDAQ:QCOM)

- FV Potential: 36.95% (3/14/2023)

- Total Returns Since: 40.45%

Amgen (NASDAQ:AMGN)

- FV Potential: 32.09% (4/29/2023)

- Total Returns Since: 35.30%

Rtx Corp (NYSE:RTX)

- FV Potential: 39.31% (7/28/2023)

- Total Returns Since: 36.98%

Elevance Health (NYSE:ELV)

- FV Potential: 35.39% (7/13/2023)

- Total Returns Since: 30.35%

Interactive Brokers Group (NASDAQ:IBKR)

- FV Potential: 53.06% (4/20/2023)

- Total Returns Since: 53.98%

Brookfield (NYSE:BN)

- FV Potential: 49.61% (3/1/2023)

- Total Returns Since: 42.31%

Followers of this column may have also read our series of previous articles. See below:

- Market Reshuffle Brings Fresh Opportunities - Here's How to Spot Them Now

- This Tool’s Sell Signal Saved Investors From 35%+ Drawdowns in These Stocks

- These Energy Stocks Jumped 40%+ Following Rare All-In Buy Signal

- Here's How You Can Find Stocks With 50%+ Upside Before the Market Does

Among thousands of other success cases.

Now, to better illustrate how Fair Value has been helping our premium users achieve market-beating results, let’s take a closer look at four recent dip-buys you could have easily spotted by just following our tool.

4 Great Picks During Market Dips

In March 2023, the banking sector faced significant turmoil, with a series of high-profile bank failures and heightened global banking concerns sending shockwaves through the stock market.

The catalyst was the sudden collapse of Silicon Valley Bank (SVB), marking the first FDIC-insured bank failure in two years.

Amid the chaos, Bank of New York Mellon (NYSE:BK) saw its stock correct alongside the broader market, hitting $43.27 on March 20, 2023. However, Fair Value analysis indicated that the stock was ripe for a rebound.

The stock bounced back, delivering an impressive near 60% return since, surpassing its fair value potential by 10%.

The Bank of New York Mellon wasn’t the only stock to stage a remarkable recovery. UBS (NYSE:UBS) also emerged as a standout Fair Value pick during the same period.

In March 2023, UBS was flagged for a potential 57.67% gain based on Fair Value's calculations, and it didn’t disappoint.

UBS not only hit its target but exceeded it, posting a 61% return, once again outperforming initial expectations.

Fantastic, right? But wait, here are a couple more examples of what we're talking about...

Back in October 2022, as the S&P 500 neared its bottom, NXP Semiconductors (NASDAQ:NXPI) was trading at $141.27 on October 17, 2022, representing a 54.69% discount as indicated by the fair value tool.

While calling a stock's bottom is oftentimes a fool's errand, users who managed to pick up on NXPI's massive upside potential using our Fair Value tool are now sitting on a massive 71.41% gain.

This highlights the fact that Fair Value is not a market-timing tool, but, rather, an essential metric for investors looking to professionally evaluate a stock's potential through its fundamental data.

Micron (NASDAQ:MU) was another stellar Fair Value call. On September 15, 2022, the stock was available at a 72.81% discount, as the tool signaled.

You can almost guess what happened next - It rallied almost vertically, delivering a 68.31% year-to-date gain, falling just around 4% short of its fair value target.

Like these examples, there are hundreds of other stocks trading at a significant discount right now, just waiting to be scooped up.

So whether you're looking for a massive 50%+ winner on the dip or just want to professionally evaluate if it's time to take profits in your positions, Fair Value will prove the ultimate game-changer.

Conclusion

September may bring volatility with key macro events looming, but savvy investors know that every dip offers opportunity.

While the "September Effect" is known for weighing down stocks, it also creates golden chances for those ready to act.

Take standout picks like The Bank of New York Mellon, UBS, NXP Semiconductors, and Micron - each stock managed to stage a turnaround after Fair Value signals, helping investors capitalize on market pullbacks for solid gains.

Will you just sit by if another market correction unfolds, missing out on potential gems available at discounted valuations?

With Fair Value insights for less than $9 a month, the choice has never been easier.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.